Overview: Vocus Communications (“Vocus”, ‘the Company”) supplies telecommunications and data centre services to Internet Service Providers (ISPs) in Australia and New Zealand. The Company owns domestic fibre and data centre infrastructure whilst sub leasing international transmission capacity to Singapore and the US. We initiated coverage in April with a ‘buy’ recommendation at $2.10/sh.

![]()

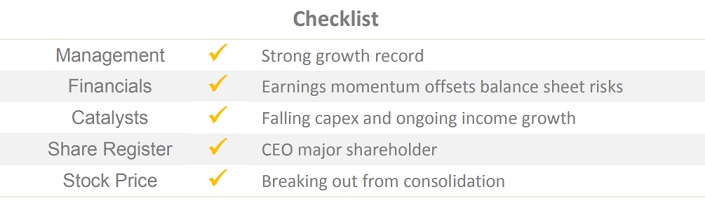

Catalysts: Customer base expansion for the past 16 consecutive quarters has driven average compound revenue and EBITDA growth of 50 percent pa for the last three years. Concurrent reduction in capital spending and improved capacity utilisation is expected to

Hurdles: Amid recent capacity investments the Company’s balance sheet is fully geared (net debt 3x EBITDA). The rollout of the National Broadband Network (NBN) could adversely impact the competitive landscape.

Investment View: Delivery of the NBN is expected to reduce competitive barriers for ISP’s, increasing market opportunities for Vocus. Independent of the NBN’s final architecture, data demand should continue booming. With significant capacity at hand, we expect Vocus’s strategic wholesale investments to yield increasing returns amid these drivers. Impressed with current earnings momentum, we maintain our ‘buy’ recommendation and upgrade our 12-month target price to $3.40/sh.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.