Overview: Trade Me Group Limited (“Trade Me”, “the Company”) is a New Zealand-based software company focused on classified advertising. Trade Me owns and operates TradeMe.co.nz, New Zealand’s largest online auction and shopping website and fifth most frequently visited website in the country. The site averages over 25m visitors per month and spans from auctions to fixed-priced sales for new and used goods, with automotive, real estate, and employment businesses.

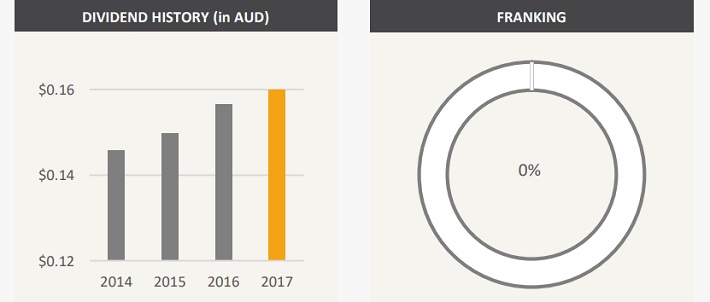

Catalysts: Trade Me is the market leader in online classified advertising and has a strong track record of earnings and dividend growth. Over the past four financial years, revenue grew at a compound annual growth rate of 10%, and continuation of this trend whilst controlling expenses is the primary catalyst for shareholders. Payable in September 2017, Trade Me is expected to increase its full-year dividend, taking the annual yield to over 3.5%.

Hurdles: In order to retain its market-leading position, Trade Me has to invest significantly in product enhancements and marketing and the Company may be subject to increasing competition from NZ and overseas. As the Company is currently focused on New Zealand only, Trade Me may be operating in a saturated market, which may no longer generate sufficient new demand for its products and services.

Investment View: Trade Me offers profitable exposure to online retail trends in New Zealand. We are attracted to the Company’s growth trajectory, market position, and history of dividend growth. Competition and market-specific risks are primary hurdles and may challenge the Company’s ability to deliver ongoing dividend growth on favourable terms for shareholders. Overall we favour the balance of risk and believe that Trade Me offers a compelling mix of capital growth and income. We initiate coverage with a ‘buy’ recommendation and add this position to our dividend portfolio.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.