Never miss a chance to improve DFS economics with near surface exploration.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 3,125,000 EV1 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our investment in EV1 over time.

Long time readers would be well aware of our performance picking companies exposed to the battery metals macro thematic.

Our 2021 pick of the year Evolution Energy Minerals (ASX:EV1) is a sustainable, ESG focussed, advanced stage graphite project in Tanzania.

Graphite is a key component in lithium ion batteries – a critical battery material.

We mainly like EV1 because it already has a Definitive Feasibility Study (DFS) completed, showing an NPV of US$323M with a low CAPEX requirement of US$87M over an 18-year mine life.

This means EV1’s graphite project is already large enough to be put into production.

Today EV1 restated its commitment to delivering that final investment decision in the second half of 2022, but more importantly:

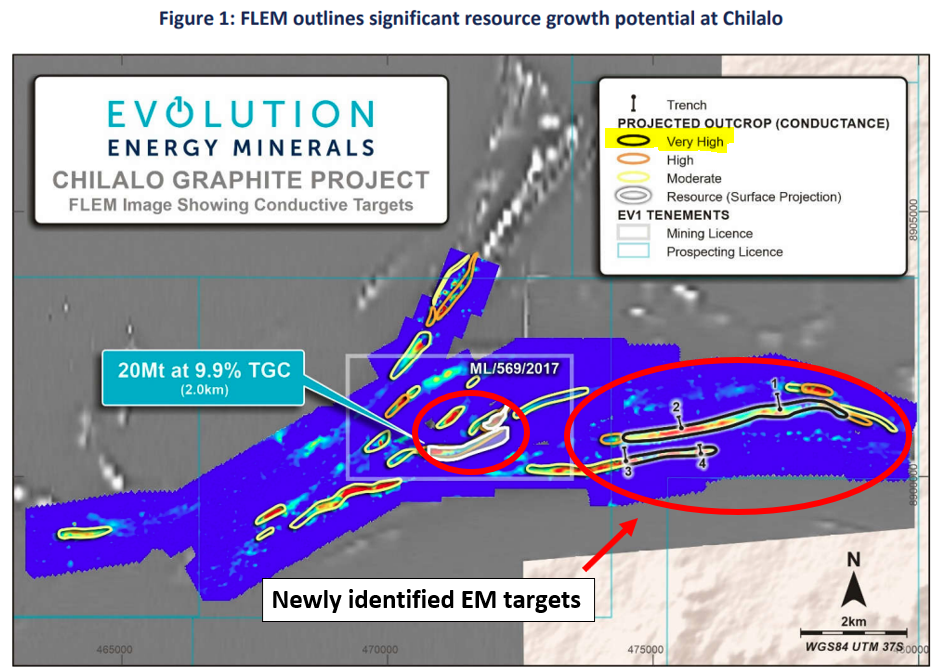

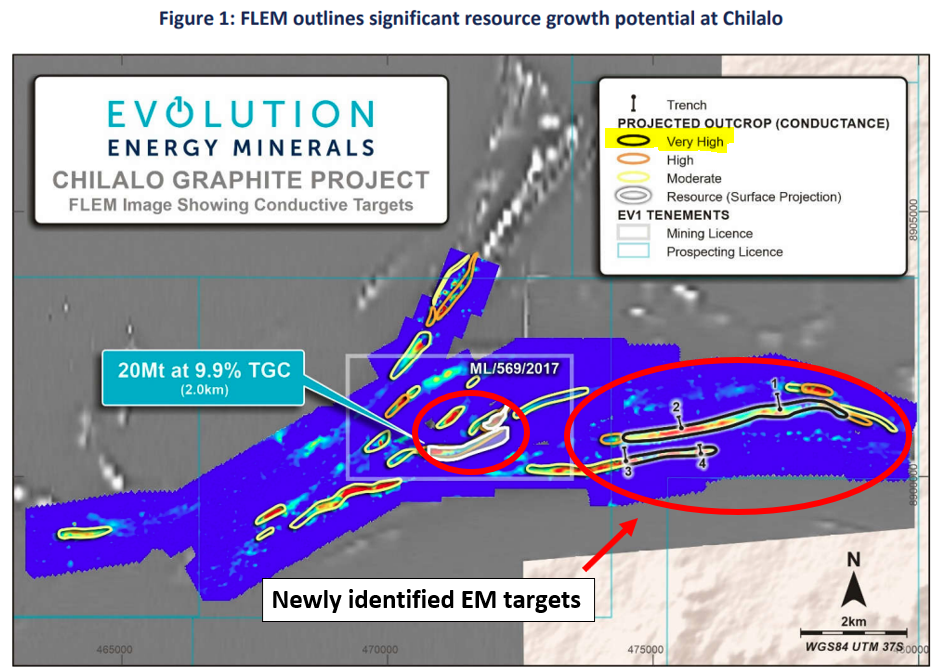

EV1 ALSO announced today that it has identified ultra high conductance EM targets over a 33km area – almost 15X the size of the EM conductor that its current 20mt resource JORC resource sits on.

8km of this area is displaying higher conductivity than the ~2km EM structure the current JORC resource sits on.

