Overview: Big Un Limited (“BIG”, “the Company”) is an Australian media and technology company focused on mobile content and enterprise marketing. BIG’s principal asset is intellectual property surrounding the Big Review TV broadcast network, which offers low-cost video production and distribution tailored for small to medium enterprises (“SME”). Since its formation in 2013, BIG has established operations in Australia, New Zealand, Singapore, Hong Kong, USA (New York & San Francisco) & UK (London). The Company listed on the Australian Securities Exchange (“ASX”) in December 2014 via a reverse merger with Republic Gold Ltd.

![]()

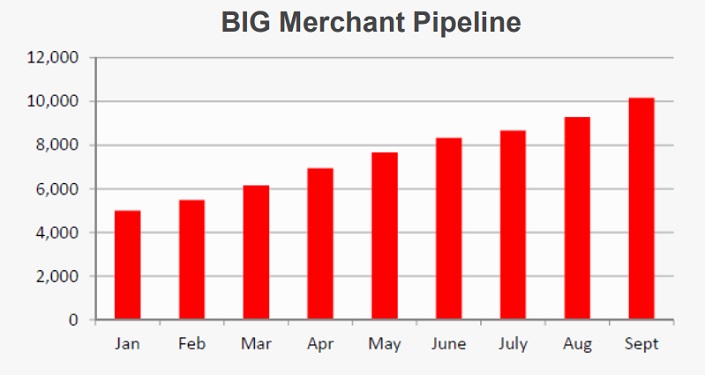

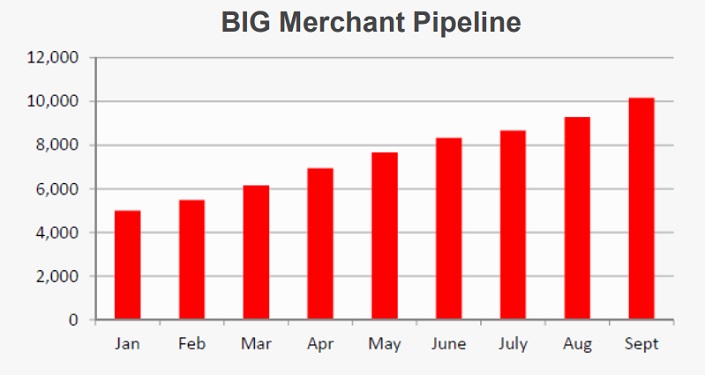

Catalysts: BIG is witnessing strong sales momentum. Revenues increased over 300 percent in FY15 and its recent partnership with CDM Direct Communication Services (“CDM”) is poised to accelerate monetisation of its sales pipeline, which currently comprises ~12,000 SME’s. Conversion of the pipeline into paid memberships is the major near-term driver, whilst the launch of the Company’s mobile consumer app represents the tipping point for execution of its longer-term strategy.

Hurdles: Whilst the Company generates revenue, BIG is reliant on external capital to finance operations and there is no guarantee ongoing funding will remain available to the Company. Limited entry barriers may stimulate competition for its video production services and existing peer review platforms to incorporate video into their offerings. There is no guarantee its broadcast network and mobile consumer app can attract the audience required to convert and retain paying SME members.

Investment View: Big Un Limited offers speculative exposure to demand video-based mobile content. Its established revenue profile, large sales pipeline, and long-term strategy are attractive qualities. Whilst funding, audience momentum, and competition are risks, the Company’s capacity to convert its existing sales pipeline into paid memberships should become salient over the coming months. With our valuation of $0.35/share representing a ~60 percent premium to recent trade, we initiate coverage with a ‘speculative buy’ recommendation.

Big Un Limited (“BIG”, “the Company”) is an Australian media and technology company focused on mobile content and enterprise marketing.

BIG’s principal asset is intellectual property surrounding the Big Review TV broadcast network, which offers low-cost video production and distribution tailored for small to medium enterprises (“SME”).

Reverse ASX listing in Dec 2014

Since its formation in 2013, BIG has established operations in Australia, New Zealand, Singapore, Hong Kong, USA (New York & San Francisco) & UK (London). The Company listed on the Australian Securities Exchange (“ASX”) in December 2014 via a reverse merger with Republic Gold Ltd. We estimate issued capital currently stands at $12.9million, or $0.156/share.

