Overview: Xped Limited (“Xped”, “the Company”) is an Australian technology company focused on Internet of Things (“IoT”) technologies. Its principal asset is intellectual property (“IP”) surrounding the Auto Discovery Remote Control (“ADRC”) technology. Xped controls nine patent families that support IoT applications and NFC-based tap applications. Following the successful completion of an $8million prospectus raising, Xped listed on the Australian Securities Exchange on 5 April 2016 via a reverse takeover of Raya Group Limited.

![]()

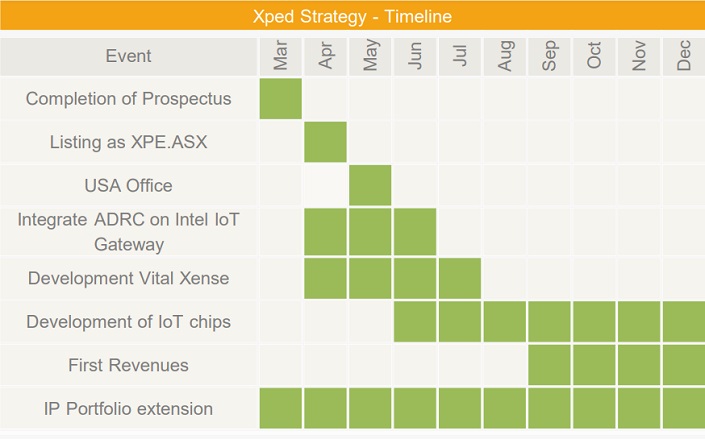

Catalysts: Xped’s technology is currently undergoing commercial trials as the company is engaging prospective industrial customers. Progression into licensing agreements can generate near-term revenue and provide a major validation signal. The Company has established MOUs with a US-listed tech giant, and a NASDAQ-listed chipset manufacturer amongst others. Supported by its recent $8million fundraising, Xped aims to generate initial revenues in 2016.

Hurdles: As Xped’s technology is currently in the validation stage, the Company does not presently generate revenue and is reliant on external capital to fund operations. The technical and economic merit of Xped’s technology remains to be validated via a binding commercial agreement. Whilst Xped’s technology benefits from patent protections, its commercial value remains subject to influence from alternative, competing for technology solutions.

Focus on ‘Internet of Things’

Investment View: Xped offers speculative exposure to demand new Internet of Things technologies. Its patent portfolio, existing commercial partnerships, and funding position are attractive qualities. Validation of Xped’s technology via a binding commercial agreement is the major potential value driver. Principal risks surround the Company’s ongoing reliance on external capital, validation requirements, and competition. As the Company attempts to deliver a universal solution for ‘mid tier’ stakeholders impacted by the IoT movement, we initiate coverage.

Xped Limited (“Xped”, “the Company”) is an Australian technology company focused on Internet of Things technologies.

Xped is principally focused on the development and commercialisation of intellectual property (“IP”) to support the “internet of things”. Xped’s most advanced asset is intellectual property surrounding the Auto Discovery Remote Control (“ADRC”) technology. Xped was founded in 2008.

Following the successful completion of an $8m prospectus raising, Xped listed on the Australian Securities Exchange on 5 April 2016 via a reverse takeover of Raya Group Limited.

Issued capital is estimated to stand at $12.1million, or 0.7c/share.

Xped has developed a portfolio of Intellectual Property (“IP”) that focuses on enabling any electronic device to be easily added to a network such as Wi-Fi and controlled via one master app known as a Device Browser or DeB for short.

Xped’s primary asset is its Auto Discovery Remote Control technology (“ADRC”, “the technology”), which allows a single control unit like a smartphone to remotely control and command any common industrial device or household item.

