Overview: Quickstep Holdings Limited (“QHL”, the Group”) is an Australian advanced materials company focused on carbon-fibre manufacturing. Its primary asset is intellectual property (“IP”) surrounding the Quickstep Process – a manufacturing technology that allows for faster and lower-cost production of carbon fibre composites. Commercialisation of the technology has seen QHL establish a manufacturing facility in Sydney, and secure contracts to supply military aerospace programs.

![]()

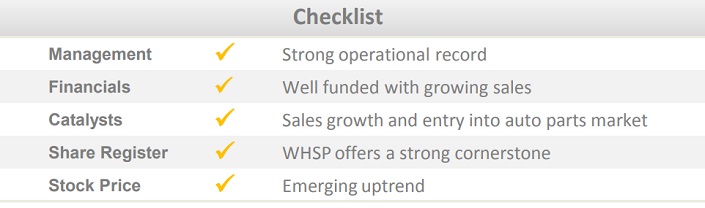

Catalysts: QHL’s strong delivery record for the existing Joint Strike Fighter (“JSF”) supply agreement is expected to stimulate its military and aerospace order book which presently stands at over 10x its FY13 revenue. Entry into the auto parts market could drive further growth following successful pilot manufacturing during 2013. Management is targeting revenue of $35m and a cash flow positive operation in FY15. After raising $12.7million in 2013, QHL is well-positioned to achieve these objectives.

Hurdles: Despite recent funding initiatives and revenue growth, QHL has yet to eliminate its reliance on external capital. Margin discipline also needs to be established as manufacturing scales up. Whilst long term supply agreements to the defence industry attract a collective value of $775million, there is no guarantee that firm orders will continue to materialise.

Investment View: Three years after commercialising its technology via the JSF supply agreement, we are attracted to QHL’s reliable manufacturing record and capacity to service $100million orders pa. Whilst scale-up risks remain, QHL’s present valuation near historic investment appears undemanding versus the carbon fibre market opportunity. Expecting ongoing growth potential into military, aerospace, and auto markets, we initiate coverage with a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.