Overview: Fatfish Internet Group Ltd (“Fatfish, “the Company”) is an Australian investment company focused on technology. It specialises in delivering capital and resources to concept-stage internet ventures in the South East Asian region. Fatfish’s principal assets include a portfolio of unlisted investments which is supported by co-investment partnerships with the Government of Malaysia and Singapore. Since its formation in 2011, Fatfish has committed in excess of $4million toward more than ten individual ventures. Fatfish listed on the Australian Securities Exchange in July 2014 via a reverse merger with Atech Holdings Ltd.

![]()

Catalysts: Fatfish’s investment selection capabilities have been recognised via its participation in Malaysian and Singaporean Government business funding schemes. Delivery of targeted capital gains via liquidity events such as trade sales or spin-offs is its major value driver. The planned Initial Public Offer of Fatfish’s mobile gaming interests via iCandy Interactive Ltd (“iCandy”) has the potential to be a major catalyst. At the Initial Public Offer price, Fatfish’s residual iCandy interest has an implied valuation of $0.29/share, undiluted.

Hurdles: Fatfish is reliant on external funding to execute and expand its investment portfolio and there is no guarantee ongoing finance will remain available to the Company. There is no guarantee Fatfish’s strategy to achieve capital gains from its portfolio will be successful or occur within targeted investment horizons. The risk and liquidity profile of its investment portfolio may challenge Fatfish’s capacity to attract fair value in its share price.

Investment View: Fatfish provides speculative exposure to early-stage internet technologies. The diversified nature of its portfolio and participation in major regional Government funding initiatives are attractive qualities. Along with the experience of its management team, these characteristics can mitigate elevated risks typically associated with investments at this stage of the technology life cycle. With the validation of its business plan via liquidity events the major value driver for shareholders, we view the planned iCandy spin-off to be a major catalyst. As we seek to monitor the performance and liquidity of iCandy, and Fatfish’s remaining investment portfolio, we are initiating coverage on the Company.

Fatfish Internet Group Ltd (“Fatfish, “the Company”) is an Australian investment company focused on technology. It specialises in delivering capital and resources to concept-stage internet ventures in the South East Asian region.

Reverse ASX listing in July 2014

Fatfish’s principal assets include a portfolio of unlisted investments which is supported by co-investment partnerships with the Government of Malaysia and Singapore.

Since its formation in 2011, Fatfish has committed in excess of $4million toward ten individual ventures. The Company now operates offices in Melbourne, Singapore, Kuala Lumpur, and Jakarta. Fatfish listed on the Australian Securities Exchange in July 2014 via a reverse merger with Atech Holdings Ltd. Issued capital currently stands at $26.8million, or $0.20/share.

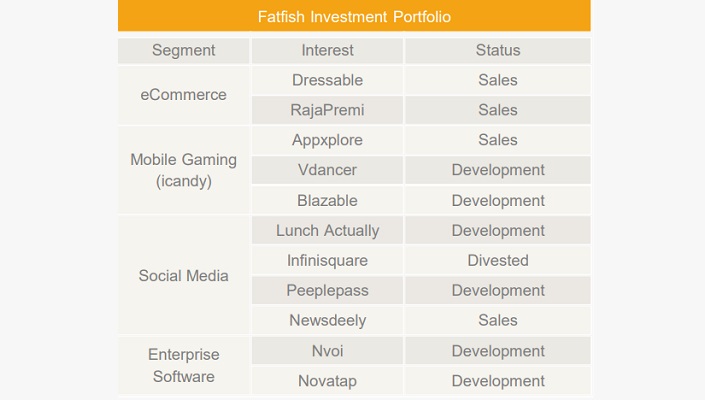

Fatfish holds a portfolio of equity interests in unlisted Malaysian, Singaporean, and British Virgin Island-based Companies developing internet-based technologies.

To date the Company has committed capital exceeding $4million toward more than ten individual ventures, developing assets focused on ecommerce, mobile gaming, social media and enterprise software. These and subsequent investments are being conducted in partnership with business funding schemes initiated by the Malaysian and Singaporean Governments.

