PRL Announces Scoping Study, 550kt per annum of Green Hydrogen

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 24,000,000 PRL shares at the time of publication. S3 Consortium Pty Ltd has been engaged by PRL to share our commentary and opinion on the progress of our investment in PRL over time.

Our 2021 Small Cap Pick of the Year Province Resources (ASX:PRL) is developing a globally significant green hydrogen project in WA.

Today PRL released its Scoping Study – here is our quick take:

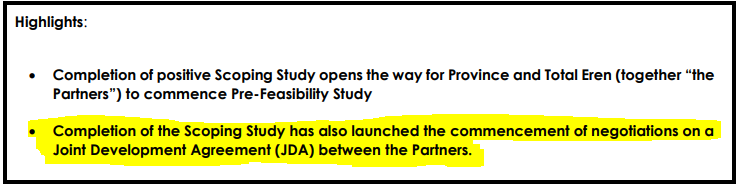

PRL’s Scoping Study was the critical step needed before PRL’s potential development partner TOTAL Eren signs off on a “Joint Development Agreement”.

With the Scoping Study now released, PRL has revealed negotiations with TOTAL Eren on this key agreement are now underway.

This partnership deal with TOTAL Eren is an absolute key part of our PRL investment thesis so we are watching very intently to see this Joint Development Agreement signed and delivered, which was contingent on today’s scoping study being released – a big tick on our PRL investment memo.

The outcome of the deal:

To lock in the MoU terms where TOTAL Eren will fund and own 100% of the renewable energy project, and 50% of the hydrogen production project, with PRL funding and owning the other 50%.

Page 11 of today’s Scoping Study has revealed an expected production of 550,000 tonnes per annum of green hydrogen (50% PRL, 50% TOTAL Eren).

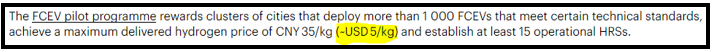

Of course, there are a lot of variables at play here, but assuming a current green hydrogen price of circa US$5 per kilo is applied to future production, that’s $3.4B per year in potential revenue.

Even at the required price for green hydrogen to compete with traditional fuels of US$2 per kilo, that’s still $1.5B per year in potential revenue.

Yes this revenue sounds great, but what are the capital cost to build the project and opex cost to produce?

What profit margin can PRL expect on their 50% of this revenue?

Well, it’s too early to say. Scoping Studies only provide a high level analysis to help decide whether to move a project into a Pre-Feasibility Study.

Scoping Studies often can’t reveal details on potential costs to build OR financial forecasts via an ASX release – as stated in the second last paragraph of today’s announcement:

‘In accordance with ASX and ASIC policy, the Scoping Study does not include any forecast financial information, including capital cost estimates, on the basis that there may not be a reasonable basis for including this information based on the preliminary nature of the Scoping Study.’

We expect the partners to be able to more accurately define these variables as part of the Pre-Feasibility phase.

…but in the meantime we have done some very rough calcs on potential project costs later in this note, based on other similar projects.

Our final key takeaway from the announcement:

“Province Resources Managing Director David Frances said it was exciting to have concluded the Scoping Study and to decide to undertake the Pre-Feasibility phase of the HyEnergyTM Project”.

The way we read it, TOTAL Eren was happy with the Scoping Study and has made the decision to progress to a Pre-Feasibility Study.

The Pre-Feasibility Study is the next key stage of de-risking the project, and will provide more details about the development costs and potential profitability – and will likely be a key de-risking milestone for much larger funds to invest in PRL.

Regular readers will remember on 15th of January last year when Vulcan Energy released their positive Pre-Feasibility Study, the shares went on a very strong run from ~$3 to touching a high of $14.20 before settling around the $8.50 mark.

The market likes a Pre-Feasibility Study as it’s often the first glimpse of the economics of a project. We will be looking forward to what PRL can deliver in the future on that front.

We made PRL our 2021 Small Cap Pick of the Year after it signed a Binding Memorandum of Understanding with Total Eren, partly owned and branded by TotalEnergies – one of the biggest global oil/energy supermajors in the world.

The MoU states that Total Eren will fund the majority of PRL’s green hydrogen project and the scoping study is a critical step towards securing Total Eren’s signature on a Joint Development Agreement.

With negotiations commenced, we suspect that the next major catalyst for PRL will be the signing of the Joint Development Agreement and the announcement of a concrete commitment by Total Eren to PRL’s Green Hydrogen project.

