Overview: WhiteHawk Limited (“Whitehawk”, “the Company”) is an ASX-listed Arlington, Virginia, USA-based cybersecurity company, providing a range of cyber risk products, services, and solutions. WhiteHawk developed and operates the first online cybersecurity exchange enabling businesses of all sizes to manage cybersecurity threats. The Company is evolving its portfolio of cybersecurity systems and services and has secured contracts with key US federal government departments, along with Fortune 500 companies, top US financial institutions, major insurers, manufacturers, utility providers and a top Defence Industrial Base (DIB) company.

![]()

Catalysts: New and extended contract announcements and partnerships have proven to be share price catalysts for WhiteHawk. This was demonstrated with the recent growth in customer contracts through its expanded product line and new SaaS product via its partnership with a major global consulting firm. WhiteHawk’s product lines and services continue to be sold and executed via cloud based online platforms, SaaS services and virtual consultations. Management has confirmed it is well-positioned to continue to support its customers and to engage with future customers seamlessly and effectively throughout the current global pandemic. Additional working capital facilities totalling A$1.9m subject to shareholder approval, provide additional funding capabilities. New contracts will boost the Company’s recurring revenue base and have the potential to be value drivers.

Hurdles: While the Company announced sufficient cash reserves through 2021, additional external capital may be required to ensure the long-term sustainability of the business. There is no guarantee that capital can be procured at favourable terms to shareholders. Despite implementing a range of mitigation initiatives, the greater impact of COVID-19 on the global economy and WhiteHawk remain somewhat uncertain and there is no guarantee that ongoing growth can be achieved. The Company may be subject to increasing competition in a growing market.

Investment View: WhiteHawk offers exposure to the growing global cybersecurity market via its cybersecurity exchange. We are attracted to management’s industry connections, the Company’s existing contracts with U.S. federal government departments & Fortune 500 companies, its partnerships and sales pipeline. WhiteHawk has a firm financial position and while the Company remains reliant on external capital, recent funding supply should provide management with near-term resources to pursue growth opportunities. The Company’s existing revenue-generating contracts are supported by a deep sales pipeline in the US across diverse sectors including the federal government, financial sector, Defense and Industrial Base as well as manufacturing and utility sectors. As the market for cybersecurity continues to grow, WhiteHawk is in a unique position to take advantage of increased cybersecurity spend through its Cybersecurity Exchange and solutions. While the long-term growth potential of the business remains to be validated, we believe that a series of favourable quarterly updates along with any new contract or partnership announcements could drive significant interest towards the stock and we, therefore, initiate coverage with a view to providing further updates in the future.

Launched in 2016, WhiteHawk commenced operations as a cybersecurity advisory service and has since expanded its offering to cloud-based SaaS solutions, simplifying how companies purchase cybersecurity solutions.

Today, WhiteHawk enables companies to identify and mitigate their priority cyber risks on an ongoing basis with demonstrated cost and time savings. Leveraging the online Cybersecurity Exchange platform and SaaS partners WhiteHawk works to identify, prioritise, and mitigate cyber risks that impact client revenue and reputation. It partners with top commercial technologies and SaaS services that leverage AI techniques and open data sources.

WhiteHawk’s expanded product line now includes the Cyber Risk Program, a software as a service (SaaS) product for mid-sized and large enterprises to defend against cyberattacks by monitoring, identifying, prioritising, and mitigating cyber risks. The company’s Cyber Risk Radar is an annual SaaS subscription that manages the business and cyber risks of an enterprise’s partners and supply chain companies. WhiteHawk’s annual Cyber Risk Scorecard subscription consists of quarterly updates combined with cyber consultant sessions in tandem with the delivery of each scorecard. The Cyber Marketplace is an online resource, offering hundreds of best-of-breed, affordable products and services catering to cyber risk mitigation needs of small to midsized businesses and organisations.

Founder and CEO, Terry Roberts, is a former deputy director of US Naval Intelligence and brings over 30 years of experience as a US national security and cyber intelligence professional. This includes time as a US Naval Intelligence Officer, a Department of Defence Senior Executive and as a Cyber Engineering, Architecture and Analytics industry executive.

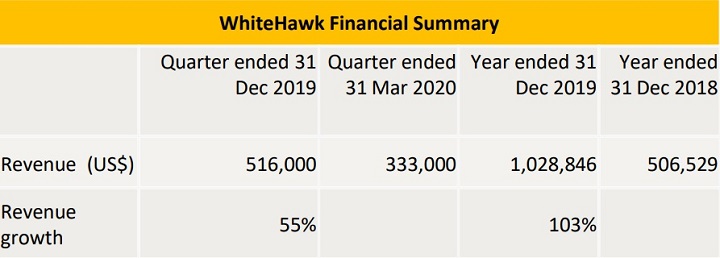

Whitehawk generated revenues of US$1.03 million (A$1.5M) during financial year 2019, a 100% gain in the prior year, of which US$867k (A$1.32M) were with two key customers in the US and US$161k (A$245k) in government contracting. Issued capital stands at US$11.2 million (A$17M) as of 31 December 2019.

The first quarter 2020 revenues of US$516k (A$787k), were up 55% from US$333k (A$508K) in Q419 and up 282% on pcp. WhiteHawk has taken a lean approach to expenses, reducing its cash burn during the quarter while increasing gross margins. It finished the first quarter with a strong cash position of US$1.5 million (A$2.3M) and a solid pipeline of sales contracts. The Company has additional Working Capital facilities available from RiverFort Global, comprising a A$400k loan and a A$1.5m combined placement and equity (subject to shareholder approval at the May 2020 AGM).

Following a period of accelerated investment in product and sales channel development, WhiteHawk is on track to again deliver growth in 2020. A recent partnership with a major global consulting firm has delivered an additional sales channel that has generated annual 2020 SaaS subscriptions of greater than US$400k, as of 15 April. The table below is a summary of WhiteHawk’s recent financial performance and highlights the growth achieved over the prior corresponding period.

WhiteHawk has made great advancements in the evolution of its business over the past year and is positioned for strong scalable growth. The Company has existing revenue generating contracts and a strong sales pipeline in the US. These span diverse sectors including US federal government, US financial sector, US Defense and Industrial Base (DIB) and the US manufacturing sector.

The Cyber Risk focused business model enables WhiteHawk to remain agile, to partner with the best open data and AI enabled platforms, and to continually evolve to align with customer needs and appetites. The Company now has optimal positioning in the cyber risk market, across companies and organisations of all sizes in the US and is seeking to increase business internationally.

WhiteHawk is on track to again deliver strong revenue growth in 2020. It has completed the online integration and automation of its product lines and added a major global consulting firm as a sales partner. Its partnership with Sontiq/EZShield provides a scalable business model and seamless access to thousands of businesses needing to address their digital risks. Plus, the new rules around cybersecurity of US government supply chain and contractor companies should generate new business.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.