Overview: Freelancer Ltd (“Freelancer”, “the Company”) is an Australian-based software company operating the world’s largest freelancing, outsourcing, and crowdsourcing marketplace. As of 30 June 2015 Freelancer 15.9m total registered users and 8m total projects and contests. Freelancer acquired payment service provider Escrow in April 2015. Our last advice was a ‘buy’ recommendation on 3 June 2015 at $1.14.

![]()

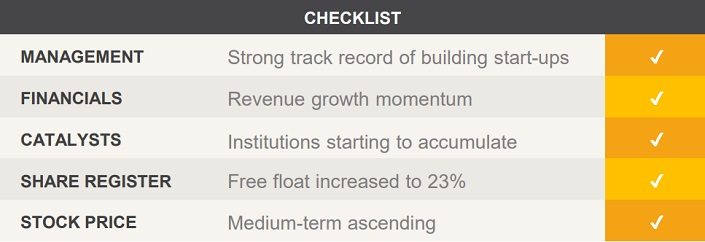

Catalysts: Freelancer is on track to achieve another year of double-digit revenue growth. We expect growth momentum to continue throughout 2015, buoyed by favourable currency exchange movements. As most of its revenue is derived offshore further depreciation of the AUD will enhance its revenue profile. Management recently sold $35m worth of shares to increase the free float to 23%. Large institutions are starting to accumulate and more liquidity should attract investor interest in the long- term.

Hurdles: Despite incremental revenue growth, Freelancer has not made a profit yet and remains reliant on external funding. Growth through acquisitions results in integration risks for management. The current valuation incorporates future earnings growth, which could result in share price depreciation if targets are not met.

Investment View: We continue to be attracted to Freelancer’s growth trajectory and favourable outlook. We expect growth momentum to continue bolstered by a low AUD. While Freelancer is starting to attract large institutions, we reiterate our ‘buy’ advice and raise our 12-month price target to $1.70.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.