Overview: Salt Lake Potash Ltd (“SO4″, “the Company”) is an Australian minerals company with operations in WA. Its most advanced asset is the Lake Wells Sulphate of Potash Project (“Lake Wells”), approximately 200km north of Laverton. SO4 has delineated a Sulphate of Potash (“SOP”) resource of 80- 85Million tonnes (“Mt”) at Lake Wells, classified as Measured, Indicated, and Inferred. A Scoping Study into an initial 200,000tpa operation was completed in August 2016, which estimated capital costs of $223million and operating costs of $241/t.

![]()

Catalysts: The Scoping Study highlighted the potential for Lake Wells to rank amongst the world’s lowest-cost sources of SOP in terms of operating cost and capital intensity. Delivery of a Pre Feasibility Study (“PFS”) now underway, may reinforce its economic potential and address technical risks. In an industry with a tightly held supply base, procurement of offtake partners stands as a major value driver.

Hurdles: There are no guarantee existing resources at Lake Wells can be converted into reserves, or the potash resource economically mined. SO4 is reliant on external capital and is likely to require further funding prior to completion of its PFS. There is no guarantee it can procure the funds necessary to develop a mining operation at Lake Wells. The Scoping Study assumed SO4 can secure a circa 10% share of the SOP market without negatively impacting prices, neither of which is assured.

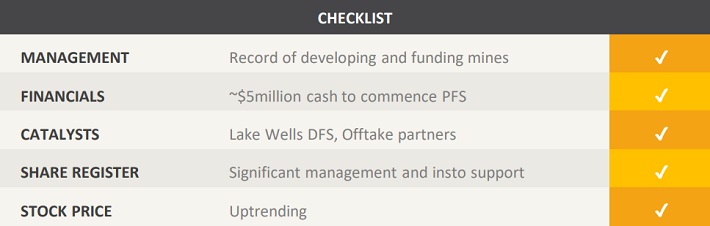

Investment View: SO4 offers speculative exposure to the potash mining industry. We are attracted to the Company’s management team, resources delineated at Lake Wells, and its potential to deliver new low-cost SOP supply into domestic and international markets. With Australia yet to develop a commercial potash mine, principal risks include the Company’s technical capability and entry barriers imposed by existing producers in the SOP market. With the delivery of the PFS and offtake partnerships as the primary catalysts, we initiate coverage on SO4 as a ‘speculative buy’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.