We believe the signing of the Joint Development Agreement could be the cue for institutional investment into PRL.

As investors, we like to see institutional investors join the registry as it gives a project added legitimacy and it helps put a floor under a (hopefully) re-rated share price post the scoping study and Joint Development Agreement.

We think today’s scoping study announcement by PRL happens within a broader macro environment where clean energy projects should thrive, with the desire for energy independence accelerated by Russia’s invasion of Ukraine.

Today’s scoping study is great progress but remember PRL is still a very early stage investment – we cover the risks later in this note.

So today we’ll put some context around what PRL is aiming to achieve with its green hydrogen project:

- The importance of PRL’s partner, Total Eren

- Our “Back of the envelope” calculations for the scoping study

- How PRL’s project compares with other hydrogen projects around the world

- Hydrogen media review

The importance of PRL’s partner, Total Eren

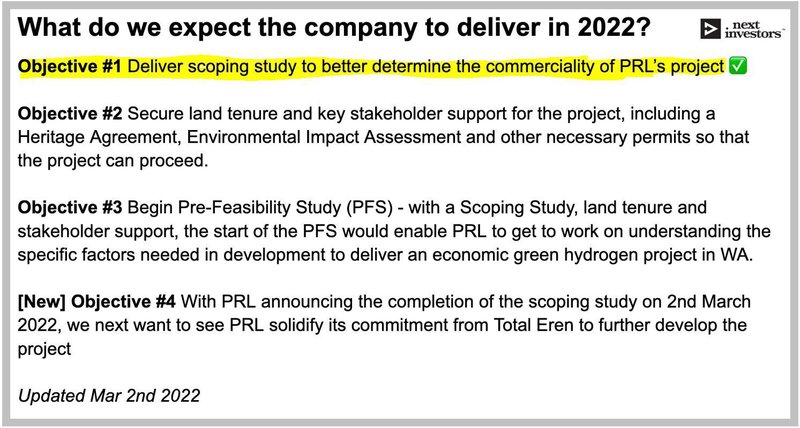

Today, PRL ticked off our Objective #1: Deliver Scoping Study, which bodes well for solidifying its relationships with Total Eren to further develop the project.

We have updated our investment memo to include this as our New Objective #4 that we want to see PRL complete by the end of 2022 – Solidify its Commitment to the Project from Total Eren.

PRL’s share price re-rated on the back of an initial partnership with Total Eren which is 30% owned by TotalEnergies (~ €130 billion market cap).

That partnership was in the form of a binding Memorandum of Understanding (MoU) to conduct a feasibility study as precursor to a significant hydrogen project in WA.

For context, Total Eren built Victoria’s largest solar farm in Kiamal, and views Australia as a strategic market.

So we think Total Eren brings the necessary experience, know-how, reach and connections to advance PRL’s project.

And we believe PRL’s green hydrogen project would be the natural next step for Total Eren in its bid to play a role in Australia’s green energy market.

We also believe that this relationship is the key to unlocking another share price re-rate for PRL. It is our view that Total Eren’s presence here de-risks our investment, and is crucial to underpinning the valuation of PRL.

The key takeaway from today’s announcement for us was that the scoping study being completed resulted in the Joint Development Agreement negotiations commencing with Total Eren.

Total Eren sticking around, and entering negotiations with PRL, is to us an implicit endorsement of the outcome of the scoping study. If the scoping study did not show any potential then Total Eren could easily have walked away from the project.

Knowing that Total Eren is still interested, and with pressure on the energy supermajors to go green, we wanted to see what TotalEnergies (Total Eren’s parent company) has been saying to investors.

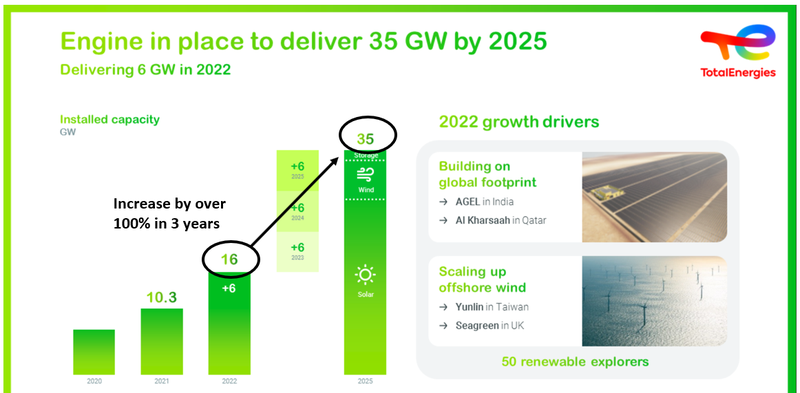

For us, TotalEnergies is a classic example of an oil and gas giant that is moving hard and fast towards renewables – in its most recent presentation on the 10th of February, TotalEnergies gave investors a glimpse of this intent.