BIG owns and operates Big Review TV – a video-driven, marketing, and peer review platform. Big Review TV is tailored for SMEs and their customers, incorporating video listings, social media, innovative mobile phone video review applications, and TV review shows.

Through its video capabilities, Big Review TV provides an extra dimension of engagement relative to existing popular peer review platforms such as Trip Advisor Inc (TRIP.US) and Yelp Inc (YELP.US).

For SME vendors, Big Review TV provides affordable access to professional digital video production, editorial, and marketing resources.

For users, the Big Review TV platform offers a valuable mobile device-orientated information portal focused on multiple segments, including Food and Beverage, Lifestyle, or Shopping.

With users encouraged to submit their own reviews on individual vendors, the Big Review TV platform is designed to host a combination of vendor-sponsored and user-generated video content.

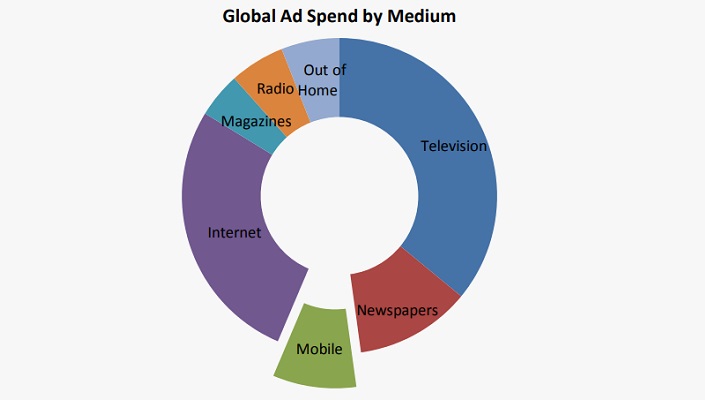

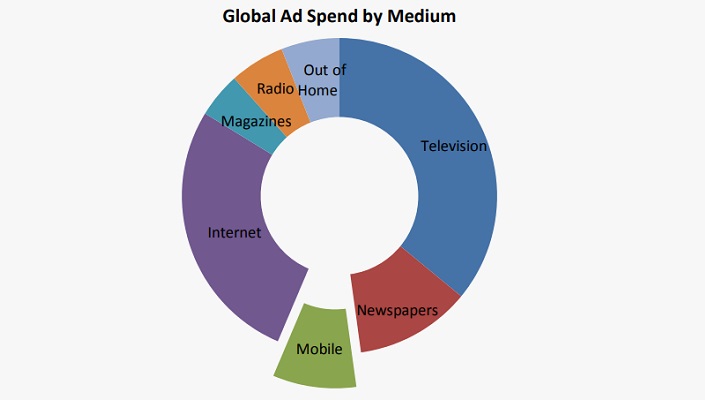

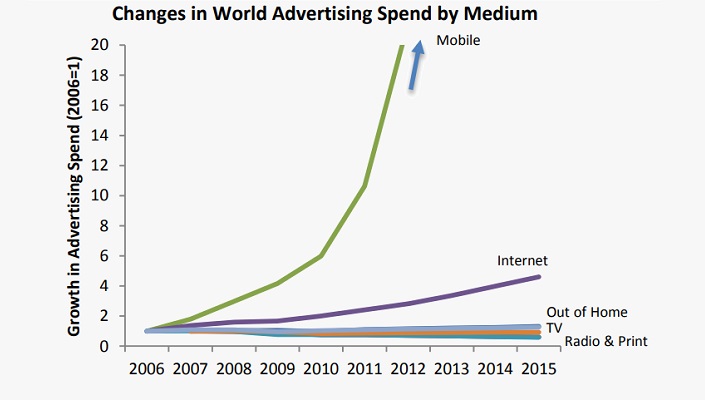

Marketing to mobile devices is the fastest growing form of advertising. Over the past decade, the value of mobile marketing expenditure has increased 100-fold.

According to Bloomberg Intelligence, the advertising medium is expected to attract US$50billion during 2015, representing 50 percent year-on-year growth.

Spending destinations are currently concentrated, with Google Inc and Facebook Inc estimated to attract three-quarters of all mobile marketing activity. However as mobile’s share of global advertising represents under ten percent of the market, there remains considerable scope for further growth.

Magna Global¹ estimates the USA to account for one-third of mobile marketing spend with three percent of expenditures occurring in Australia.

