Euro Manganese Inc (ASX:EMN; TSX-V:EMN) is developing the Chvaletice Manganese Project (CMP). The company’s plan involves the re-processing of Europe’s largest manganese deposit hosted in historic mine tailings in the Czech Republic. EMN aims to produce high-purity manganese products (HPM) in an economically, socially and environmentally-sound manner. It will be recycling waste to produce highly refined manganese products.

The Chvaletice Manganese Project stands to become the only primary producer of battery grade manganese products in Europe, with the potential to provide up to 50% of projected 2025 European demand for high-purity manganese, and 28% of its anticipated 2030 requirements.

Management just informed the market today that the company has secured the support of EIT InnoEnergy, a Knowledge and Innovation Community supported by the European Institute of Innovation & Technology.

This EU-backed organisation has agreed to help EMN secure financing of up to €362M for the commercial development of the Chvaletice Manganese Project.

EIT InnoEnergy has invested €560M in sustainable energy innovations since its establishment in 2010. The organisation has delivered investment and added value services to some 380 companies, including flagship platers like Northvolt, a vertically integrated sustainable battery manufacturer.

A recent example of the support InnoEnergy can provide is where they led the Battchain consortium submission for €1.2b of Coronavirus Recovery Funds – Infinity lithium is in line for a €256M euro capital injection if the InnoEnergy led bid is successful.

As a first step, EIT InnoEnergy will make an initial €250,000 investment in EMN that will go towards ongoing work on a detailed feasibility study and demonstration plant, both targeted for completion by the end of 2021, effectively expediting the project and its benefits for Europe.

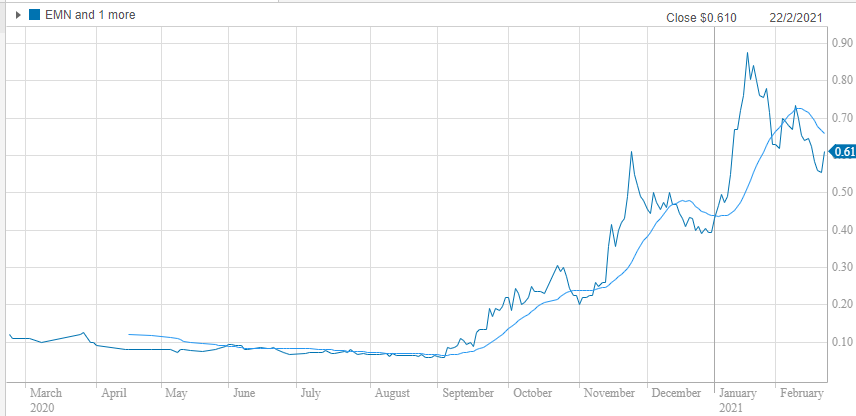

When Wise-Owl initiated coverage on EMN in September last year, we highlighted two years of significant share price catalysts that would increase confidence in the company’s ability to bring CMP into production, as well as potentially driving investor interest with the latter providing an incentive for opportunistic retail investors, as well as garnering support from capital markets for ongoing funding.

As this scenario unfolded the company’s shares increased from 6 cents at the start of September to close at an all-time high of 87.5 cents in mid-January 2021.

In the last month, the company’s share price has seen some retracement, and this may represent a buying opportunity for investors who might have missed this stock in 2020. The company’s share price came off an extremely low base in August 2020 and has delivered a 10x return since.

Despite this spectacular growth, the company’s market cap is still circa $200M, and given it’s a development stage company aiming to move to production over the coming years, there is a strong case for the stock being undervalued.

We still view EMN as a compelling investment given the uniqueness of the project in Europe as the only sizeable and economically recoverable source of manganese in the EU.

The fact that the project is cleaning up tailings from a decommissioned mine, is leveraged to demand battery metals in Europe, and has strong ESG credentials adds to its appeal.

Such is our belief in the CMP project and management’s ability to progress it to production, we have taken a number of opportunities at various price points to establish a significant position as long-term investors.

Being located on the doorstep of a number of European battery factories will work in the company’s favour.

The European Union has also demonstrated its support for renewable energy, unveiling a €750,000 billion plan for a climate-led economic recovery from COVID-19 that prioritises investment in renewable energy, clean transport, smart energy, and emissions reduction.

This underlines the importance of today’s news that a wholly-owned Czech Republic subsidiary, Mangan Chvaletice, has secured the support of EIT InnoEnergy.

EIT InnoEnergy will marshal its broad network and resources to accelerate the Chvaletice Manganese Project’s successful integration into the European Union’s battery supply chain.

Through its subsidiary Mangan Chvaletice, EMN owns 100% of the rights to the Chvaletice deposit.

The project has a strategic land parcel, which is connected to a major rail line, is adjacent to an 820-megawatt power plant, and will be the site of its proposed state-of-the-art HPM processing plant.

Importantly, the company completed the land assembly for its proposed plant site, including the acquisition of a rail switch that will provide a second access to the railway spur line that adjoins it.

In 2019 the company, EMN signed five Memorandum of Understandings (MoUs) with potential customers, as the first step towards offtake agreements.

One of the key challenges in developing new projects for both large and small companies is financing, and on this front Euro Manganese had a very successful year, raising approximately C$17 million in new equity during the calendar year 2020 – support from EIT InnoEnergy should strengthen the company’s ability to access capital markets in the near to medium-term.

