Overview: Carnarvon Petroleum Limited (“Carnarvon”, “the Company”) is an oil and gas exploration company focused on the North West Shelf of Australia. Carnarvon’s assets incorporate a 100% interest in the Cerberus project (permits covers ~3,700 km2) and a 20% interest in the joint venture exploration project in the Phoenix area (permit covers ~22,000 km2). An independent resource assessment has determined contingent resources of 31m and prospective resources of 72m barrels of oil for the Phoenix project.

![]()

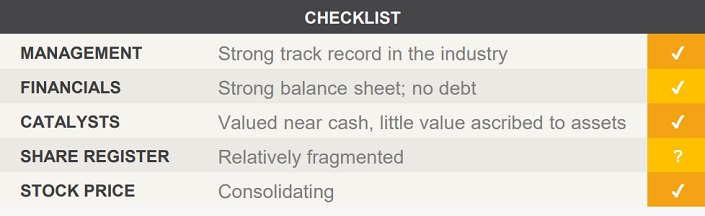

Catalysts: Carnarvon’s Roc-1 exploration well is scheduled to commence drilling in the 2015 December quarter. The Company made a significant oil discovery in the Phoenix South-1 well in August 2014, the largest of its kind in more than 20 years. Carnarvon Petroleum is well funded with zero debt and more than $100m cash after divesting its Thailand assets earlier this year. Management has a strong track record in the industry.

Hurdles: There is no guarantee that existing resources can be converted into economically recoverable reserves. Oil prices have declined sharply over the past year and further falls would restrain the Company’s ability to generate future earnings. Carnarvon’s share registry is relatively fragmented and could leave the Company open to takeovers below the fair value of its securities.

Investment View: Carnarvon Petroleum provides speculative exposure to the domestic oil and gas industry. We are attracted to the magnitude of its land package, management track record, and its strong balance sheet. Oil prices remain volatile and there is no guarantee that the Phoenix project will yield economic benefits. With Carnarvon’s current share price tracking close to its cash backing, and the company free carried on the upcoming Roc-1 well, little value has been ascribed to its exploration assets. Whilst the technical chance of success at Roc-1 has been estimated at 42 percent, we favour the balance of risks and initiate coverage with a ‘speculative buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.