Overview: Sun Resources NL (“Sun Resources”, “the Company”) is an Australian energy company focused on oil and gas exploration in the Gulf of Mexico, USA. Its principal asset is a 50% interest in the Bowsprit Project (“the Project”), which consists of two granted petroleum leases covering 4.6km2 of shallow transitional waters of Louisiana. Whilst certified reserves remain to be defined, the Project is estimated to host contingent resources of 0.76million barrels (2C gross), and unrisked prospective resources of an additional 1.72 million barrels (Best; gross).

![]()

Catalysts: The recent recapitalisation, acquisition of the Bowsprit Project, and appointment of CEO Alex Parks are driving a revival at Sun Resources. Appraisal drilling targeted for Q4 2018 is designed to convert existing resources to reserves ahead of a 5 well field development at Bowsprit. As the Project offers potentially robust economics, the demonstration of flow rates possible via horizontal drilling is the major value driver. Alleviation of near-term funding risks either via an equity raise or farm out transaction could also drive interest.

Hurdles: Sun Resources is reliant on external capital and has an immediate funding demand. There is no guarantee it can procure the funding required to expedite commercial field development. Demonstrating commercial oil production through horizontal drilling carries technical risk and there is no guarantee it can be achieved at a reasonable cost. As the conceptual base case operating life of Bowsprit is limited to 5-6 years, Sun Resources may need to acquire other assets in order to sustain a longer-term production profile.

Investment View: Sun Resources offers speculative exposure to international oil markets. We are attracted to the record of its new management, and development potential of the recently acquired Bowsprit Project. Bowsprit offers a pathway to near-term, profitable oil production in a capital-efficient manner, where success could pave the way to further value accretive acquisitions. Whilst immediate funding risks are weighing on the stock and may impact near-term performance, these concerns appear largely overdone. With our valuation of $0.012/share representing a premium of 300 percent to recent trade, we initiate coverage with a ‘speculative buy’ recommendation.

Sun Resources NL (“Sun Resources”, “the Company”) is an Australian energy company focused on oil and gas exploration in the Gulf of Mexico, USA.

Its principal asset is a 50% interest in the Bowsprit Project (“the Project”), which consists of two granted petroleum leases covering 4.6km2 of shallow transitional waters of Louisiana.

Whilst certified reserves remain to be defined, the Project is estimated to host contingent resources of 0.76MMbbls (2C gross), and unrisked prospective resources of an additional 1.72 million barrels (Best; gross).

Sun Resources was incorporated in September 1986, and listed on the Australian Securities Exchange (“ASX”) in August 1993. It acquired the Bowsprit Project and appointed its current management team in 2017 following a recapitalisation. Issued capital since this time stands at $1.29m.

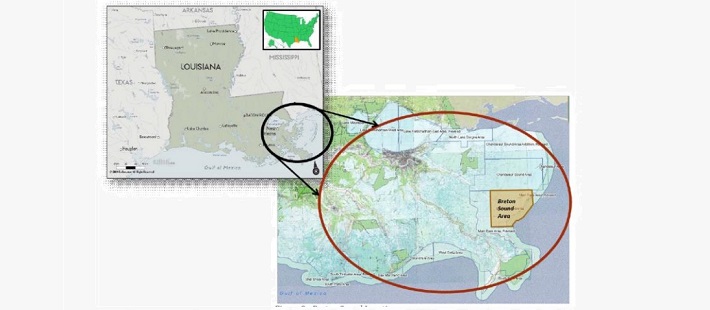

The Bowsprit Project (“the Project”) consists of two granted Petroleum Leases in Louisiana, USA. The leases are located in the shallow protected transition zone waters of Breton Sound, St Bernard Parish, Louisiana, covering 4.6km2 close to the existing infrastructure.

Breton Sound fields were relinquished by Shell in the 1980’s

The licenses are operated in a 50/50 joint venture with Pinnacle Exploration Pte Ltd (“Pinnacle”; “the JV”), a private, upstream oil and gas company incorporated in Singapore. In August 2017, Sun Resources earned its 50% working interest in the Bowsprit Project by paying 100% of the initial leasing cost of approximately A$300,000. The lease now runs for 3 years and does not contain any work commitments.

