Overview: Mincor Resources NL (“Mincor” or the “Company”) is an Australian mining company with nickel assets in Kambalda, Western Australia. It operates the Miitel and Mariners nickel mines, which host reserves of 0.67Million Tonnes (MT) @ 3.2% Ni, for 21kT contained metal. Operations commenced in 2001 and existing reserves imply a remaining mine life of two years. Additional Indicated and Inferred resources total 2.4MT @ 3.7% Ni, for 95kT contained metal.

![]()

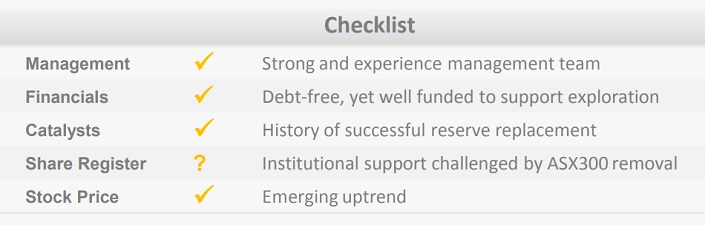

Catalysts: Mine life extensions and a turnaround in nickel prices are the primary value drivers. Amid weak spot market’s MCR has continued to deliver resilient operational performances, cutting its cash costs by 26% over two years to $4.5/lb, and maintaining positive operating cash flows. With cash reserves of $57M, the Company is well funded to sustain operations under current market conditions and delineate additional reserves. Prices have increased 11 percent following the imposition of unrefined export restrictions by Indonesia in January.

Hurdles: Whilst the Company has successfully extended reserves since 2001, the current two-year mine life of its Kambalda operations is a major barrier to income visibility. Nickel prices have contracted for the past three consecutive years and continuation of the trend could significantly challenge Mincor’s financial position. Recent exclusion from the ASX300 index limits the universe of possible institutional buyers of its shares.

Investment View: Mincor offers self-funding exposure to nickel price trends. We are attracted to its operational record, financial position, and capacity to realise immediate benefits from improved nickel markets. Accounting for 17 percent of global nickel production, Indonesia’s export restrictions could providing a platform for recovery off five-year lows and we are initiating coverage with a ‘buy’ rating.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.