VUL continues to execute as sustainable lithium demand surges. So what’s next?

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 563,000 VUL shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by VUL to share our commentary on the progress of our investment in VUL over time.

Our investment Vulcan Energy Resources (ASX:VUL) has delivered everything it said it would do over the two years since we first invested.

Heading into 2022, the company shows no signs of slowing down in achieving dual production of renewable energy and battery quality lithium chemicals with net zero carbon footprint.

VUL is aiming to deliver first production of lithium to supply the EU battery market in 2024.

And now, with lithium prices at all time highs and continuing to rise, the project’s economics are looking even better than we had initially expected.

Today, we take a look back on what VUL has achieved since we first invested and the milestones we are looking ahead to in 2022.

VUL’s past achievements since we invested

When we invested in VUL in August 2019, the then ~$7 million micro cap had a vision of supplying European battery and auto makers with carbon neutral lithium.

After ten months of getting to know the VUL team and seeing how they operate, in June 2020, we initiated coverage on VUL on Wise-Owl.

VUL has since gone on to secure significant funding, demonstrate production from pilot plants, sign offtake agreements and convert its exploration target into a JORC resource.

Reaching these milestones, combined with VUL’s tight capital structure and the lithium price surging, each worked in VUL’s favour to rerate its share price multiple times in the last two years.

Here is what the now $1.4 billion capped VUL has delivered since mid 2019:

✅ June 2019: Acquisition of disruptive EU focussed Zero Carbon Lithium Project

✅ Aug 2019: Commencement of Scoping Study

✅ Dec 2019: Lithium grades above expectations

✅ Jan 2020: Maiden Indicated Lithium Resource Reported

✅ Feb 2020: Positive Scoping Study completed

✅ June 2020: Wise-Owl Initiation Coverage

✅ Aug 2020: Test Work Shows Excellent Lithium Recoveries

✅ Aug 2020: Expanded Licence Granted Area & Updated Mineral Resource

✅ Jan 2021: Positive Pre-Feasibility Study

✅ Feb 2021: Collaboration with DuPont

✅ Feb 2021: $120 Million Placement endorses Zero Carbon Lithium

✅ July 2021: Lithium offtake Agreement 1: EV battery Maker LG

✅ Aug 2021: Bankable feasibility advisor appointed – BNP Paribas

✅ Aug 2021: Lithium offtake Agreement 2: Renault

✅ Sept 2021: Completes $200M Placement

✅ Sept 2021: VUL added to ASX 300 Index

✅ Sept 2021: First Production of Battery Grade Lithium from pilot plant

✅ Oct 2021: Lithium offtake Agreement 3: Umicore

✅ Nov 2021: Lithium offtake Agreement 4: Stellantis

✅ Dec 2021: Lithium offtake Agreement 5: Volkswagen

✅ Dec 2021: Acquires geothermal plant and becomes renewable energy producer

What we expect to see from VUL in 2022

Click here to view our VUL Investment Memo summarising why we are holding VUL during 2022, including our key investment objectives, investment risks, and our investment plan.

Building on its performance to date, there are a number of objectives that we expect VUL to achieve over the coming year, as follows:

Objective #1 – Complete Phase 1 Definitive Feasibility Study (DFS)

The major milestone of the upcoming year is completion of the Phase 1 Definitive Feasibility Study (DFS), also called a Bankable Feasibility Study (BFS) — expected in the second half of 2022. This will provide further clarity on the project’s economics and development feasibility. Lab and pilot studies for the DFS have been ongoing since April 2021, while the impact of its latest deals (last week’s offtake agreement with Volkswagen and operational geothermal power plant acquisition) will also inform the DFS. The help of BNP Paribas has been secured to to help with its DFS and in structuring project finance to build the project.

🔲 Definitive/Bankable Feasibility Study Complete

🔲 Demonstration Plant Constructed

Objective #2 – Secure Project Financing

Having raised $320M via two Placements in 2021, VUL is financed through to completion of its DFS, but further financing will need to be secured to fund project construction. With materials prices having risen over the past year the project’s CAPEX may be higher than forecast in the PFS. More clarity on project economics will be available in the DFS/BFS.

