Overview: Algae.Tec Ltd (“Algae.Tec”, “the Company”) is an Australian technology company focused on the manufacture of algae-based products. Algae generate energy and nutrient-rich oils more efficiently than any other known natural or engineered process. Algae.Tec’s production technology, the ‘Algae.Tec system’, is the world’s most land efficient algae manufacturing technique.

![]()

Catalysts: After operating a demonstration facility during the past year to showcase its technology, the Algae.Tec system has received independent validation. Accelerated commercialisation into high-value nutraceutical markets is planned by expanding the Company’s existing Nowra operation. Economics appear attractive, with a cash flow forecast from 2015, generating an Internal Rate of Return (IRR) of 90 percent.

Hurdles: Whilst the Algae.Tec system’s modular design reduces expansion risks there is no guarantee that production yield’s achieved in validation tests will be replicated in a commercial setting. The Company remains reliant on external capital to fund operations and development projects. Market opportunities for transportation fuels require a further appraisal.

Investment View: As commercialisation of algae-based transport fuels remains an industry-wide challenge, we favour Algae.Tec’s strategic shift towards nutraceutical markets. Independent validation of its technology offers a major catalyst after the same milestone drove a six-fold valuation gain for US-based Solazyme. The Nowra expansion supports Algae.Tec’s growth, and with our $0.40/share valuation representing a 233 percent premium to recent trade, we re-institute coverage with a ‘speculative buy’ recommendation.

Algae.Tec Limited (“Algae.Tec”, “the Company”) is an Australian technology company focused on the manufacture of algae-based products. Its primary asset is Intellectual Property (IP) surrounding the Algae.Tec system (“the technology”), which allows for sustainable production of algae-based products in a controlled, commercial setting.

The Company aims to manufacture algae products for nutraceutical and biofuel markets. A demonstration facility to showcase the Algae.Tec system was commissioned in August 2012 at Nowra, New South Wales. Independent validation of the technology’s biomass production yield was secured in December 2013.

Algae.Tec was founded in 2007 and listed on the Australian Securities Exchange in January 2011 after raising $5million at 20c/share. It was the best performing Initial Public Offering in Australia during 2011. The Company’s shares (American Depository Receipts) are also listed on the US OTCQX market (ALGXY), and Frankfurt Stock Exchange (GZA). Issued capital currently stands at $14.92million, or 5.3c/share.

Algae.Tec has exclusive, royalty-free rights to IP surrounding the Algae.Tec System – a process designed to manufacture algae-based products in a controlled, commercial setting.

The Company secured an exclusive, royalty-free global license to the Algae.Tec system in April 2010 from Teco.Bio LLC. The license applies to industrial applications of the technology for an indefinite period. Licensing of the technology saw Teco.Bio LLC acquires a dominant shareholding in Algae.Tec, which currently stands at 72 percent. Executive Chairman, Roger Stroud and Technical Director, Earl McConchie, together with control 100 percent of Teco.Bio LLC.

Since listing, Algae.Tec has advanced the technology from a concept phase through to commercial trials. After successfully operating a demonstration facility at Nowra, NSW for the past 12 months, the technology has received independent validation by the Sydney Environmental and Soil Laboratory Pty Ltd (SESL).

Accredited by the National Association of Testing Authorities, and ISO benchmark 9001:2008, SESL’s validation program confirmed the Algae.Tec system’s biomass production yield and its capacity to deliver significantly greater output per unit of land than any other known algae production technology.

