Overview: TZ Limited (“TZL”, the Company”) is an Australian technology company focused on asset security. It has developed devices and software which enable the management, control, and monitoring of business assets, including aircraft, buildings, data centres, and parcel delivery systems. TZL’s core technology enables remote operation of mechanical devices such as fasteners and locks. It was founded in 1998 and listed on the ASX via a reverse merger in 2004.

![]()

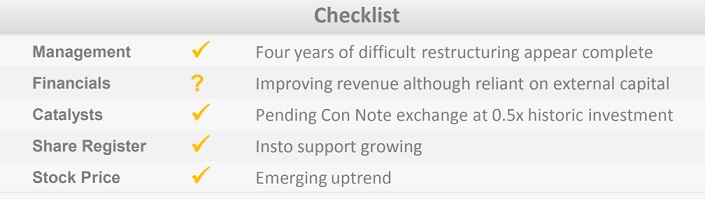

Catalysts: Renewed balance sheet health and greater concentration on technology sales are expected to drive growth for TZL. Loss-making engineering services unit, PDT, was disposed of in 2013, and convertible note holder, QVT Funds has agreed to a $24m ordinary equity exchange. The transactions are expected to drive a significantly improved financial performance in FY14 with the Company targeting ~2x revenue growth to $8m and operating cost savings up to 25 percent.

Hurdles: Despite cumulative investment exceeding $100m, TZL remains reliant on external capital to finance operations. Confidence in the Company has been impaired by high levels of historic executive turnover and an unsuccessful tender for Australia Post in 2012. Convertible note exchange is subject to shareholder approval in February.

Investment View: TZL is a speculative turnaround play with leverage to data center growth and a trend towards the ‘internet of things’. Restructuring undertaken during 2013 has the potential to deliver significant operating and financial improvements. Whilst further capital may be required to reach a self-sustaining trajectory, current prices of ~0.5x historic investment offer value as commercial applications for TZL’s Intellectual Property portfolio expand. We expect recent successful tenders with Poste Italiane and Singapore Post to boosted near-term confidence, and initiate coverage with a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.