VUL Short Squeeze – Here’s Why

Here is why we think the Vulcan Energy Resources (ASX:VUL) share price could spike UPWARDS today and close at an all time high – as a GameStop style “short squeeze” may force up to an extra $20,000,000 of BUYING in VUL IN ADDITION to its usual trading volumes.

We suspect there are many traders out there who have figured this out too and are waiting to buy VUL on market first thing on open – remember even a small move upwards in the VUL price will likely force the short sellers into buying VUL shares on market.

We have calculated that any trading above $13.50 will pressure the short sellers.

On Wednesday short sellers planned to profit by “shorting” VUL’s stock and releasing a report designed to make the VUL share price go down by scaring investors with disinformation.

In today’s note we outline in detail why we think VUL’s share price started rising in the lead up to the short report and why this could trigger a short squeeze on the stock.

Vulcan Energy Resources

ASX:VUL, FWB:6KO

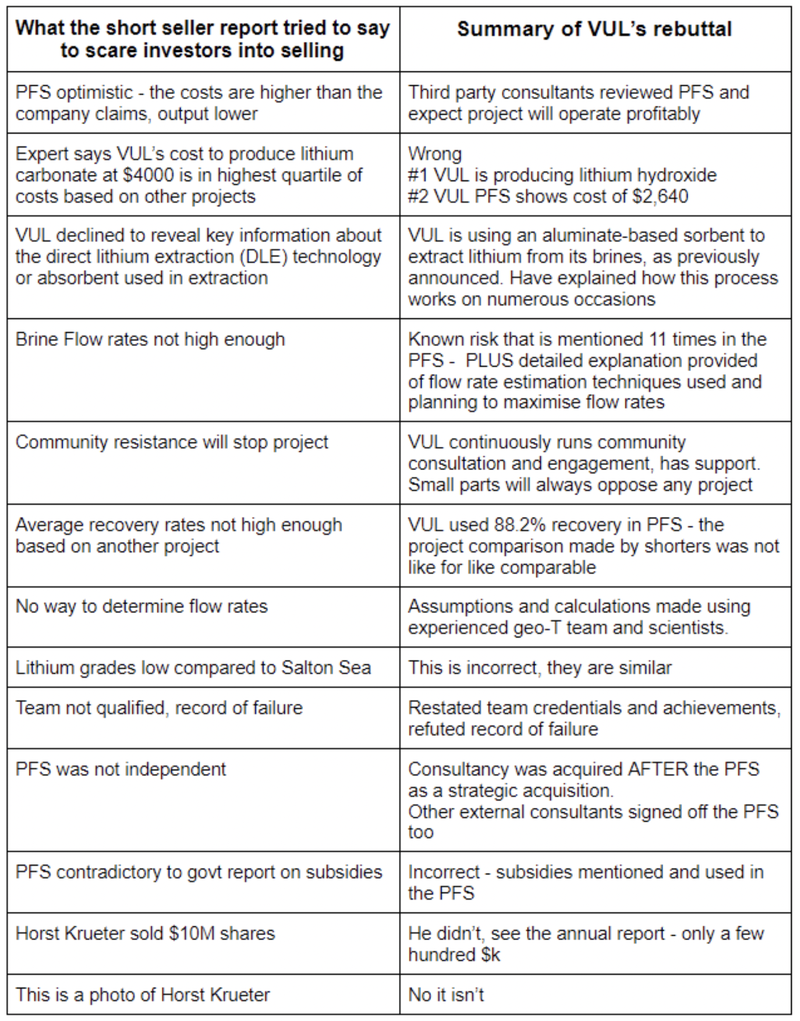

Before we talk about a VUL short squeeze, here is our quick-fire summary on VUL’s rebuttal to false and misleading claims in the short seller report.

VUL’s comprehensive rebuttal combined with halting trade will have dampened the fear effect of the report – which will contribute to today’s squeeze.

As investors, we have followed VUL for over two years and have observed that VUL’s management always does what they say that they are going to do, achieved many things in the time frames that they have set and have been clear with the risks of their project.

It is a star in our portfolio for a reason – because VUL, and its management, reliably deliver what it promises, in the timeframe it sets.

Yesterday, VUL provided a detailed response to every single false claim made in the report after the market closed:

VUL said: The Report contains many claims that are wrong and misleading. Vulcan categorically rejects the claims contained in the Report in detail below. While the wrong and misleading statements in the Report are too numerous to mention, Vulcan’s responses to key claims in the Report are outlined in the following pages, all of which are refuted.

