Overview: Centaurus Metals Ltd (“Centaurus”, “the Company”) is an Australian minerals company focused on developing iron ore mining operations in Brazil. Ore Reserves totalling 48.5million tonnes (Mt) have been delineated as part of a Bankable Feasibility Study (BFS) at its most advanced Project, Jambreiro. The Company has established a broader mineral Resource portfolio totalling 216Mt, inclusive of Reserves.

![]()

Catalysts: Development of Jambreiro into a producing mine is Centaurus’s major value growth driver. With feasibility and permitting works completely, an offtake partnership and procurement of construction finance would send a strong signal of the asset’s near-term, scalable cash flow potential.

Hurdles: With almost two years passing since completion of the original Jambreiro BFS, marketing and execution risks are impacting confidence toward the stock. Management must contend with international price benchmarks one third lower year to date, and a funding environment contingent on offtake clarity.

Investment View: Centaurus offers speculative exposure to the iron ore mining industry and Brazilian steel demand. We are attracted to the advanced status of its Jambreiro Project, and value growth which pending offtake and funding events could deliver. Whilst they may require a recovery in international price benchmarks, a high degree of risk appears to be factored into the stock. With our valuation offering a premium of 170 percent to recent trade and varying to iron ore prices by a factor of three, we initiate coverage with a ‘speculative buy’ recommendation.

Centaurus Metals Limited (“Centaurus”, “the Company”) is an Australian minerals company with iron ore assets in Brazil. Its most advanced project is Jambreiro, located in the State of Minas Gerais, which accounts for over 60 percent or 170mtpa of Brazil’s iron ore production. Mineral reserves of 48.5million tonnes (Mt) have been delineated at Jambreiro as part of a Bankable Feasibility Study. The reserve estimate is contained within a mineral resource portfolio totalling 216Mt.

Centaurus Resources Ltd was founded in June 2006 and listed on the Australian Securities Exchange in August 2007 upon raising $4million at 20c/share (CUR.ASX). After procuring a portfolio of Brazilian mineral assets, Centaurus Resources Ltd executed a merger with Glengarry Resources Ltd (GGY.ASX) which closed in February 2010. The scrip based transaction saw shareholders of Centaurus Resources Ltd receive 53 per cent of the merged entity.

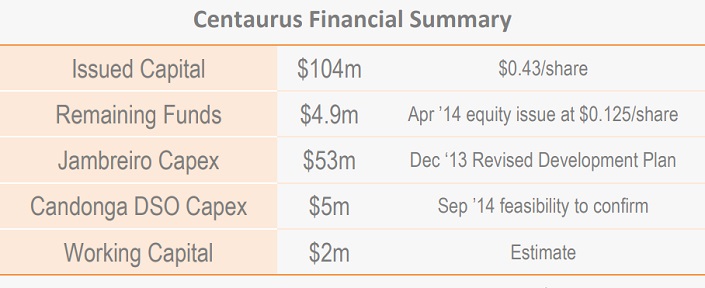

The Company commenced trading as Centaurus Metals Ltd (CTM.ASX) in April 2010. Issued capital currently stands at $103.5million, or $0.43/share.

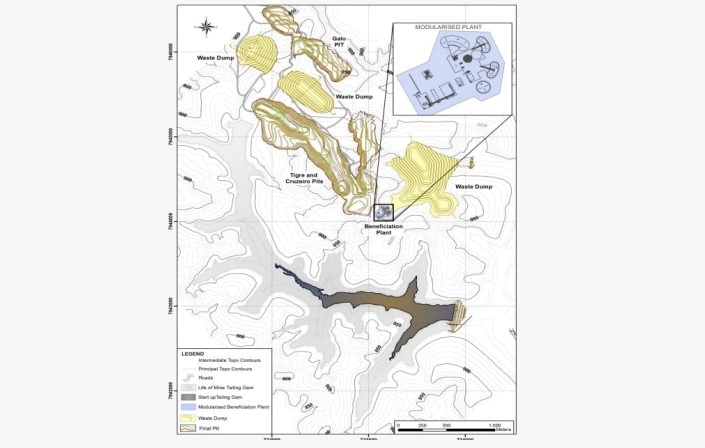

The Jambreiro Iron Ore Project consists of three Mining Leases covering 32.7.km2 in the State of Minas Gerais, Brazil. The Jambreiro Project site is located approximately 200km northeast of the State Capital, Belo Horizonte, and 12km from the township, São João Evangelista.