Just prior to our initiation of coverage, Euro Manganese filed its Environmental Impact Assessment notification. EMN received a tick of approval from the Czech Ministry of Environment in January, having completed the initial screening procedure. This was a key milestone as EMN can now move forward to the final stage of the EIA stage of the project environmental permitting process.

Public and regulatory feedback from the screening procedure will be incorporated into the Final Environmental Impact Assessment, which is targeted for completion in December 2021. Management has also obtained two favourable environmental rulings that will enhance the feasibility of the project.

All in all, despite some of the inhibiting factors created by COVID, management has made good progress in significant areas that will pave the way for operational events in the coming 12 months.

During the three months ended December 31, 2020, an order was placed for the demonstration plant, and the feasibility study was resumed, including verification test work and associated engineering activities. Subject to additional financing, the completion of the Chvaletice demonstration plant and commissioning thereof, as well as the completion of the feasibility study is now expected by the end of calendar 2021.

While this provides a backdrop in terms of where Euro Manganese is at the moment, the following discussion regarding upcoming catalysts is likely to be the main focus in terms of attracting further investor interest in 2021, even though management was able to attract significant financial backing in the face of challenging conditions in capital markets in 2020.

- Complete the Feasibility Study: target – late 2021.

- Complete the Final Environmental Impact Assessment: target – late 2021.

- Build, install and commission the Demonstration Plant: target – late 2021.

- Advance with the supply chain qualification of products – ongoing.

- Develop additional strategic customer relationships – ongoing.

While these individual catalysts in isolation are potential share price catalysts on their own account, they have broader implications regarding the progress of the CMP project.

For example, the completion of the demonstration plant will provide Euro Manganese with proof of concept data and finished product samples for potential client’s supply chain qualifications.

It is worth noting that as of mid-February approximately 55% of the demonstration plant’s planned first-year production of these products had been allocated to five customers for testing and qualification.

These parties and their markets include a global leading participant in the lithium-ion battery supply chain, for use in NMC cathodes, as well as a company, focused on large-scale lithium-ion battery manufacturing, for use in NMC cathodes.

Other interested parties included a global chemicals and specialty materials company considering use in metal hydride for hybrid automobile anodes and JFE Corporation, a leading Japanese steel producer, for use in specialty steel applications.

Upon successful completion of testing and evaluation by these parties, and subject to a production decision being made based on the results of a feasibility study, management intends to work towards establishing long-term commercial offtake arrangements for the supply of its high purity manganese products.

Management continues to hold active discussions and negotiations with several consumers of high-purity manganese products that include a battery, chemical, and automobile manufacturers in Asia, Europe, and North America, and it expects to allocate the remainder of the demonstration plant’s initial year of production in the near term.

Progress made on this front would definitely have a significant impact on the company’s share price as it would provide financial stability, as well as representing an endorsement of the product quality which would likely be viewed by other industry participants that are looking for a similar product.

The Chvaletice Manganese Project is the only significant manganese deposit in Europe. EMN stands to become the EU’s only primary producer of high purity manganese products. We view it as a strategic European asset, particularly given its location in the heart of Europe’s EV and battery manufacturing hub.

With EMN emerging as both a sustainable and reliable producer of exceptional quality battery raw materials to satisfy the needs of producers of lithium-ion battery supply chain, as well as those of other high-technology applications, it is ideally positioned as demand for electric vehicles and battery products grows exponentially over the coming decade.

In terms of quality, EMN is targeting the production of ultra-high-purity electrolytic manganese metal (“HPEMM”) with specifications exceeding 99.9% Mn and ultra-high-purity manganese sulphate monohydrate (“HPMSM”) with a minimum manganese content of 32.34%, with very low imprurity contents, both of which exceed typical industry standards.

Importantly, EMN has not only demonstrated its resolve in taking advantage of this unprecedented commercial opportunity, but it has also committed to progressing in an effective, efficient, and diligent manner, while adhering to the best practices in corporate governance, application of technology, environmental excellence, and social responsibility.

ESG (environmental, social, governance) parameters have emerged as increasingly important drivers in terms of gaining support for projects at a government, corporate and retail investor level.

As an emerging producer of a product that will meet the needs of green electric vehicles and battery makers in an environmentally friendly manner (this is waste recycling, not mining), EMN is particularly attractive to investors/financiers and customers who require sustainable practices from raw material producers.

This project is seen as a great opportunity for the Czech Republic to transition into a greener, more sustainable economy, and for Europe to achieve a measure of self-reliance in a critical battery raw material.

With significant operational milestones in the pipeline and the prospect of further commercial deals being struck, we see Euro Manganese as an evolving story that will continue to be news-flow driven, particularly as its financial profile is enhanced by revenue visibility and ongoing funding.

Further, the upcoming demonstration plant trials will provide the evidence investors and potential offtake partners have perhaps been waiting for in terms of fully engaging with the group at a capital markets and commercial level.

The fact that EIT InnoEnergy has agreed to help Euro Manganese secure financing for the Chvaletice Manganese Project represents a show of confidence in the project from an EU-backed organisation with a high profile within the EV and battery industries.

Given the project’s full-scale commercial development is estimated at €337 million (US$403 million), EIT’s assistance in gaining support from potential funding sources that include Europe-wide and regional grant programs, as well as European project finance and economic development banks could well be an enticement for other investors to come on board.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.