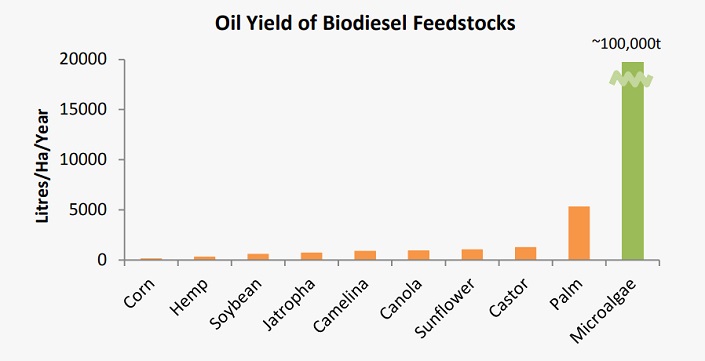

Algae are simple plants that can range from microscopic (microalgae) to large seaweeds (macroalgae), such as giant kelp more than one hundred feet in length. Individual species number in the tens of thousands. Having evolved over billions of years, these organisms generate energy and nutrient-rich oils more efficiently than any other known natural or engineered process.

Ten species of microalgae are commercially produced at present for use as health extracts, food supplements, and cosmetics. Supply is fragmented, with hallmarks of a ‘cottage industry’, however the market value of existing world production has been estimated at US$800million¹.

A much broader, presently untapped market opportunity exists in the transportation fuels industry. Investigation of the potential to convert algae into biofuels has witnessed an investment boom during the past decade. Private investment since 2000 is estimated to exceed US$2billion whilst US Government agencies have committed in the order of US$300million².

These research and development efforts have seen algae-based fuels power passenger aircraft flights, navy vessels, and vehicles on a demonstration basis. However further investment is required to deliver technology capable of supporting commercial production.

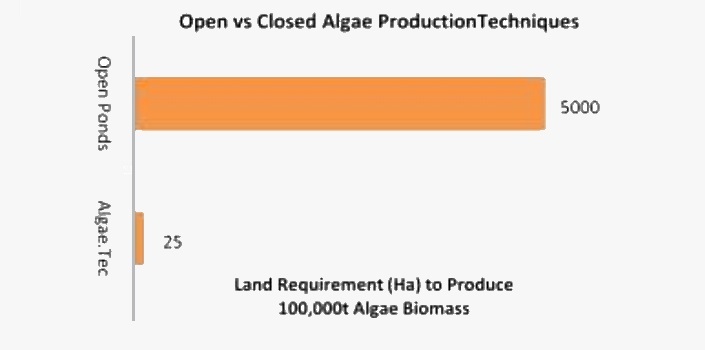

Independent validation of the Algae.Tec system has confirmed its capacity to deliver significantly greater output per unit of land than other known algae production techniques. The validation program encompassed Chlorella, a variety of algae currently utilised in the production of health and cosmetic products.

Validation readies the Algae.Tec system for deployment in nutraceutical markets, and there remains ongoing potential as a platform to manufacture biofuels.

Advantages over existing production techniques and technologies under development include location flexibility, land requirements, quality control, and input demands.

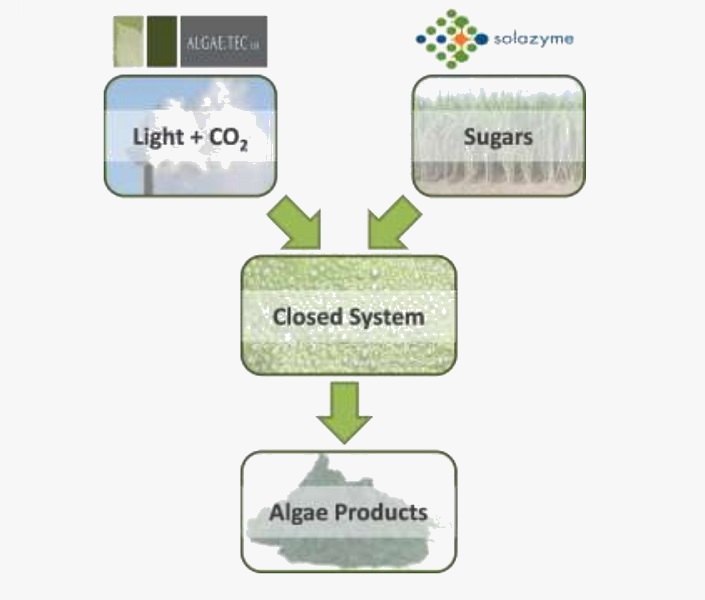

Existing cultivation practices and most new technologies under development utilise open ponds to grow algae. This requires a large land area with an available water supply. The Algae.Tec system has a ‘closed’ design, incorporating stackable modules within a controlled warehouse setting.

