Our New Investment – ASX: IRD added to Wise-Owl Portfolio

After months of due diligence, research and multiple calls with management, we have decided to make a long term investment in Iron Road Ltd (ASX: IRD) in our Wise-Owl Portfolio.

IRD owns a $4.5BN iron ore resource in South Australia that sits ~ 150km away from its part owned port development that will allow its iron ore to reach the market. IRD’s project includes development of a green hydrogen export facility.

We invested in Iron Road’s recent placement because we believe IRD is currently undervalued by the market given the stage of its project, the global appetite for iron ore and rising interest in the green hydrogen thematic.

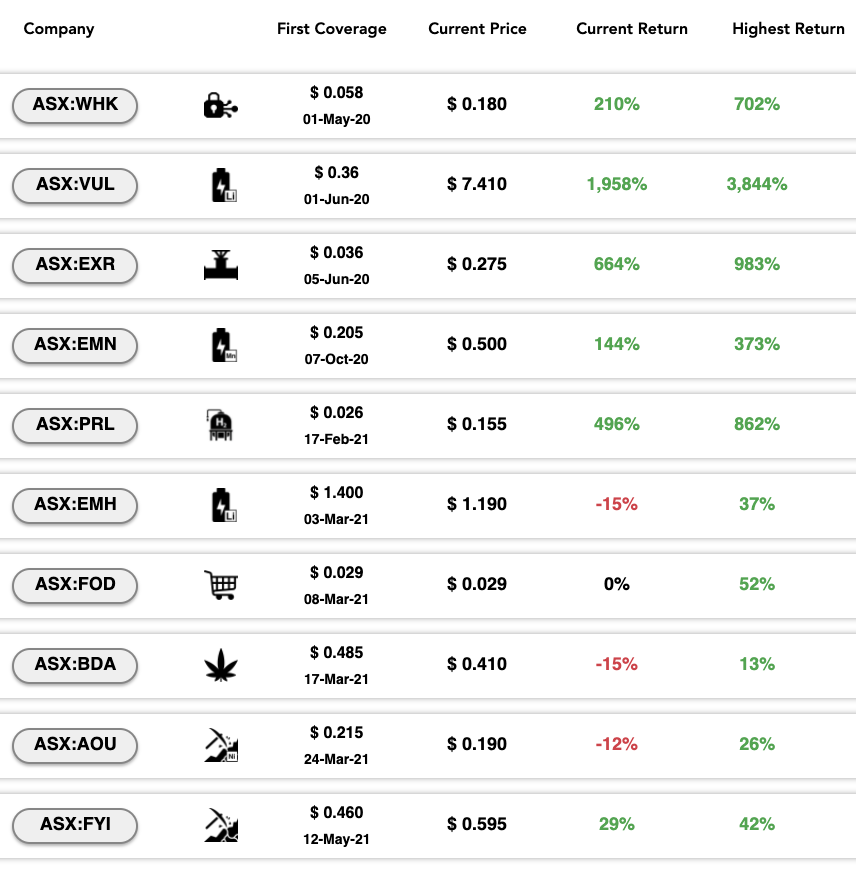

Wise-Owl’s new “investment portfolio” model (introduced in May 2020) is to make around ten long term investments per year in carefully selected ASX companies and share our analysis on why we are invested. Here is our track record:

We always do extensive research and due diligence before we make a new investment, and in our experience holding long term for the company to deliver on its business plan has given us the best returns.

We send updates on all our investments as they evolve over time, and whenever we make a new investment.

Over the last 12 months we have made ten investments in our portfolio.

Today we are pleased to announce our eleventh long term investment.

We invested in IRD because it is leveraged to both a rising iron ore price AND green hydrogen – we like both thematics and think they will do well over the coming decade.

We will provide our full research and analysis report in the next few weeks, for now here is a summary of IRD and why we invested:

IRD’s Iron Ore, Port and Green Hydrogen Projects

Iron Road owns a $4.5BN tonne iron ore resource in South Australia which is ~ 150km away from a port development that will allow it to get its iron ore to market.

IRD owns 25% of this port development with partners Macquarie Capital and Eyre Peninsula Co-operative Bulk Handling.

IRD owns 100% of the port site and has partnered with Macquarie Capital and Eyre Peninsula Co-operative Bulk Handling to retain 25% of a “grain first” port development.

IRD also has a 1,110 hectare site next to the port where it is looking to develop a green manufacturing industry, including green hydrogen.

Why We invested in IRD:

Leverage off IRD’ past investment: IRD has spent over $170 million since 2008 to get the company to where it is today, and at its current $150M market cap we feel like we are getting in at a very good valuation at the right time as iron ore starts to run again.

Strong macro theme: We expect IRD will perform very well if the iron ore price strength will continue in the global post pandemic construction boom.

Realistic path to market: A port development project for shipping its iron ore is already well progressed since 2008 – IRD is in the right place, at the right time with an advanced project.

