Overview: Crowd Mobile Limited (“Crowd Mobile”, “the Company”) is an Australian technology Company focused on mobile software and services. Its principal assets include product distribution capability via 60 mobile phone carriers in 25 countries, and proprietary content production capabilities focused on consumer advice. Founded in 2005, the Company listed on the ASX via a reverse merger with Q Limited. After entering into a Heads of Agreement to acquire Netherlands-based Track Holdings BV (“Track”), Crowd Mobile has announced FY15 results, expanded its product portfolio, and secured a cornerstone funding facility.

![]()

Catalysts: Execution of the Track acquisition is approaching and Crowd Mobile is witnessing strong organic growth. FY15 revenues increased 31 percent whilst utilisation of its ‘message’ services is accelerating. Volumes have increased for five consecutive quarters and last month’s launch of the ‘Crowd Butler’ transaction service represents the first in a series of next-generation consumer products designed to leverage its distribution assets. The Track driven expansion of Crowd Mobile’s distribution base is now supported by a debt offer representing 40 percent of the deal value. Discussions regarding the balance are advanced.

Hurdles: With the quantum of service deliveries across its network increasing at double the pace of FY15 revenue, there is a risk that recent growth is coming at the expense of margin contraction. The pending Track acquisition remains subject to funding and integration risks. With entry barriers to the industry primarily limited to complexities surrounding the procurement of carrier relationships, Crowd Mobile may face increasing competition.

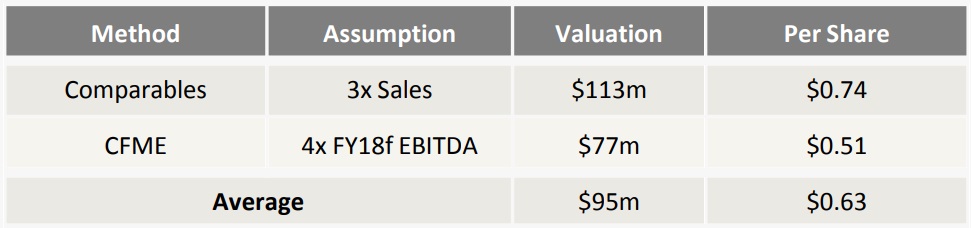

Investment View: Crowd Mobile provides profitable exposure to the market for mobile software and services. We remain attracted to the Company’s income profile and growth potential. With Crowd Mobile’s FY15 results and ‘Crowd Butler’ launch demonstrating the sound capacity to leverage existing distribution assets, finalisation of Track acquisition funding is the major near-term driver. Recent debt initiatives support our existing valuation of $0.63/share. Representing a premium of ~100 percent to recent trade, we maintain our ‘buy’ recommendation.

THE BULLS SAY

THE BEARS SAY

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.