Overview: Monadelphous Group Limited (“MND”, “the Company”) is an Australian engineering services company. It is engaged in providing construction, maintenance, and industrial services to the mining, energy, and infrastructure sectors throughout Australia. MND has two divisions: Engineering Construction and Maintenance and Industrial Services.

![]()

Hurdles: MND’s revenue has declined for the past two consecutive years and its long-term performance is dependent on increasing levels of investment in the mining and energy sector. A further slowdown in global economic conditions with adverse impact on coal, iron ore, and LNG demand, would aggravate the risks of fewer new order flows or deferral of existing contracts.

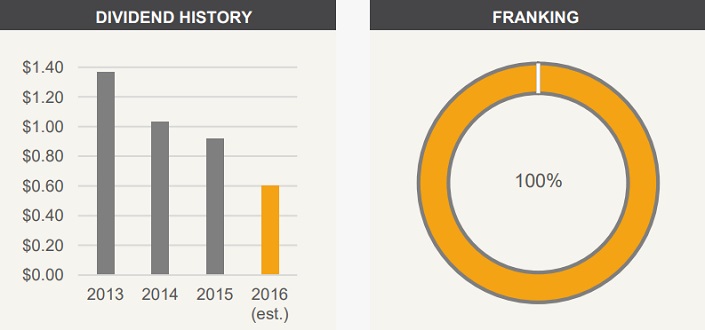

Catalysts: MND is well placed to benefit from a recovery in the depressed mining services sector. Backed by its diversification into the marine infrastructure sector and cost restructuring measures, MND’s results are projected to be less impacted by the cyclical downturn. Most key commodity prices have recovered year-to-date which should enable management to reward shareholders via attractive dividends. The FY16 dividend distribution is estimated to yield ~$7%.

Investment View: MND is strategically placed to leverage from any recovery in mining investments. We are attracted to its long-term earnings growth record, free cash flow profile, and management’s interest in driving shareholders’ return. Whilst the near-term outlook for the metal and mining sector looks challenging, MND is well placed to benefit from any cyclical recovery. The stock is trading at an undemanding valuation and we estimate a dividend yield of ~7% and with a resilient business model of the diversified revenue base, we initiate coverage with a ‘buy’ rating.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.