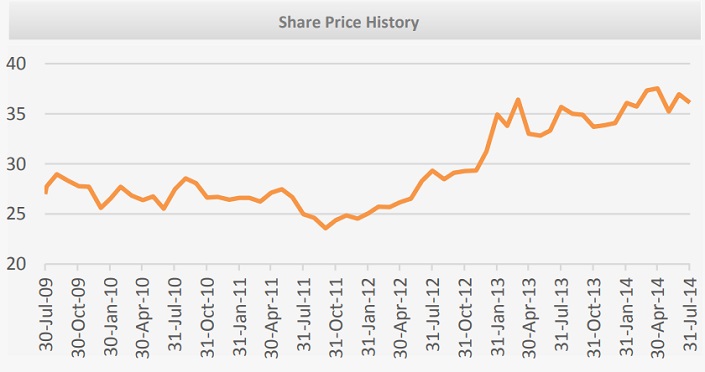

Overview: Woolworths (WOW) is a retailer with primary activities in Supermarkets. WOW’s other operations include BIGW discount department stores; Home Improvement; Petrol through the Woolworths/Caltex alliance; and Hotels. Since re-listing in 1993 Woolworths has been one of Australia’s most successful and consistent retailers. Woolworths announced strong half-year results with revenue up 6% and net profit up 14.5%. Woolworths is a heavyweight on the ASX and attracts shareholders with its diversified balance sheet. solid dividend yield and predictable earnings. The solid share price performance highlights the blue-chip nature of the stock.

![]()

Dividend and Investment View: Woolworths Limited (WOW) has increased its net dividend consistently in line with the rising stock price over the past decade. In 2013 the total net dividend amounted to $1.33 excluding franking credits. The FY14 interim dividend was paid on 24th April 2014 and was $0.65, an increase of $0.03 compared to the previous corresponding period. The final dividend will be announced with the full-year results on 29th August 2014 and is expected to be in the range of $0.71-$0.75. WOW’s dividend enjoys a 100% franking credit.

Historically, the value of the stock has increased before the ex-dividend date. WOW has underperformed the market in the past 6 months and is trading almost $3 below its April high. The full-year results along with the dividend are expected to increase buying pressure. The company has disclosed to the market that its Home Improvement business will not meet its guidance for FY14 which lowered expectations. However strong results from the supermarket, liquor, hotel, or petrol divisions are expected to offset those losses.

Please note: The recommendations of the Dividend Portfolio have a medium to long-term outlook and are not part of the Active Investor’s Portfolio.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.