Overview: Newcrest Mining Limited (“Newcrest Mining”, “the Company”) is an Australian gold mining company. The Company is engaged in the exploration, mine development, mine operations, and the sale of gold and gold/copper concentrate. It owns and operates a portfolio of mines and a pipeline of brownfield and greenfield exploration projects located in Australia, Papua New Guinea, Indonesia, and in Cote d’Ivoire, West Africa. Newcrest’s two largest projects – Lihir and Cadia – have a combined ore reserve of 46moz gold and 4.3mt copper.

![]()

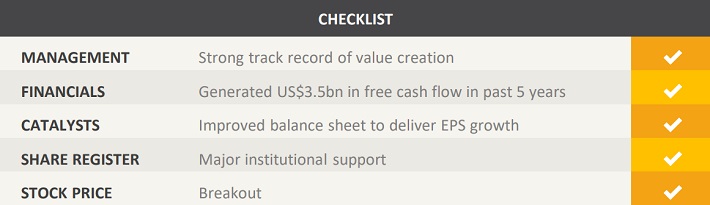

Catalysts: Newcrest Mining has outperformed major peers over the past five years following a successful turnaround of the business that commenced in 2013. The turnaround was driven by significant operational improvements at the Lihir Mine, a reduction in debt, and value-added acquisitions that enhanced the company’s asset portfolio. Being one of the world’s lowest cost major gold producers with AISC of $738/oz, Newcrest’s assets have the potential to generate ongoing free cash flow and earnings per share growth.

Hurdles: While Newcrest has a track record of successful mine operations, there is no guarantee it can continue to operate its complex large-scale mines as efficiently as in the past. Operating in South East Asia and Africa, geopolitical risks could impact Newcrest’s ability to extract value from its assets. With revenues directly correlated to the volatile gold and copper prices, further price deterioration could impair Newcrest’s financial performance.

Investment View: Newcrest Mining offers profitable exposure to the global gold industry. We are attracted to the Company’s profitable and diversified portfolio of high-quality mine and exploration projects and its ability to generate free cash flow in various gold price environments. There are technical, geopolitical, and market risks that could negatively impact the share price. Newcrest has outperformed major gold peers over the past 5 years offering a diversified portfolio of high-quality gold assets across a number of geographies and we initiate coverage with a buy recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.