Mobile Marketing is witnessing the fastest growth but only accounts for ten per cent of all ad expenditure

A growing proportion of domestic mobile marketing spend may originate from Australia’s two million SME’s. Representing 99.7 percent of all businesses, domestic SMEs are characterised by under-utilisation of their digital assets.

Mobile marketing spend up 100 fold in past decade

According to Sensis2, 65 percent of Australian SME’s have a website. However, less than 20 percent advertise their business on other websites or have formulated a digital strategy.

Core technology underlying the Big Review TV platform is operational and its associated mobile application has been developed and public launch is pending. BIG’s commercial strategy is presently focused on building the upstream side of the business, which involves attracting vendors to the platform.

Vendor build up phase is poised to generate cash flow

The vendor procurement phase is scheduled to generate cash flow. BIG generates revenue by providing a contemporary video to the SME. Videos are then licenced under an annuity membership model for the SME to use on their own distribution channels. BIG has created a video-centric ecosystem for the SME including a mobile app for filming SME and consumer reviews which can be shared within the BIG ecosystem and on social media.

Relative low production costs versus conventional media and advertising groups are the primary attraction for vendors to partner with BIG. Vendor procurement commenced in Australia in January 2015 and as of October, the Company reported over 1,200 enterprise subscribers as well as an additional ~1,000 merchants as part of the freemium model.

As of October 2015, the Company had a sales pipeline exceeding 12,000 SME’s for which it had showcased video production capabilities. To accelerate conversion of the pipeline into enterprise subscribers, BIG has partnered with CDM Direct Communication Services (“CDM”).

CDM Partnership is poised to monetise BIG’s sales pipeline without a major capital outlay

The CDM partnership is scheduled to expand BIG’s sales team from 15 to 100 telesales personnel and provide a service capability from Auckland, New Zealand.

The expanded service capability requires no additional capital outlay from BIG, and is calibrated to suit the Company’s recently established global operations in New Zealand, Singapore, Hong Kong, the UK and USA.

By the end of FY16, BIG aims to have increased its sales pipeline to 25,000 SME’s around the world. By building critical mass for its video production services, the Company expects to;

a) Expand its enterprise service offering to other related field’s such as IT or social media management, and

b) Leverage its SME database by launching the consumer Big Review TV app, currently under development

In Australia, expanded service capability would enable the Company to capture the $9,700 per annum SME’s spend on IT3.

On a global scale, the launch of the Big Review TV app would enable the Company to position itself alongside the likes of other peer-review platforms such as Trip Advisor Inc (TRIP.US) and Yelp Inc (YELP.US).

BIG has utilised the latest technologies and a lean overhead structure to develop an affordable video production service for SMEs. The Company estimates its services require an outlay in the order of 25 percent of what a traditional media and advertising group would charge.

SME’s get digital video at 75% below traditional cost

BIG delivers the video production service in return for a deferred application fee plus a weekly membership fee. The application fee covers BIG’s cost of production and customer acquisition whilst the membership fee is designed to cover hosting, promotion, and periodic updating of the content on its broadcast platform.

The application fee is currently $399, whilst membership costs range from $7.50/week to $75/week dependent upon the membership level purchased and scale of distribution.

The deferred nature of the application fee is designed to procure vendor interest without the need for a financial commitment. Whilst the strategy requires BIG to fund production expenses that may not translate into revenue, discussions with management suggest that uptake of its services once filming has been showcased stands in the order of 45 percent.

Membership revenue potential $1.1billion across Australia, Singapore, UK and USA according to Telsyte

Earnings from the current vendor procurement phase are therefore a product of the quantity of SME’s which adopt BIG’s service and their average membership tier.

Across Australia, Singapore, the UK, and the USA, Independent Research Group – Telsyte estimates the market opportunity for BIG’s video services stands in the order of $1.1billion

To date, the Company has showcased its services to ~12,000 SME’s. Whilst personnel constraints have to date limited its capacity to convert this sales pipeline into memberships, the CDM partnership is positioned to accelerate uptake.

Discussions with management suggest the platinum tier

membership (~$50/wk) has been the most popular package to date.

BIG has the potential to build these memberships into long-term recurrent income streams. Its capacity to attract a substantial consumer audience for its mobile app, which is currently under development, could positively impact retention rates.

