Overview: iiNet Limited (“iiNet”, the Company”) is an Australian provider of telecommunications and media services. It is the country’s second-largest DSL Internet Service Provider, supporting over 1.7 million broadband, telephony, and Internet Protocol TV services. We initiated coverage in July 2012 at $3.24 with a ‘buy’ recommendation for its strong growth outlook. Our last advice was a ‘hold’ recommendation in Mar 2013 at $5.19.

![]()

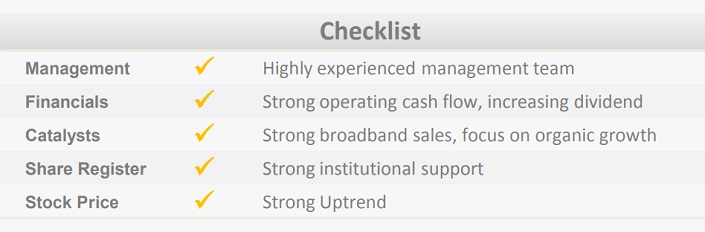

Catalysts: iiNet has a strong earnings trajectory, delivering its fourth consecutive period of growth in 1H14. With revenue up 4% to $493m and Earnings Per Share up 19% to 19.4c, the Company is demonstrating attractive operating leverage. The ongoing integration of three acquisitions worth $225m during the last two years is realising projected synergies, creating a strong platform for iiNet to deliver future organic growth strategies. Supported by its Fetch TV platform, the Company aims to increase Products per Customer from current levels of 2.24 to 3. A shift towards organic growth could reduce capital spend and financing costs, supporting higher dividend payouts.

Hurdle: With an NBN market share of 25%, iiNet is exposed to changes in the scale of Government investment in the industry. As iiNet’s earnings multiple represents a premium to market averages, a degree of future earnings growth appears to be captured in the stock price, creating downside risk if its fundamentals were to change.

Investment View: iiNet offers exposure to rising digital media and data consumption, supported by sound fundamentals. We are attracted to its earnings growth trajectory and a strong record of free cash generation. With earnings leverage and the prospect of higher dividend payouts expected to drive capital growth, we are upgrading our view to ‘buy’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.