The short seller report tried to attack as many different angles as they could to see what would stick, here is our quick take summary:

Ok, so the short seller report has been comprehensively disproven AND the VUL share price had already started running since the short positions were opened.

This is NOT GOOD for the short sellers.

Assuming now the number of investors who get scared into selling will reduce, here is why we think traders who are watching VUL are going to try to profit by driving the VUL share price up this morning to trigger up to $20M dollars of forced VUL buying in a text book “short squeeze”.

What is a Short Squeeze?

A short seller makes money when a share price goes down.

What happens to a short seller if a share price goes UP instead?

The short seller is forced to BUY shares on the open market to “cover their short position” – which makes the share price go up EVEN MORE.

The short seller loses a lot of money. Existing shareholders enjoy a nice share price spike. It’s a win-win.

This glorious phenomenon is called a “short squeeze”

A short squeeze caused Gamestop (NYSE:GME) shares to rise by 1,600% earlier this year.

Tesla was the most shorted stock in August 2020 when it was $300 per share – it started rising and ultimately rose to $450 as short sellers were forced to buy shares to cover their short positions.

We think there is a short squeeze coming this morning on VUL.

We think it actually already started in the last two trading sessions when the VUL price was spiking (some shorts were already covering before the trading halt, details below).

VUL clearly addressed all the disinformation in a short seller report released on Wednesday that was designed to scare VUL investors and push the VUL share price down.

The VUL share price was ALREADY RISING in the lead up to the trading halt.

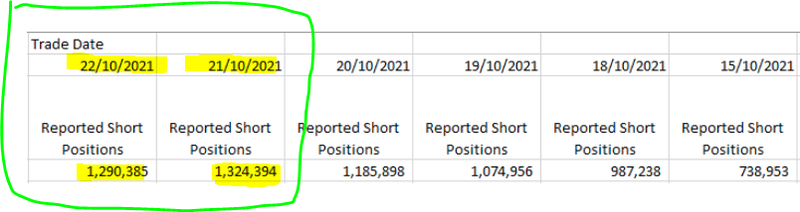

There are 1,290,385 shorted VUL shares as of 22nd October – possibly more as of today.

At $14.99 (last close price) the shorters will need to buy back over $20,000,000 of VUL stock on the market to cover their short positions.

IF the VUL share price keeps going up they will need to pay even more.

We think VUL will open up this morning.

If VUL even goes up A LITTLE BIT above $13.50 we think the short sellers will get so worried that their “short seller report” didnt work they will be forced to cover their short position by BUYING VUL shares on market, pushing the price up EVEN MORE.

We think VUL could close at an all time high if the 1,290,385 shorted shares are covered today, based on $20M of buying being above the average daily trade volume.

We think there are plenty of traders out there who have seen this opportunity.

We will see after 10am.

But first let’s start at the beginning…

The Short Squeeze Background:

Here is a video about what a “short squeeze is and how it makes share prices spike upwards:

Here is a timeline of what happened, and why we think the VUL price will spike up if shorts are forced to cover:

In September VUL raised $200M at $13.50 – VUL share price tracks down below the placement price, short sellers become interested

Based on past history and most other stocks, after a cap raise a stock usually falls to below the placement price for a while. With this share price weakness it probably looked like a pretty good time to start shorting the stock and then spread disinformation to help the price down (if that’s your thing):

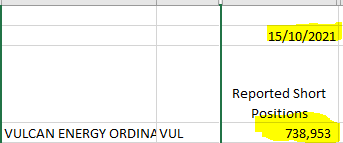

By 15th October there is already a 738,953 shares total short position in VUL

You can review all short positions on the ASX for here – (note the latest short sale data is always 4 days behind the current day).

18th September – VUL signs third offtake agreement, now totalling $5 billion of future offtake revenue – VUL share price starts rising

See our offtake revenue calc here

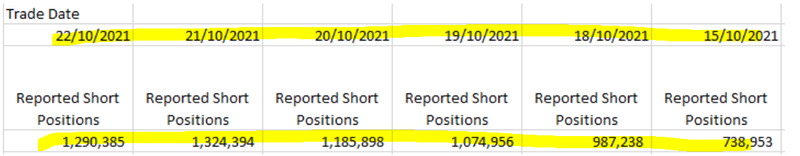

18th to the 21st October: Short sellers add more to existing short position in VUL in anticipation of short seller report

From what we understand, the short sellers paid a company called J-Capital to write a report designed to scare VUL shareholders into selling and make the share price go down, with the short sellers hoping to profit from the falling VUL price.

Prior to the report being launched, we believe that the short sellers built up a short position by borrowing VUL shares and selling them at the day’s price, hoping to buy them back cheaper later, once the short seller report is released.