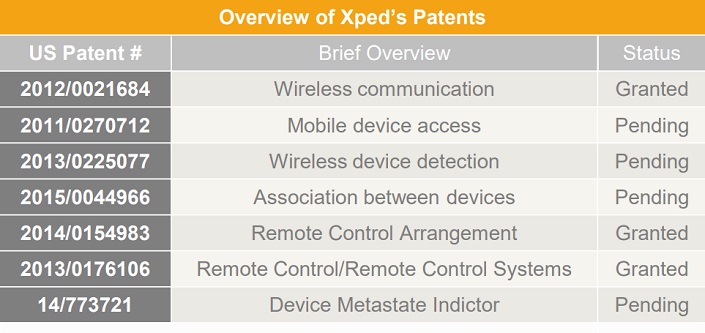

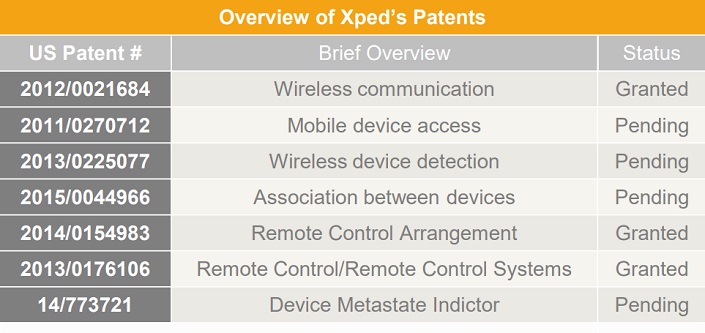

Development commenced seven years ago and the technology is currently undergoing commercial trials. IP associated with the technology is protected by a granted patent in the US, and further patent applications in 13 countries.

Subject to outcomes of current user trials, Xped intends to commercialise the technology via licensing agreements with third parties.

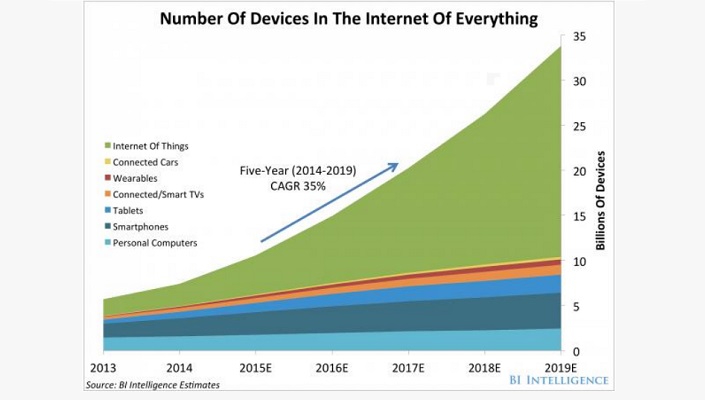

The Internet of Things (“IoT”) is a colloquial expression for technology that enables physical objects or ‘things’ to collect and exchange data with cloud platforms, other things, and humans via connectivity with the Internet.

Industry estimates for connected devices to the internet range from 20 to 100 billion with a median average of around 50 billion devices that could be connected to the Internet by 2020¹. Other estimates suggest that IoT producers and service suppliers will generate revenue exceeding US$300 billion by 2020².

50 billion devices could be connected to the internet by 2020

As IoT technology will enable communication amongst objects generally not considered computers, collaboration from a broad range of stakeholders is necessary.

Participants converging to facilitate IoT technology include object manufacturers, parts suppliers, software developers, and communications providers. This movement was characterised by the founding of the Industrial Internet Consortium by AT&T, Cisco, General Electric, IBM, and Intel in March 2014.

To date, a lack of historical interface between stakeholder groups has created a dynamic characterised by a lack of standards, or conversely too many competing standards.

There is no universal IoT solution for consumers and manufacturers

Presently there is no adopted IoT solution that provides for the various needs of both consumers and manufacturers.

Xped is offering a technology solution that is agnostic to the competing interests of existing stakeholders. Its ADRC technology intends to markedly simplify the IoT on-boarding process and the provision of a single application or browser to control “things”.

Xped has invested more than $6m to date to develop the technology, and secure granted patents in the US, and further patent applications in 13 countries.

Xped has spent the past seven years developing and patenting its ADRC technology at a cost of ~$6million. The technology is presently at the validation stage which typically involves commercial trials and independent testing.

Technology currently in validation stage

With the ADRC software supporting prototype demonstrations, Xped is now engaging prospective industrial customers.

