Overview: Dicker Data Limited (“Dicker Data”, “the Company”) is an Australian company focused on the distribution of hardware. Dicker Data acts as a distributor of leading technology brands, selling to over 3000 resellers across Australia. Dicker Data was founded in 1978 and listed on the ASX in 2011.

![]()

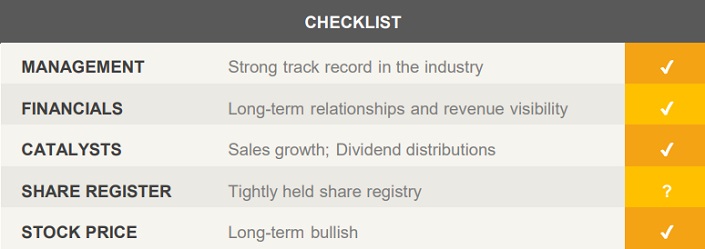

Catalysts: Dicker Data is experiencing sales growth has doubled revenues over the past three years. Revenue visibility in the medium- term is strong as the company has established long-term relationships with a number of high-profile customers. Dicker Data is scheduled to distribute quarterly fully-franked dividend distributions yielding ~7%. The Company has consistently paid a dividend since listing in 2011.

Hurdles: Even though Dicker Data is posting consistent revenue growth, earnings have historically been volatile which may affect the company’s ability to pay dividends. With a balance sheet gearing of 3x EBITDA, Dicker Data may be restricted to fund future growth initiatives. While management controls the majority of the stock, the ability of minority shareholders to influence the direction of the Company is impaired.

Investment View: Dicker Data offers profitable exposure to the domestic technology industry. We are attracted to its revenue growth trajectory, relationships to vendors and resellers, and history of dividend distributions. Primary risks include earnings volatility, corporate structure, and balance sheet gearing. While the Company is experiencing organic growth and from its acquisitions, the Company appears well-positioned to continue to reward shareholders via dividend distributions. Offering an attractive mix of capital growth and income we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.