Three of the Directors of Pinnacle (Craig Martin, Robert Fisher, and James Brown) including its Chairman and Managing Director, are former colleagues of Sun Resources CEO, Alex Parks, and Bill Bloking.

In accordance with SPE PRMS (2007) guidelines, an independent resource assessment was completed in April 2018 by RISC Advisory Ltd (“RISC”). Bowsprit is estimated to host contingent resources of 0.76million barrels (2C gross), and unrisked prospective resources of an additional 1.72 million barrels (Best; gross).

The prospective resources are not discovered as the presence of a significant quantity of moveable hydrocarbons has yet to be demonstrated. RISC assesses the chance of success for the prospective resources as 20% (1 in 5).

The table below shows Sun Resources 50% share of the Bowsprit independent resource estimate.

The Gulf of Mexico area is one of the most important US regions for energy resources and infrastructure. Gulf of Mexico federal offshore oil production accounts for 17% of total U.S. crude oil production. Over 45% of total U.S. petroleum refining capacity is located along the Gulf coast, as well as 51% of total U.S. natural gas processing plant capacity.

Louisiana is the second-largest oil-producing US state on the Gulf of Mexico, producing 3.7million barrels in 2017. Its shallow transitional waters have a long history of oil production. The Bowsprit lease is near the boundary of St Bernard and Plaquemines Parishes that covers the transition zone from onshore to the federal waters offshore Louisiana. The two Parishes have produced a combined 1.2 billion barrels of oil and 5.2 trillion scf of gas since 1978. The area is a prolific hydrocarbon province with over 1,800 wells drilled in the St Bernard parish alone.

Structure underneath Bowsprit produced gas for 25 years prior to the advent of horizontal drilling techniques

The Bowsprit project area also has a long production history. The field was principally developed as a deep gas field by Shell in the 1960s and contains 16 historical wells, drilled between 1952 and 1982.

The underlying field produced gas and condensate over more than 25 years. The deep gas field was abandoned and the area relinquished by the former owner in the 1990s prior to the advent of horizontal drilling.

Through the use of modern exploration and production methods including 3D seismic and horizontal, Sun Resources is aiming to redevelop the Bowspirit field as a near-term oil producer.

Since Sun Resources acquired its interest in the Bowsprit Project, the JV has focused on resource identification and estimation.

In April 2018, the JV announced contingent resources of 0.76million barrels (2C gross) and unrisked prospective resources of an additional 1.72 million barrels (best gross). Refer to table 2 for further detail.

This resource is assessed to be contained in an undeveloped conventional Miocene aged oil sand at a depth of approximately 7,400ft (2,255m) that is located above the deeper 9,500ft gas field that was developed in the 1960s by Shell and produced through to 1980s.

Drill targets sit above the structure originally developed by Shell

This part of the structure is estimated to have historically produced 1billion scf gas and 0.075million barrels oil via vertical wells from sands at 7,200ft and 7,400ft depth. Oil flowed from two separate wells but was not of commercial significance at the time (~40 barrels oil per day “bopd”).

The JV has determined that the Bowsprit structure can be developed with up to five horizontal wells and could potentially be produced through a simple unmanned production platform.

Analogous, albeit thinner sands 12km south of Bowsprit are successfully producing at 300-400 bopd following application of horizontal drilling

Saratoga Resources drilled and produced a 750ft horizontal well in an analogous quality, albeit thinner sand, 12km south of Bowsprit. After achieving initial production rates exceeding 1,500 bopd, during the last 3 years, the well has produced over 460,000 bbls of oil and is still producing at over 300 bopd. Sun anticipates drilling wells with longer horizontal sections in a thicker column of oil in Bowsprit.

First well targeted for Q4

The project viability is contingent on demonstrating that a horizontal well will produce at commercially significant rates. The JV is planning to drill the first well in Q4 2018 post the hurricane season. The first well is expected to cost US$3.25m and is expected to be partly funded via a farm out.

