FYI Resources (ASX: FYI) is positioning itself to be a significant producer of high quality, high purity alumina (HPA) in Western Australia.

FYI has two key assets:

FYI is in the advanced stages of bringing its High Purity Alumina plant into production using feedstock from Cadoux to process at Kwinana.

HPA is increasingly used in Electric Vehicle (EV) batteries and energy storage, as well as established industries including LED lighting and semiconductors.

HPA is classified based on purity, 4N HPA is 99.99% pure, while 5N HPA is 99.999% pure. The production of 5N opens up new markets because of its high-end applications in areas such as lithium-ion battery manufacturing. Currently 4N HPA sells for circa US$25,000 per tonne, meanwhile the higher purity 5N HPA sells for cicra $50,000 per tonne.

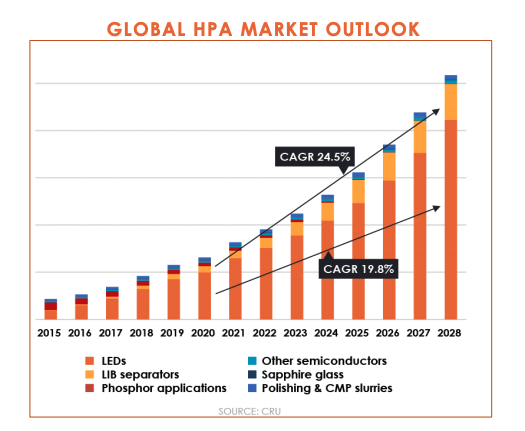

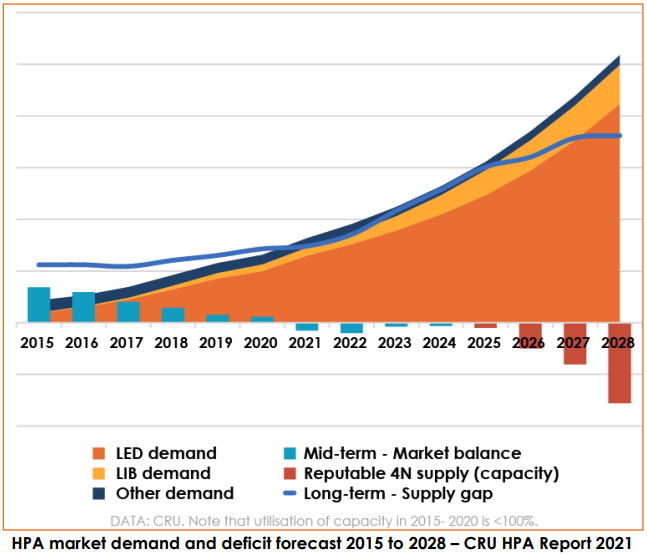

Some forecasts have the demand for HPA to rocket from the current 40,000 tpa to over 140,000 tpa by 2026.

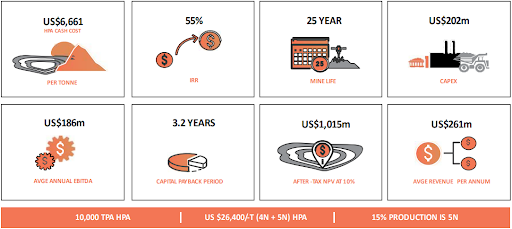

FYI is currently capped at $173M and recently updated a Definitive Feasibility Study (DFS) which demonstrated a Net Present Value of over US$1.015BN (A$1.3BN).

FYI is currently in exclusive negotiations with Alcoa Australia Ltd on a potential JV that would accelerate development of its project. Alcoa Corporation (NYSE: AA) is a Fortune 500 company, and one of the world’s largest alumina producers.

FYI also has backing for up to A$80 million from Luxembourg-based private equity group, GEM Global Yield LLC SCS. The funding gives FYI capital support for the development of its HPA project, particularly at key funding requirement stages.

FYI has a proven resource, solid operational and financial metrics and proof of concept in terms of being able to bring a premium product to market.

FYI has a large kaolin resource that it will mine and transport to a processing facility to convert it into High Purity Alumina (HPA).