The project is located close to existing infrastructure including good quality sealed roads, a sealed airstrip, industrial water supply and high voltage power, all of which are readily available for use by the Company. The steel-making region, Ipatinga is situated 110km south.

Centaurus acquired the Jambreiro Project in June 2010 as part of an 18 tenement package within Minas Gerais for US$3million plus a future production royalty.

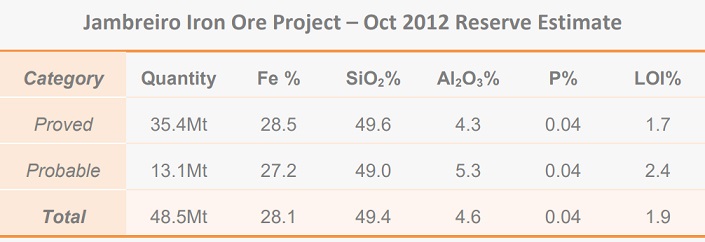

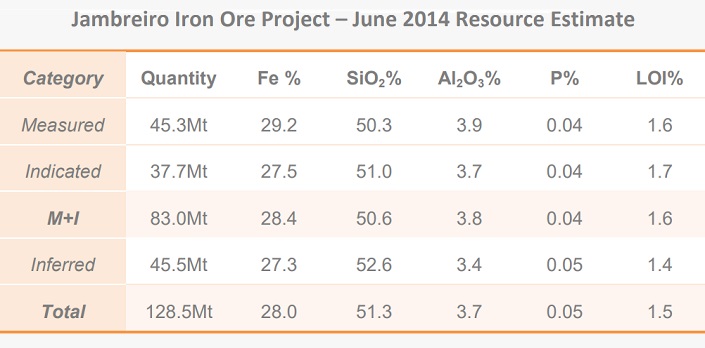

The area under Mining Lease was the subject of a Bankable Feasibility Study (BFS), completed in November 2012. Within the Mining Leases, Measured, Indicated, and Inferred Resources totalling 128.5million tonnes have been delineated, from which Proved and Probable Reserves totalling 48.5million tonnes were established as part of the BFS.

Significantly, the Reserve estimation only incorporated near surface material otherwise known as ‘friable’ ores. Deeper ‘compact’ material which comprises approximately half of the Measured and Indicated Resources were excluded from the Reserve estimation despite satisfying open-pit mining requirements.

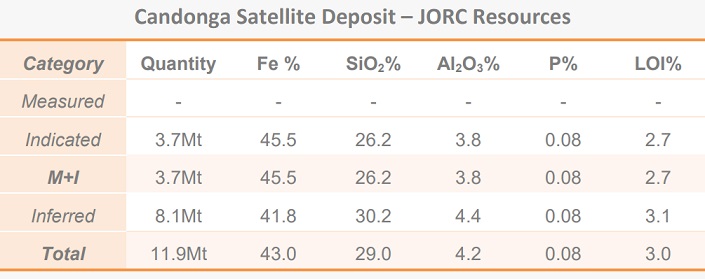

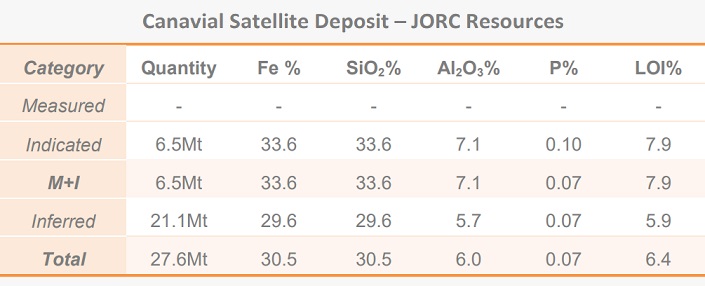

Subsequent to completion of the BFS, Centaurus has outlined additional mineral resources proximal to the Mining Leases within its Canavial and Candonga tenements (“Jambreiro Satellite Deposits”). Indicated and Inferred Resources totalling 39.5Mt have been delineated.