Here is the daily increase in shorted VUL stock from the 18th October after the offtake – the data is always about 4 days behind so there could be more OR less by today:

By our very rough calculations, 585,441 VUL shares were shorted at around an average of ~$13.50 over those few days, that’s around ~$8M worth of VUL shares that need to be bought back at some point by the short sellers to cover…

This is IN ADDITION to the 738,953 already shorted VUL shares before October 18th when VUL’s latest offtake was announced (sucked in to those shorters too).

You can find the daily short position for any ASX company here.

Monday 25th October: A Short Sellers nightmare – the VUL share price unexpectedly starts moving up… fast

The share price started having another run and looked like the momentum was going to take it back above it’s all time high of $16.45.

At the $14.99 close price on Wednesday (before the trading halt) the recently taken 585,441 share short position now would cost $8.77M (almost an extra $1M) for the shorter to buy back… adding the original 738,953 shoterd shares requires a FURTHER $11.07M to buy back on market.

That’s nearly $20M of buying that needs to come into VUL at some point – and this $ value of buying increases with every cent the VUL share price goes up…

The short sellers probably start getting worried at this mini price run up – they probably thought the price would keep going down below the $13.50 cap raise price like many shares usually do… but VUL had hit the market with their THIRD offtake agreement in 90 days and it looked like the share price wanted to keep going:

We also note around this time the total short position started REDUCING – which we in our opinion means some of the short sellers had lost their nerve as the price started running and were forced to BUY VUL shares on market to cover their short position

Tuesday (evening) 26th October: Short sellers release a disinformation report to try and make the VUL price go down.

Our understanding is that the short sellers that commission the Jcap report usually intend to cover their short position (i.e. buy VUL shares) the day after the report comes out and shareholders (likely retail) are scared into selling, pushing down the price.

For example if the VUL price opened at say $11.50 the shorters could buy VUL shares to cover the shares they sold at $13.50 and made over $2.5 million – not a bad trade…

The Jcap short seller report tried to throw a LOT of various allegations at VUL, but at the end of day, even the report disclaimer and cover of the Jcap website it is clear that their objective is to make money by making stock prices go down:

Tuesday (evening) 26th October: Short sellers release a disinformation report to try and make the VUL price go down.

Our understanding is that the short sellers that commission the Jcap report usually intend to cover their short position (i.e. buy VUL shares) the day after the report comes out and shareholders (likely retail) are scared into selling, pushing down the price.

For example if the VUL price opened at say $11.50 the shorters could buy VUL shares to cover the shares they sold at $13.50 and made over $2.5 million – not a bad trade…

The Jcap short seller report tried to throw a LOT of various allegations at VUL, but at the end of day, even the report disclaimer and cover of the Jcap website it is clear that their objective is to make money by making stock prices go down:

We were 100% satisfied with VUL’s responses and have full trust in management.

Thursday 28th October: VUL goes into a trading halt to address the short seller report.

In the morning before the market opens the day after the short seller report is released… VUL goes into trading halt to prepare a detailed response to the questions raised.

The shorters were probably getting EVEN MORE worried now given that the key day for them to buy back ~1,290,385 VUL shares (on the cheap) to cover their short position was during “peak fear” straight after their report was released.

After the market closed yesterday, VUL released a very detailed response addressing everything in the JCap report as we summarised at the start of this note.

So what happens next: Short Squeeze?

We think that the initial “fear” from the report will have subsided given the time spent in the trading halt and that VUL has addressed all the disinformation…

BUT there are still 1,290,385 VUL shares (maybe more) that the short sellers need to BUY on market to cover their short positions… and fast given that we think their short sell report won’t really work

We estimate short sellers need to buy 585,441 below $13.50 to AVOID A LOSS, plus the other 738,953 at an unknown price…

That is a material amount of buying and is roughly about the average daily TRADING volume on VUL.

We suspect there are many traders out there who have figured this out and are waiting to buy VUL on market first thing on open – remember even a small move upwards in the VUL price will likely force the short sellers into buying VUL shares on market.

We also note that in the short seller report, the VUL share price chart used stops on the 4th of October, meaning that the short seller report was being produced and short positions being taken BEFORE the VUL price ran back upwards post the VUL’s third offtake announcement – looks like the short sellers plan was already unravelling well BEFORE before VUL debunked all the false claims in their report.

See the below chart showing the share price running up in the time after the final draft of the short seller report was finalised – a short seller’s worst nightmare:

We can only wait and see what will happen on open, but it promises to be an interesting day today.