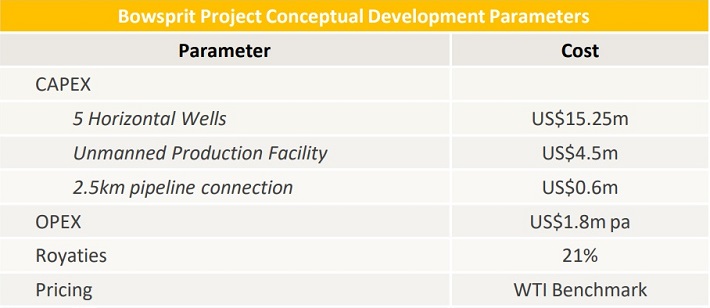

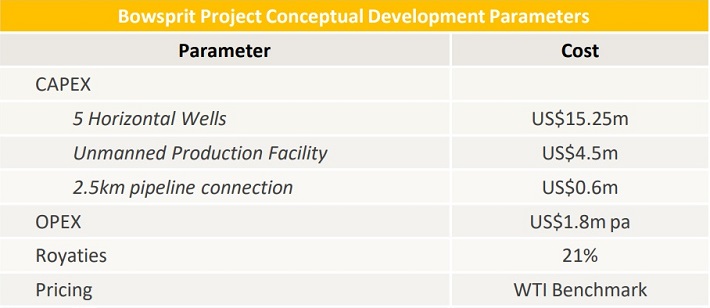

The JV has prepared a conceptual development plan in the event that commercial oil flow is demonstrated at Bowsprit. Assuming two horizontal development wells are drilled, the minimum economic recovery is assessed to be approximately a 0.5million barrels assuming a (WTI) oil price of US$60/bbl and state royalty of 21%. The 2C resources are estimated by RISC to be 0.76million barrels. Full development of the field including 5 horizontal wells, an unmanned production facility, and pipeline connections is estimated to require US$20.35m.

Provided the first well demonstrates commercial flow rates, Bowsprit offers low capital intensity and high margin oil production

Note that the first of these wells to demonstrate commercial viability is budgeted to cost US$3.25m and is targeted for Q4 2018. Should this well demonstrate commercial viability, full-field development, and first oil production could commence in 2019.

Operating costs associated with the unmanned production facility is expected to be below US$2million per annum. Assuming 2.5 million barrels of recoverable oil from 5 wells (A combination of prospective resources and contingent resources), the breakeven oil price would be in the order of US$25/bbl.

High margins expected with breakeven oil price US$25/bbl

As Sun Resources assets are currently in the exploration phase, the Company does not presently generate revenue and is reliant on external capital to fund operations.

Whilst the Company has historically generated operating revenue from oil production, these assets were divested as part of a recapitalisation in 2016 and its sole focus is now the Bowsprit Project.

Capital raising and farm out pending

Sun Resources acquisition of an interest in the Bowsprit Project was announced in August 2017. During the half-year period to December, a loss of $0.36m was recorded.

Since its recapitalization, Sun Resources has financed operations via a combination of Director loans and equity. Its most recent fundraising exercise was a rights issue completed in December 2017. The issue sought subscriptions for up to 324m new shares on a basis of three new shares for every four shares at $0.004 per new share with one free-attaching option for every two new shares allotted.

The rights issue raised $1.29m and were the Company’s first financing exercise since acquiring its interest in the Bowsprit Project. As of March 30, Sun Resource’s cash reserves were $0.2m and its principal liability is a convertible loan with a face value of circa $1.1million

The convertible loan carries an interest of 5% pa and its maturity date was recently extended to 31 March 2021. As part of this restructure, the lender Winform Nominees Pty Ltd (“Winform”), a subsidiary of Hancock Prospecting Pty Ltd, allowed provisions for Sun Resources to repay the loan from its share of future Bowsprit cash flow. This included an allowance for Sun Resources to raise up to $10million for appraisal and development of the Bowsprit Project.

Given its current cash position, Sun Resources expects to fund operations via a combination of new equity issuance and a farm-out transaction. We note that Directors of Sun Resources have also supported the Company via loans and participation in recent capital raisings.

A farm out transaction would introduce a new partner into the Bowsprit JV, reducing Sun Resources funding commitment and equity interest. There is also potential for such a transaction to compensate Sun Resources for expenses incurred at Bowsprit to date.

Sun Resources investment appeal rests in the Bowsprit JV’s development potential. Whilst Sun Resources is seeking a farm-out partner to help fund development, we have undertaken the valuation based on its current 50% interest.