With an overall target of achieving “Net Zero” carbon emissions by 2050, TotalEnergies seems to have recognised that to get there it needs to invest NOW.

The slide below shows TotalEnergies is targeting 35GW of renewables installed capacity by 2025 versus its current 16GW. This is more than a 100% increase in installed capacity – a massive commitment in the next 3 years:

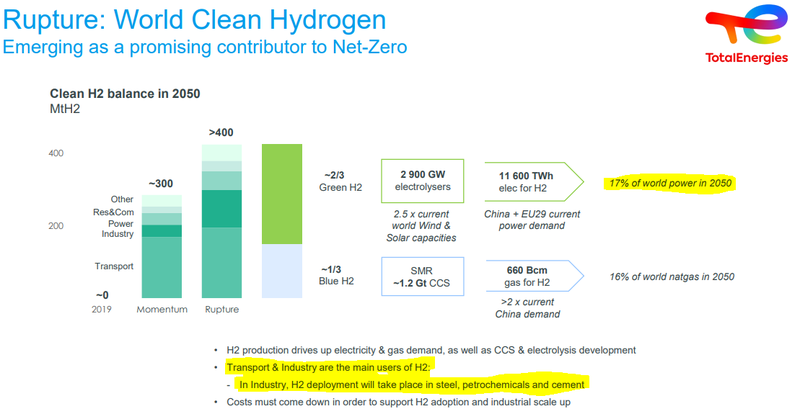

TotalEnergies isn’t stopping there though, in another presentation from last year they also put out a slide where it details how it believes that 17% of all world power consumed will be green hydrogen.

TotalEnergies sees green hydrogen as the primary renewable energy source to replace fossil fuels in transportation and industrial sectors. These are two of the most energy intensive sectors in the world:

The slide above comes from an investor day that TotalEnergies held on the 27th and 28th of September 2021. This was two days in which TotalEnergies released three different slide decks all focussed on reinventing the way energy is produced and consumed.

For a company to place this much emphasis on green energy, which was built on fossil fuels and who is still largely dependent on fossil fuels for its revenues, speaks volumes.

You can view the presentations we mentioned by clicking the images above, alternatively you can find most of TotalEnergies presentations here.

What’s a scoping study and why are they done?

Given today’s announcement, it’s important to understand what a scoping study is and why companies do them.

Scoping studies come about after the concept stage of a project’s life cycle.

First a company has an idea, it then starts to piece together the first few building blocks of it, and then when it has a clear line of sight towards what is trying to be built, a scoping study will get commissioned.

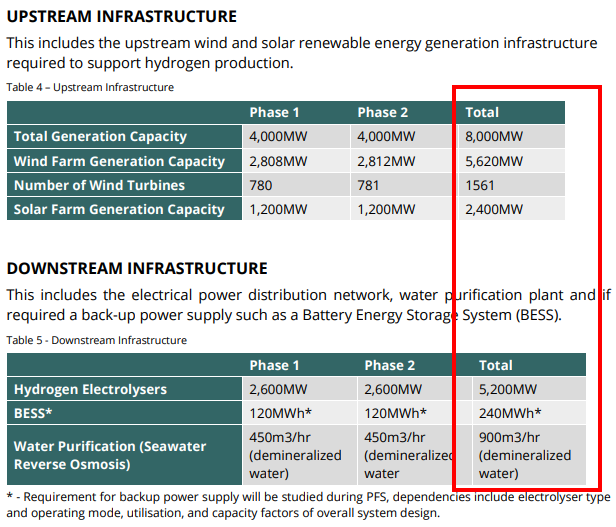

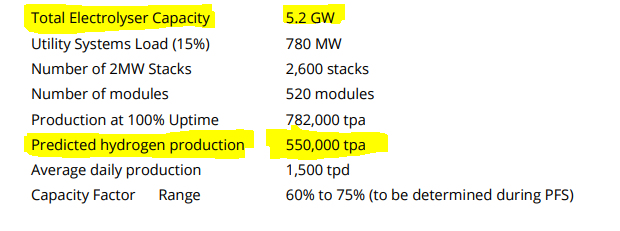

In PRL’s case this is a 5.2GW Green hydrogen project using 8GW of upstream generation.

