Overview: Coca-Cola Amatil Limited (“Coca-Cola Amatil”, “the Company”) is an Australian diversified consumer company focused on beverages. The Company manufactures and distributes carbonated soft drinks, water, sports and energy drinks, fruit juice, flavoured milk, coffee, and packaged ready-to-eat fruit and vegetable products. Coca-Cola Amatil is the principle licensee of the Coca-Cola brand in Australia and also operates in New Zealand, Fiji, Indonesia, Papua New Guinea, and Samoa.

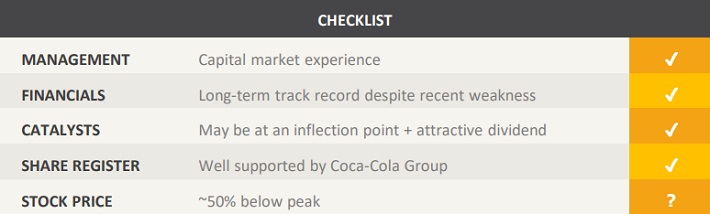

Catalysts: After a period of sustained underperformance Coca-Cola Amatil’s share price is trading ~50% below its peak and the valuation appears undemanding in light of the Company’s balance sheet strength, recent operational improvements, and somewhat defensive business model. A mix of capital management initiatives and a rebalancing of the Company’s product portfolio has the potential to drive earnings growth.

Hurdles: Revenues and earnings have been volatile over the past five years and there is a risk that the Company’s financial performance may continue to decline. Coca-Cola Amatil has invested heavily in capacity and operations and there is no guarantee that this will yield a return on shareholder funds. Operating in a number of foreign jurisdictions across Asia-Pacific, the Company may be subject to regulatory hurdles.

Investment View: Coca-Cola Amatil offers profitable exposure to demand for beverages in Australasia. We are attracted to the Company’s balance sheet, defensive business model, and potential to return to earnings growth. Risks include ongoing erosion of sales and earnings, unfavourable consumer trends, and regulatory hurdles. After a period of sustained share price weakness, we believe that recent hurdles have been largely factored into the share price and we see reasonable value growth potential given the risks. Coca-Cola Amatil’s valuation appears undemanding as we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.