🔲 Commence Trading on Main German Stock Exchange

🔲 Project Financing

Objective #3 – Expansion of scope

Demand for production from the Zero Carbon Lithium™ Project, as reflected by VUL’s multiple lithium offtake agreements, suggests there is scope for the company to expand its scope for future lithium production. It is seeking to acquire more land holdings and more projects to help meet anticipated rising demand.

🔲 Acquire more brine/land

🔲 Brownfield project acquisitions

🔲 Partner with Volkswagen to expand project

Objective #4 – Heat offtake agreements

VUL is looking to sign offtake agreements in order to sell renewable heat generated from its geothermal brines into the local market. It is currently in discussions with local businesses and utilities to supply heat to the local community from its geothermal operations.

While electricity generated can be fed directly into the local grid, the sale of heat energy requires bilateral offtake agreements, and directly benefits local stakeholders, so it is an important part of public acceptance. “Heat sales” were not considered in the PFS but will be examined in the upcoming DFS.

🔲 Heat Offtake 1

🔲 Heat Offtake 2

🔲 Heat Offtake 3

Objective #5 – More strategic partnerships (to demonstrate execution)

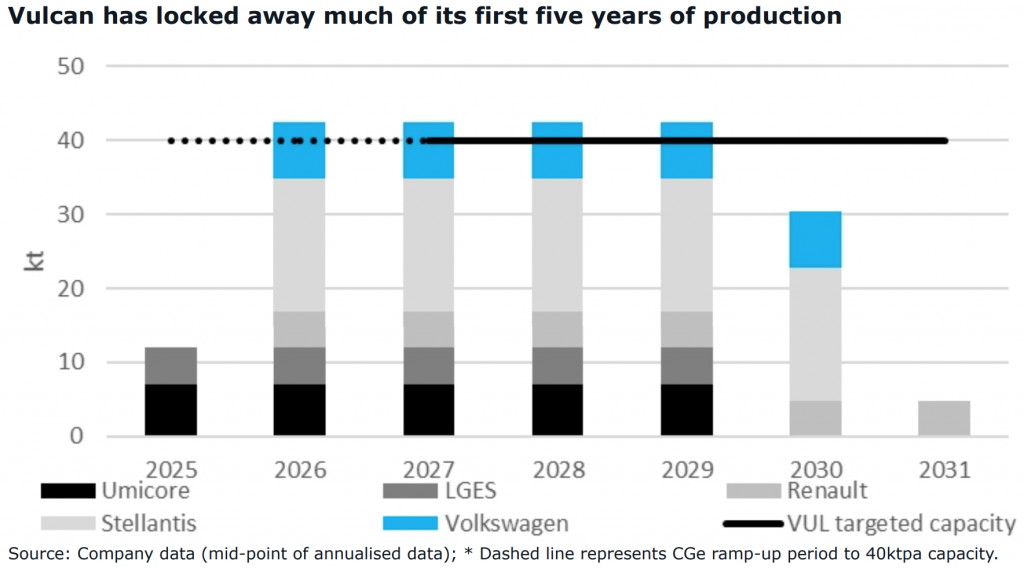

While VUL has already locked away much of its first five years of lithium production, it continues to develop strategic partnerships across all three of its businesses.

🔲 New Partnership 1

🔲 New Partnership 2

We recently introduced Investment Memos for each of the companies we are invested in. These help us look back and compare actual company performance against our expectations.

Our Investment Memo: Click here to view our VUL Investment Memo summarising why we are holding VUL during 2022, including our key investment objectives, investment risks, and our investment plan.

Analyst Reports: VUL’s potential has also been recognised by analysts at Canaccord Genuity, which have given a $21 target price and by German-based AlsterResearch which has lifted its target price to $25 — more than double the current share price.

A short summary of VUL’s milestones achieved

Strong capital position

Over the past year VUL successfully completed two capital raises led by Goldman Sachs and Canaccord, raising a total of $320M.

The first Placement saw VUL raise $120M at $6.50 a share, attracting the interest of local and international ESG funds, including BNP Paribas’ BNP Energy Transition Fund, plus a cornerstone investment from Gina Rinehart’s Hancock Prospecting. This came in addition to an earlier investment from her son John Hancock, who had taken a substantial position (over 5%) in VUL in the weeks prior.