Significantly, the Candonga Resource contains 0.9Mt of Direct Shipping Ore (“DSO”) grading 58.6% Fe which is now the focus of additional drilling and feasibility works to support a potential small scale production opportunity.

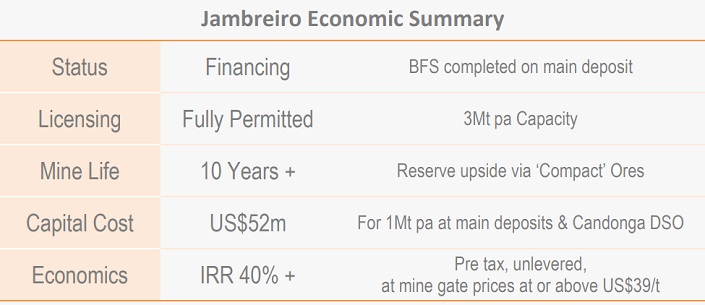

Completed in November 2012, the Jambreiro BFS appraised the economics of a nine year mining and beneficiation operation producing 2Mt pa of high grade (+65% Fe), low impurity sinter blend concentrate for domestic steel markets.

Whilst development scenario’s considered in the BFS indicated robust economics (post-tax IRR 33%, NPV8 $140million), Centaurus is pursuing a staged development strategy to reduce start-up capital requirements.

The Staged Development Plan was announced in December 2013. It envisages an initial 1Mt pa operation, with the ability to expand. Benefits include large reductions in preproduction capital expenditure, an accelerated development timeline, and greater financing flexibility.

Release of the Staged Development Plan coincided with the receipt of Mining Leases in January 2014. Jambreiro is now fully licensed and permitted to deliver 3Mt pa.

Higher grade ore recently delineated at the Candonga satellite deposit is being investigated as an early stage cash flow opportunity. A decision on its role within the Jambreiro development is expected in Q4 2014 with the first production possible in Q1 2015.

Completed feasibility works to date have focused on the main Jambreiro deposit. Investigations currently underway for the Candonga satellite deposit could confirm a small-scale but potentially high-value addition to the mine plan.

Discussions with management suggest Candonga could be brought into production rapidly for a capital outlay of no more than A$5million. It is envisaged that cash flow generated at Candonga be used to supplement funding for the main Jambreiro deposit, which is expected to require a capital investment of A$53million (US$47million) to establish a 1Mt pa operation.

The difference in capital requirements relates primarily to Candonga’s smaller operating scale and absence of a beneficiation plant, which is needed to treat Jambreiro ores.

Whilst further investigations are required to ascertain Candonga’s operating metrics, Jambreiro, operating cash costs plus royalties are estimated to be A$22 (US$20) per tonne of saleable concentrate at the mine gate.

Subsequent logistics charges associated with road transportation to domestic steel mill customers are scheduled to be incorporated into selling prices. Jambreiro concentrate pricing is expected to be referenced to the international CFR China 62% Fe benchmark (“China benchmark”), adjusted for grade and quality characteristics.

