Overview: QBE Insurance Group Limited (QBE) is a general insurance and reinsurance company with operations in 38 countries. The headquarter is in Sydney, NSW. In Australia, QBE provides localised services in each state and territory. The company is listed on the ASX since 1973 and historically aims to boost growth through acquisitions.

![]()

Catalysts: Over the last three years QBE moved sideways, finding support at $10. Last year the Group announced strategic reviews of its US-based middle-market operations. QBE aims to return to profitability in its North and Latin American operations by selling parts of its underperforming operations. The Group returned to profit during FY14 and with much of the changes now complete, management can focus on delivering profitable growth.

Hurdles: QBE’s share price has underperformed the broader market since the GFC and has suffered from volatility. Whilst the company aims to transform the underperforming operations, there is no guarantee that it will result in earnings growth. A strong USD may discount its domestic operations as the Group reports in USD.

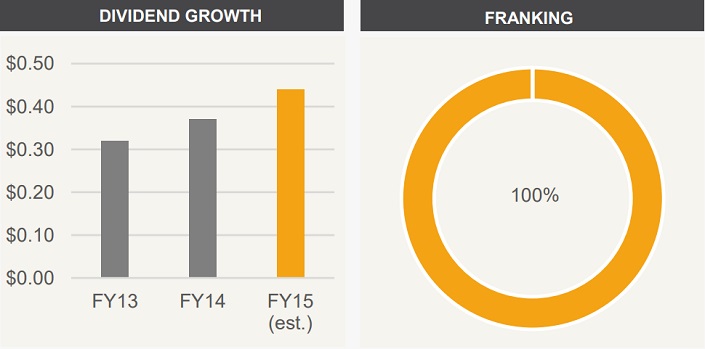

Investment View: After years of underperformance and heavy volatility QBE is refining its operations, as the management aims to return to sustainable and predictable growth. Dividend yield is expected to gradually increase during FY15. QBE offers exposure to an established company with an international footprint.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.