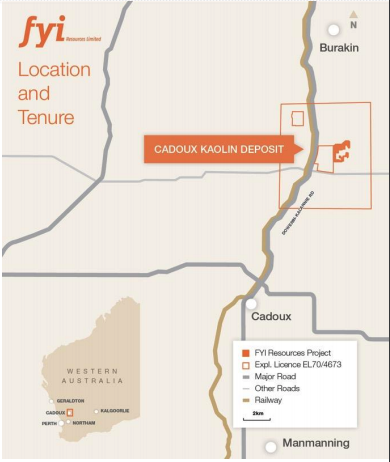

FYI’s aluminous clay (kaolin) resource can be found in Western Australia at its 100% owned Cadoux Kaolin Project.

This resource is located 220 kilometres north-east of Perth and according to its DFS has a modelled 25 year plus mine life, a reserve of 3.2 million tonnes grading 24.8% Al2O3.

Once mined, the product will be trucked 256km to FYI’s processing facility located in the Kwinana-Rockingham Industrial Area, better known as “Battery Valley”.

Here, FYI is aiming to develop a 10,000 tpa HPA plant. FYI plans to produce 8,500 tpa of 4N HPA and 1,500 tpa of 5N HPA, largely using kaolinite mined and beneficiated at Cadoux, and truck it to Kwinana for refining.

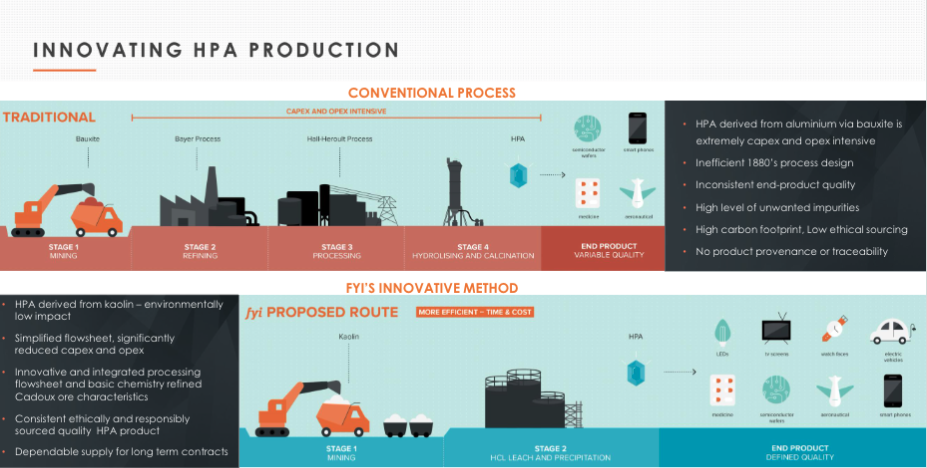

HPA is traditionally derived from aluminum via bauxite, producing an end product of variable end product quality and high levels of impurities. It is a carbon intensive that has seen little evolution since the 1880s.

FYI intends to use kaolin clay as a feedstock for its HPA production, which will have a much lower environmental impact. The process is simple, resulting in cheaper capital and operating costs.

FYI’s process reduces raw material waste and generates low toxic waste, with extensive recycling at the inputs and outputs.

FYI has calculated approximately 50% reduction in greenhouse gas emissions and 40% reduction in processing energy consumption per ton of HPA.

High ESG standards have become a prerequisite for HPA offtake customers and FYI has best practise here, including traceability of its process.

Following FYI’s Pilot Plant work, the company has demonstrated it can deliver a dependable supply of HPA for long term contract buyers, with high ESG standards – putting it in good standing to attract Tier 1 customers.

FYI has entered into a 90 day exclusive period for a joint venture negotiation with Alcoa Australia Ltd.

Alcoa is one of the world’s leading alumina producers and has significant global reach.

Any outcomes of negotiations should provide a clear path for the HPA project development, funding, operation and product marketing.

The outcomes of these negotiations should provide investors with much greater clarity on how the project’s costs will be funded – the company’s most recent DFS demonstrated upfront capital costs of US$202M – more on that below.

The JV could arguably prompt analysts to revise valuations due to a dilution in risk metrics surrounding product development and the securing of financing and offtake agreements.

Making this development even more significant is Alcoa’s close involvement with FYI during the testing process and the establishment of an updated DFS – in short, this is a show of faith by a multinational that has an intimate knowledge of FYI and its capabilities.