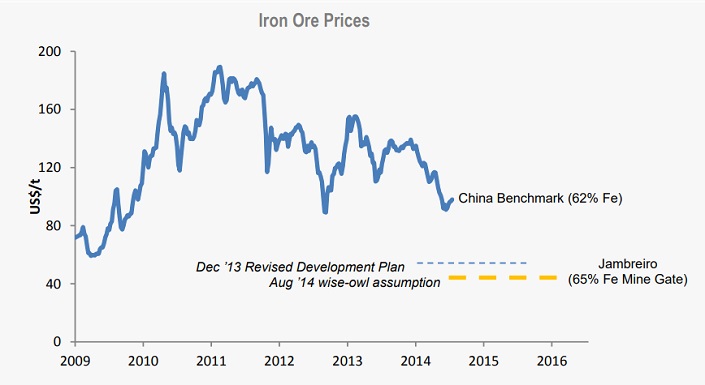

Centaurus’s staged development plan budgeted an initial mine gate sales price US$53/t (after logistics ‘net backs’), which represented a discount exceeding 55 per cent to the prevailing China benchmark of US$120/t.

The China benchmark has subsequently contracted below US$100/t. Whilst linearity of its relationship with Jambreiro concentrate has yet to be tested, a similar discount would yield a selling price of US$39/t, after logistics netbacks

At this price, our modelling indicates the Jambreiro Project generates an unlevered, pre tax Internal Rate of Return above 40 percent. However, in the absence of an offtake partner, the reference price methodology surrounding Jambreiro remains a major source of risk.

The Itabira Projects consist of 3 exploration licenses spanning 41km2 in the State of Minas Gerais, Brazil, approximately 80km northeast of the State Capital, Belo Horizonte. Vale’s 40mtpa Southern System iron ore operations at Itabira are situated within 30km, the State’s largest smelter, Usiminas’ Ipatinga, is located within 80km, and Arcelor Mittals’ steelworks at Joao Monlevade and Timóteo are within 50km.

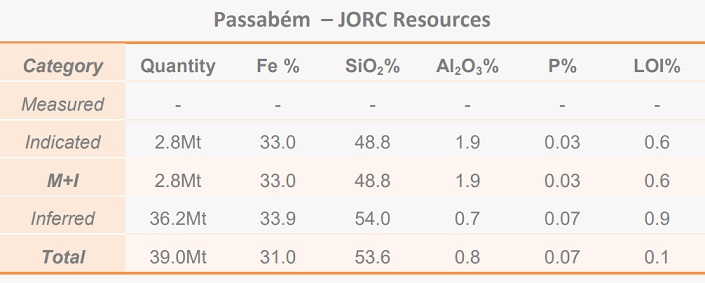

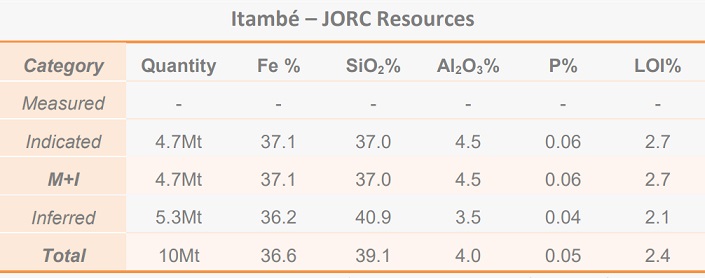

The Itabira Projects were acquired by Centaurus Resources Ltd in April 2008. The Company has subsequently delineated Indicated and Inferred resources totalling 49million tonnes at the Itambé and Passabém project sites. A scoping study on the Itambé project area was completed in August 2009.

The Itambé scoping study appraised a staged DSO development initially producing 0.5Mt pa for domestic steel markets. The Passabém and Itambé mineral resource estimates were updated in late 2010. Concurrent metallurgical testing indicated the deposits are more suitable for a beneficiated development, similar to that being pursued at Jambreiro. Whilst further feasibility studies are required to establish the merits of such a development, Centaurus is presently prioritising capital towards Jambreiro.

As its mineral assets are still in the development phase, Centaurus is reliant on external capital to advance their development. To date, the Company has funded activities through equity.

Issued capital currently stands at $103.5million, or $0.43/share. The Company’s last equity issue concluded in May 2014. $5.5million was raised at $0.125/share, resulting in the issue 44.2million shares, expanding total shares outstanding by 22 per cent. To establish production at Jambreiro, we estimate the Company will require additional capital of at least $60million. Management is considering debt and equity financing structures.