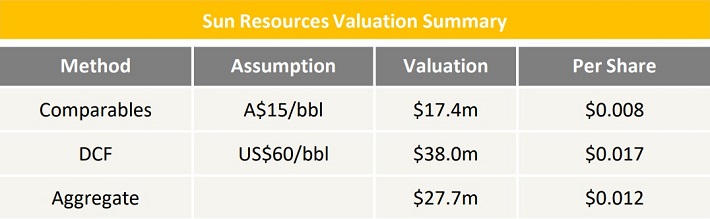

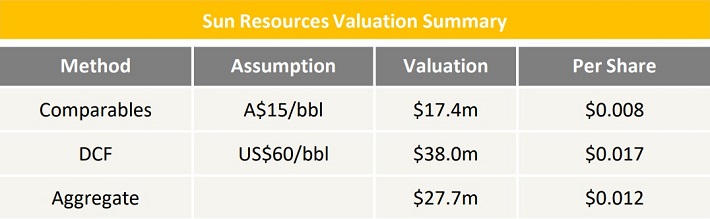

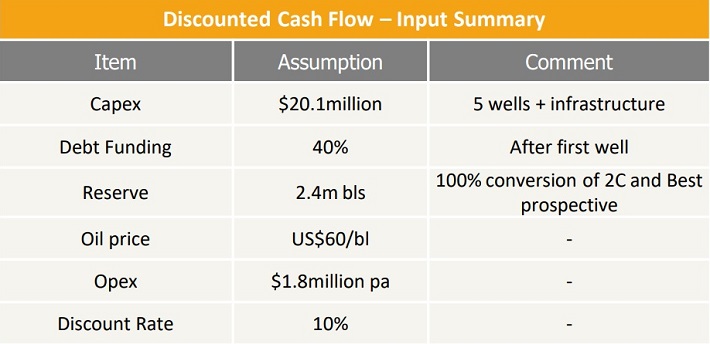

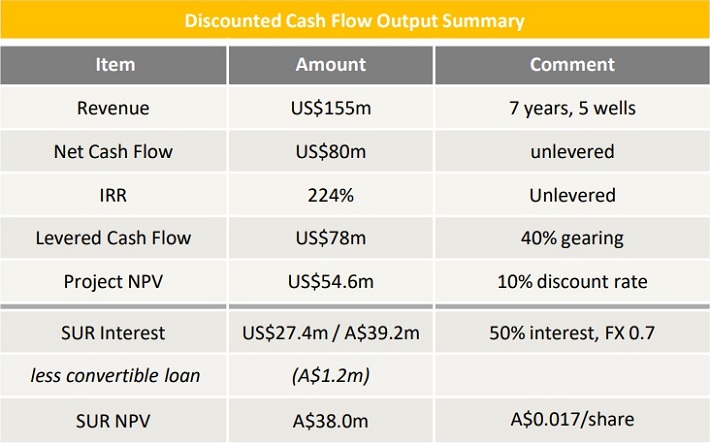

We have considered the Company’s potential worth using Discounted Cash Flow (“DCF”) and Comparables methodologies.

Both techniques are based on an expanded share count of 2,279million, which assumes the Bowsprit JV’s capital requirement is 40% debt-funded after the first appraisal well is drilled. Sun Resources portion of the remaining equity component is assumed to be $7.3million, funded via a combination of new share issuance and option exercise.

Valuation $0.012/share

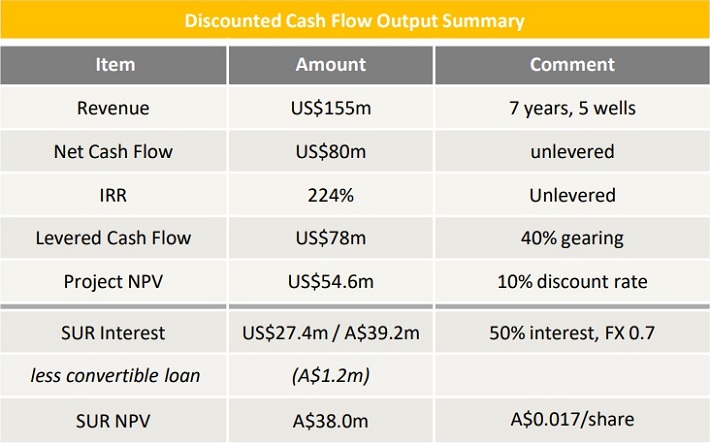

Our DCF method arrives at a valuation of $38.0million, or $0.017/share. Our Comparables method arrives at a valuation of $17.4million, or $0.008/share. Applying equal weightings to both methods results in an aggregate valuation of $27.7million, or $0.012/share.

