Overview: Freelancer Ltd (“Freelancer”, “the Company”) is an Australian-based software company operating the world’s largest freelancing, outsourcing, and crowdsourcing marketplace. Founded in 2009, the company connects employers and freelancers from over 247 countries. The Company has 14.3m users and 6.9m total projects and contests as of 31 December 2014. The company listed on the Australian Securities Exchange in November 2013.

![]()

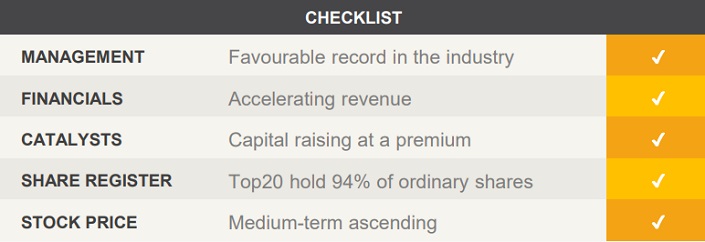

Catalysts: Revenue has increased by 58% per annum for the past three years. As the business operates with a relatively low degree of fixed and variable costs, incremental revenue growth can have a significant impact on profitability. In April Freelancer acquired payment service provider Escrow.com for US$7.5m funded from a A$10m placement, which was raised at a premium to market. The acquisition of Escrow.com as well as the launch of the new business arm ‘Local Jobs’ underlines management’s effort to pursue growth opportunities.

Hurdles: Whilst revenue has been growing at a modest pace, earnings have been subdued. Competitive barriers are limited as startups may increasingly push in the market space to threaten Freelancer’s leading position.

Investment View: We are attracted to Freelancer’s market position and growth trajectory. Whilst current earnings appear marginal, we expect accelerating revenue growth to be a major long-term value driver. Management has a favourable record of building start-up tech ventures and pursuits a proactive strategy to achieve horizontal growth in the online space. We initiate coverage with a ‘buy’ recommendation.

S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this report is general information only. Any advice is general advice only. Neither your personal objectives, financial situation nor needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice.

Conflict of Interest Notice

S3 Consortium Pty Ltd does and seeks to do business with companies featured in its reports. As a result, investors should be aware that the S3 Consortium may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making any investment decision. The publishers of this report also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this report.

Publishers Notice

The information contained in this report is current at the finalised date. The information contained in this report is based on sources reasonably considered to be reliable by S3 Consortium Pty Ltd, and available in the public domain. No “insider information” is ever sourced, disclosed or used by S3 Consortium.