Reducing land requirements, the design also allows for greater site flexibility as cultivation can occur at industrialised zones as well as marginal land. The Algae.Tec system’s closed setting also provides greater quality control over open pond systems. Key variables such as light and temperature can be monitored to produce a more consistent product with lower risk of contamination.

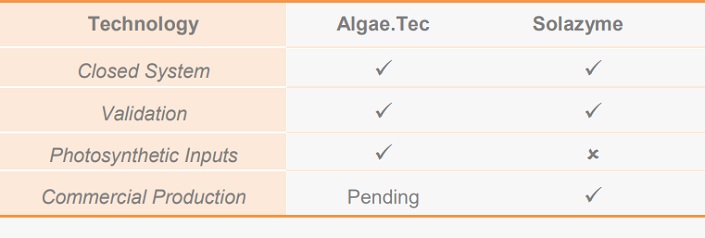

Other ‘closed’ algae production methods have recently been developed for commercial use. However as the algae species involved require sugar as opposed to light and carbon dioxide for growth, challenges surrounding input pricing and supply may emerge.

Unsustainable competition for cropping land between the biofuel and food industries originally sparked the investment boom into algae as an alternative feedstock. As the Algae.Tec system’s primary inputs include light and carbon dioxide, the technology is uniquely positioned to deliver a sustainable closed manufacturing solution.

After developing the Algae.Tec system from a concept stage through commercial trials, the Company proposes to develop its demonstration facility in Nowra, NSW into a commercial scale manufacturing plant.

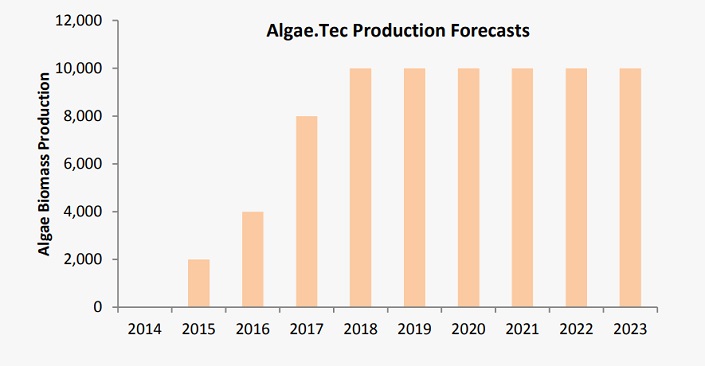

Configured to produce feedstock for nutraceutical markets, the plant’s initial capacity will be 2,000 metric tonnes per annum (mta) of algae product, expanding to 10,000 mta within five years. The proposal is supported by a supply agreement with Nutrition Care Pharmaceuticals Pty Ltd, an Australian based manufacturer of nutritional and herbal medicines. The expanded Nowra facility is scheduled for operation from 2014-15.

For subsequent growth, the Company intends to develop additional sites, a strategy supported by a development agreement with Macquarie Generation. Owned by the NSW State Government, Macquarie Generation operates two power plants in the Hunter Valley region and is Australia’s largest coal-based electricity producer.

Macquarie Generation has executed an agreement with Algae.Tec to develop an algae manufacturing facility adjoining its Bayswater power plant, utilising carbon emissions from the site as a feedstock (“Mac Gen Project”). Bayswater consumes 7.5million tonnes of coal pa, and offers the capacity to support a 100,000tonne pa algae plant.

Algae.Tec envisions the staged development of a 20,000tpa plant, expanding towards 100,000tpa over time. The Company is presently engaged in the permitting and feasibility process.

