Overview: ALS Ltd (“ALQ”, “the Company”) is an Australian commercial services company focused on testing and quality assurance. The Company undertakes food and pharmaceutical quality assurance; mining and mineral exploration; commodity certification; equipment maintenance, and asset care operations. It operates one of the world’s largest analytical and testing services businesses in more than 50 countries with over 300 locations. The Company was founded in 1863 and listed on the ASX in 1952. The Company was previously known as Campbell Brothers. It is a member of the ASX100 index.

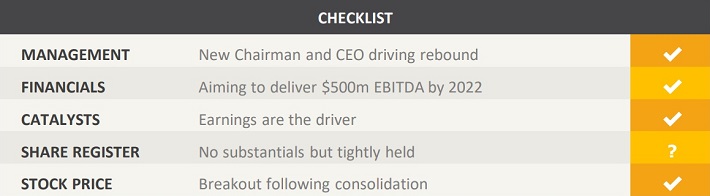

Catalysts: Following last year’s divestment of its oil and gas services unit, ALQ’s financial position has been strengthening. Earnings are rebounding strongly whilst the Company has used surplus capital to undertake share buybacks and acquisitions in the less cyclical life sciences industries. Aiming to increase EBITDA by more than 70% by 2022, further earnings growth is the primary driver for ALQ.

Hurdles: Over a third of the Company’s revenue is driven by commodity industries where demand is subject to cyclical trends and has impacted financial performance in the past. The Company relies to a significant degree on acquisitions to drive growth and must restore confidence in its ability to deliver value-accretive deals following an unsuccessful foray into oil and gas during 2013 (since divested).

Investment View: ALQ offers profitable exposure to the mineral sampling and food testing industries. We are attracted to its strong market position, reputation, high barriers to entry, and growth targets. As its financial performance rebounds solidly from recent cyclical lows, the Company aims to increase EBITDA by over 70% by 2022. Further commodities industry cyclical weakness and integration risks associated with recent acquisitions are the principal risks. Whilst the stock trades at a premium valuation to the market, its high entry barriers, share buyback program, and growth trajectory, create a favourable balance of risks and we rate the stock a ‘buy’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.