Overview: WPP AUNZ Ltd (“WPP”, “the Company”), formerly STW Communications Limited, is an Australian services company focused on advertising, marketing, and communications. The company’s advertising channels include television, radio, print, outdoor and electronic. In April 2016, the Company merged with the Australian and New Zealand business of WPP plc (“WPP”) which forms an entity that generates Pro-forma sales of ~$850million pa.

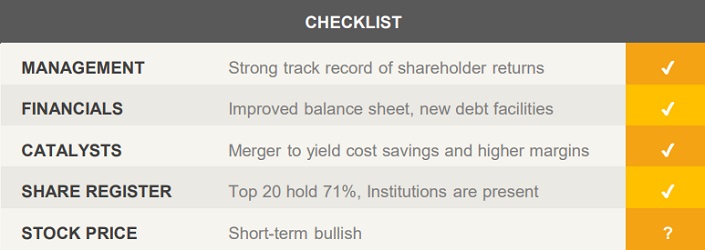

Catalysts: The merger of STW and WPP combines two of the largest participants in the local marketing industry and is expected to yield cost savings of $15m and more favourable debt facilities. While STW as a single entity has posted six consecutive years of revenue growth, merging with WPP should increase competitive barriers further. Successful integration of the two individual businesses and consolidation of the industry is expected to be the primary drivers.

Hurdles: With Federal election campaigns underway, the Company may be challenged maintaining current utilisation rates, which could represent a cyclical peak. The merger is subject to integration risks and there is no guarantee that synergies will arise, nor that cost savings will occur. Whilst the merger reduces balance sheet leverage to ~2x EBITDA, these borrowings may constrain the Company’s ability to expand.

Investment View: WPP offers profitable exposure to the domestic marketing and advertising industry. The merger represents a major rationalisation of the domestic ad services industry and synergies could drive margin growth. Integration risks, balance sheet gearing, and post-election market momentum are principal risks. New debt facilities provide WPP with sufficient working capital to unlock value from the transaction. Attracted to the competitive position of this newly formed entity, we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.