The purpose of a scoping study is to get a really high level summary of whether or not the project is economically feasible without spending too much time or cash on piecing together detailed costs on everything.

For PRL, it would be the same as going and doing a high level calculation of how much it would cost to build 1mwh of wind farm generation capacity and then extrapolating it over the requirements of its project.

Again, on the revenue side it would be the same simple calculation, produce X tonnes of hydrogen and sell it for $Y per tonne to get the revenue figure.

PRL would then have to run these numbers over its project’s life cycle and come up with a “return figure” – this would set the first basis for “project economics” from which PRL can build on and look to improve the attractiveness of its Green Hydrogen project.

Having established what a scoping study is and why companies do them, here are some back of the envelope calculations that we have done which we think could be a rough guide in the absence of any discrete figures from PRL.

Our “back of the envelope” calculations for the scoping study

We thought we would run some back of the envelope calculations to try and give ourselves an understanding of what the financials behind the scoping study might have looked like to PRL and Total Eren.

Before we dive into them we want to stress that these are our calculations, and should not be used to make any investment decisions. We always recommend speaking to a professional investment advisor before investing in stocks.

PRL’s HyEnergy “Zero Carbon Hydrogen” Project is planned to be developed through two stages, for our back of the envelope calculations we will focus on the full development.

8GW of upstream generation, 5.2GW downstream electrolyser producing ~550kt of Zero Carbon Hydrogen per annum.

All of this can be found in the announcements today and using these numbers we did some very high level back of the envelope calculations:

First we looked at the cost of developing upstream generation – this is the cost of developing the wind and solar to generate the energy required to produce hydrogen.

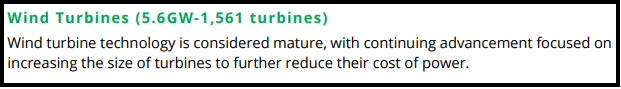

We remember reading about Infigen energy’s 113MW wind farm development in NSW which cost ~$240M for a total of 113MW of onshore wind power. This put the costs to build upstream generation at $2.1-2.2M per MWH.

This was in 2017 though and with the increases in construction costs we think a fair number for a high level calculation would be something like $3M per MWH.

With a total of 5.6GW (5,600MWH) at $3M per MWH the total cost for upstream generation would be ~$16.8 billion.

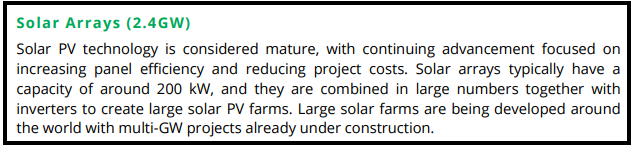

The second part is the 2.4GW of Solar arrays (farms).

Using the figures from a 50MW development Genex did in QLD for $126M in 2017, this put the cost at $2.5M per MWH, again we think a fair number for a high level calculation would be $3M.

So 2.4GW (2,400MWH) of Solar at $3M per MWH would be ~$7.2 billion.

This gives a rough overall cost estimate at ~$24 billion for the upstream generation. Importantly, under the current MOU this is 100% to be financed by Total Eren.

Again, these are OUR calculations based on other projects we have seen. There is no guarantee that this will be the case for the PRL / Total Eren project, we are merely trying to do some rough calculations on orders of magnitude here.

Second we looked at the development of the Hydrogen plant which is to be developed 50:50 with Total Eren and PRL.

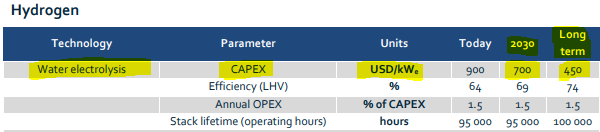

Using the assumptions from the Scoping Study, a 5.2GW electrolysis plant producing ~550kt of hydrogen could be built using a $950/kw (US$700/kw from the image below) capex figure.

This would mean a 5.2GW (5,200MW) electrolysis plant could cost up to ~$5 billion.

Keeping in mind that the costs are likely to reduce over time, in the image above if we took the long term forecast for CAPEX then the cost to build the electrolysis plant comes down to ~$3.2 billion.

