Overview: Collaborate Corporation Limited (“Collaborate”, “the Company”), formerly Qanda Technology Limited, is an Australian technology company operating in the sharing economy enabling the peer-to-peer rental of assets. The Company’s primary asset is Intellectual Property (“IP”) surrounding a peer-to-peer sharing and identity verification platform, which can be utilised for multiple industry verticals. Collaborate owns DriveMyCar, a peer-to-peer car rental platform, which allows car owners to rent their vehicles to others, as well as MyCaravan, Mobilise, and PeerPass. Foundation IP was acquired in 2014.

![]()

Catalysts: DriveMyCar is witnessing accelerating growth whilst achieving claims loss ratios substantially below industry benchmarks. Sustaining these trends via further corporate partnerships and leveraging its integrated ID verification platform PeerPass are major value drivers. Collaborate’s funding position is poised to strengthen with its partly underwritten options tranche (2c/sh, Apr 30) projected to meet short – medium-term funding requirements. Re-purposing IP to other verticals represents a long-term source of scalability.

Hurdles: Collaborate and its subsidiaries are not currently cash flow positive and there is no guarantee they will become self-funding despite the availability of capital from upcoming options exercise. Whilst existing partnerships and market share provide a competitive edge, there is no guarantee they will insulate the Company from new entrants to the market where primary entry barriers include IP, access to inventory, and financial resources.

Investment View: Collaborate offers speculative exposure to demand peer-to-peer sharing. We are attracted to its growth trajectory, corporate partnerships, and balance sheet. Principal hurdles include reliance on external capital and competition. With management demonstrating their ability to forge and leverage corporate partnerships, we anticipate a re-rating in the stock as DriveMyCar builds toward critical mass and favourable ecosystem risk outcomes that attract strategic interest. As our valuation of $0.06/share represents a 150% premium to recent trade, we initiate coverage with a ‘speculative buy’ recommendation.

Collaborate Corporation Limited (“Collaborate”, “the Company”), formerly Qanda Technology Ltd, is an Australian technology company focussed on peer-to-peer sharing. The Company’s primary asset is Intellectual Property (“IP”) surrounding a peer-to-peer sharing and identity verification platform, which can be utilised for multiple industry verticals.

DriveMyCar was acquired in 2014

To date, Collaborate has purposed this IP for vehicle sharing and general asset sharing. It has developed two-vehicle sharing platforms (DriveMyCar and MyCaravan), whilst its general asset sharing platform, Mobilise, is due to launch in 2017. Each of these platforms is supported by the Company’s identity verification technology, PeerPass.

Foundation IP behind these businesses was acquired in 2014 when the Company also underwent a 10:1 share consolidation and changed its name from Qanda Technology Ltd to Collaborate Corporation Limited.

Collaborate has developed a proprietary technology platform to facilitate the peer-to-peer rental of assets. This platform is capable of enabling multiple online marketplaces targeting different asset classes. Collaborate currently operates three businesses being DriveMyCar, MyCaravan, and Mobilise (to be launched in 2017).

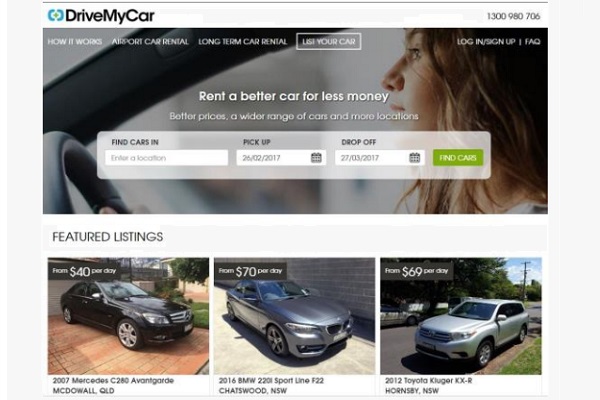

The most advanced asset is DriveMyCar, a peer-to-peer marketplace that allows car owners to rent vehicles to third parties. DriveMyCar is tailored for both private and corporate clients. DriveMyCar was founded in 2010 and acquired by Collaborate in 2014.

