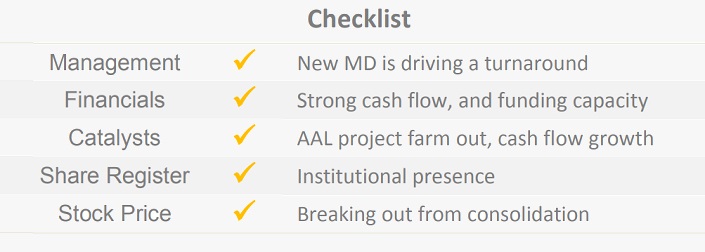

Overview: AWE Ltd (“AWE”, “the Company”) is an Australian oil and gas producer with a diversified portfolio of production interests in Australia, New Zealand, and the US. Over recent years its performance has been characterised by weakening production and underwhelming exploration results. However, after undertaking a strategic review, and implementing new management, we consider AWE’s turnaround prospects?

![]()

Catalysts: For the first time in four years AWE is on track to deliver a rise in annual output, and its new management aims to more than double operating cash flow by FY16. Strategic changes should become increasingly salient as last year’s acquisition of the AAL project in Indonesia nears Final Investment Decision (‘FID’). ALL could elevate 2P reserves by 70 percent post FID, although a farm-out process is underway to reduce AWE’s capex requirements.

Hurdles: If a farm-out agreement for the AAL project does not proceed, AWE would bear sole liability for the $600m capex requirement. Earnings are significantly influenced by the performance of its BassGas project, which accounts for 50 percent of reserves, and uncontrollable oil and gas prices. Whilst AWE has approximately 10 years of reserves at current production rates, it is reliant on exploration to maintain its reserve base.

Investment View: AWE is a profitable, diversified oil and gas producer emerging from a turnaround phase. After stabilising its production profile, the focus should shift towards management’s $200m pa free cash flow target. Expecting the AAL farm out to provide near-term validation of their strategy, we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.