To date, Xped has utilised a combination of direct and channel marketing strategies. Xped’s direct marketing initiatives have thus far seen various industrial manufacturers commit to commercial trials of the technology.

Xped is now engaging prospective industrial customers and has established a number of MOUs

The Company has established MOUs with a US-listed tech giant, and a NASDAQ-listed chipset manufacturer. Additional MOU’s have been established with a number of privately-held entities including South Australian-based – Tytronics.

After satisfying the requirements of the validation phase, Xped aims to commercialise the technology via a licensing approach. Xped aims to provide its intellectual property via reference designs, standard hardware modules, a pre-programmed chip, and firmware for direct integration with a customer’s own hardware.

Xped secured its first licensing agreement in March with privately held, LEAPIN Digital Keys LLC (“LEAPIN”). The LEAPIN agreement covers the use of the ADRC technology within door locking systems, with Xped to receive USD$5 per unit sold worldwide.

Licensing agreements involving Xped’s other MOU partners are contingent on the outcome of further commercial trials and integration of the ADRC technology into chipsets.

Xped aims to generate revenue primarily by licensing its ADRC technology to third parties such as semiconductor vendors, device manufacturers, and software manufacturers. Additional revenue streams are possible via the sale of device apps, usage data, and services revenue generated from Xped’s platform.

The core business is to license Xped’s ADRC technology which will be based on a subscription model with volume-based unit pricing. A single licensing charge may apply for software embedded into each chipset unit. Whilst the LEAPIN agreement provides a licensing fee of USD $5 per unit, expectations for licensing charges around higher volume markets are expected to be in the order of USD $1.50 per unit sold.

Targeting revenue from mid-2016

The Company aims to generate revenue in the second half of 2016 following successful trials of products it has designed for a number of customers.

Licensing offers a low capital intensity approach to commercialisation

Another potential revenue stream can be generated by Xped charging a fee-for-service when assisting device manufacturers design-in ADRC to their products. The Company has created a range of reference designs for home automation products (IP cameras, smart plugs, infrared blasters) that can be manufactured by consumer product manufacturers and sold.

Xped also aims to generate service revenue through Xped’s platform. The platform enables device manufactures to directly communicate with their end customers thus transforming them from “box movers” to service providers. Xped targets monetisation of services through cloud services or eCommerce.

Xped does not presently generate revenue and is reliant on external capital to fund technology development.

To date, Xped has financed operations via equity. Its most recent raising was an $8 million prospectus raising completed in March 2016. Xped issued 320 million new shares at $0.025 to raise $8m. In addition, 150 million performance shares and 30 million Options were issued expiring 24 months from the allotment and exercisable at between 7 and 13 cents.

Strong demand for $8m raising

Issued capital after the prospectus raising is estimated to stand at $12.1million, or 0.7c/share. Following the prospectus raising Xped is estimated to hold approximately $9.7m in cash.