A second oversubscribed Placement later in the year raised a further $200M at $13.50 a share. These raises fully fund the upcoming completion of the DFS and provided the funds required for VUL’s recent geothermal plant acquisition.

Multiple lithium hydroxide offtake agreements

A surge in demand for electric vehicles has seen some of the world’s largest car makers sign offtake agreements with VUL, committing to buy future lithium output. VUL’s sustainable carbon neutral battery-grade lithium product, has attracted huge interest from auto and battery makers and allowed it to be selective in signing the following offtake agreements:

- Volkswagen: Group 34-42kt over five years from 2026

- Stellantis: 81-99kt over five years from 2026

- Umicore: 28-42kt over five years from 2025

- Renault Group: 26-32kt over six years from 2026

- LG Energy Systems: up to 45kt over five years from 2025

The most recent, a definitive offtake agreement with Volkswagen Group, will see VUL supply Volkswagen with 34-42kt of lithium hydroxide over five years with first commercial delivery set for 2026. Volkswagen manufactures cars under the brands Volkswagen, Volkswagen Commercial Vehicles, ŠKODA, SEAT, CUPRA, Audi, Lamborghini, Bentley, Porsche and Ducati.

The late November offtake agreement with Stellantis will see VUL supply the automaker with 81,000 to 99,000 tonnes of battery grade lithium hydroxide over an initial five year term.

While Volkswagen is the largest automaker in Europe by revenue, Stellantis is Europe’s largest automaker by volume, and it has plans to offer full-electric vehicles across all 14 of its vehicle brands, including Peugeot, Jeep, Ram, Fiat and Opel/Vauxhall.

Stellantis estimates that by 2030, more than 70% of its European sales and more than 40% of its U.S. sales will be low emission vehicles (up from 14% Europe and 4% for North America this year). To support that transition, Stellantis plans to invest in no fewer than five battery cell manufacturing plants in Europe and the U.S.

At this stage all signs are pointing to the need for additional capacity to meet demand —

Source: Canaccord

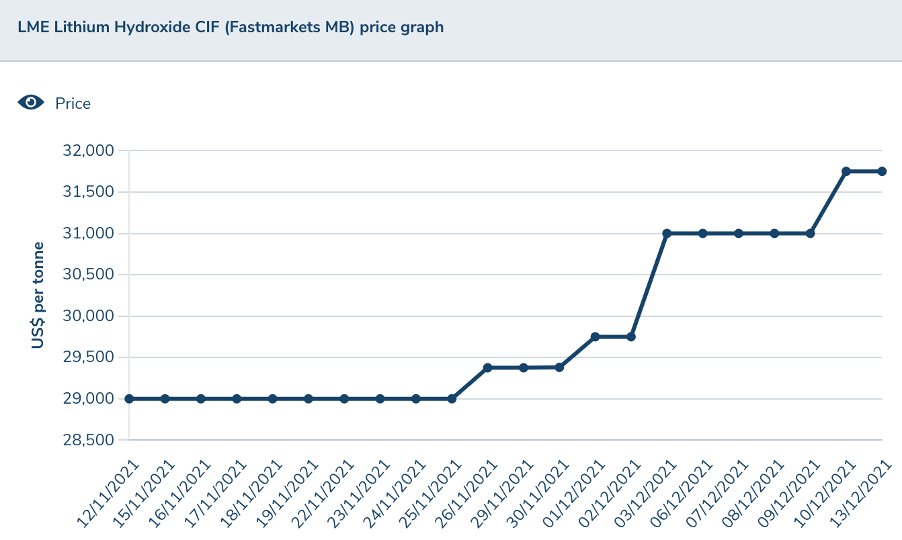

Under each of the agreements, pricing will be based on market prices for lithium hydroxide, and with the way lithium prices are trending these agreements may prove to be worth much more to VUL than shareholders may suspect.

Source: LME

Of course, there is no certainty around commodity prices and with lithium prices rising vertically throughout 2021 we can’t expect this trend to continue forever. However, the consensus view is that there will be an ongoing battery grade lithium hydroxide supply-demand imbalance over the coming decade at least.

View to expand project scope

Following its latest offtake agreement with Volkswagen, all of VUL’s projected production volume over the first five to six years of production (as per the PFS) has now been spoken for.

