Overview: Bendigo and Adelaide Bank Ltd (ASX:BEN) is an Australian publicly listed company offering a broad range of banking and other financial services. Under the Bendigo and Adelaide bank umbrella, the business operates under four distinct brands and offers retail and wholesale banking, wealth management services, business, and commercial lending, payments services, foreign exchange, and superannuation. The company has assets under management of more than $52bn.

![]()

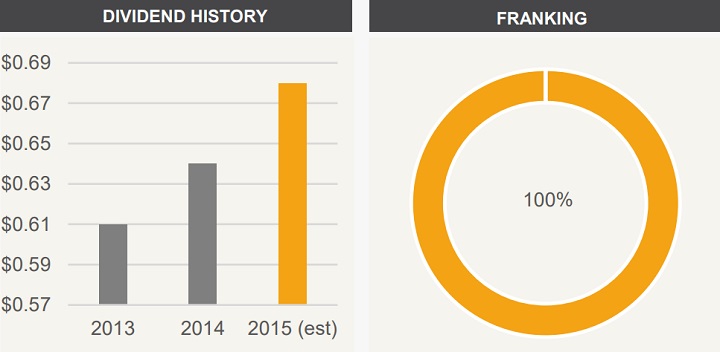

Catalysts: Bendigo and Adelaide Bank Ltd announced solid half-year results for FY15 with NPAT of $227.9m up 25.8% on the previous corresponding period (PCP). Total lending rose 7.5% during the half with business lending rising 19.7%. BEN pays an attractive dividend with full-year distribution yielding 4.8% at the current price. BEN has increased NPAT by 90% since FY12 and is on track to achieve another year of double-digit growth. The stock travels in a moderate long-term uptrend and the $12.50-$12.60ish level is the lower end of its trading range.

Hurdles: The company operates in a competitive sector that is historically being dominated by the big four banks. Weak economic conditions may further weigh on the market sentiment which could slow both retail and business lending. FY15 half-year results showed an increase in cost margins.

Investment View: Bendigo and Adelaide Bank Ltd offer profitable exposure to the financial services industry. We are attracted to BEN’s fully franked dividend and earnings growth trajectory. Subdued economic conditions could weigh on its earnings, however, BEN remains an attractive income opportunity that is currently trading at the lower end of its trading range.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.