Since June 2012 the Company has been an official partner of the i.JAM funding scheme of the Media Development Authority of Singapore (MDA). In November 2014 Fatfish was also appointed as a co-investment partner of Cradle, an early-stage technology funding agency under the Ministry of Finance of Malaysia.

Fatfish’s most advanced investments include its interests in consumer-orientated eCommerce portal, Dressable, and social network company, Lunch Actually Group. Fatfish holds a direct 15 percent interest in Dressable, with an option to acquire up to 49 percent. Dressable is currently generating US$2million in sales p.a., and is currently expanding to Indonesia and Malaysia. Fatfish’s interest in Lunch Actually Group is presently 1.5 percent, with the venture presently generating sales of ~ US$6m p.a.

Also generating sales yet at an earlier stage of development is Fatfish’s interest in RajaPremi, an online insurance portal operating in Indonesia. Fatfish has a 32.5 percent effective interest in RajaPremi.

To further advance its mobile gaming assets, Fatfish has established a special purpose vehicle, iCandy Interactive Ltd (“iCandy”), for which it is seeking a listing on the ASX. It is envisaged for Fatfish shareholders to receive an in specie distribution of iCandy shares.

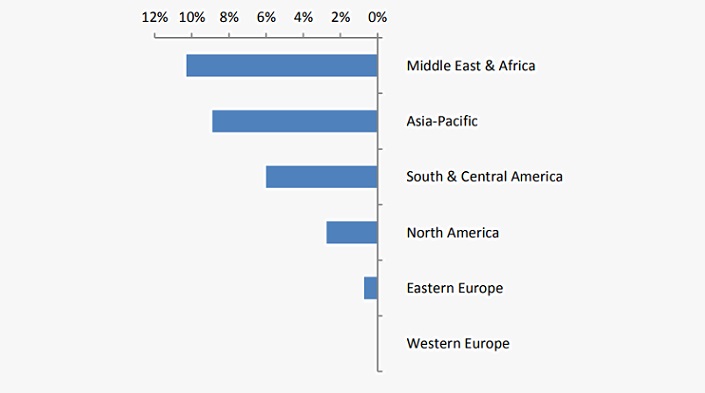

Over the last 15 years, the Asia Pacific region has overtaken Europe to become home to the world’s largest number of wireless internet connections. For the past five years, it has witnessed the second strongest growth in wireless network connections, behind The Middle East & Africa. As a result, more than 50% of total wireless networks are located in the Asia-Pacific reason.

An increasing amount of Asia Pacific internet use has become subscription-driven. Penetration of Post Paid connections have risen from 20 to 25 percent over the past five years, however with Western Europe currently at 58 percent and North America at 86 percent, there remains significant scope for further growth.

Over the last 15 years the Asia Pacific region has overtaken Europe to become home to the world’s largest number of wireless internet connections.

To date, Australia appears to have played a disproportionately small role in the funding of new start-up ventures made possible by the region’s rapidly growing wireless network infrastructure. The Australian Private Equity and Venture Capital Association Limited has reported the nation’s quantum of venture capital funding relative to GDP to be less than half the OECD average.

Fatfish has been established as a vehicle to channel capital from Australia into new start-up internet-based ventures focused on the South East Asian region.

Whilst focused on southeast Asian internet ventures, Fatfish is pursuing a diversified partnership approach towards its investments. The Company has established a portfolio of over ten individual ventures with equity interests ranging from 5 percent to over 50 percent.

The value of its initial capital contributions ranges up to $0.2million per investee. A typical holding period is two to five years, during which Fatfish retains the flexibility to increase contributions to $1million.

To mitigate funding and execution risks, Fatfish invests alongside Government agencies, industry, and other private venture capital partners.

To advance the development status of its investments, the Company has the capacity to provide advisory and mentoring for its investees in a nonexecutive manner.

Realisation of its investments is targeted via a trade sale or Initial Public Offering on major regional securities exchanges in Australia, Singapore, Indonesia, and Malaysia.