Volkswagen and VUL also agreed to a first right of refusal to invest in additional project capacity, demonstrating Volkswagen’s confidence in the Zero Carbon Lithium™ project following its due diligence, and it may point to a larger scale development.

VUL is now seeking out sources of additional capacity following strong early lithium demand. The plan is to grow to meet that demand and scale up operations.

It has already expanded the size of its project, picking up additional permits and growing the size of its lithium resource to 15.85Mt LCE (lithium carbonate equivalent) — the largest in Europe.

Geothermal plant acquisition

VUL has recently acquired the operational Insheim geothermal power plant in the Upper Rhine Valley. This is consistent with its strategy of acquiring and upgrading existing brownfield renewable energy and brine infrastructure and to de-risk and grow its Zero Carbon Lithium™ Project,

The acquisition of the Insheim plant, as announced earlier this month, validates VUL as an operational renewable energy business, one of only three on the ASX.

The plant pumps lithium-rich brine to the surface for geothermal energy generation before the brine is reinjected into the reservoir. It can produce a maximum of 4.8MW renewable power, with annual output enough to supply electricity to ~8,000 local households.

VUL expects the energy sales from the plant to be a source of revenue for the company — in the FY ending 31 December 2020 the plant had renewable energy sales of €5.8M and earnings (EBITDA) of €2.9M.

This milestone sees VUL tick the box on half of its goal of dual production of renewable energy and battery quality lithium chemicals with net zero carbon footprint, and is a major step in VUL becoming a revenue generating renewable energy producer.

VUL intends to build a number of distributed geothermal renewable energy plants across the Upper Rhine Valley region — it is in ongoing discussions with local stakeholders to provide renewable heating to communities and renewable power to the German grid.

Other progress in 2021

Over the year, VUL also developed its first battery quality lithium hydroxide monohydrate inhouse from its pilot plant. It secured a site for its Central Lithium Plant at one of the largest chemical parks in Europe, and acquired 3D seismic data surveys totalling 315 km2. It also acquired electric drill rigs ahead of first drilling which are a scarce, strategic asset.

This year also saw VUL appoint the world’s oldest investment bank, Berenberg, in preparation to list on the main German stock exchange. The new listing, combined with Berenberg’s network of investors, brings in a whole new pool of German and European institutional investors. Given the project’s German location and ESG credentials, we expect it to appeal to European investors.

Furthermore, the company’s progress saw it added to the ASX 300 Index during September quarterly rebalance — a major milestone as it makes the stock attractive to fund managers and large institutional index investors.