The existing global market for commercially produced microalgae products has been estimated at US$800million¹. Demand is dominated by the health extract, food supplement, and cosmetic industries. We understand this market is presently constrained by the availability of consistent supply. The potential market for algae-based biofuels is excluded from these figures.

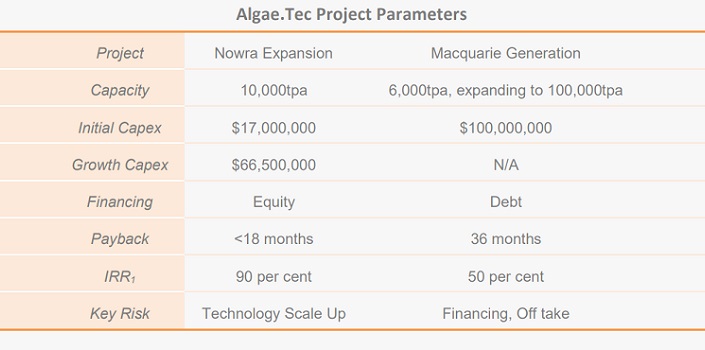

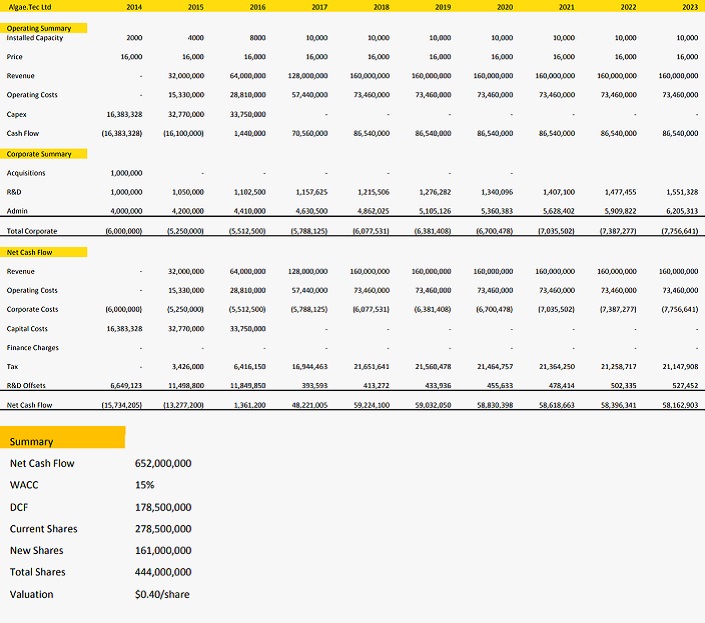

Algae.Tec’s proposal to expand its Nowra demonstration facility into a 10,000tpa plant is expected to require an initial capital investment of

$17million, and produce algae product at a cost below $7,500 per tonne. Subsequent growth capital is expected to total $66.5million, funded through a combination of cash flow, R&D offsets, and equity.

Expected outputs include Chlorella, Beta Carotene, Spirulina, and Omega 3 Oil, which attract current market prices ranging from $8,000 to $90,000 per tonne. Chlorella used for the recent validation program attracts prices of $16,000/t, and is the benchmark used in our subsequent analysis.

Under this base case output scenario, the expanded Nowra plant is expected to generate peak revenues of $160million pa and EBITDA of $80million pa. Before corporate costs, interest, and tax, we estimate the project would generate a payback period of less than 18 months and an internal rate of return (IRR) of 90 per cent.

Due to its greenfield nature, the Mac Gen Project is scheduled to require a larger initial capital investment, in the order of $100million, and is subject to further feasibility studies. We have excluded the Mac Gen Project from our financial appraisal of Algae.Tec but estimate that it could generate a payback period of 2-3 years and an unlevered, pre tax, project IRR in the order of 50 per cent.

As its technology is still in the process of being commercialised, Algae.Tec is reliant on external capital to advance development. To date, the Company has funded activities through equity, hybrid equity, Government Research and Development Rebates, and loans.