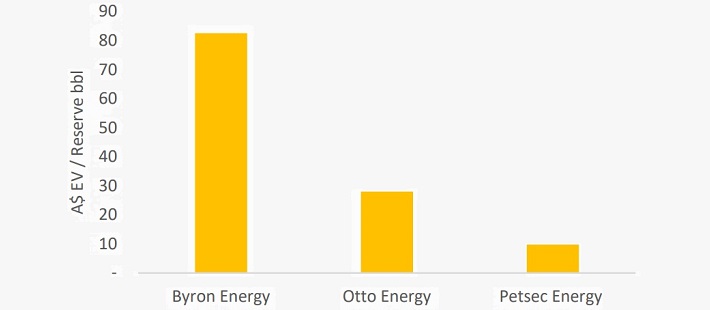

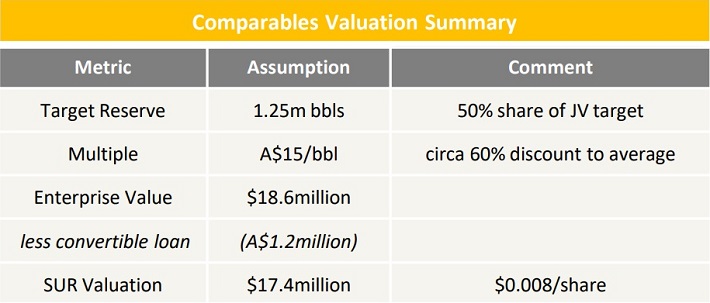

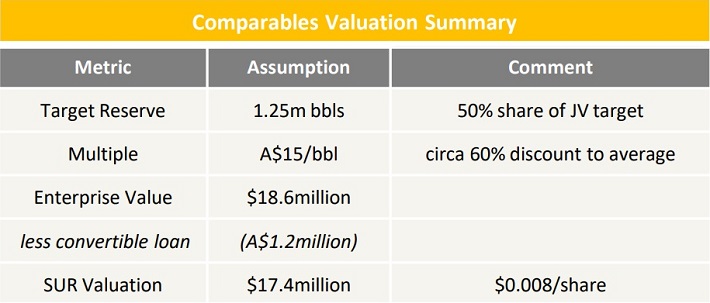

A universe of comparable companies has been assembled which are principally engaged in oil and gas exploration in the Gulf of Mexico. There are three relevant data points, which have operations in relatively shallow waters of the Gulf of Mexico.

These companies indicate that the Bowsprit JV could attract a valuation of between $10 and $80 per barrel if current contingent and prospective resources are converted into reserves.

Our comparables valuation assumes all existing 2C contingent and Best case prospective resources at the Bowsprit convert into reserves. Whilst we have applied a circa 60% discount to the average multiple of its comparables to arrive at a $15/bbl multiple for Sun Resources, we have not applied a specific risk factor surrounding the reserve conversion.

Thus to Sun Resources 50% share of the Bowsprit JV’s oil reserve target, we arrive at a Comparables valuation of $17.4million, or $0.008/share.

