Overview: Afterpay Holdings Limited (“Afterpay”, “the Company”) is an Australian microfinance company focused on payment solutions. Afterpay offers a service and software infrastructure that allows retail merchant clients to offer ‘buy now, pay later’ programs to end- customers. Afterpay generates revenue via merchant and transaction fees and as of the date of the prospectus had 100 retail clients and 38,000 registered end-customers. The company was founded in 2015.

![]()

Catalysts: Since its inception in 2015, Afterpay has witnessed interest for its services, and increased monthly revenue 10-fold while securing more than 100 retail merchant clients and 38k end-customers. In order to sustain the trend, Afterpay will use the proceeds to increase funding and working capital. Progression from product validation to scalable sales growth is expected to be the main share price driver.

Hurdles: Afterpay is reliant on external capital to fund its daily operations and with a limited operating history there is no guarantee that planned growth initiatives will yield a return on shareholder funds. Afterpay operates in a highly competitive environment and may be subject to increasing competition. A significant degree of the unallocated free float may impair early trade in its shares.

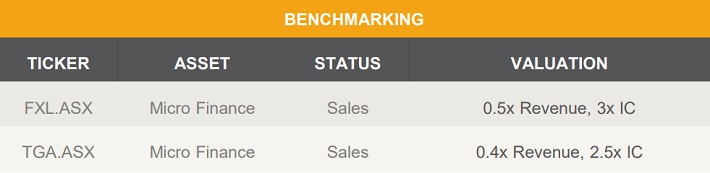

Investment View: Afterpay offers speculative exposure to the microfinance industry. Early growth momentum and existing client network are attractive qualities. However, the company was founded in mid-2015 and has a limited operating history, whilst being reliant on external capital. Demand for its product is an initial validation signal, however, IPO participants are required to have a high-risk appetite for this start-up.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.