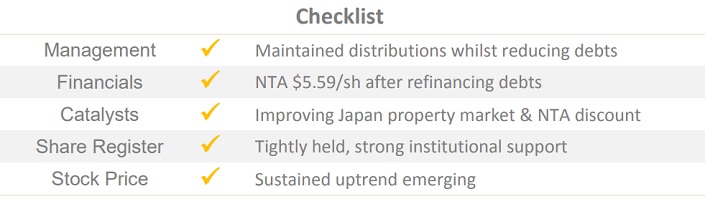

Overview: Astro Japan Property Group (“Astro Japan”, ‘the Group”) is an investment vehicle focused on the Japan real estate market. It currently holds interests in a portfolio comprising 36 retail, office, and residential properties, of which 80 percent are situated in central and greater Tokyo. After encountering balance sheet issues for the past five years, we initiate coverage for its turnaround potential.

![]()

Catalysts: Completion of refinancing initiatives post June 30th are expected to see Astro Japan’s statutory Net Tangible Asset (“NTA”) backing lift from $3.75/sh to $5.59/sh. Reduced interest costs also drive a forecast 20 percent rise in FY14 distributions to 20c/sh. With the Group witnessing valuation gains in its portfolio for the first time since 2008, emerging stability within the Tokyo property market could narrow Astro Japan’s NTA discount. Every one percent change in portfolio value impacts NTA by two percent.

Hurdles: NTA discount stems from ten consecutive half-year periods of valuation contractions within Astro Japan’s portfolio, and a two-decade trend of declining national urban land values. Whilst borrowings now stand at manageable levels, debt servicing consumes a significant proportion of operating income, constraining distribution payouts. With cancellable leases making up 47% of income, distribution stability is not assured.

Investment View: Government initiatives to reinflate Japan’s economy could alleviate two decades of structural real estate market declines. Astro Japan is positioned to benefit after rationalising its portfolio and recapitalising its balance sheet. Attracted to its income profile and capital growth potential stemming from a 35 percent discount to NTA, we initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.