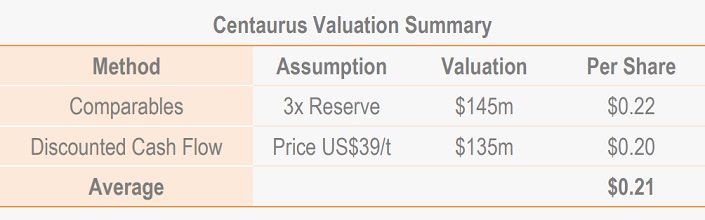

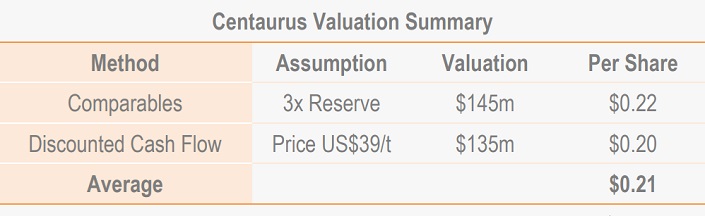

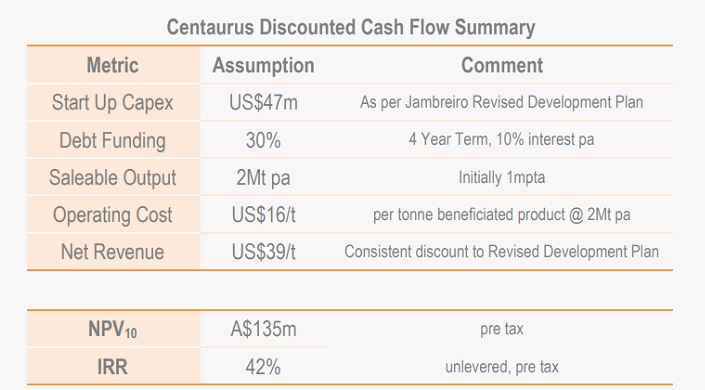

Centaurus’s investment appeal rests in the development potential of its iron ore portfolio. We have focused our appraisal on its Jambreiro Project, utilising a Comparables-based approach and Discounted Cash Flow methodology.

Per-share valuations are derived from both methods by assuming pre production capital is funded 30 per cent debt with the balance equity at $0.10/share.

The Discounted Cash Flow arrives at a valuation of $135million which equates to $0.20/share. Our Comparables approach arrives at a valuation of $145million, which equates to $0.22/share. Applying equal weightings both methods deliver an aggregate valuation of $140million or $0.21/share.

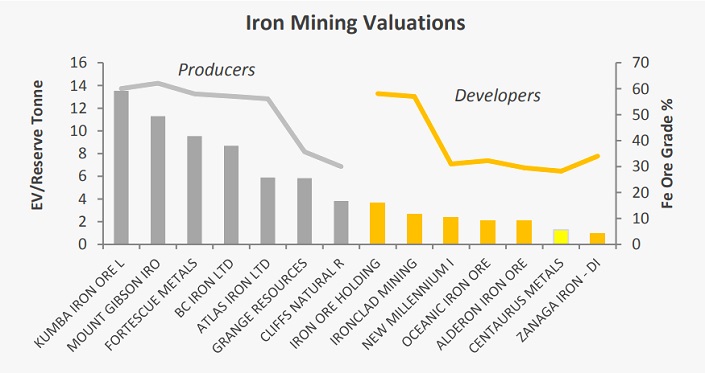

Our peer-based valuation of Centaurus is based on a universe of publicly listed companies with predominantly iron ore mining assets. The average valuation for existing producers is presently above $8 per tonne of Reserve. The average valuation for companies with assets in the development phase is presently above $2 per tonne of Reserve.

Developer valuations include forecast capital expenditures. Adjustments have been made for Companies with non-controlling interests, whilst non-producing assets without assigned capital expenditure have been omitted.

Centaurus is presently in the development phase. Its current Reserve multiple of ~$1.30 per tonne stands at the lower end of the Developer peer group. After procuring project finance and commencing sales, the present valuation curve suggests a higher multiple is possible.

