What’s next for our investment in IRD

Australians live in THE lucky country.

As happened when the global financial crisis struck in 2008, and now with the Covid-19 worldwide pandemic, Australia has been able to withstand and avoid extended recession. Indeed, our island continent is almost alone as being able to post record current account surpluses over the last 2 years.

This has been in large part due to the nation’s iron ore production being able to feed hungry Asian demand. Spot prices have been on the rise for the past 3 years, reaching highs of $230/t back in May this year, before falling back to prices more consistent with several longer-term analyst perspectives.

Shareholders of Australian producers such as BHP, Rio Tinto and Fortescue have been well rewarded with record dividends on the back of massive profits. Consider that Fortescue earlier posted a record $US10.3 billion full-year profit, more than double its previous record from last year, resulting in a dividend yield in excess of 14% – rare for blue chips, and the stuff that superannuation fund managers’ dreams are made of.

At Wise-Owl, we are looking to invest in the next generation of iron ore companies to join the big boys. We are patient long term holders and our investment Iron Road Ltd (ASX:IRD) is progressing one of the largest development-ready iron ore projects in Australia.

We like that our IRD investment is tracking to be one of the few developers able to transition to significant (ie over 6Mtpa) production over the next few years.

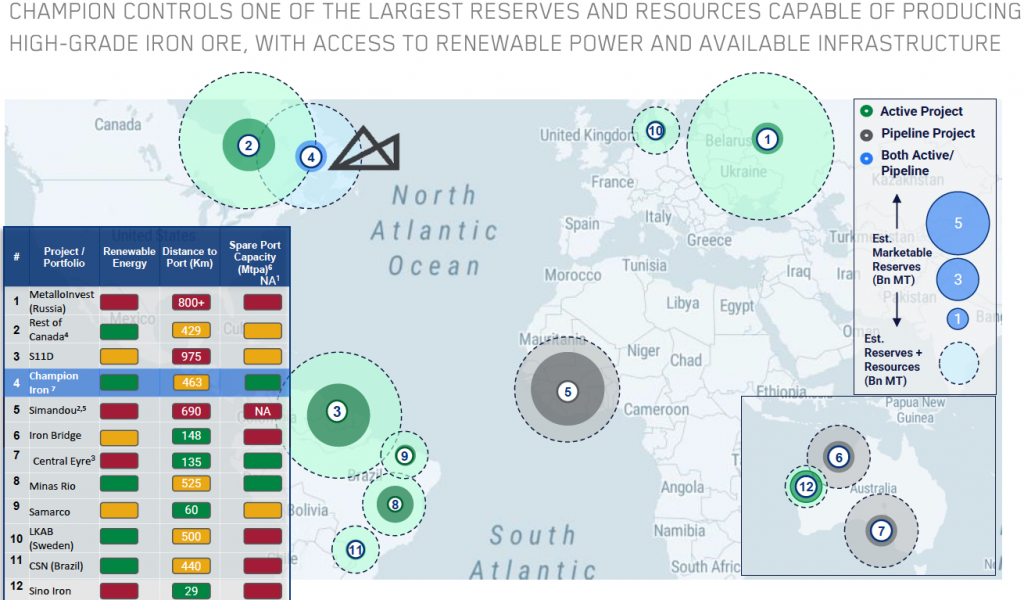

IRD’s Central Eyre project #7 – Source: Champion Iron presentation 27 September 2021

Timing-wise, we expect demand for its premium commodity to be strong over the medium to long term, which could coincide with early production for IRD. Furthermore, there is a fairly strong history of producers paying dividends fairly quickly once production occurs, especially when their margins are wide.

Source: Iron Road annual report 2021

Since we invested in IRD in May 2021 at an entry price of 21.5c, trading has gone as high as 30c, before falling to under 18c as the commodity price has more than halved. The reasons for our selection of IRD as the pick of the sector for long-term investing can be seen here – This is why we invested in ASX: IRD.

Let’s take a look at what progress has since been made.

ASX: IRD

When the iron ore price hit all-time highs of over US$230/tonne in May, the future appeared rosy for any company able to feed the insatiable demand by steel mills across the world, especially those in China.

