Overview: Teranga Gold Corporation (“Teranga”, “the Company”) is a Canadian company focused on gold mining in Africa. Its primary asset is the Sadiola Gold Mine in Senegal, which was commissioned in 2009. Sadiola hosts a 3.5Million tonne (Mt) pa processing mill and produced 212,000oz during 2014 at the all-in sustaining cost of $865/oz (“AISC”). Proven and Probable Reserves are 59Mt grading 1.36g/t for 2.6million oz. These Reserves are contained within Measured, Indicated, and Inferred Resource estimates totaling 8.4million ounces.

![]()

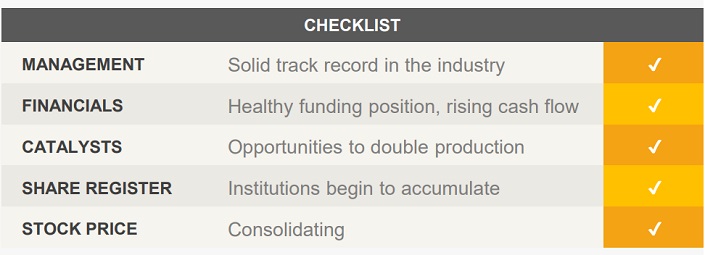

Catalysts: Free cash flow has risen for the past two consecutive years amid a weakening gold price regime, providing a platform for counter-cyclical acquisitions. Supported by a ‘first mover’ advantage in Senegal, and a regional land package exceeding 1000km2, opportunities have been identified to more than double production in the medium term.

Hurdles: Development of the high-grade Gora deposit is scheduled to see AISC rise in 2015. Last year’s streaming deal to finance its acquisition of the Oromin Joint Venture requires delivery of 22,500oz for the next six years, and 6 percent for the balance of mine life at 20 percent of the spot price.

Investment View: Teranga offers profitable exposure to the gold mining industry. We are attracted to its recent operating performance, financial position, and organic growth potential over the medium term. Scalability of the Sadiola operation is expected to mitigate costs associated with last year’s streaming transaction and current development works. With the Company well placed to benefit from any cyclical recovery in the gold market, we initiate coverage with a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.