Overview: Grange Resources Limited (“Grange”, the Group”) is the largest integrated iron ore pellet producer in Australia. It owns and operates the Savage River magnetite iron ore mine in north-west Tasmania and the associated pellet plant and port facility on the State’s north-west coast. The initial capex for Grange’s 70:30 JV project, Southdown Magnetite, estimated at $2.89b with its operating costs estimated at $58.5/T (April’12). During FY13, the Company completed the relocation of its corporate headquarters from Perth to Tasmania.

![]()

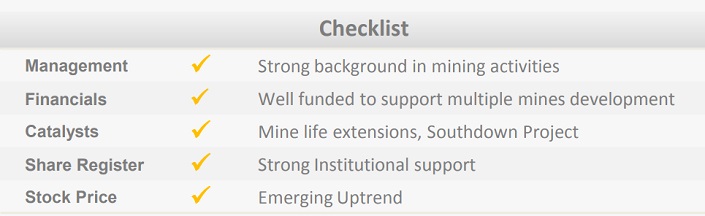

Catalysts: Grange posted the highest ever iron ore quarterly production of 0.62MT in 4Q13 (4Q12:0.44MT) followed by management guidance of 2.3MT in FY14. Retrieving access to North pit premium-grade ore in 3Q13 led to improved average price realizations of US$149.4/T in 4Q13 (4Q12: US$123.84/T). The advanced phase Southdown Project can add up to 6.6MT p.a., and induction of an equity partner is expected to drive growth. The recently announced 107MT resources at Long Plains and focus on mining development at multiple locations indicate cumulative resources of ~340MT securing Savage River mine life extension to 2030 and beyond.

Hurdles: Future cash flows remain subject to unfavorable exchange rate movements and commodities price fluctuations. The slowdown in demand from Asian regions or failure to secure new fixed long-term contracts may result in inventory pile–up.

Investment View: The trend for iron-ore and pellet premiums is likely to continue in FY14 due to an upsurge in demand for high-grade ore on the back of Chinese government regulatory compulsions. We are attracted to management’s rich background in the mining industry, Grange’s strong funding positions, and positive operating cash flow profile. Its strategic position as the supplier of premium grade ore and commercialization of South Pit mine in 2014/15 offering strong leverage to the upcoming global demand for steel and we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.