Institutional Backing: Private equity firm Sentient Global Resources Funds owns 72% of IRD and has been a very long term holder – which means there aren’t many shares available free float on the market. Macquarie Capital is also on IRD’s register via its holding of Warrants.

Co-investing alongside big, cashed up institutions makes us feel confident in the investment over the long term.

Cash in Bank: IRD is debt free (subject to FIRB and shareholder approval of final debt to equity conversion) and has a healthy cash balance following recent capital raises that brought in $16M – we participated in this most recent placement at 21.5c and so did IRD’s Directors in the SPP on the same pricing terms.

Unknown and undervalued: We like IRD because it’s currently one of the lesser known stocks we have seen on the ASX. IRD appears to have done very little promotion to gain new investors over the last few years, hence offering a good chance of share price upside as they start to roadshow the story.

Net Present Value: IRD’s most recent financial modelling of the iron ore project demonstrated a NPV of US$2.6BN at a high grade iron ore price (65% Fe) of US$120/t.

What are the risks?

Many early stage iron ore hopefuls fall over at lack of infrastructure to ship to market. Building the infrastructure to get iron ore to market is expensive and needs funding, – we will talk more about this in our deep dive analysis in a few weeks.

Why Iron Ore? Why Now?

The iron ore price hit all time highs of over US$230/tonne a few weeks ago…

It was less than a decade ago that we had our last iron ore boom, with the spot price reaching a then record US190/t in 2011.

During that period, several small cap juniors transformed into multi-billion dollar companies – consider the likes of Atlas Iron, Mt Gibson, (went bad for Sundance!), and the emergence of Fortescue Metals Group.

Fast forward to the present, on the back of post-pandemic stimulus spending across the globe igniting steel demand, we are in the midst of the next iron ore boom…

This time, the spot prices are now exceeding US200/t.

This comes at the same time as ‘Green Hydrogen’ generating a lot of attention – even Twiggy’s Fortescue is looking at it after making billions of dollars in iron ore profits.

More detail on IRD’s Projects:

There are three parts to the IRD story that attracted us.

1. IRD owns 100% of a multi-billion dollar iron ore resource.

IRD has a world class, coarse grained, magnetite ore body on the Eyre Peninsula in South Australia.

IRD’s 3.7 billion tonne ore reserve estimate is the largest of any magnetite resource in Australia.

IRD has an annual production target of 12 Mtpa (dry) at a grade of 66.7% iron (considered premium), over an initial 22 year mine life. The life of mine concentrate is 250 Mt.

IRD’s most recent financial modelling of the project demonstrated a NPV of US$2.6BN.

That’s assuming a US$120/dmt iron ore price – which is a conservative figure, well below recent spot prices over US$200/dmt and AUD/USD of 0.80.

The infrastructure components of the project has been recognised by Infrastructure Australia as a Priority Project for the nation.

The problem with iron ore assets is they can be stranded if not close to a port and a way to get to market.

That leads us to Part 2 of the IRD story.

3. IRD has 25% of planned nearby port infrastructure for grain exports – expanded port facility required – to get the iron ore to markets

IRD has been working on its master plan for several years, recognising that an iron ore resource without a way to get it to market is difficult to be commercialised.

The solution is a planned, giant export facility at Cape Hardy, designed to be South Australia’s first “Capesize capable” port – Capesize ships are the largest size bulk ships in the world.

This port is in the advanced stages of development, with the project nearing Final Investment Decision.

This port can be used by IRD to get its iron ore to market, but it also offers a way to market for multiple bulk commodity industries in the region including grain.

There are two other partners on the port – one is an Eyre Peninsula farmers cooperative, representing local farmers who want to see a grain export business happen, the other is Macquarie Capital – who can bring financial muscle to the project and expertise in infrastructure investments.

Stage I of the Port involves constructing and operating an export facility that can store, handle, and export up to 1.3 Mtpa +/- 60% of grain, and the import and export of other commodities (e.g. minerals, hay, fertilizer), serviced by giant Panamax sized ships.

Stage II of the Port will enable the port to service the iron ore project.

Stage III will be building a rail network linking Cape Hardy to the National Rail Network – which would significantly increase the port’s catchment area.

3. IRD has exposure to the upside in the nation’s move to Green Hydrogen

IRD owns 100% of the 1,100 ha Cape Hardy Port site.

The upside in IRD, that is harder to quantify, is what might be possible with the development of a port and infrastructure at Cape Hardy in the future.

In January, IRD announced master planning for a ‘green manufacturing precinct’ that will integrate an iron ore ‘green pellet’ plant fuelled by renewable energy, using high grade iron ore concentrate from its iron ore deposit.

As the world pivots to green energy sources, IRD could play a major role for the state of South Australia, beyond simply shipping iron ore exports.

What’s next? IRD catalysts to look out for:

- Drive Stage I of the port to a Final Investment Decision

- Potential partial sell down of iron ore project to a strategic partner

- Build green hydrogen partnerships

- Plan longer term manufacturing site at the port.

We will provide our full research and analysis report on IRD in the next few weeks.