Whilst realisation is expected to become an increasing focus for Fatfish, to date, the Company’s activities have been focused on the investment phase, and procurement of co-investment partnerships.

At the Government level, to date, Fatfish has participated in business funding schemes initiated by the Malaysian and Singaporean Governments.

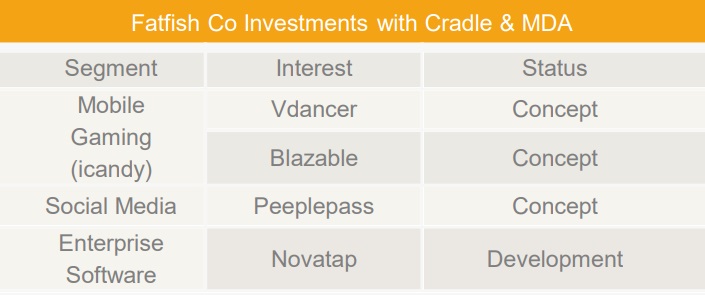

Since June 2012 the Company has been an official partner of the i.JAM funding scheme of the Media Development Authority of Singapore (MDA). In November 2014 Fatfish was also appointed as a co-investment partner of Cradle, an early-stage technology funding agency under the Ministry of Finance of Malaysia.

The i.JAM funding program allows a co-investment partnership between Fatfish and MDA that sees investment of up to SGD0.25million (~A$0.25million) of seed funding into early stage startup in exchange for minority equity position.

Fatfish Ventures is one of four investment partners selected by Cradle to run the program. Fatfish will identify and qualify startups in Malaysia under the program with Cradle matching each investment made by Fatfish on a one-for-one basis up to RM0.5million (~A$0.17million).

Fatfish aims to generate returns from its investments via capital gains. Investee’s that successfully achieve their business objectives through cash flow or economies of scale, create the potential for Fatfish to generate incrementally higher book valuations.

Ultimately, monetisation of its investments at much higher valuations is the major value driver for Fatfish. Monetisation is possible via trade sales or Initial Public Offerings. Over a two to five-year holding period, Fatfish targets a minimum 200 percent Return on Investment (ROI) for each of its investees. This equates to Internal Rates of Return between 25 percent and 70 percent depending on the holding period.

Minimum ROI Target 200 Percent

As Fatfish’s activities to date have focused on executing investments and procurement of co-investment partners, realisation transactions within its portfolio have been limited. To date, successful investment realisations involved scrip-based transactions.

In October 2014, Fatfish’s social networking venture, Love Out Loud was acquired by Lunch Actually Group. The transaction resulted in an undisclosed noncash capital gain. Fatfish’s interest in the venture is now represented by a shareholding in Lunch Actually Group, which remains privately held.

Primary Exit Strategy via IPOs and M&A’s

In the coming quarter, Fatfish is increasing its focus on investment realisations. Its mobile gaming ventures are being consolidated and spun off into a separately listed vehicle, iCandy Interactive Ltd (‘iCandy”). Fatfish is scheduled to retain a ~85 percent interest in iCandy, which has been flagged for distribution to Fatfish shareholders in species. At the Initial Public Offer price of $0.20/share, Fatfish’s residual iCandy interest has an implied valuation of $0.29/share, undiluted.

Fatfish reports some revenue’s as a result of cash-generating interests within its investment portfolio. During the half-year ending December 2014, Fatfish recorded revenue of $0.5million.

However as the generation of capital gains rather than operating income is its modus operandi, Fatfish remains reliant on external capital to fund operations and expand its investment portfolio.

June placement provides working capital

To date, the Company has funded these initiatives via equity. It’s most recent financing activity was a $0.55million institutional placement at $0.19/share. The placement expanded shares outstanding by 2 percent.

We estimate cash reserves now stand in the order of $1.87million and issued capital to be $26.8million or $0.20/share.