The Producer group average Reserve multiple is above $8 per tonne. Considering the grade characteristics of Jambreiro ore, we believe a multiple toward the lower end of the Producer range is an appropriate target.

Applying a $3 per tonne Reserve multiple offers a target Enterprise Value of $145million, post capital investment. Assuming equity proceeds are procured at Centaurus’s volume-weighted average price of $0.10/share, the Comparables valuation equates to $0.22/share.

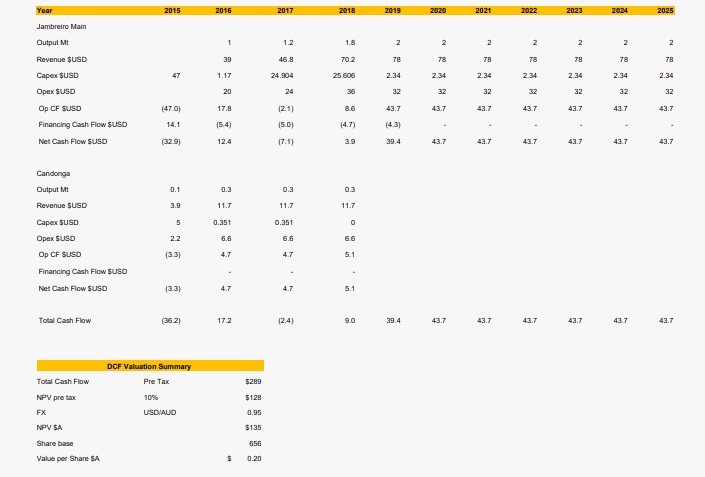

Incorporating the December 2013 Staged Development Plan, we have modelled a ten-year operation at Jambreiro initially producing 1million tonnes pa.

A staged expansion to 2Mt is forecast, funded by cash flow from a concurrent DSO operation at Candonga. We’ve assumed Candonga delivers 1Mt over a three to four-year period.

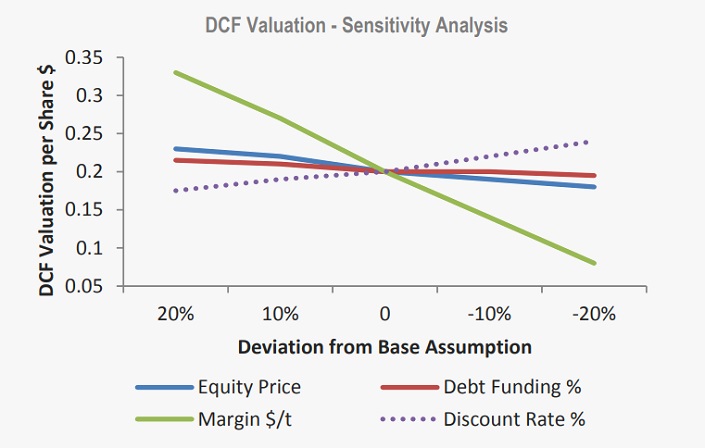

Utilising US$39 per tonne as a base case pricing scenario for Jambreiro product, applying a 10 per cent discount rate, and 30 per cent debt funding to its initial capital requirement, we calculate a pre tax Net Present Value of A$135million.

Assuming equity proceeds are procured at $0.10, the Discounted Cash Flow valuation equates to $0.20/share.

Centaurus offers speculative exposure to the iron mining industry and Brazilian steel demand. We are attracted to the advanced status of its Jambreiro Project, where feasibility works have been completed to a Bankable level, and near-term cash flow opportunity provided at Candonga.

Development of Jambreiro into a producing mine is the Company’s major value growth driver. Valuation multiples ascribed to existing iron ore producers are at least double those attributed to developers. This compliments our aggregated valuation of Centaurus representing a premium of 170 percent to recent trading levels.

However, with almost two years passing since completion of the original Jambreiro BFS, marketing and execution risks are impacting confidence toward the stock. Management must contend with international price benchmarks one third lower year to date, and a funding environment contingent on offtake clarity.