However, commodity prices have since fallen to ~ US$120/t in early October, as China has put its foot down in restricting steel production. This has coincided with the suspension of China’s largest property developer, Evergrande, on the back of what is reportedly US$305Bn in debts that it is struggling to repay, permeating throughout the Chinese property and construction sectors.

To be blunt, iron ore sentiment is very much in the doldrums.

But in the famous words of iconic investor Warren Buffet, “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

In other words, we believe poor investor sentiment is generally the ideal time to invest IF there is underlying value in the business.

This is in line with our usual investment philosophy, our goal is to target emerging players that offer the potential for substantial share price growth as their valuations fall in line with the worth of their assets.

As we will go on to flesh out later, history shows us that in this climate those emerging companies are often the ones that are snapped up at premium prices by the majors because of the size of the resources and the scope to add scale to established producers.

Given the size of its resource, high-grade product, and the long-standing support from global resources funds, we believe that IRD remains one of the standout smaller players in the sector.

We think the Net Present Value of over $2 billion is justified

In terms of size, IRD’s 100%-owned Central Eyre Iron Project (CEIP) in South Australia has a global mineral resource of more than 4.5 billion tonnes, and within that nearly 3.7 billion tonnes is in the reserves category.

So in terms of resource size, IRD is far from small – we believe with its market capitalisation of about $140M it fails to capture the value of its flagship project.

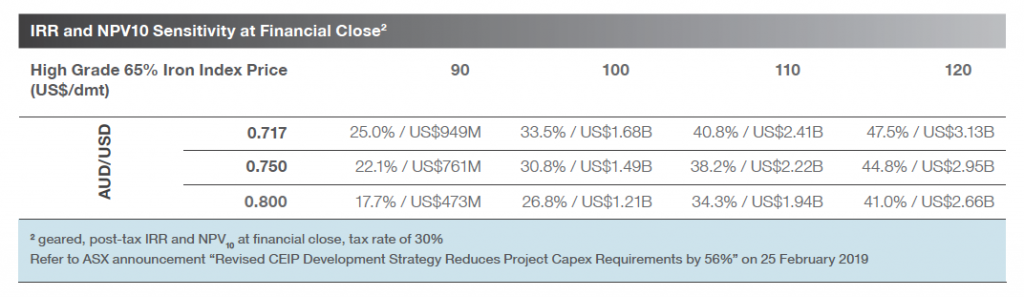

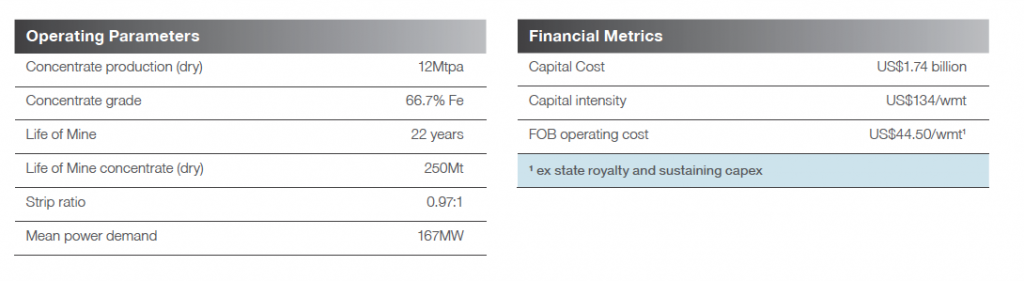

IRD released a revised development strategy in February 2019 that substantially reduced overheads, and with strong pricing for its high grade product, its anticipated production metrics bode well for future.