BIG currently generates revenue from the provision of video production services and membership fees. However, with a limited operating history, current revenue levels have not eliminated BIG’s dependence on external capital.

FY15 Revenue up 323%

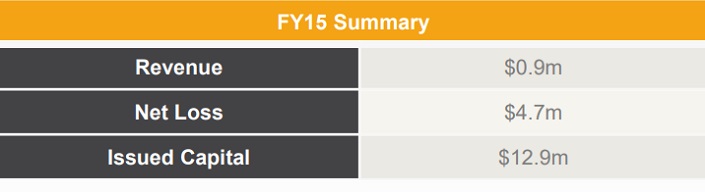

During FY15, the Company generated revenue of $0.9million, and a net loss of $4.7million. Revenue grew 323 percent versus the previous year. Excluding the one-off goodwill impairment relating to the reverse listing transaction, BIG’s underlying net loss was $3.3m.

The loss is attributed to one-off legal and advisory costs in relation to the reverse listing transaction, the higher corporate costs required by a public listed entity, and the increased cost of operations in the reflection of the higher volume of sale and production activity.

To date, the Company has funded these initiatives via equity. It’s most recent financing activity was a $4million placement at $0.20/share. Completed in July 2015, the placement will be used to accelerate growth to meet increased demand from a commercial partnership with CDM, facilitate marketing and promotional growth of the business and working capital.

Following the placement we estimate BIG’s cash balance to be in the order of $3million whilst issued capital currently stands at

$12.9million or $0.156/share.

BIG’s investment appeal rests in the current and future revenue streams generated by its digital video production services, and memberships to its Big Review TV platform.