Delivery of an offtake partner and subsequent funding are the major near-term catalysts for Centaurus. Whilst they may require a recovery in international price benchmarks, a high degree of risk appears factored in to the stock price.

Changes to our base case revenue assumption impact Centaurus’s valuation by a factor of three. As Jambreiro presents a ‘turn-key’ opportunity to capture favourable market conditions, we initiate coverage with a ‘speculative buy’.

Whilst economic studies at Jambreiro have been conducted to a BFS level, there is no guarantee that actual mining and processing results will meet operating and capital cost forecasts. Feasibility studies are ongoing at Candonga, creating uncertainty surrounding its possible contribution to forecast expansions at Jambriero

Although the state of Minas Gerias hosts a significant steel-making industry, and offtake discussions are underway, there is no guarantee Centaurus will be successful in marketing its planned 1mtpa production from Jambreiro. There is also a risk that revenue per tonne is lower than scheduled as pricing will be linked to international spot markets. The CFR China 62% Fe benchmark has contracted over 20 per cent from its 2013 peak, and there is no guarantee against further declines.

Centaurus is reliant on external funds to sustain operations and requires capital investment in the order of $60million to develop Jambreiro into production. There is no guarantee the Company will be successful in procuring these funds. There is also a risk that future fundraising initiatives generate greater dilution than forecast in our analysis, which would negatively impact our valuation.

Delays in project execution, expansion, and financing could impair Centaurus’s valuation to present equity holders. Our Discounted Cash Flow valuation is sensitive to production forecasts, which anticipates sales from Candonga DSO in early 2015 and commissioning at Jambreiro main deposits during late 2015.

The Bulls Say

The Bears Say

Mr. Murcia is a lawyer with over 25 years of legal and corporate experience in the resources industry. He currently holds an Order of Australia and is currently Honorary Australian Consul for the United Republic of Tanzania. He is the Chairman and founding director of Perth-based legal group Murcia Pestell Hillard, and is Director at Gryphon Minerals Ltd, Cradle Resources Ltd, & Alicanto Minerals Ltd.

Mr Gordon is a Chartered Accountant with 20 years’ professional experience, predominantly in the mining industry as a senior finance and resources executive. Mr. Gordon has had extensive involvement in financing resource projects from both a debt and equity perspective, including his previous position as Chief Financial Officer and Company Secretary for Gindalbie Metals Limited

Mr Freund joined Centaurus in 2009, bringing significant experience in progressing major projects from exploration through to production. Prior to coming to Centaurus, Mr. Freund was the General Manager of the Karara Joint Venture between Gindalbie Metals and Ansteel. He also worked for BHP at the Whyalla steelworks and iron ore pellet plant in South Australia, BHP Minerals Division in Melbourne, and the Groote Eylandt manganese mine in the Northern Territory. In South America, Mr. Freund has led the MIM team that constructed the world- scale Alumbrera copper mine

Mark is a Chartered Accountant with more than 25 years of professional experience, including senior financial roles across a number of leading Australian and international companies including Lend Lease Corporation Ltd, Woodside Petroleum Ltd, and Premier Oil plc. Since 2006 he has held senior roles at Atlas Iron Ltd, most recently as Chief Commercial Officer. Over that period Atlas has grown from a junior explorer to fast growing producer and member of the ASX 100. In addition Mark has served as Atlas’ representative on the Board of other ASX listed iron ore players, Warwick Resources, Aurox Resources and Giralia Resources.

Mr. Westdorp is a Chartered Accountant with 20 years of resource experience. He is former CFO of Iron Ore Producer, Murchison Metals. He has held senior positions with North Ltd Group including 6 years with Robe River Iron Associate JV.

1. All figures in USD millions unless stated otherwise

2. Net Present Value and per share Value is pre-tax

3. All salable output is presently categorized as Reserve, except Candonga material, which is Indicated (0.7Mt) Inferred (0.2Mt)

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.