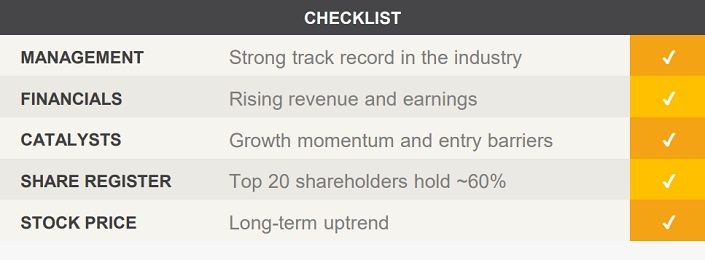

Overview: TFS Corporation Ltd (“TFS”, “the Company”) is an Australian industrial company focused on the production of Indian Sandalwood products. It controls the world’s largest ethical and sustainable supply of Indian Sandalwood, a $1billion market characterised by exhausted natural reserves. Our last advice was a ‘buy’ recommendation in February 2013 at a price of $0.56.

![]()

Catalysts: TFS has achieved average top-line growth of 31% while NPAT increased 57% p.a. over the past four years. We expect increasing harvest volumes, market validation, and capital management initiatives to sustain the trend. With harvest volumes scheduled to rise 10x in FY16; enhanced earnings quality and transactional endorsement of consumer demand could galvanise interest towards the stock. We also see an opportunity for TFS to enhance its balance sheet profile via refinancing of its US Dollar bonds.

Hurdles: Historical development of the Company’s plantation estate has been capital intensive and there is no guarantee that external funding requirements have been eliminated. Recent acquisitions may result in integration risks and operational challenges. The Company’s capacity to extinguish debt through cash flow appears constrained and there is no guarantee that these long-term debts can be refinanced.

Investment View: TFS offers profitable exposure to the Indian Sandalwood market. We are attracted to the Company’s growth trajectory, strong market position, and high competitive barriers. Whilst capital intensity of its operations and external funding requirements are principal risks, we expect shareholders to be rewarded as the Company’s transition towards a more diversified, consumer-driven earnings mix becomes salient. Offering a combination of capital growth and modest income, we resume coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.