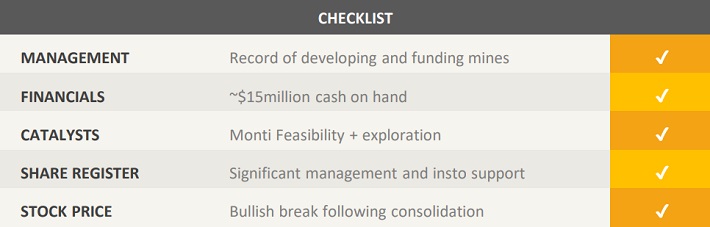

Overview: Talisman Mining Ltd (“Talisman”, “the Company”) is an Australian minerals company with operations in WA. Its most advanced asset is a 30% interest in the Springfield JV, covering 198km2 immediately to the east of Sandfire Resources NL’s DeGrussa Copper-Gold Mine in the northern Murchison Goldfields. Indicated and Inferred resources totalling 1.05Million tonnes (Mt) grading 9.4% Cu and 1.6g/t Au have been delineated at the Monti deposit. Talisman also holds the 290km2 Sinclair Nickel Project, near Agnew, which incorporates the historic Sinclair Mine and infrastructure.

![]()

Catalysts: A feasibility study incorporating the Monti deposit is due for completion in Q1 2017 and is expected to form the basis of a development decision. Its proximity to the Degrussa Mine has the potential to drive M&A. Two years after acquiring the Sinclair Project in late 2014, Talisman has commenced exploration drilling with the aim to delineate new resources close to existing infrastructure.

Hurdles: There is no guarantee existing resources at Monti can be economically mined, or extended through additional exploration. Talisman is reliant on external capital and there is no guarantee it will be able to deliver its share of development capex at the Springfield JV. Talisman’s minority shareholding in the Springfield JV may impair its ability to optimise development planning and scheduling. Certified resources aren’t delineated at the Sinclair Project and there is no guarantee exploration will be successful.

Investment View: Talisman offers speculative exposure to the copper and nickel mining industries. We are attracted to the profile of its board, management, and shareholders. Technical studies at Monti have the potential to drive near-term interest towards the stock, whilst the Sinclair Project underpins a longer-term value play. Originally discovered by Talisman’s “ex Jubilee” team in 2005, Sinclair hosts infrastructure with a $120million replacement value and potential for additional resource delineation. With exploration and feasibility activities progressing concurrently, we initiate coverage with a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.