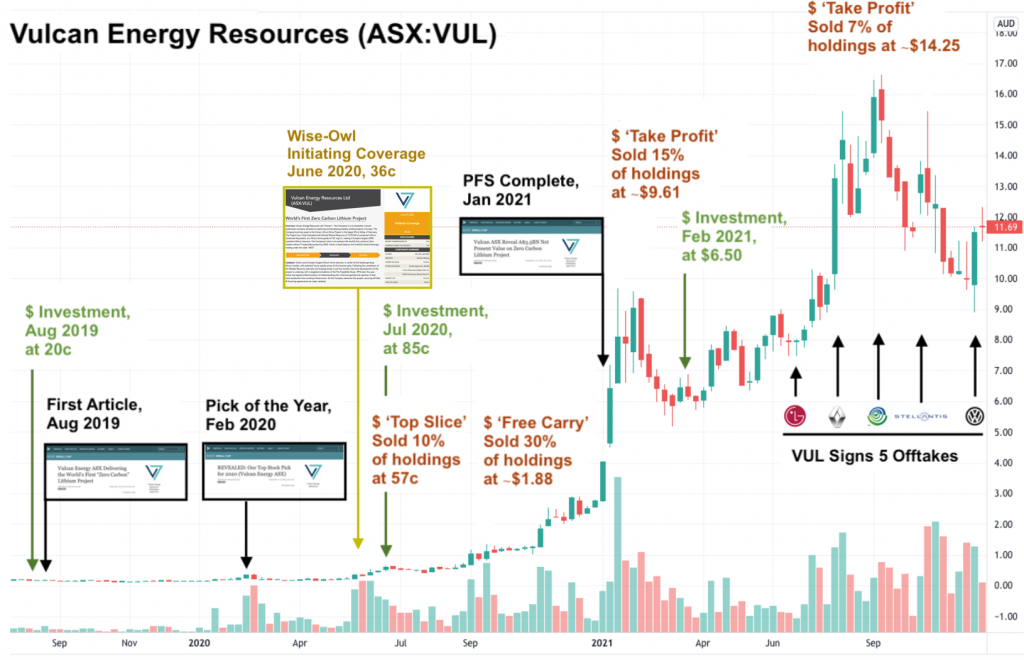

Our investment history in VUL

We first invested in VUL (then named Koppar Resources) in August 2019 — when it was trading at 20¢ — impressed with VUL’s goal of supplying lithium from its Zero Carbon Lithium™ Project to Europe’s battery and electric vehicle market.

At the time the market sentiment around lithium was bearish, yet a supply shortage was forecast for the coming five years — the type of situation that we like to see when investing in a broad thematic. We believed in the ESG angle and senior management’s ability to deliver a Scoping Study within the next 6-12 months.

Throughout the remainder of 2019, VUL continued to make good on its plans towards delivering battery grade lithium to European battery makers. It delivered a few key wins, including a positive scoping study, and in February 2020 we announced VUL as our 2020 Small Cap Pick of the Year under our partner brand Next Investors.

But unfortunately, the very next trading day the market crashed due to COVID-19: We then initiated coverage on Wise-Owl in June at 36¢,

We then initiated coverage on Wise-Owl in June at 36¢,

Our first sell down of VUL was for ~10% of our position at ~57c, which occurred 4 weeks later. Shortly after, we increased our investment at 85¢.

Per our investment strategy, between October and December of 2020 we sold ~30% of our position, enough shares to free-carry our investment at an average sell price of $1.88, and took advantage of the capital gains tax discount for having held our position for over 12 months.

We then sold some more in January 2021 after the PFS announcement, when the price surged above $9 (15% of our position at ~$9.61). At this point, while we had taken some profit, we still held a significant position in the company.

We then invested $250k cash in the $6.50 cap raise in February 2021, and while the share price went sideways for a while, we held on.

In the new financial year, between August and October 2021, we sold a further ~7% of our total position between ~$13.50 and $16.00.

We currently hold 563,000 shares of VUL – read our VUL investment memo for 2022 for what we expect from this investment over the next 12 months.

Above chart is indicative and for illustration purposes. All trades made in accordance with our trading blackout periods. For more information please read our trading policy, for more information on our investment strategy see our ebook.

At Wise-Owl we try to find promising early stage companies with quality senior management and an emerging macro thematic.

Going forward in 2022 we will continue to execute on our 2022 investment plan for VUL. So far, we are free carried, have taken some profit, and held through the recent share price volatility. Still with a considerable position, we now look ahead to the next phase of VUL’s path to commercial production.

VUL‘s team has perfectly executed on its business plan without delays, and its share price has reflected that success. It has been our best investment to date and we look forward to seeing the VUL team deliver on its 2022 objectives.

This investment strategy works for us, but investing in small caps might not suit your own risk profile. Always seek professional advice before investing in speculative small cap stocks.

Just like all pre-revenue small cap stocks, an investment in VUL carries risk. Which leads us to the current investment risks we see in VUL.

VUL Investment Risks

Development risk: the project economics could be hurt by a declining lithium price or cost blowouts in the project construction. Alternatively, the flow rates from the lithium project (how much lithium comes out of their project’s wells) could be slower than adequate, in turn hurting the project economics.

Market risk: it’s possible the oil price takes a sharp dip on a major global economic slowdown, slowing the uptake of EV vehicles in Europe.

Financing risk: we think the DFS is going to be VUL’s calling card for financing the project, but things may change. For example, the full project currently calls for expenditure of €1.78B ($2.81B) as of the Pre-Feasibility Study (PFS). Should development risks and market risks play out this could negatively impact the level of financing. Put simply, VUL is operating in an early-stage market that could change rapidly due to a number of factors.

Stakeholder risk: VUL needs a social licence to operate. Local landowners, business owners and community members may oppose the project’s development, either slowing down the development or preventing it altogether.

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities, own 563,000 VUL shares at the time of writing this article. S3 Consortium Pty Ltd has been engaged by VUL to share our commentary on the progress of our investment in VUL over time.