For the purposes of our back of the envelope calculations lets just go with the $4.9 billion figure. Again – complete estimates here – we have used some very rudimentary assumptions, and we are not specialists.

Third, we looked at the revenue side. PRL expects to produce 550kt of Hydrogen per annum.

Using the extract from the report below, at a US$5/kg sale price, PRL could hypothetically generate $3.4 billion (US$2.5 billion) in revenues/annum.

The cost to produce green hydrogen is currently forecast at US$3/kg but over time we expect this to come down. Once costs are lower we suspect the sale prices will also come down but the margins shouldnt change that much.

For the purposes of our back of the envelope calculations we went based on that US$5/kg figure we found.

Of course we haven’t considered all of the costs but our back of the envelope estimate of what the costs might look like is our attempt to picture what Total Eren and PRL are looking at when negotiating that all important Joint Development Agreement.

Summarising our back of the envelope estimates we get this picture:

- Upstream costs (Wind/Solar) ~AU$24 billion – 100% Total Eren funded.

- Downstream costs (Electrolysis plant) of ~$5 billion – Split 50:50 Total Eren/PRL

- Revenues of $3.4 billion per annum. – Split 50:50 with Total Eren

So PRL could potentially be paying ~$2.5 billion for what we estimate could be ~$1.7 billion in revenues per annum net to PRL.

Of course there are going to be costs attached to these revenue numbers but even if PRL were to make a 5-10% margin on its share of the revenues it could mean over $85-$170M in cash flow net to PRL.

This is all extremely high level and is built on assumptions we made internally. Hydrogen is frontier technology in the energy space so our estimates are unlikely to be correct by the time the project actually gets built.

Costs could go down as efficiency improves, or they could go up due to construction costs rising. Hydrogen sale prices are also likely to change dramatically.

We only did this calculation to try and get a sense of what Total Eren and PRL would be looking at when negotiating the Joint Development Agreement.

We expect the numbers to be vastly different from what we have, given PRL spent over 9 months putting together their Scoping Study.

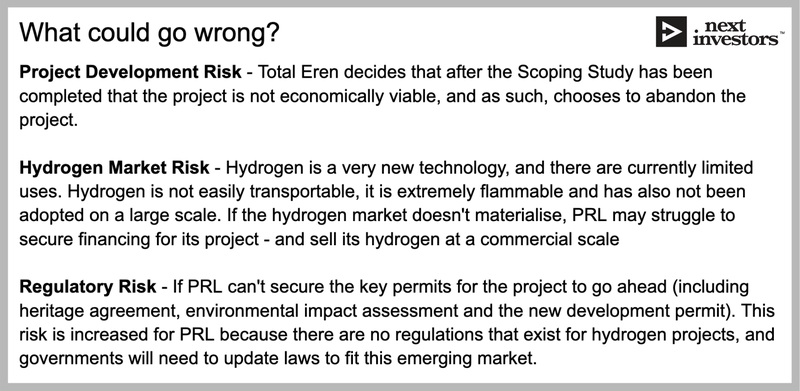

Now is probably a good time to remember the risks with PRL

Like any small cap stock, PRL has risks associated with an investment.

Whilst not exhaustive, here are the key risks we identified in our 2022 investment memo for PRL:

Comparable projects around the world

In its final form, PRL’s green hydrogen project is a proposed 8GW green hydrogen project and to try and contextualise everything we thought we should compare it to other projects that are currently being progressed around the world.

Up-to-date data is not widely available, but we’ll profile two major projects which show you at what stage PRL’s project is at relative to other green hydrogen projects.

It’s possible that PRL’s proposed hydrogen energy projects would be one of the Top 10 largest projects in terms of GW globally.