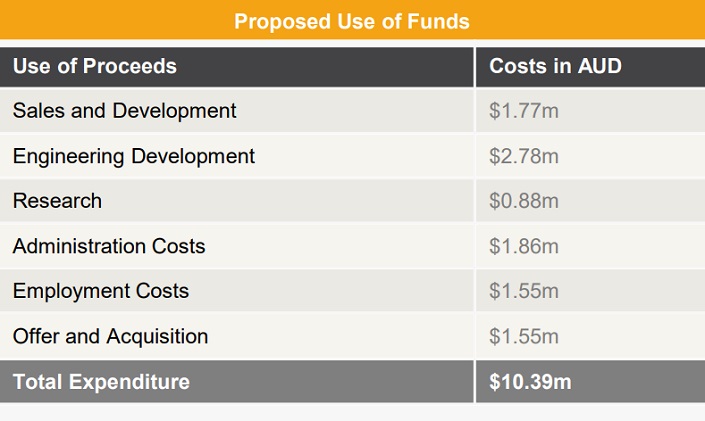

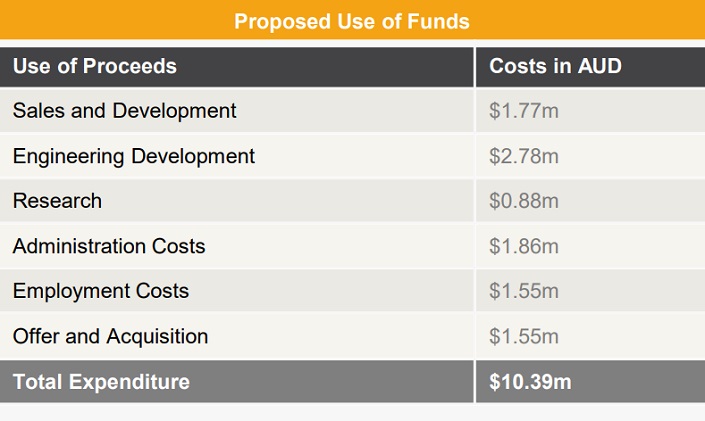

The table below is a summary of the proposed use of funds for the two years pursuant to the raising.

Xped offers speculative exposure to demand new Internet of Things technologies. Its patent portfolio, existing commercial partnerships, funding position, and potential to serve the US$80 billion ‘internet of things’ movement are attractive qualities.

Currently undergoing commercial trials, the progression of Xped’s technology into licensing agreements can generate near-term revenue and provide a major signal of Xped’s commercial potential. Validation of Xped’s technology via binding commercial agreements, therefore, represents the major potential value driver.

Commercial agreements are near-term catalysts

Principal risks surround the Company’s ongoing reliance on external capital, validation requirements, and competition from entrenched industry stakeholders. Whilst Xped’s technology benefits from patent protections, its commercial value remains subject to influence from alternative, competing for technology solutions.

As the Company attempts to deliver a universal solution for ‘mid tier’ stakeholders, we initiate coverage.

Mr. Chris Wood has a track record of developing technologies for the telecommunication and embedded device industries. He has worked for several major MNCs in various countries. In 2003 Chris founded Neve Technologies Pty Ltd, which developed and commercialised an augmented GPS system. Chris assisted Neve to raise capital and successfully commercialise its technology internationally.

Mr. John Schultz focuses on companies specialised in the design, manufacture, and business development of electronics systems. John is an entrepreneur founding and growing various companies and has experience in managing staff and contractors.

Mr. Athan Lekkas is the Executive Chairman of Xped and a Director of First Growth Funds Limited. He has focused on corporate advisory transactions with a specific view towards value creation, successful restructuring, and recapitalisation of various ASX listed companies in various sectors. Athan was instrumental in the negotiation of terms for this Xped acquisition and has utilised his strong relationships with institutions in Asia and North America to fund this transaction.

Mr. Michael Clarke has 18 years of experience in the Information Technology industry working across both public and private companies. Mr. Clarke has consulted and provided services to a variety of industries including manufacturing, corporate, government and education sectors. Michael demonstrated strong corporate skills and abilities that enabled Raya Group to evaluate and finalise this transaction.

Whilst the development of Xped’s technology has reached a stage that facilitates prototype demonstrations, there is no guarantee performance can be replicated in a commercial setting and that current user trials convert into binding licensing agreements.

Whilst Xped’s technology benefits from patent protection, its commercial value is subject to influence from alternative technology solutions. Many competing technologies are being developed by large corporations such as Google, Intel, Samsung, and Qualcomm, which have access to significantly more capital than Raya Group.

As the technical merit of Xped’s technology remains to be validated, there is no guarantee that sufficient demand exists to generate a return on shareholder funds. Whilst the Company anticipates its unique technology and competitive position will attract vendors, there is no guarantee this will arise.

Xped’s licensing strategy requires core software to be embedded in third-party parts and products. Whilst the quantum of parts and products carrying Xped’s software is scheduled to drive its financial performance, there is no guarantee that industry best practice reporting and tracking methods will be sufficient to prevent unauthorised use.

As Xped currently does not generate sufficient revenue, the Company remains reliant on external capital. There is a risk the Company won’t be able to secure ongoing funding or at a cost favourable for existing shareholders.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.