Overview: Collection House Limited (CLH) is an Australian professional services provider focusing on receivable management and debt collection services. The Company operates 11 offices in Australia, New Zealand, and the Philippines.

![]()

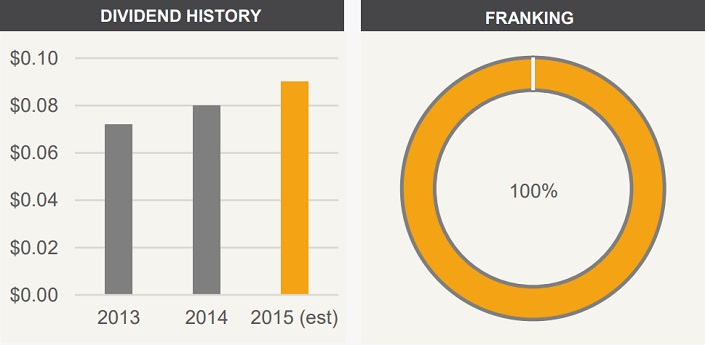

Catalysts: Collection House Ltd pays a stable, fully franked semi-annual dividend which yields ~4% at current prices. CLH has achieved earnings growth in the past eight consecutive years. Over the last three years, CLH’s revenue grew by ~11.5% while net profit increased by ~22% y-o-y. Reliable cash flow provides a fundamental income base for the company while acquisitions and partnerships provide growth opportunities. CLH will trade ex-dividend on 22 September 2015 distributing a final dividend of 4.7 cents.

Hurdles: The company experienced decelerating earnings growth over the past three years which may further slow down in challenging domestic trading conditions. The company is exposed to interest rate movements as it affects the returns on bad debt available.

Investment View: Collection House Group is a profitable income opportunity with an expected dividend yield of ~4%. Reliable cash flow and double-digit earnings growth provide the base for higher-income distributions in FY16. Whilst capital growth may be limited, CLH remains a robust business and pays a fully franked dividend. We initiate coverage with a ‘buy’ recommendation. This position has a 12-month outlook and is part of the Wise-owl ‘Dividend Portfolio’.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.