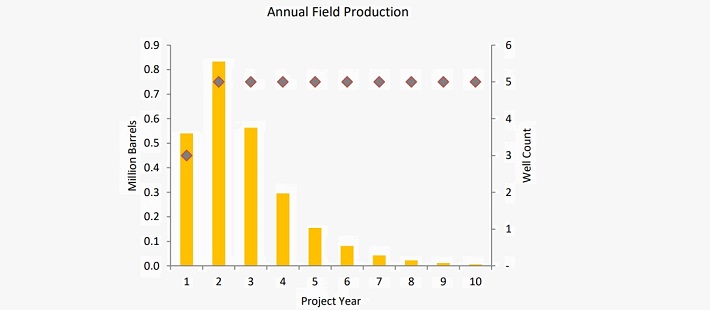

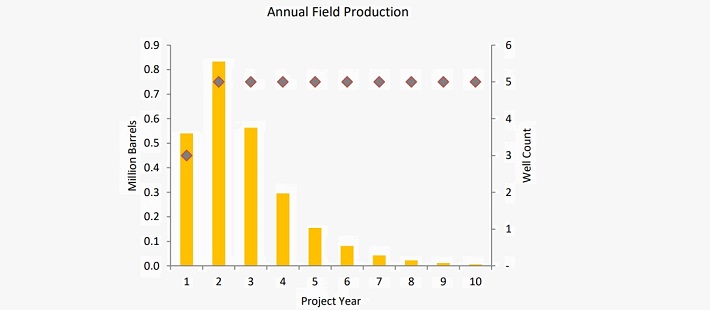

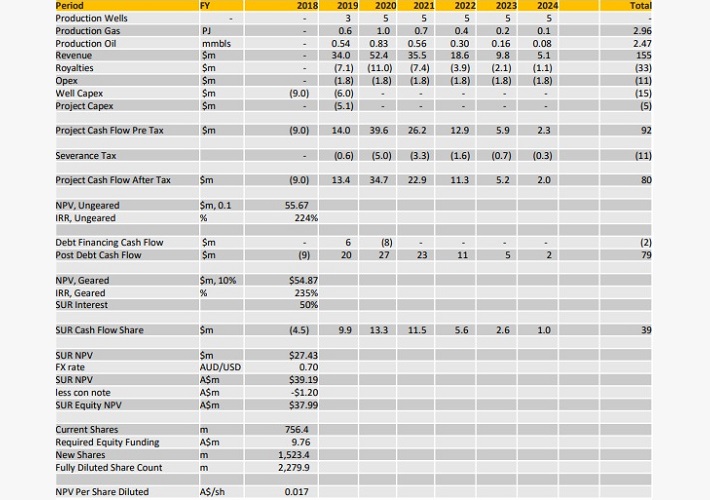

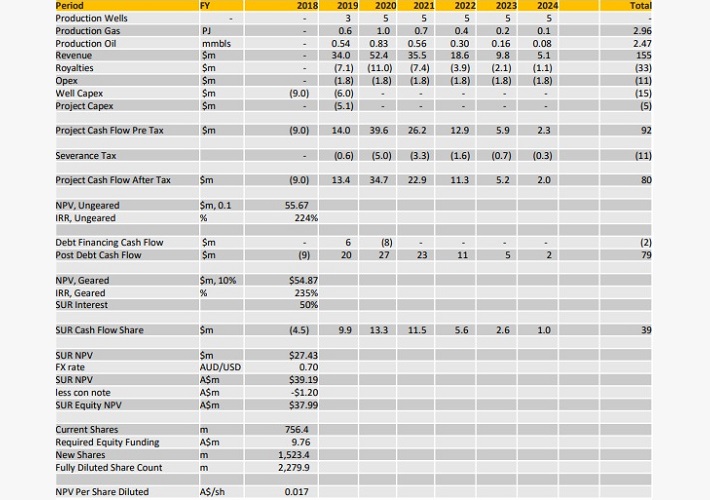

We have modeled the development of the Bowsprit JV for over seven years, with a production life of up to six years. Our projections assume the first appraisal well-targeted for late 2018 is commercially successful and within budget. Field development is assumed to take place from 2019 with 5 wells producing by 2020.

All of the current 2C contingent and Best case prospective resources are assumed to convert into reserves. Revenue is modelled at an oil price of US$60/bbl and a gas price of US$2.50/mmBtu. A terminal value has not been applied.

Bowsprit Project IRR 224%

Capital costs associated with the development are estimated to total US$20.1million. We have assumed that 40% of this cost is debt-funded post completion of the first appraisal well.

Operating costs are assumed to be largely fixed, and equate to an average of less than US$5/bbl.

Our model projects gross revenues of US$155million over the project life and net cash flow of $80million. On an unlevered basis, the Internal Rate of Return (IRR) is estimated to be 224 percent.