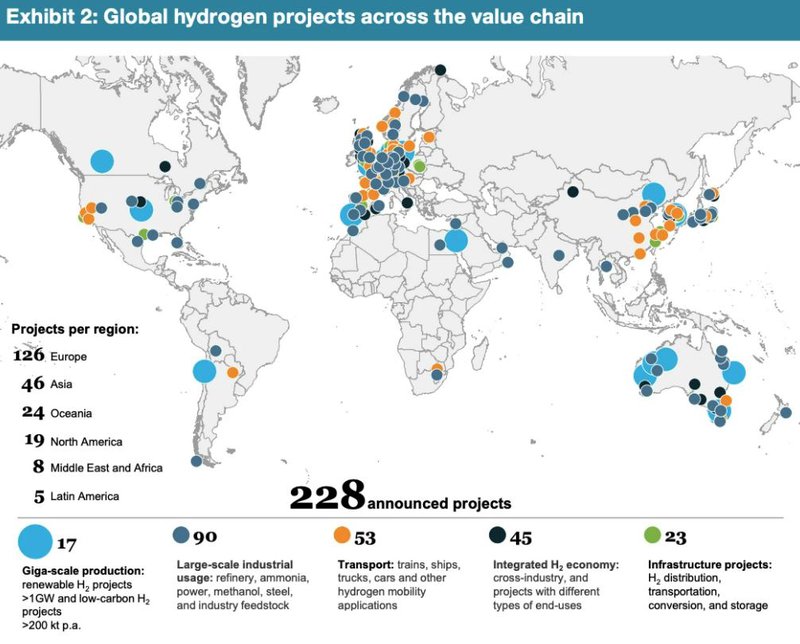

You can see a map of where proposed hydrogen projects are located around the world below:

You can see a main cluster in Europe, a good chunk in Australia, the US, East Asia and a couple scattered in the Middle East, South America and Africa.

Australia, particularly the part of WA that PRL is working within, is a uniquely sunny and windy place so it makes sense.

As this is an emerging industry what we’re looking for is a broad understanding of how PRL’s project stacks up.

Indeed, the end-use market is yet to be firmly established – so key to PRL’s success further down the track is securing an offtake.

The largest project in Europe has an offtake agreement…

Currently, the largest proposed project is in Europe, called HyDeal Ambition – a network of European hydrogen projects, with the most advanced project arm located in Spain:

“Most gigawatt-scale green hydrogen projects that have been announced to date are somewhat speculative, focused more on production than usage — yet without guaranteed off-takers, developers will struggle to raise the necessary finance.

A new 7.4GW renewable H2 project has been announced in Spain that largely solves this problem, by including two major industrial consumers — steel maker ArcelorMittal and fertiliser producer Fertiberia — among the developers.

HyDeal España — the first part of the 67GW HyDeal Ambition project that spans Spain, France and Germany — will use 9.5GW of solar energy to power 7.4GW of electrolysers that will split water molecules into hydrogen and oxygen. And the 330,000 tonnes of H2 produced each year will be supplied to a new industrial hub in the Asturias region, northern Spain, and bought by ArcelorMittal and Fertiberia (and other companies yet to join the project).”

9.5 GW is just slightly larger than PRL’s project’s capacity, so it gives you some sense of the scope of the company’s work.

Another notable project is a bit closer to home, but less advanced.

Western Green Energy Hub

The proposed Western Green Energy Hub in South East WA would have a capacity of 50GW and cost ~$70-100B.

Details are relatively sparse on the project which would cover the shires of Dundas and the city of Kalgoorlie-Boulder in south-east of WA. .

Its output is said to be in the region of 50GW, so a really large project.

The project is being put together by InterContinental Energy, CWP Global and Mining Green Energy Limited.

We see the Western Green Energy Hub as less developed compared to PRL’s project and still in its infancy.

That being said, mainstream media is picking up on the green hydrogen story in Australia in a big way, and what follows are three articles and key takeaways from each.

PRL: Green Hydrogen Media Review

Key takeaways:

- Electrolyser costs could fall by 55-65% by 2030

- Federal Government could do more in the future

- Japan and South Korea the key markets

Key Takeaways:

- “Renewable energy costs need to come down to below $20 per MWh. That’s when we get green hydrogen costs down to $1.5 per kg” – Kashish Shah, energy analyst at the Institute for Energy Economics and Financial Analysis

- Good breakdown of pros and cons of various types of hydrogen

US$2 a kg is the “tipping point” for green hydrogenKey Takeaways:

- Twiggy Forest’s Fortescue Future Industries intends to build the Uaroo Renewable Energy Hub, which would have capacity of up to 5.4 gigawatts from 340 wind turbines and a solar farm

- Goal is to power Fortescue’s iron ore mining operations in the Pilbara

- Located 120km south of Onslow in North West WA

Our 2022 PRL Investment Memo:

Below is our 2022 investment memo for PRL where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company’s performance against our expectations 12 months from now.

In our PRL Investment Memo you’ll find:

- Key objectives for PRL in 2022

- Why we continue to hold PRL in 2022

- What the key risks to our investment thesis are

- Our investment plan

To access the PRL Investment Memo simply click here.