The DriveMyCar platform allows car owners to generate income from renting their vehicles to other people. The platform was initially designed for private consumers, however, Collaborate’s strategic focus on corporate partnerships with companies like Orix, InterLeasing, Subaru, Trivett Automotive, and Uber are rapidly demonstrating scalability.

Car rentals are available for a minimum of four days and up to a maximum of 12 months. Suppliers have the ability to generate income from their vehicles, while consumers are incentivised to use the platform through competitive rates and a wide selection of vehicles. As of February 2017, DriveMyCar had over 880 listed vehicles, and its total fleet is valued at over $20 million. The website has over 32,000 registered users.

The MyCaravan and Mobilise (to be launched in 2017) business units leverage Collaborate’s existing technology. MyCaravan is focused on peer-to-peer sharing of caravans, camper trailers and motorhomes and is in a start-up phase. Mobilise is a platform to rent any underutilised asset and will launch in 2017, in partnership with Aon, the world’s largest insurance brokerage firm.

Each of these platforms is supported by the Company’s identity verification technology, PeerPass. We understand PeerPass is a crucial risk mitigation tool that has enabled DriveMyCar to witness claims loss ratios substantially below industry benchmarks.

Collaborative consumption, also known as the sharing economy, refers to an industry where mostly private owners rent out under-utilised goods or assets to consumers. The sharing economy allows these owners to generate income from goods or assets they are not using, while consumers have the ability to rent assets without the need to purchase them. Goods can be anything from real estate to vehicles or less valuable assets such as bicycles or a fridge.

Awareness and popularity of the collaborative economy have increased significantly in recent years through the rise of widely known brands such as U.S.-based real-estate sharing platform, Airbnb, and the transportation focussed technology company, Uber. These companies own the IP to allow users to share their assets and do not own any of the underlying inventory available for rent.

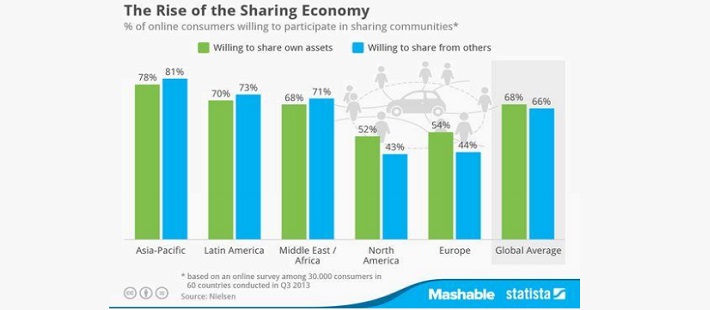

In Asia Pacific 78% of consumers are willing to share their own assets

In Australia, over 60% of the population are aware of the collaborative economy and over 50% have indicated that they have participated in some way in peer-to-peer sharing.1 Willingness to participate in the sharing economy is particularly high in Asia-Pacific with 78% willing to share and 81% willing to rent assets. This compares to the global average of 68% and 66% respectively.2 The industry has witnessed a shift in consumer behaviour where consumers increasingly trust ‘strangers’ despite a lack of regulation.

Consumers increasingly trust ‘strangers’. This shift in trust helps fuel the collaborative economy.

Having recognised the rising demand for collaborative consumption, Collaborate has developed proprietary technology to enable peer-to-peer transactions. DriveMyCar is its most mature application of the technology, targeting peer-to-peer car rentals.

The Australian car-sharing market is an alternative to traditional car rental services, which include commonly known brands such as Avis, Thrifty, or Hertz. The car-sharing market can be split into three pillars: Ridesharing, car-sharing, and peer-to-peer car sharing. The leading provider of ridesharing services is Uber and industry leaders for car-sharing include GoGet, GreenShareCar, or Hertz 24/7. DriveMyCar is focused on the third pillar of the industry, peer-to-peer car sharing.