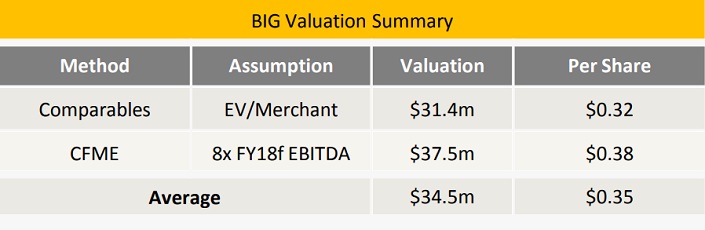

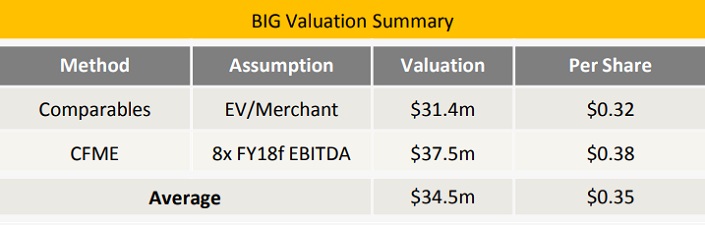

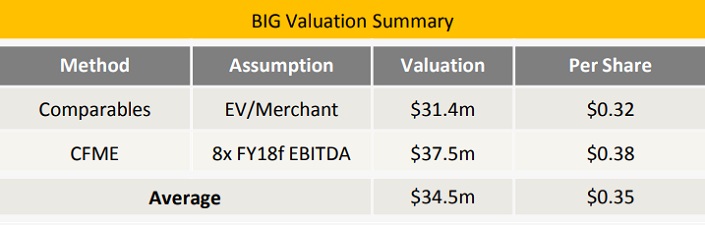

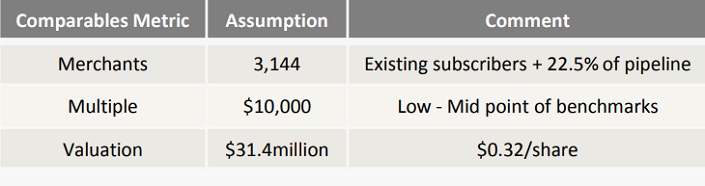

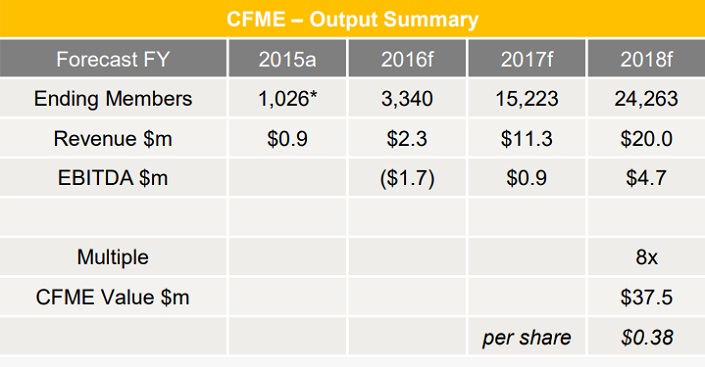

We have considered the Company’s potential worth using a Comparables approach and Capitalisation of Future Maintainable Earnings (“CFME”) methodologies. Our appraisal is based on an expanded share count of 98.95million, reflecting an additional funding demand of circa $2.5million.

Valuation $0.35/share

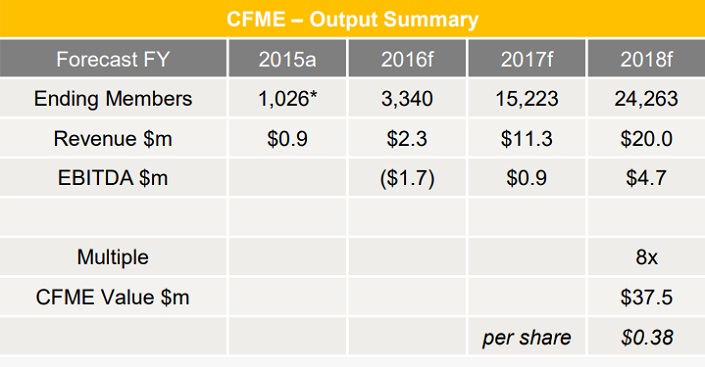

Our Comparables approach arrives at a valuation of $31.4million, or $0.32/share. Our CFME method arrives at a valuation of $37.5million, or $0.38/share Applying equal weightings both methods delivers an aggregate valuation of $34.5million or $0.35/share.

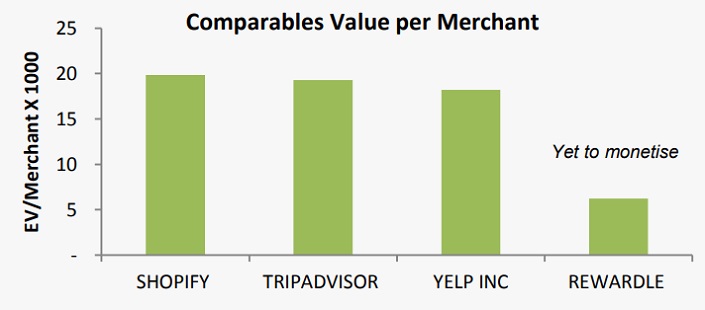

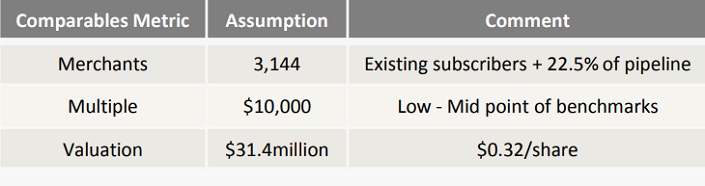

A universe of comparable companies has been assembled which are involved in the operation of technology/media platforms serving SMEs. There are four principal data points, which we have evaluated on an EV per Merchant basis.

We note that Companies that have successfully monetised their Merchant base trade at higher multiples. Whilst BIG has partly monetised its Merchant base, we have adopted a low to mid-range multiple of $10,000 and applied it to the company’s existing paid merchant base (~1,000) plus 22.5 percent of its current pipeline.

Over 70 per cent of BIG pipeline is not captured in comparables valuation

The approach arrives at a comparables valuation of $31.4million or

$0.32/share. We note that the applied conversion rate is approximately half of the Company’s actual conversion rate to date. No value has been ascribed to the remainder of BIG’s pipeline.