The proposed iCandy Initial Public Offer has been registered with the Australian Securities and Investments Commission. Under the existing iCandy prospectus, Fatfish is scheduled to hold a ~85 percent interest in the venture which will hold its mobile gaming interests.

With the listing price of $0.20/share representing a market capitalisation of $44million, successful execution of the iCandy IPO would represent a valuation of $0.29/share for Fatfish.

Fatfish Internet Group Ltd provides speculative exposure to early-stage internet technologies. The diversified nature of its portfolio and participation in major regional Government funding initiatives are attractive qualities.

Alongside the experience of its management team, these characteristics can mitigate elevated risks typically associated with investments at this stage of the technology life cycle.

Principal risks surround its ongoing reliance on external funding; the unpredictable nature of capital gain realisations; and potential challenges in attracting fair value for its underlying investment portfolio.

iCandy IPO is a major catalyst

Validation of its business plan via liquidity events such as a spin-off or cash divestment is, therefore, the major value driver for shareholders. In that respect, the planned Initial Public Offer of its mobile gaming interests via iCandy has the potential to be a major catalyst.

As we seek to monitor the performance and liquidity of iCandy, and Fatfish’s remaining investment portfolio, we are initiating coverage on the Company.

Kin-Wai Lau founded his first technology company when he was 23 and has since taken three technology companies public. Mr. Lau began his career in a mobile Internet startup company called Viztel Solutions Berhad as co-founder and Managing Director. Mr. Lau took the company public before co-founding the regional biotechnology company Cellsafe Biotech which is now operating in four countries. Mr. Lau graduated from the University of Manchester in the U.K. as a scholar of a Malaysian government-controlled corporation.

Dato’ Larry worked with Accenture, one of the worlds leading consulting firms, for 26 years in diverse leadership and consultation roles. He was also Managing Partner for Asia and managed the firm’s Venture Fund in Asia Pacific. Presently he is Chairman of numerous companies and was formerly a director of ASX listed iProperty Group (ASX:IPP)

Donald H. Low has worked in the corporate advisory and corporate finance sector specialising in start-ups, Initial Public Offerings, Reverse Take Overs and M&As. Donald Low has been involved in a diverse range of businesses with interests in Asia, Australia, and Europe ranging from finance to manufacturing. He is now Secretary as well as Non-Executive Director for Fatfish Internet Group.

Apart from his non-executive director role for Fatfish Internet Group, Mr. Tan is also director of Fraden Projects Australia Pty Ltd, which was involved in the Yen So Park Project in Vietnam. Mr. Tan has 16 years’ experience in equities, derivatives, and portfolio advisory roles.

Mr. Datuk Marco Yap is overseeing the finance activities for the Company and is responsible for formulating Fatfish’s overall business strategies. Mr. Yap has graduated from the University in Auckland, New Zealand with a Bachelor’s degree in Commerce and obtained a Masters in Business Administration from the Charles Sturt University in 2002.

Fatfish’s principal asset is a portfolio of early-stage internet ventures. The technical merit and commercial potential of these investments to a large degree remain to be validated.

Investee’s within Fatfish’s portfolio are not guarded by significant intellectual property protections such as patents, hence their major competitive barriers are mainly associated with speed to market.

Fatfish’s primary asset is a portfolio of unlisted, early-stage investments in Malaysian, Singaporean, and British Virgin Island-based Companies. These securities are highly illiquid and subject to variances in corporate regulation.

Fatfish is reliant on external capital to fund overheads, undertake additional investments and maintain existing equity interests. There is no guarantee subsequent funding will be available to the company nor on favourable terms for existing shareholders.

The unlisted and early-stage nature of Fatfish’s investment portfolio provides the limited capacity to appraise the Company’s value. In the absence of significant valuation watermarks, catalysts for share price appreciation may be limited.

Fatfish’s primary return driver is capital gains arising from realisation of its investments. The timing of these realisations is dependent on internal development milestones by its investees and external market factors beyond Fatfish’s control. The longer the horizon required to realise its investments, the greater its funding demands, the net impact of which is likely to be lower shareholder returns.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.