Overview: Sonic Healthcare Limited (SHL) is an international medical diagnostics company, offering laboratory medicine/pathology and radiology services to the medical community. The company is structured as a decentralised federation of medically-led diagnostic practices, with the head office in Sydney, Australia. SHL provides the services and infrastructure in eight countries: Australia; New Zealand; the UK; Germany; Switzerland; Belgium; Ireland; and the USA. The domestic strategy is to retain cost leadership through the reinvestment of capital into new technology. The building of new facilities delivers cost savings through leveraging new technology.

![]()

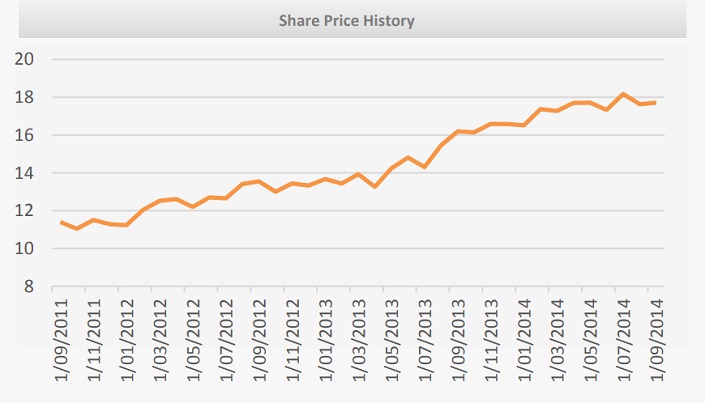

Dividend and Investment View: Sonic Healthcare Limited (SHL) has delivered steady growth in the past few years. The full-year results for FY14 have shown a 12.3% increase in revenue and a 14.9% increase in net profit. SHL’s P/E ratio is in line with the sector standard and the stock can therefore be considered as fairly valued. The total dividend increased by 8.1% to 67c per share and the final dividend is 40c, 55% franked. The company expects 5% EBITDA growth, however, many analysts believe SHL will be able to beat these expectations. A well-positioned company, good dividend yield, and a favourable long-term outlook make SHL a solid dividend play. The ex-dividend day is 5th September 2014 with a record date of 9th September 2014.

Please note: The recommendations of the Dividend Portfolio have a medium to long-term outlook and are not part of the Active Investor’s Portfolio.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.