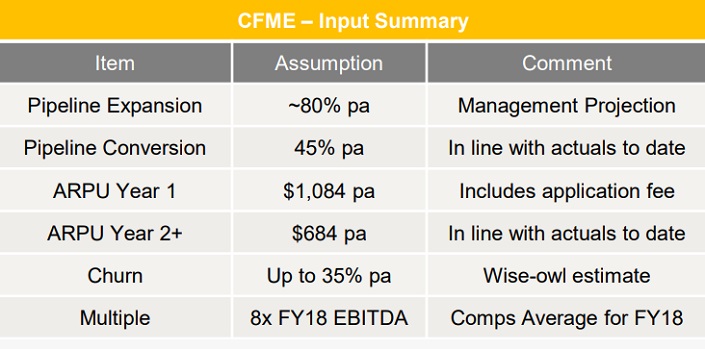

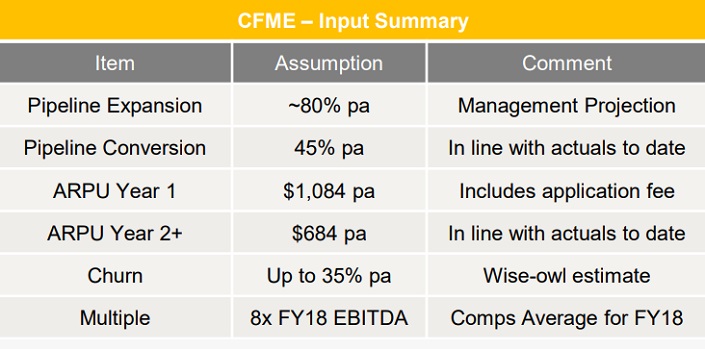

We have projected the Company’s financial performance for the next three financial years to a level that could represent a sustainable earnings capacity. To our estimation of future maintainable earnings, an industry-based multiple has been applied to arrive at a valuation of the Company.

Our financial projections are based on the organic expansion potential of BIG’s existing operations. Assumptions governing the expansion model are presented below.

Utilising these assumptions, we forecast BIG to generate EBITDA of $4.7million in FY18. After considering benchmark multiples range from 5x to 10x consensus FY18 EBITDA, we have applied a multiple of 8 times to our FY18 projection, arriving at a valuation of

$33.1million, or $0.34/share.

Big Un Limited offers speculative exposure to demand video-based mobile content. Its established revenue profile, large sales pipeline, and long term strategy are attractive qualities

Pipeline conversion is the major driver

Principal risks surround its ongoing reliance on external funding, rising costs associated with its international expansion, the untested nature of its consumer mobile app, and the potential for increased competition.

In partnership with CDM, the Company’s capacity to convert its existing sales pipeline into paid memberships and build a scalable, engaged audience for its video content are the stock’s principal catalysts.

Our valuation of $0.35/share represents a ~60 percent premium to a recent trade. With international benchmarks demonstrating salient value growth potential should BIG successfully execute its business plan, we are initiating coverage with a ‘speculative buy’ recommendation.

Richard is the founder and CEO of a previously ASX-listed company with a market cap of $40m. Richard is a co-founder of Big Review TV Ltd and was the Company’s first investor

Andrew is experienced in handling the finances of tech start-ups in the UK and Australia among other talents. He brings 15 years of corporate finance and governance to the team.

Big Review TV is Brandon’s concept. Brandon was responsible for proof of concept, business development and every aspect of the business model through to listing. At 21 he became the youngest founder of a publicly listed company

Sonia is a blue-chip experienced global brand, marketing, and communications expert. Sonia was responsible for developing the Big Review TV brand.

Critical to the sustainability of BIG’s business strategy will be its Big Review TV consumer app. With the product currently under development, there is no guarantee it will host the functionality required to attract a large user base.

Competitive barriers surrounding BIG’s assets are limited to ‘know how’, speed to market, and its ability to establish a critical mass. There is a risk its core video production service becomes subject to increasing competition or that existing peer review platforms incorporate video into their services, mitigating Big Review TV’s competitive edge.

In order to generate interest in its services, BIG funds production costs for prospective vendors to showcase its services. Whilst management indicates recent conversion rates to be encouraging, any decline in uptake rates or membership renewals would adversely impact its financial performance.

Whilst BIG generates revenue from its video production services and membership fees, income has yet to reach sufficient levels to reduce its reliance on external capital. There is a risk the Company won’t be able to secure ongoing funding or at a cost favourable for existing shareholders.

The valuation is contingent on BIG achieving a significant degree of success converting its existing sales pipeline into paid memberships and subsequently expanding the sales pipeline. Neither of these assumptions is assured.

THE BULLS SAY

THE BEARS SAY

1. Data accessed via Bloomberg Intelligence 2. e-Business Report 2014. Sensis.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.