Issued capital currently stands at $14.92million, or 5.3c/share. Interest-bearing liabilities total $1.35million, incorporating a $0.35million secured loan from Macquarie Bank, $0.75million second-ranking convertible notes, and a $0.25m unsecured facility.

The convertible notes mature in October 2014, carry an interest rate of 7.5 percent and a conversion price of 22c/share. The Macquarie Bank loan is secured against Algae.Tec’s entitlements under the Federal Government’s AusIndustry R&D Tax Incentive Program.

For approved R&D expenditure, Algae.Tec is eligible to receive reimbursement amounting to 45 cents in the Dollar after the spending has occurred. Algae.Tec has received Government approval for a $12.15million cash refund on incurred and budgeted development expenditure for the financial years 2012 to 2015.

The Macquarie Bank loan has delivered approved rebates in advance, although expenditure additional to the initial budget of $27million will also be eligible for further funding grants.

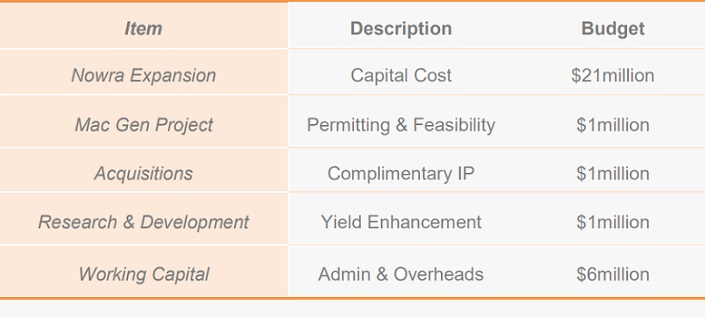

To further commercialise its technology, Algae.Tec is preparing to raise up to $30million via an equity issue. Its most recent equity raising was completed in June 2013, incorporating a placement and share purchase plan, raising $1.72million at 22c/share.

Proceeds from the current round are scheduled to fund the Nowra plant expansion, feasibility studies over the Mac Gen Project, strategic acquisitions, and further Research and Development.

Algae.Tec’s investment appeal rests in the near term commercialisation of its technology for nutraceutical markets and potential future applications for transportation fuels.

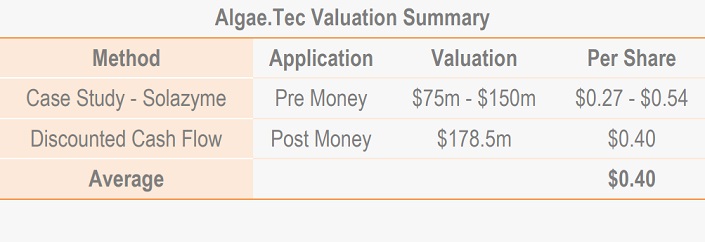

We have appraised its potential worth utilising Discounted Cash Flow and Case Study methodologies. The Discounted Cash Flow arrives at a valuation of $178.5million after incorporating future financings, which equates to 40c/share. Our Case Study approach yielded a valuation between $150million and $75million for Algae.Tec on a ‘pre money’ basis, which equates to a range between 54c and 27c/share. Using an average of these techniques, we value Algae.Tec at $0.40/share.

A peer-based valuation of Algae.Tec is constrained by the very few listed companies focused on algae production and associated technologies. After reviewing the universe of public and privately held competitors for Algae.Tec, we have focused our analysis on NASDAQ listed Solazyme Inc (“Solazyme”).

We believe Solazyme offers the most relevant benchmark for Algae.Tec due to similarities in technologies, target market, and initial funding profiles.

The closed nature of Solazyme’s technology is similar to Algae.Tec. Its ability to deliver controlled, industrial-scale production for nutraceutical markets has attracted investment from consumer goods manufacturer, Unilever, and agribusiness, Bunge Ltd.