Post debt servicing, we estimate the Net Present Value to be US$54.6million, of which Sun Resources share is US$27.4million (A$39.2million). After accounting for the outstanding convertible loan, we estimate Sun Resources DCF valuation to be A$38.0million. On a per-share basis, we estimate this equates to a valuation of $0.017/sh.

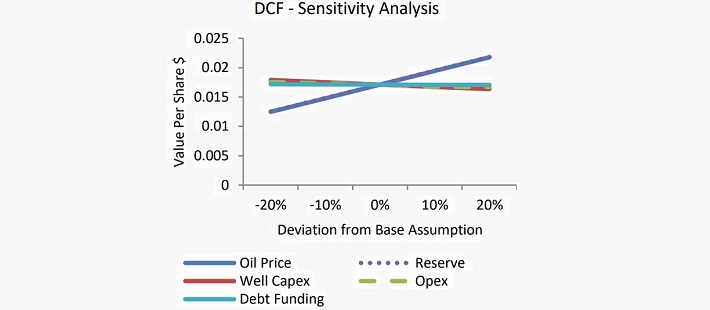

The DCF valuation is most sensitive to changes in the oil price and reserve assumptions. We note that at current spot prices (US$70/bl), the DCF valuation rises to $0.021/sh.

Sun Resources offers speculative exposure to international oil prices. We are attracted to the record of its new management, and development potential of the recently acquired Bowsprit Project.

The recent recapitalisation, acquisition of the Bowsprit Project, and appointment of CEO Alex Parks are driving a revival at Sun Resources. Bowsprit offers Sun Resources a pathway to near-term profitable oil production in a capital-efficient manner, paving way for a rebuild of the Company.

Targeted Q4 appraisal drilling is the major catalyst

Principal risks surround the Company’s ability to secure near-term funding and convert existing contingent and prospective resource estimates into reserves.

Results of planned appraisal drilling targeted for Q4 2018 are therefore the major share price catalyst. A farm-out agreement could also drive interest by reducing Sun Resources share of capital demands at Bowsprit.

Whilst immediate funding risks are weighing on the stock and may impact near-term performance, these concerns appear largely overdone. With our valuation of $0.012/share representing a premium exceeding 300 percent to recent trade, we initiate coverage with a ‘speculative buy’ recommendation.

Mr Ian McCubbing was appointed to the Board as a Non-Executive Director and Chairman on 25 October 2016. Mr. McCubbing is a Chartered Accountant with more than 30 years’ corporate experience, including five years of investment banking, principally in the areas of corporate finance and M&A. Mr. McCubbing has spent more than 15 years’ working with ASX 200 and other listed companies in senior finance roles, including positions as Finance Director and Chief Financial Officer in mining and industrial companies. Mr. McCubbing is currently a Non- Executive Director of Avenira Limited, Swick Mining Services Limited, and is Chairman of Rimfire Pacific Mining NL. Mr. McCubbing holds a Bachelor of Commerce (Honours) from UWA and an Executive MBA from the AGSM. Mr. McCubbing is a Chartered Accountant and a Graduate of the Australian Institute of Company Directors.

Mr. Alexander Parks was appointed to the Board as Chief Executive Officer and Managing Director on 2 November 2017. Mr. Parks previously served as Non-Executive Director since 18 February 2016. Mr. Parks is an energy expert with over 20 years of experience in the oil and gas industry, commencing as a petroleum engineer with RPS Energy Australia (formerly Troy-Ikoda, UK & Australia) in 1997. Mr. Parks has managed companies and company projects in Australia, SE Asia, North America, New Zealand, Europe, FSU, and North Africa. Projects have included onshore and offshore exploration, development, production, and significant new ventures and transactions. Recently Mr. Parks has focussed on building a sound knowledge of unconventional oil and gas plays in North America.

Mr. Parks has a Petroleum Engineering degree from Imperial College, London, is a member of the Society of Petroleum Engineers (SPE), is a Member of both the Petroleum Exploration Society of Australia (PESA) and Australian Institute of Company Directors (GAICD). Mr. Parks is currently a Director of Tamaska Oil & Gas Ltd (ASX:TMK) and TMK Montney Ltd, he has previously held the positions of Chief Commercial Officer at Cue Energy Resources Ltd, CEO of Mosaic Oil NL, CEO of Otto Energy Ltd, and Technical Director at RPS Energy.

