Overview: MACA Limited (“MACA”, “the Company”) is an Australian services company providing contracting, infrastructure and civil services to the resources industry. The company operates predominantly in the civil and contract mining industry in Western Australia and Brazil. As of 31 December, the Company had an order book totalling $1.15 billion.

![]()

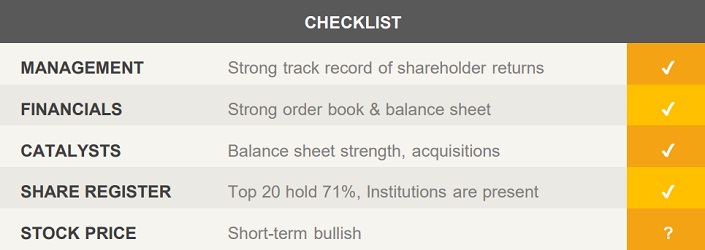

Catalysts: MACA is generating free operating cash flow and its order book of ~2x revenue provides good financial visibility at bottom of the industry cycle. The Company has a strong history of rewarding shareholders via high yield dividend distributions. A strong balance sheet enables countercyclical acquisitions while increasing focus on gold projects positions the Company to benefit from any cyclical recovery.

Hurdles: Continuation of recent contraction in the mining industry could significantly impact the Company’s ability to procure new contracts and sustain dividend payments at current levels. Any recent and future acquisitions are subject to integration risks.

Investment View: MACA offers profitable exposure to a turnaround in the resources sector. We are attracted to the company’s order book, balance sheet strength, and increasing focus on the gold industry. While further contraction of mining activity could impact MACA’s ability to procure new contracts, there is no guarantee that management can sustain dividend payments at current levels. However, management has a strong track record of delivering shareholder returns and financial liquidity provides scope to grow via acquisitions. We initiate coverage with a ‘buy’ recommendation for MACA’s turnaround potential.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.