Differences between Solazyme’s technology and the Algae.Tec systems rest in their input requirements and level of development. Solazyme’s closed process utilises algae that feed off sugar, whilst Algae.Tec uses photosynthetic specimens which require light and carbon dioxide as their primary inputs.

Solazyme’s technology is at a more advanced stage of commercialisation. Sales into nutraceutical markets commenced during 2011, and manufacturing capacity in the order of 200,000tpa is currently being established at two large plants in Brazil and the US.

With its market capitalisation exceeding US$500million, Solazyme’s development pathway highlights significant growth potential for Algae.Tec.

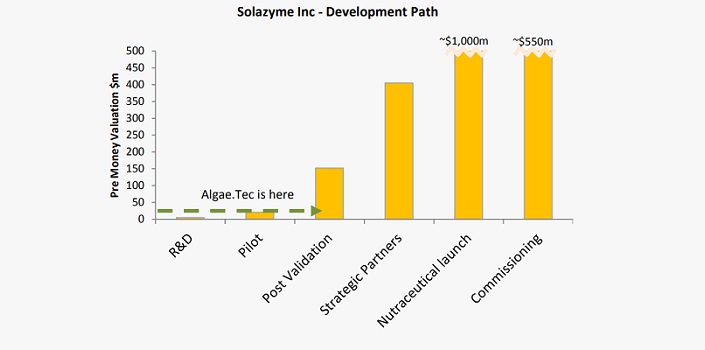

Solazyme concluded its demonstration program during 2007 at a similar cost to what Algae.Tec has now achieved (~$20million). The process was privately funded, with Solazyme attracting a pre-money valuation of U$$20million prior to its successful demonstration program.

Validation of its technology delivered a significant wave of value growth. Solazyme’s next financing round concluded in February 2009, attracted a pre-money valuation in the order of US$152million – more than six times greater than its previous 2007 fundraising program.

High-profile commercial partnerships and strategic investment followed the validation process. Solazyme listed on the NASDAQ in mid-2011 after raising US$227million. Its current market value is more than 25 times greater than that witnessed pre-validation.

To follow Solazyme’s development path, Algae.Tec must navigate substantial commercial challenges. However, in our view, this Case Study illustrates significant value growth potential which validation is poised to deliver. For benchmarking purposes, the Solazyme case study suggests that a valuation of up to $150million may be possible for Algae.Tec post validation. After incorporating movements in the market price of Solazyme securities since its last financing round, we have adopted a valuation range of $75million – $150million, pre-money, for Algae.Tec using the Case Study Method, which equates to a range of $0.54 to $0.27/share.

We have projected Algae.Tec’s activities over a 15 year period ending 2028, incorporating the Nowra expansion. Algae.Tec expects to have 1,000tpa installed capacity during 2014 expanding to 10,000tpa by 2018. To mitigate scheduling risks, we have modelled cash flow commencing from 2015.

We have assumed the Nowra expansion is equity financed, and that capital investments are eligible for the Federal Government’s AusIndustry R&D Tax Incentive Program. Utilsing a 15 percent discount rate, we appraise the Nowra Project to be worth $178.5million, which equates to $0.40/share. Our discounted cash flow appraisal is very sensitive to the Algae.Tec system’s production yield.

We have utilised a base case output scenario confirmed in recent validation tests, but acknowledge there remains significant upside from process enhancements already identified by the Company’s technical team.

The need for further R&D to commercialise algae-based transport fuels is common across the algae technology industry. We, therefore, favour Algae.Tec’s strategic shift towards nutraceutical markets, for which we view recent technology validation as a major value driver.

From a similar capital base, Solazyme witnessed a more than the six-fold rise in its valuation following a successful validation phase. Algae.Tec’s commercialisation plan offers comparable growth potential, with both the Nowra Expansion and Mac Gen Project supported by attractive base case economics.

Replicating the Algae.Tec system’s ‘demonstration phase’ performance in a commercial setting is now the Company’s primary challenge.