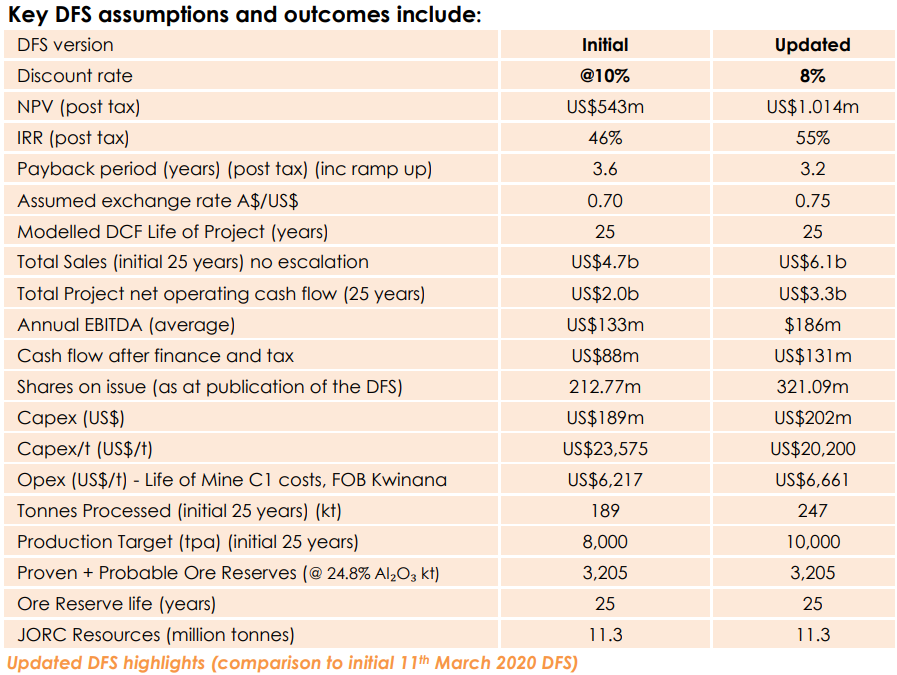

There are compelling metrics from the updated DFS, which indicate that FYI’s sub-$200 million enterprise value isn’t an accurate reflection of the group’s investment merits.

The most significant of these metrics are:

The assumptions and outcomes in the above table, confirm FYI’s base case production profile while pointing to enhanced revenue generation and advantageous commercial positioning.

What the DFS shows is that FYI is now well placed to supply high demand 5N HPA that fetches circa double the price of 4N product.

Key metrics from the updated DFS include:

The DFS presents a persuasive economic case and demonstrates the merit of the project as a high quality, low capital and operating cost project.

The DFS presents a persuasive economic case and demonstrates the merit of the project as a high quality, low capital and operating cost project.

The next steps for FYI will be to secure a financing pathway to production based off the above numbers.

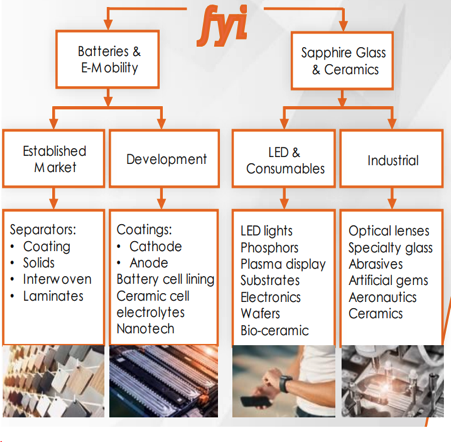

High Purity Alumina (HPA) is used for fast growing, high-tech sectors involving semiconductors and LED screens, along with a multitude of high-tech applications, including lithium-ion batteries and LED lights.

HPA is a processed premium non-metallurgical alumina product characterised by its purity level – i.e. 99.99% (4N), 99.999% (5N). The market price, application and performance of HPA varies widely according to its degree of purity.

The 4N product fetches approximately US$25,000 per tonne, while customers in the electric vehicle and energy storage industries are paying in the vicinity of US$50,000 per tonne for 5N HPA.

HPA’s demand growth can be put down to global investment in electric vehicle production.

The following graphic illustrates HPA many applications and the markets FYI is targeting:

The current global 4N HPA market demand is currently ~30ktpa, but is expected to increase to >104ktpa by 2028.

FYI is in advanced discussions with a number of Tier 1 industry groups across the lithium-ion battery separator, sapphire glass and other specialty markets regarding HPA marketing and off-take arrangements.

