Overview: Crowd Mobile Limited (“Crowd Mobile”, “the Company”) is an Australian technology company focused on mobile software and mobile marketing services. Its principal asset is a Question and Answer platform (‘Q&A’) and a mobile payments network spanning 212 telco carriers, 64 countries, and 30 languages. This distribution network was built by the Company and its predecessors over 15 years. In addition, the Company launched a new division, Crowd Media, to take advantage of the $3.5bn markets for digital influencer advertising. Our last advice was a ‘spec buy’ recommendation in June 2017.

![]()

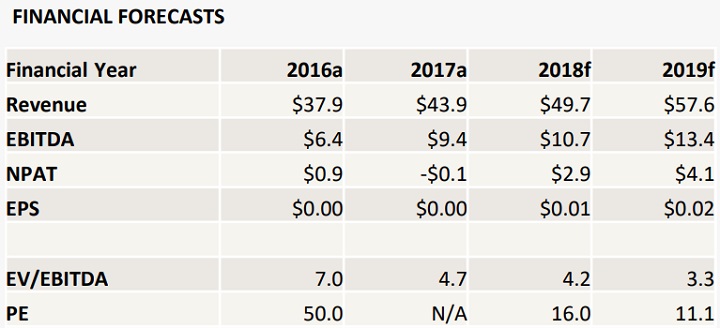

Catalysts: Supported by a new institutional investor and strengthened balance sheet, Crowd Mobile has met our FY17 forecasts (Revenue up 16%, EBITDA up 49%). With June its strongest quarter, the Company has the momentum to deliver further growth in FY18. With the cost of acquisition in its Q&A unit 20% lower YoY, early benefits of the Crowd Media initiative are beginning to show. The rhetoric surrounding the recently sluggish Subscription unit was positive, although initiatives in this unit are yet to flow through to the financials.

Hurdles: Despite the Company’s improved liquidity, its reliance on external capital may not be entirely eliminated. Whilst the performance of the Subscriptions business unit has stabilised, there is no guarantee against further erosion of its earnings base. A lack of growth within the Subscriptions division may challenge Crowd Mobile’s ability to attract an appropriate valuation for its growing Q&A division. Crowd Mobile does not own any patents to its technology and may be subject to increasing competition.

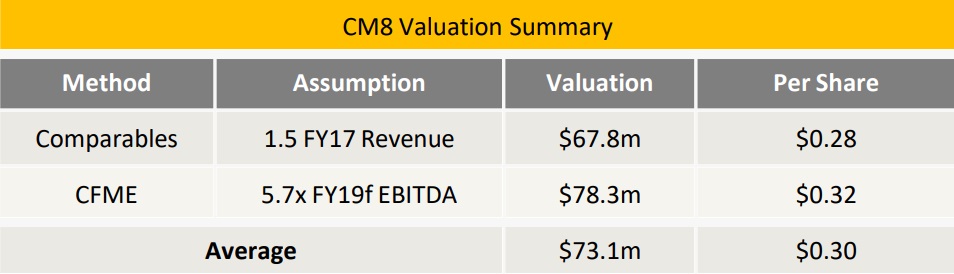

Investment View: Crowd Mobile provides profitable exposure to mobile software and services trends. After meeting our FY17 forecasts and restoring balance sheet health, the Company is in a sound position to invest in its digital influencer strategy. With recent growth fuelled by the smaller (Q&A) of its two divisions, we are carefully monitoring the performance of the sluggish Subscriptions unit and recently launched Crowd Media initiative. After updating our forecasts with the full-year result, our valuation of $0.30 per share (up 3%) represents a 66% premium to recent trade, and we maintain our ‘speculative buy’ recommendation.

THE BULLS SAY

THE BEARS SAY

Summary of revisions vs 8-Jun-2017 update

Notes:

EV/EBITDA and PE ratios are based on a diluted share count of 242.3million, net debt of $2.9million, and option proceeds totalling $4.4million.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.