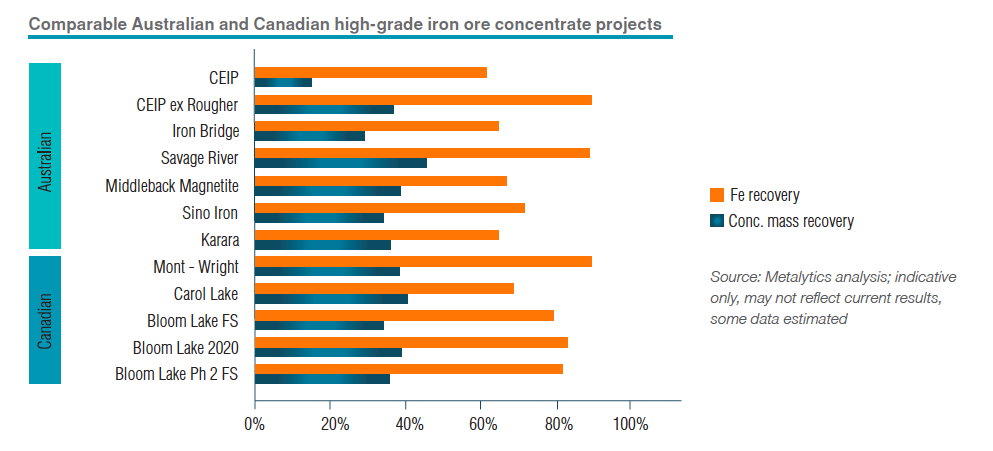

With a concentrate grade of 66.7% Fe, IRD is positioned to be a producer of some of the highest grade iron ore in Australia, with various blends already demonstrating that they meet the needs of China’s iron ore manufacturing industry. Such a high-grade product typically delivers 10-20% premium over the benchmark 62% Fe spot price.

Iron ore prices were more subdued when the study was released in 2019 with the top end of iron ore pricing assumptions pitched at US$120 per tonne, lower than even recent Fe 65% price, post crash.

Just crunching those numbers and applying current foreign exchange rates, our rough calcs show that the project is valued at approximately US$3 billion.

Source: Iron Road annual report 2021

This being the case, even allowing for further retracement in the iron ore price, we think net present value (NPV) in excess of US$2 billion for the project appears justified.

However we should emphasise here that these are just financial modelling exercises based on assumptions, and a lot can happen between now and IRD getting into production.

As long-term investors, we’re not too concerned about the recent weakness in the IRD share price, which we believe is driven by current poor commodity sentiment and a few short term speculators leaving after the iron ore price tanked. Our belief is that value still resides in this business, as owner of one of the most advanced, large, high-quality iron ore projects in Australia.

Should IRD’s management be able to progress its flagship project through development, attracting a big brother joint venture partner would likely be the next step – with discussions already underway, our bet is that its project ultimately gets the greenlight for development, and becomes a producer over the next few years.

Will we see corporate activity?

The last time the iron ore price surged and there were substantial undervaluations applied to smaller emerging players was in 2010/2011, this resulted in intense corporate activity with numerous takeovers occurring, including some notable acquisitions of Australian companies.

One that stands out is the acquisition of Giralia Resources by Atlas Iron with the Bid Implementation Agreement (BIA) being lodged in December 2010.

The BIA implied a market capitalisation of $828 million at the offer price, representing a premium of more than 50% to Giralia’s trading price.

At the time, Giralia had a resource of 300 million tonnes – not a reserve – less than 10% of the IRD’s Central Eyre iron ore reserve

And bear in mind, we are talking about a company that still as yet to transitioned from the exploration to production stage and was a long way off it with its McPhee Creek project having only been the subject of study development options on a base case of 2 million tonnes per annum.

So we aren’t comparing a company generating material production with IRD which falls under the category of being an emerging producer at this stage.

Harking back to the Atlas transaction, the combined entity highlighted at the time that all shareholders would ultimately benefit from a combined 600 million tonnes of resources and exploration targets potentially producing grades of between 56% and 60%, once again, shy of Central Eyre Iron Project grades.

Further, even the combined resource of the two groups represented less than 20% of IRD’s reserves.

While the numbers may seem outlandish, if you apply the same market capitalisation to resource metrics as that attributed to Giralia by the proportionate value of the Atlas takeover it would imply an IRD market cap of $12.4 billion, this is one data point that reinforces our belief that IRD’s market cap of about $140 million sees it substantially undervalued. NOTE: This is just our rough calculation based on info that is out there in the market.

Iron ore – where is it headed?

It was more than a decade ago when the iron ore price went within a whisker of US$200 per tonne before collapsing in the wake of the GFC.

From 2014 through to early 2019, the spot price has been fairly lacklustre in trading under US$100/t. Since then, the price has been steadily growing, reaching new record highs in 1H2021.

Even accounting for the 2021 Chinese Government’s steel quota intervention and Evergrande’s impact, the current, more modest spot pricing is above US$100/t, still representing the third straight year of commodity price growth.