Peer-to-peer car sharing refers to a market where vehicle owners make their own vehicles available for rent. DriveMyCar has developed processes and technology to cater to specific needs of the motor vehicle market to ensure that owner’s and renter’s needs are met. It holds unique insurance coverage designed to specifically cover the peer-to-peer rental of assets, which encourages car owners to transact via the DriveMyCar platform rather than privately.

In 2015, the New South Wales Government released a position paper on the sharing economy, welcoming the “positive impacts” of the collaborative economy.

Core technology has been developed over six years and supports the DriveMyCar and MyCaravan business, while Mobilise is currently in development for launch in 2017. The objective of Collaborate is to scale revenue in each of its business units through the organic expansion of its existing channels, strategic partnerships as well as horizontal growth within the peer-to-peer sharing economy.

The identity verification platform, PeerPass, was developed by Collaborate to verify customers before the first transaction occurs enabling a thorough vetting process to improve ‘trust’ and provides asset owners with more confidence to monetise their assets through the Collaborate marketplaces. The introduction of PeerPass has resulted in a rapid reduction in insurance claims to a level substantially below industry benchmarks, whilst simultaneously building a database of verified customers. Collaborate has identified the potential to license the PeerPass platform to other online marketplaces.

The DriveMyCar business unit is the most mature business generating the majority of Collaborate’s revenue, targeting car rentals of between four days and one year in the Australian market. Whilst competition in the short-term car rental market is high, there are few providers focussed on medium to long-term segments, for which we understand DriveMyCar commands a dominant market position.

PeerPass improves trust and has resulted in a rapid reduction in insurance claims

The Company aims to grow the total value of transactions across its platform by expanding the available fleet. With vehicle supply being the major historic constraint on growth, management is strategically focussed on expansion via corporate partners holding large underutilised fleets.

DriveMyCar has been successful in engaging corporate fleet owners and providing opportunities to create rental income streams for ex-lease and under-utilised vehicles. The partnership with Subaru Australia announced in February 2017 witnessed a 20% expansion of DriveMyCar’s fleet which was completely rented out in just 13 days.

20% fleet expansion absorbed in just 13 days

In parallel, management aims to leverage the technology and marketing strategies of DriveMyCar to grow the MyCaravan and Mobilise business units. The Mobilise business unit is preparing for launch in 2017 and benefits from the existing peer-to-peer back-end processing technology developed by Collaborate. The Company has announced a strategic partnership with Aon to promote the Mobilise marketplace, whilst it is planning to engage with further strategic partners.

The domestic car rental market is estimated at $3 billion per annum and is currently dominated by conventional short-term rental agencies which typically own their own vehicle fleet. Peer-to-peer rentals currently represent a small yet fast-growing segment.

Collaborate generates revenue when a customer makes a booking on one of its peer-to-peer sharing marketplaces. The value of the transaction is correlated to the market value of the asset and the duration of the confirmed booking.

Supply deals with major brands ensures availability of fleet on platform

Depending on the type and value of the asset, Collaborate retains a commission whilst paying back a portion of the fee to the owner of the asset. The average value per transaction on the DriveMyCar platform currently stands at $1,390 per contract with gross revenue earned by DriveMyCar of approximately $550 per contract. Users rent cars for 38.3 days on average.

Collaborate does not own the inventory offered for rent on its platform, hence there are no upfront costs associated with the procurement of the fleet. Collaborate has created a marketplace for users to exchange goods and revenue is derived from the total value of goods offered across all platforms and users’ willingness to make bookings. We estimate that DriveMyCar recorded approximately ~1,200 bookings during FY16.

The total value of inventory that is available for rent is estimated at over $20 million as of December 2016 and we understand that approximately half of the fleet is actively being used. Management has been able to generate revenues equivalent to between 4-8% of its active fleet value over the past two years. We understand this “utilisation rate” is improving on the back of management’s corporate partnership strategy and favourable claims loss ratio’s within the DriveMyCar ecosystem.

The domestic car rental market is estimated at $3 billion per annum

Collaborate has the potential to reach a cash flow breakeven position within the next 12-36 months, albeit contingent on further growth and management expects the more advanced DriveMyCar business to break even at an earlier date. Whilst supply on the platform has historically been a limiting factor, discussions with commercial partners are positioning the Company to accelerate uptake.