Trial product has been sent by request to market participants including HPA customers and traders.

Further to this, multiple rounds of meetings already conducted in Taiwan, South Korea, Japan, Europe, the US and the UK.

FYI recently listed on the OTC under the ticker code OTCQB: FYIRF.

An OTC market listing gives FYI better access to a wider pool of capital in a bigger market.

FYI is now looking to build its North American shareholder base in response to increased US investor interest.

The investor interest includes equity funds, ESG funds and family offices.

The interest FYI has received from North American investors is a direct result of:

The Frankfurt and Munich listings have already provided valuable exposure for FYI to European investors.

The Frankfurt listing assists FYI’s investor reach and increases its exposure to European investors.

The Frankfurt Stock Exchange is the world’s third largest exchange-trading market, behind the New York Stock Exchange and NASDAQ.

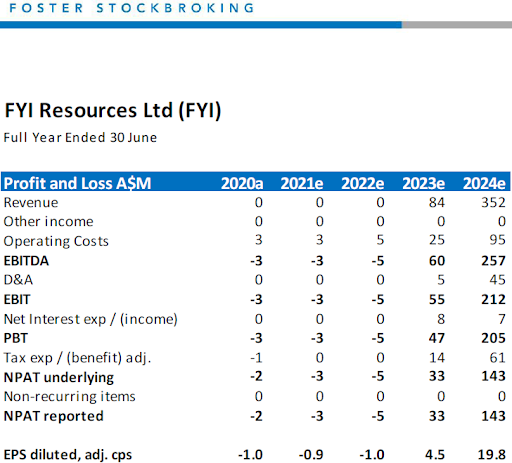

The upgrade in valuation from Foster Stockbroking prompted the broker to reaffirm its ‘’buy’’ recommendation and increase its price target to $1.52 per share, implying upside of nearly 200% to the company’s recent trading range.

Just this week, Taylor Collison added another dimension to the valuation metrics, applying an enterprise value/EBITDA financial multiple, a valuation method that is commonly used in relation to specialty chemical companies.

Importantly, the bottom end of the implied range ($2.6 billion to $3.9 billion) is double the NPV in Australian dollar terms (circa $1.3 billion).

Taylor Collison also modelled a more conservative scenario where operating costs were higher and HPA sale prices were 20% below assumptions, and the numbers speak for themselves,

“If we increase operating costs, and decrease HPA sales prices by 20%, the EBITDA reduces to A$170 million, which would result in unrisked multiple valuations of between A$1.70 billion and A$2.55 billion.”

FYI’s Managing Director Roland Hill holds 5.25% (all paid for) of the company, while the top 20 shareholders hold 40.93% of the company.

Mr Hill’s holding would suggest he is well motivated to deliver results for shareholders, and this is an appealing aspect of FYI’s capital structure.

One point of note is the 37.6 million unlisted options on issue with exercise prices ranging between A$0.10 and A$0.15.

These options are all in the money, and whilst conversion of these options will bring in capital to the company, it also has the potential to slightly hamper share price momentum in the coming months.

FYI has several share price catalysts on the horizon including:

FYI’s advanced stage, strong economics, leverage to battery metals, relationship with Alcoa and ESG credentials were compelling factors in terms of our decision to invest in the stock.

FYI’s shares have increased approximately ten-fold in fiscal 2021, driven by the group’s ability to demonstrate the value of its resource, the strength of its technologies and its ability to forge a strong relationship with a global player.

With investors now able to place a value circa US$1 billion on FYI’s project and a strengthening of its relationship with Alcoa, the company should continue to benefit from positive momentum and has been significantly de-risked.

The fact that multiple analysts are now covering the stock should generate further interest and a better understanding of the company’s core business/industry exposure which falls into the niche category.

Investors continue to embrace ESG stocks with billions of dollars being pumped into the sector, and this should continue to work in the company’s favour.

Further positive news regarding accelerated use of HPA in new age industries, in particular those involved in green energy, should be well received by investors attracted to FYI.

Based on peer comparisons we initially saw the potential for significant share price upside and we believe that a further rerating could occur on the back of an uptick in the group’s market capitalisation, as it begins to trade more in line with traditional financial valuation methodologies, similar to those applied by Foster Stockbroking and Taylor Collison.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.