Overview: Beach Energy Group (“Beach Energy”, “the Company”), is an Australian oil and gas company focused on the Cooper/Eromanga basin. During FY16 Beach Energy produced 9.7M barrels of oil equivalent, with 53% being oil and 47% gas and gas liquids. The Company recently completed the merger with Drillsearch Energy Limited, which is now operating as a fully owned subsidiary of Beach Energy, and divested assets in Egypt and Queensland.

![]()

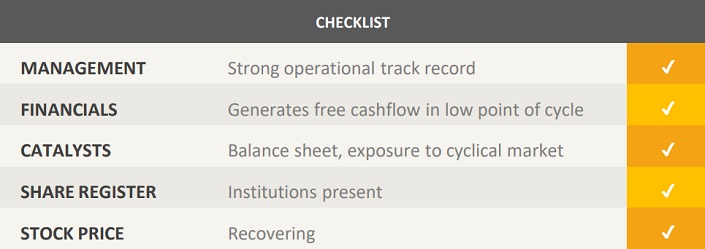

Catalysts: Beach Energy is highly leveraged to any recovery in the oil price generating an additional $50m NPAT if oil prices increase by US$10 per barrel. The Company successfully identified operational cost savings, reducing the cash flow break-even point to $26 per barrel. Beach has a strong balance sheet with 243 million in cash and undrawn debt facilities of $350m. The merger with Drillsearch may result in further synergies and could be a value driver.

Hurdles: Global benchmark oil prices have significantly declined since 2014 and there is no guarantee that prices won’t fall further. Beach Energy posted a statutory loss during FY16, which may affect the company’s ability to pay dividends in the future. There are integration risks associated with the Drillsearch merger.

Investment View: Beach Energy offers transitional exposure to the domestic oil and gas market. The Company has a strong balance sheet with surplus cash and access to additional capital. Generating free cash flow at the lower end of the commodity cycle, Beach Energy is well-positioned to benefit from any cyclical recovery in the oil and gas market which may allow for higher dividend distributions. However, commodity price volatility, lumpy earnings, and integration risks are primary hurdles. Beach Energy is sensitive to price movements but we believe the valuation is compelling and the risk to reward ratio favourable. We initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.