The Company’s verification platform PeerPass provides Collaborate with a competitive advantage by reducing risk and encouraging growth in the supply of assets and creating a pool of verified customers. PeerPass adds the ‘trust’ component to Collaborate’s platforms and can be monetised further through Collaborate’s marketplaces or those owned by third parties.

Collaborate currently generates revenue from transactions across its peer-to-peer sharing platforms. The Company charges daily rates based on the market value of rentable assets and generates gross revenue by charging administration and insurance fees. Cash flow is a result of the total rental transaction value, thus significantly higher than gross revenue. However, current revenue levels have not eliminated Collaborate’s reliance on external capital.

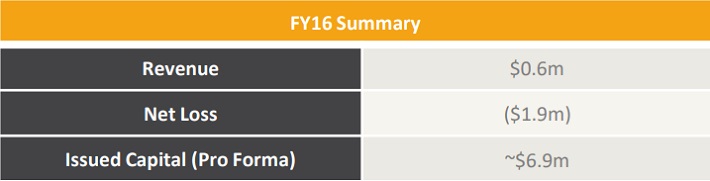

During FY16, the Company generated revenue of $0.6million resulting in a net loss of $1.9 million. Revenue grew 46% versus the previous year. The total loss for the year was reduced by 14.5% from $2.3 million to $1.9 million.

During H1FY17 Collaborate posted total revenues of $0.4million, a 34% increase, while the net loss decreased 16% to $1million.

Revenue growth was largely attributed to growth in the DriveMyCar business. The net loss declined as a result of lower costs and higher revenues. The most recent update for the March 2017 quarter indicated a 90% growth in bookings, which is one of the key indicators for revenue growth.

To date, the Company has funded operations via equity and debt but is currently debt-free. Since June 2016 Collaborate has held a $2.25 million equity facility with existing shareholders which enables the Company to draw on funds if required. The facility converts into shares at a discount of no more than 15% to the 10-day vwap and $1.76 million capacity remains available.

The principal focus of Collaborate’s financing initiatives presently is 172 million options exercisable at 2c/share due to expire April 30th. Over 1/3rd of this option tranche is underwritten for proceeds totalling $1.26 million.

$1.26m funding from underwritten options secured

Prior to the impact of this underwriting agreement, Collaborate’s cash balance was $0.1 million. Following the acquisition of the DriveMyCar IP and subsequent change of business direction, we estimate issued capital to stand at ~$6.9 million or $0.016/share.

Collaborate’s investment appeal rests in the current and future revenue streams generated by its peer-to-peer sharing platforms.

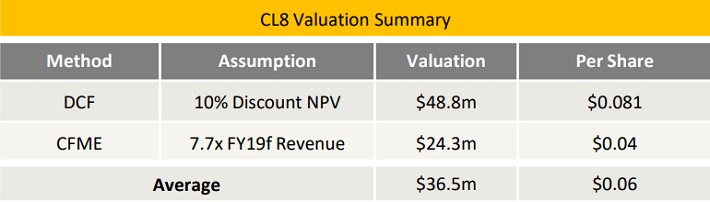

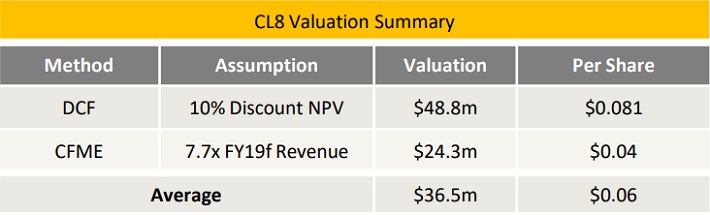

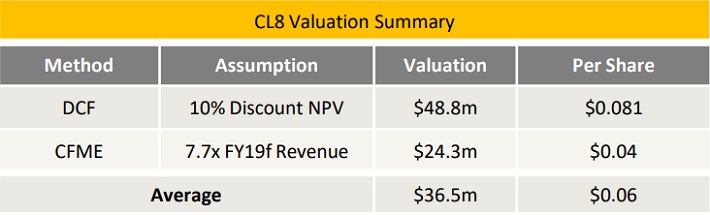

We have considered the Company’s potential pre-tax worth using the Discounted Cash Flow (‘DCF’) and Capitalisation of Future Maintainable Earnings (“CFME”) methodologies. Our appraisal is based on an expanded share count of 604 million, reflecting the sum of all existing shares and all expiring options in the April 2c/sh tranche.