The technology’s modular design mitigates some expansion risks, which in our view, balance favourably against our $0.40/share valuation of the Company. Representing a 233 percent premium to recent trade, we re-institute coverage with a ‘speculative buy’ recommendation.

Whilst production yield’s from the Algae.Tec system has been independently validated at the Company’s demonstration facility, there is no guarantee the performance will be replicated in a commercial setting. Our valuation is very sensitive to production yields.

Algae.Tec’s supply agreement with Nutrition Care Pty Ltd reflects indicative market demand but is non-binding with regards to price and volume. There is no guarantee that Algae.Tec will be able to sell its production at the price and volumes specified in our analysis.

Algae.Tec is reliant on external capital for operating and development activities. There is no guarantee the Company will successfully attract further financing. There is also a risk that future fundraising initiatives generate greater dilution than forecast in our analysis, which would negatively impact our valuation. Our appraisal is very sensitive to ongoing participation in the Federal Government’s AusIndustry R&D Tax Incentive Program. Whilst the Company has received approval for expenditures totalling $27million, eligibility of subsequent capital investment is not guaranteed.

The Company’s largest investor controls 72 percent of shares outstanding. This can impair the ability to buy and sell shares, and increase transaction costs.

The technology surrounding the Algae.Tec system is not subject to patent protection, which could impair the Company’s ability to develop and maintain a competitive advantage.

Delays in project execution, expansion, and financing could impair Algae.Tec’s valuation to present equity holders. Our Discounted Cash Flow valuation is sensitive to production forecasts, which anticipates commercial receipts from Nowra by 2015.

The Bulls Say

The Bears Say

Roger has over 35 years of experience in a variety of industries. He spent over 10 years in finance in a number of areas including credit, money market, and investment banking for CitiNational (Citibank/National Mutual) merchant bank. Following the above, he floated a mining company, with a head office based in Sydney, and undertook the role of Managing Director for 8 years. In the late 1990s, Roger began the process of building businesses in the renewable fuel sector, primarily biodiesel. This included floating two separate biodiesel companies. Roger is a founding director and controlling shareholder of Teco.Bio LLC, and is based in Perth, WA. Roger has received a BSc from Sydney University, majoring in Chemistry and Geology, and a BA (Economics) from Macquarie University. He is currently chairman of the “Centre for Research into Energy for Sustainable Transport”, a collaborative research initiative between Curtin and Murdoch Universities.

Peter has over 30 years of experience in a range of senior executive positions with Australian and international companies. He has an extensive skill-set in the areas of business optimisation, capital raising, and company restructuring. He was recently Managing Director of a leading integrated metal recycling and contracting company, CMA Corporation Ltd. Peter is currently a director of Teco Pty Ltd, Kresta Holdings Ltd, Barminco Pty Ltd, and is also based in Perth, WA. Peter graduated as a Chartered Accountant in the United Kingdom, where he worked for Coopers and Lybrand (now PriceWaterhouseCoopers), and subsequently moved to Africa, where he spent 8 years in Malawi, where he was CFO of the Malawi operation of an international trading group, Guthrie Limited.

Colin has over 25 years of experience managing and directing projects and operations in a variety of industries. His background in engineering and project management, working over 15 years in a number of roles at Qantas airways including aviation fuel. He has also held the roles of Director of the Project Management Unit for the Defence Materiel Organisation plus Chief Operating Officer for a high technology manufacturing firm in Sydney. Colin is a certified Master Project Director and directed the winning project for the Australian Institute of Project Management Achievement Awards at both the state and national levels. Colin has received a Master of Business Administration (MBA), Bachelor of Engineering BE (Manufacturing), and Bachelor of Manufacturing Management (BMM).

1. We have modeled a 15-year operation extending to 2028. The above summary illustrates forecasts to 2023, after which key variables are held constant

2. All capital spending is assumed to be eligible for R&D offsets, for which $27million is currently approved

3. Production and Capacity forecasts are for Nowra expansion only

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.