Our view is that government stimulus packages totaling trillions of dollars will underpin infrastructure spending over the next decade, much of which will involve the use of steel and stainless steel.

This will coincide with the substantial spending on green infrastructure, once again driven by both government stimulus packages and a changing regulatory landscape that will see a surge in demand for all metals, not just the battery metals that are followed more closely.

Against this backdrop, one of the world’s largest iron ore producers Vale of Brazil earlier this year announced that it had halted production at its Timbopeba mine and part of its Alegria mine following warnings about tailings dam risks.

IRD premium grade product could make it a mid-tier player

IRD has an annual production target of 12 Mtpa (dry) at a grade of 66.7% iron (considered premium high-grade), over an initial 22 year mine life with a life of mine concentrate of 250 million tonnes.

This premium product would fetch a substantially higher price than the spot price of circa US$120 per tonne for 63.5% iron content.

As the following 5-year iron ore price chart shows, the early 2021 surge to over US$200/t, followed by the dramatic drop off to under US$100/t has occurred in relatively quick time. What is important to note is that the price has been in an upward trend over the past several years. Even with the recent decline, today’s price is significantly up from where it was at the start of 2021, which is well up from where it was at the start of the preceding year, and again for 2019.

Source: Trading Economics

FMG is a good example of how an emerging player can transition to a multinational blue-chip iron ore company pretty much in the space of a decade.

The group didn’t start generating meaningful revenues until fiscal 2009 when production increased from 1.6 million tonnes in the previous year to 27 million tonnes.

As its operations ramped up and were assisted by a buoyant iron ore price FMG’s revenues increased approximately three-fold by fiscal 2011.

In the three year period from December 2008 to December 2011 the company’s market capitalisation increased from about $6 billion to more than $17 billion, and today the iron ore giant is a $44 billion enterprise.

And this is what happens to your share price when you emerge from being one of Rio’s and BHP’s poor relations to a serious player in the industry

What attracted us to invest in IRD

Leverage off IRD’s past investment: IRD has spent nearly $180M since 2008 to get the company to where it is today, and at its current ~$140M market cap, we believe we are set at a good price (note we participated in the IRD placement during May 2021 at 21.5c, IRD is currently trading at ~18c).

Strong macro theme: We expect IRD will perform very well if steel demand continues to be strong over the next decade, especially in light of a global post pandemic construction boom.

Realistic path to market: A port development (Cape Hardy Stage 1) project for shipping its iron ore is steadily advancing. Its development paves the logistical way for IRD to ultimately get its premium product to market – IRD is in the right place, at the right time with an advanced project.

Institutional Backing: US Private equity firm Sentient Global Resources Funds owns 72% of IRD and has been a very long term holder – which means there aren’t many shares available free float on the market. Macquarie Capital is also on IRD’s register holding unvested warrants.

Cash in Bank: IRD is debt free and has a reasonably healthy cash balance of over $4.7 million as of 30 June 2021 with the company estimating that will last 6 more quarters (see last IRD quarterly report).

Net Present Value: IRD’s most recent financial modelling of its flagship project demonstrated a NPV of US$2.95BN assuming pricing of US$120 for its premium product and an AUD:USD exchange rate of 75 cents, a far cry from its current market cap.

What are the risks? The world and especially Australia is littered with good commodity projects that are stranded from getting their products to market. As an iron ore developer, while IRD is far advanced in developing a port, IRD will still need to secure funding to build it. There are also risks around delays in building the port.

Key People

- Jerry Ellis Non Exec Director – former chairman of BHP, and formerly on the boards of Newcrest Mining and ANZ

- Robert Keryn – former South Australian premier, is chairman of Portalis (ie Cape Hardy Stage 1 Port Project, IRD owns 25%)

Why we invested

- Exposure to commodity with strong and sustainable growth demand

- Australia’s next likely new iron ore producer, premium product

- Growing demand for ‘green steel’ – set to be one of the most in-demand inputs over the next 2 decades

- 25% ownership of port ideally located close to planned major green hydrogen hub

- IRD have spent nearly $180M to date on advancing its asset

- Established in 2008, IRD has been progressing Central Eyre Iron Project for over a decade