Exercise of all the April options would provide a working capital surplus of $1-$2million above our projected funding requirement. This surplus has not been credited to the valuation but provides a buffer for the model in the event of a delay.

Our DCF approach arrives at a valuation of $48.8million, or $0.081/share. Our CFME method arrives at a valuation of $24.3million, or $0.04/share Applying equal weightings both methods deliver an aggregate valuation of $36.5million or $0.06/share.

Valuation $0.06/share

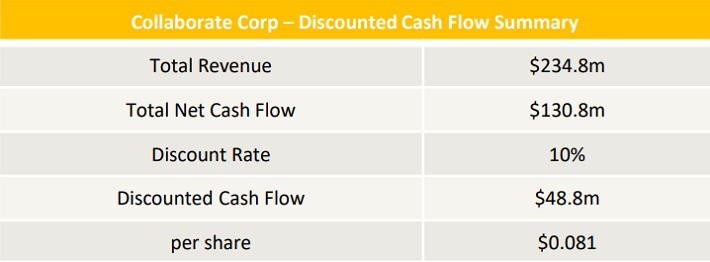

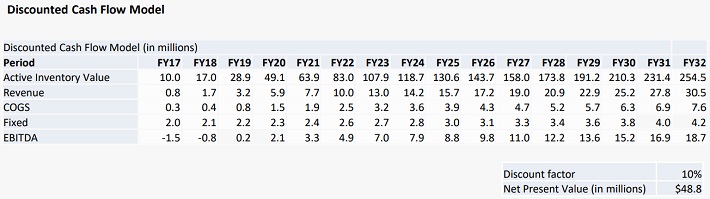

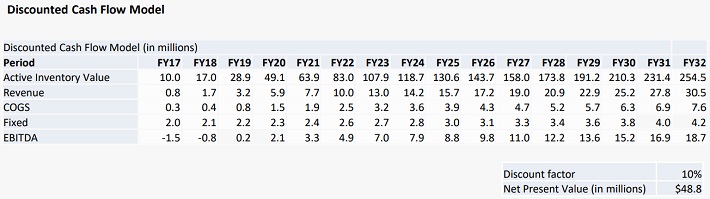

We have projected Collaborate’s activities and cash flow over a 15 year period ending 2032 and discounted the operations by 10% to arrive at the Net Present Value (‘NPV’).

The primary driver of this model is the Company’s value of active inventory available on its peer-to-peer sharing platforms, for which we have applied a three-stage growth model. The first stage assumes 70% growth over the next three financial years, followed by 25% through 2022 and 10% growth thereafter.

Historically, Collaborate has achieved a revenue to active inventory ratio of 4% – 8%. Based on projections, recent growth trajectory, and the shift towards corporate contracts we have applied a growth model leading to an improved utilisation rate of 12% for FY20. Both variable and fixed costs are projected to increase over the period.

Our model predicts a cash flow break-even position in FY19

Our model predicts a cash flow break-even position across all businesses in FY19 and subsequent profitability assuming steady growth rates. We understand DriveMyCar is positioned to reach cash flow positive earlier in the cycle. Applying a discount rate of 10% yields an equity valuation of $48.8 million, or $0.081/share, fully diluted.