Mr. William Bloking was appointed to the Board as a Non-Executive Director on 25 October 2016. Mr. Bloking is a leading energy expert with more than 40 years of experience in the oil and gas industry, mainly with ExxonMobil and BHP Billiton Petroleum. Prior to his retirement in 2007, Bill was President, Australia Asia Gas, for BHP Billiton Petroleum and prior to joining BHP Billiton he served in a number of senior executive roles in the USA, South America, Europe, and Asia for ExxonMobil.

Mr. Bloking is currently Non-Executive Chairman of Nido Petroleum Limited and Torrens Mining Limited and he is a Non-Executive Director of Challenger Energy Limited. He is a fellow of the Australian Institute of Company Directors. He was formerly Chairman of Transerv Energy Limited, Cool Energy Limited, Norwest Energy NL, the National Offshore Petroleum Safety Authority Advisory Board, and Cullen Wines Australia Pty Ltd.; Managing Director of Eureka Energy Limited and Gunson Resources Limited; a Non-Executive Director of the John Holland Group, Miclyn Express Offshore Limited, the Australian Petroleum Production and Exploration Association (APPEA), the Lions Eye Institute and the West Australian Symphony Orchestra; a Councilor of the West Australian Branch of the Australian Institute of Company Directors; a Governor of the American Chamber of Commerce in Australia; and an Adjunct Professor at Murdoch University. Mr. Bloking has a Bachelor’s Degree in Mechanical Engineering (Summa cum Laude) from the University of South Carolina in the USA. He is a citizen of both the USA and Australia.

Ms. Jo-Ann Long was appointed to the Board as Company Secretary and Chief Financial Officer on 8 April 2018. Ms. Long is a Corporate Finance Executive and CA with over 28 years of broad commercial experience in public and private companies building, leading, and advising on financial management, restructures, expansion, acquisitions, and risk management both domestic and international.

Ms. Long has more than 20 years of experience in the onshore and offshore oil and gas industry and her expertise lies in Oil and Gas joint venture operations, tax strategies, risk management, and governance, with strong skills in complex business structures, audit, commercial agreements, corporate law, tax strategy and business risk management including health safety and environment.

Ms. Long graduated from the University of Western Australia, is a Fellow of the Institute of Chartered Accountants, and a Graduate of the Australian Institute of Company Directors. Ms. Long served as a Regional Councillor and Chairman of the Chartered Accountants in Business for the Institute of Chartered Accountants.

Whilst Sun Resources plans to utilise industry-standard methods to develop Bowsprit, there is no guarantee the Bowsprit JV will achieve commercial flow rates, or at a cost that justifies further development of the Project. There is no guarantee the Project hosts sufficient resources to support the JV’s conceptual development plan, or that they can be converted into Reserves.

There are multiple oil and gas developers operating in the Gulf of Mexico, generating competition for funding, services, and expertise. Sun Resources may face challenges distinguishing itself from other operators in the area or fall subject to an opportunistic takeover below fair value.

Whilst international oil prices have strengthened over the past two years, they remain inherently volatile and price declines have a material impact on Sun Resources project economics. Although the Bowsprit Project offers a potentially low breakeven oil price (US$25/bbl), there is a risk that recent oil price strengthening stimulates new supply, threatening the longer-term revenue potential of the Bowsprit JV.

The Bowsprit JV is reliant on third-party contractors to provide essential services at the project site, including but not limited to engineering, drilling, and ultimately installation of production infrastructure. Although Sun Resources has an experienced management team to mitigate this risk, many factors in the project development process are outside of the JV’s control and potential shortfalls in scheduling, budgeting, and quality assurance can have a direct impact on project economics.

Sun Resources is reliant on external capital and there is no guarantee it can procure the necessary funding required to advance the Bowsprit JV into production. Whilst execution of a farm-out transaction could help reduce its funding demands, the Company has an immediate need to raise capital.

Sun Resources is also exposed to the willingness and ability of its JV partner to approve ongoing development and meet funding commitments for the Bowsprit Project.

The valuation is contingent on the Bowsprit JV achieving commercially robust flow rates at its first well within budget, and also at subsequent wells outlined in the conceptual development plan. Failure to meet these hurdles or execute within the specified budget would adversely impact the valuation per share.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.