Overview: Money3 Corporation Limited (“MNY”, “the Company”) is an Australia-based financial services company. It is engaged in providing specialized small cash loans, secured and unsecured personal loans, vehicle financing, car rental, cheque cashing, and international money transfer. Presently, it has a 69 branch network spread throughout Victoria, New South Wales, South Australia, Queensland, and Tasmania.

![]()

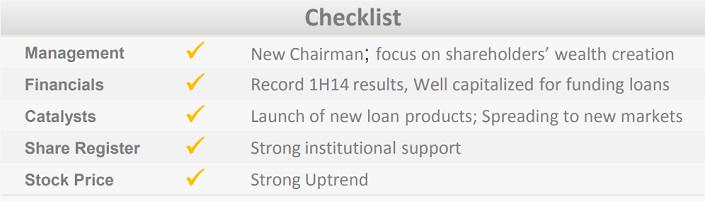

Catalysts: With its record 1H14 results, on the back of web store and broker network expansion and rationalization of branch network, MNY is poised to deliver yet another robust performance in 2H14 and higher earnings. Whilst its loan book expanded by 81% to $55million in 1H14, additional capital of $26million raised since the beginning of FY14, ensures strong lending capacity. Accessing debt facilities via unlisted bond issues worth $30million to fund loan books provides additional momentum. The pre-tax profit for 9M14 increased by 84% y/y to $6.8M and management’s guidance for FY14 pre-tax profit of $9M, looks attainable.

Hurdle: The recent 10% upward revision in ‘acceptable’ bad debt levels by the Company highlight risks of deteriorating credit quality. Bad debt as a percent of revenue rose from 8.8% in 1H12 to 13.8% in 1H14. Annual interest payment commitment of $2.7million, post completion of the unlisted bond issue, may put downward pressure on its operating margins.

Investment View: MNY offers profitable exposure to the under-serviced microfinance industry. We are attracted to its earnings growth trajectory and management interest in scale-up operations via organic growth and acquisitions. Whilst the review on consumer credit market legislation remains pending, MNY has transited well to the new regulatory environment and we initiate coverage with a ‘buy’ for its growth potential.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.