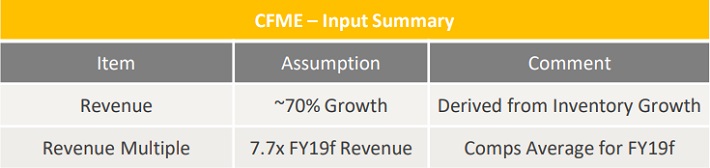

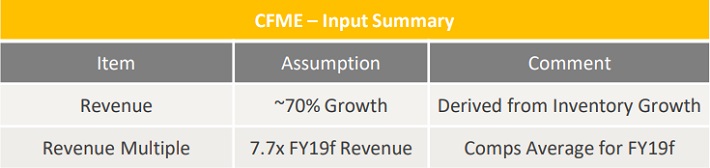

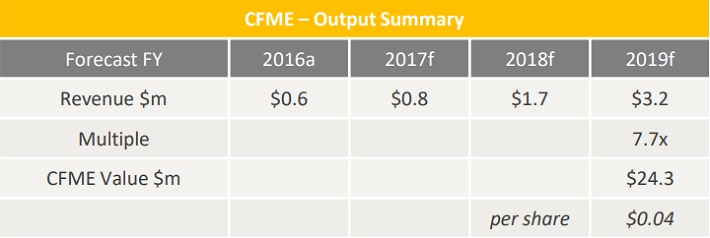

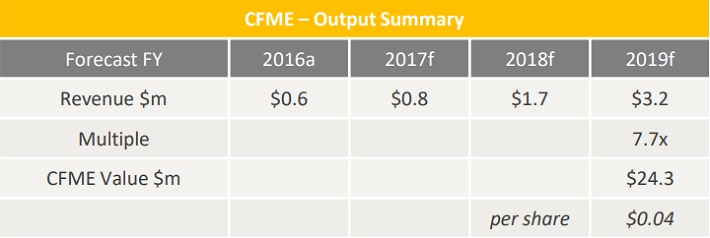

We have projected the Company’s financial performance for the next three financial years to a level that could represent a sustainable revenue capacity. To our estimation of future maintainable revenue, an industry-based multiple has been applied to arrive at a valuation of the Company.

Our financial projections are based on the organic expansion potential of Collaborate’s existing operations. We have assumed ~70% inventory growth over the next three financial years and forecast Collaborate to generate revenue of $3.2million in FY19.

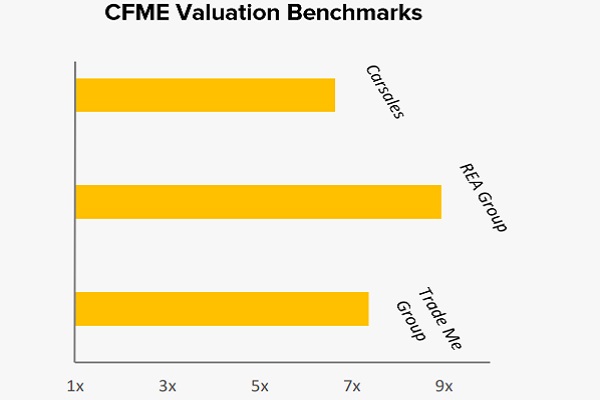

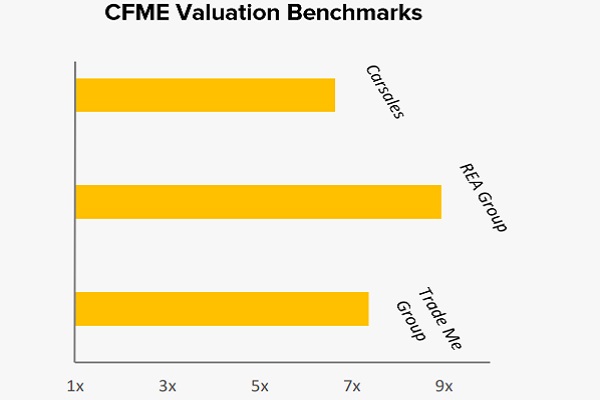

In selecting appropriate benchmark multiples we have taken a universe of online marketplace companies and applied a market share filter. In recognition of the substantial market position which DriveMyCar has established, we have adopted a benchmark group where estimated market shares are greater than 20%.

With our benchmark multiples ranging from 6.6x to 8.9x consensus FY19 revenue, we have applied a mid-point multiple of 7.7x to our FY19 projection, arriving at a CFME valuation of $24.3 million, or $0.04/share.

Collaborate offers speculative exposure to demand for peer-to-peer sharing. We are attracted to its growth trajectory, corporate partnerships, and funding clarity which the upcoming option exercise can deliver.

Principal hurdles include the Company’s need to reach a self-funding position and competition. Access to a ~$1.8 million equity facility and

$1.26 million via April options underwriting mitigates near-term funding risks as the Company builds toward a critical mass.

With management demonstrating their ability to forge and leverage corporate partnerships, we anticipate a re-rating in the stock as DriveMyCar witnesses the benefits of scale, and its favourable insurance record attracts strategic interest.

Valuation represents 150% premium to trade

As our valuation of $0.06/share represents a 150% premium to recent trade, we initiate coverage with a ‘speculative buy’ recommendation.

Mr. Noone has led the development, launch, and optimisation of many innovative companies that have helped define the digital market in Europe, Asia, and Australia. Mr. Noone led the Asia Pacific business for Microprose and then moved to London as Commercial Director for Hasbro. Mr. Noone also went on to launch Vodafone‘s games business in Europe and later become their head of Business Development and Content. Mr. Noone moved back to Australia in 2006 to ramp up ninemsm’s mobile business, taking responsibility for the monetisation of the mobile products of Microsoft, ACP Magazines, and Channel 9 as well as the 5th Finger and HWW mobile businesses. In addition to helping large corporations evolve in a digital environment, he has also co-founded a number of start-up businesses.

Mr. Bunter has over 20 years’ experience in accounting, finance, and a broad range of corporate advisory roles ranging from mergers and acquisitions, divestments of businesses, debt/equity raising, and strategy development and execution. Adrian is an executive director of Venture Advisory, specialist telecommunications, media, and technology financial advisory firm operating out of Australia and AsiaPac. Mr. Bunter is a Chartered Accountant, a Senior Associate of Finsia, and has completed a Bachelor of Business and a Graduate Diploma in Applied Finance. Adrian is a member of the Executive Committee of Australia’s leading angel investing group, Sydney Angels and is also a non-executive director of 8common Limited (ASX:8CO)

Jim is the grey hair of technology disruption having worked, led, and directed a broad range of technology-based businesses in the public and private domains. He has significant experience in fintech, biotech, and eCommerce businesses. In his role as a TEC Chair, he has mentored and developed many of Australia’s business leaders across many industries.

Critical to the sustainability of Collaborate’s business strategy is the Company’s ability to replicate the success of its DriveMyCar business model for its remaining peer-to-peer sharing marketplaces. The DriveMyCar unit is currently the only platform that generates meaningful revenue and there is no guarantee that MyCaravan or Mobilise will follow the same growth trajectory.

Whilst corporate partnerships and the integrated ID verification platform PeerPass provide Collaborate with a competitive advantage, entry barriers surrounding Collaborate’s assets are limited to ‘know how’, speed to market, and its ability to establish a critical mass. There is a risk that its peer-to-peer sharing platforms become subject to the increasing competition which may mitigate Collaborate’s competitive edge.

To stimulate demand, the cost, and convenience of peer-to-peer sharing need to be attractive versus alternatives such as purchasing or renting from a conventional vendor. There is no guarantee that peer-to-peer sharing can maintain a favourable price and convenience arbitrage over such alternatives. The vehicle rental and insurance market are highly regulated. Collaborate’s PeerPass platform mitigates the Company from adverse regulatory shifts, however, there is no guarantee its business model is fully insulated from such changes.

Whilst Collaborate generates revenue from transactions across its platforms, income has yet to reach sufficient levels to reduce its reliance on external capital. There is no guarantee that capital resources currently available to the Company will be sufficient for it to reach a self-funding position, or that additional capital would be available if required.

The valuation is contingent on Collaborate achieving significant growth of total available inventory, and subsequently increasing transactions across all of its platforms. Failure to achieve these milestones would significantly impair the valuation.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.