EV1 is expecting to drill in May of this year.

By drilling these EM conductors, EV1 will be specifically targeting high grade, near surface graphite, which can lead to lower strip ratios (waste mining) and an extended mine life.

All of which, we expect will make its project economics that much stronger.

As the battery industrial complex gets bigger we think the demand for the raw materials that are needed to produce electric vehicle batteries will increase exponentially.

None of these raw materials are as important as Graphite – which is the dominant material across all lithium-ion batteries – comprising over 50% of every lithium-ion battery (and over 95% of every battery anode).

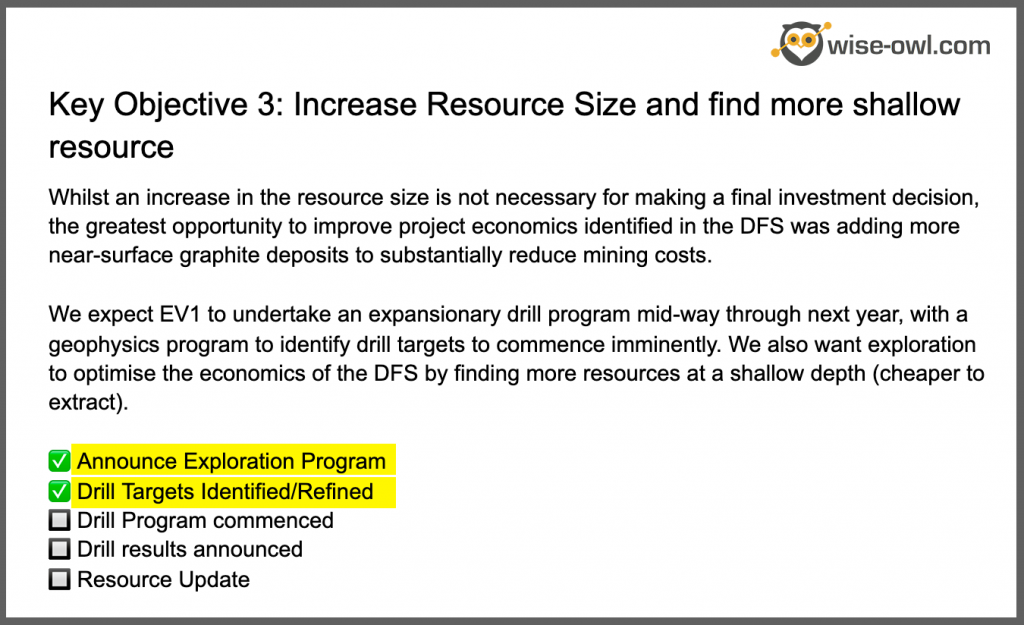

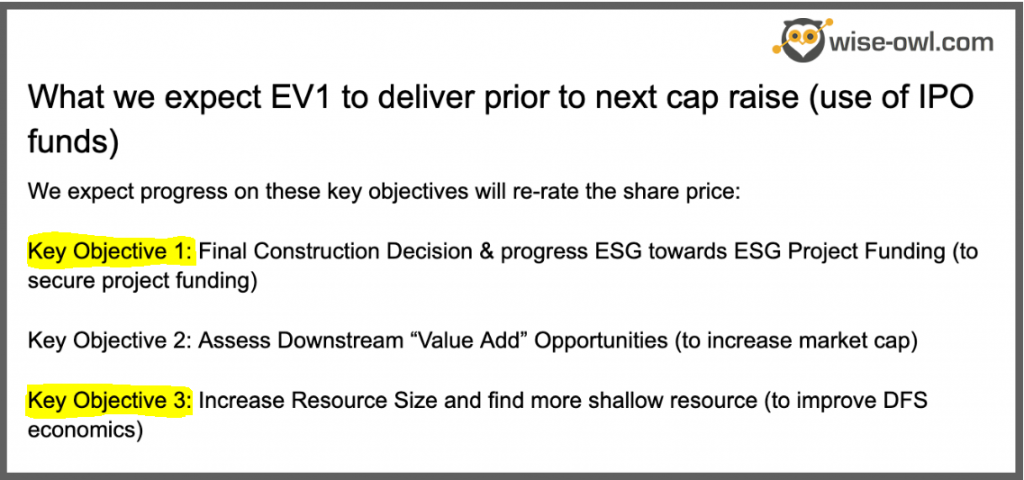

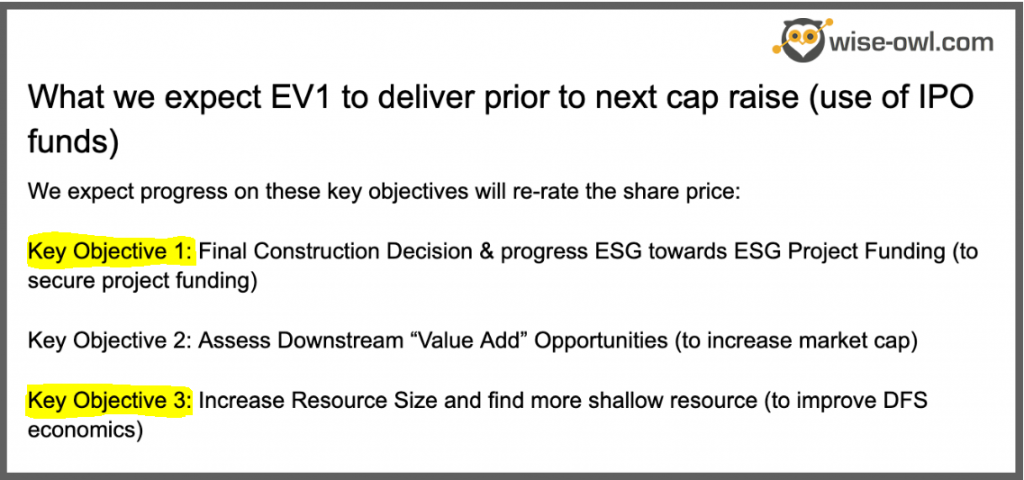

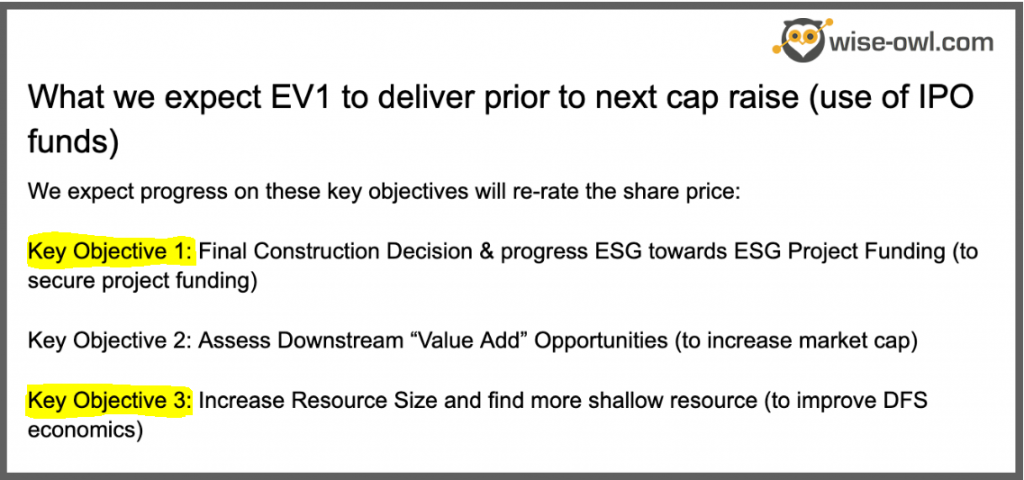

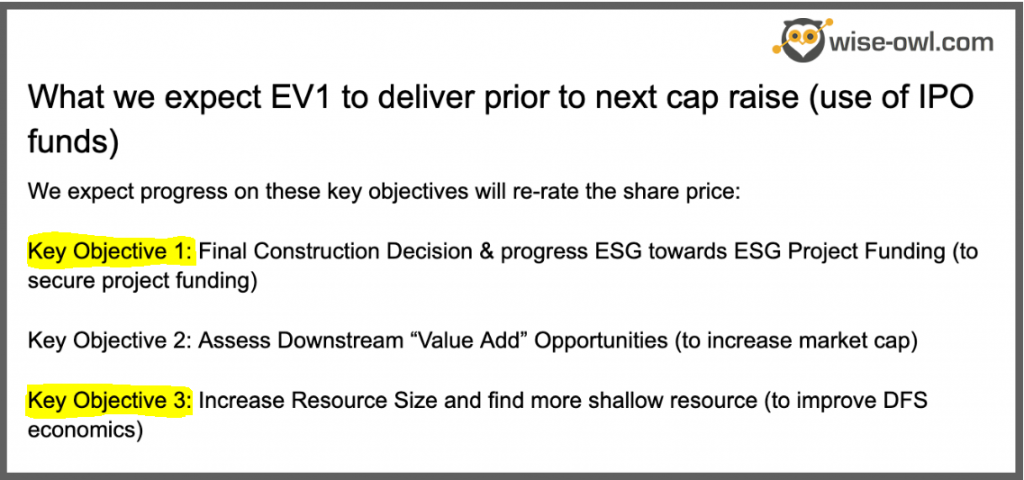

In our 2022 EV1 Investment Memo, we listed the Final Investment Decision as our first key objective for what we wanted to see EV1 achieve in 2022.

We also listed the expansion of the resource size as our third key objective, which is what today’s announcement is all about.

Below is a screenshot of our key objectives from our 2022 EV1 Investment Memo: Note: If you want to read the full, detailed article on why we invested in EV1 click here).

Note: If you want to read the full, detailed article on why we invested in EV1 click here).

More specifically, EV1 has announced two milestones today that get us closer to achieving our Objective #3:

More on the EM targets

To get to these EM targets, EV1 first ran some airborne EM surveys and then followed some parts of the project up with ground based EM surveys.

The typical process to generate EM targets is to run airborne surveys and map out a larger area before going in and targeting the most interesting structures with ground based EM surveys to measure size and conductivity.

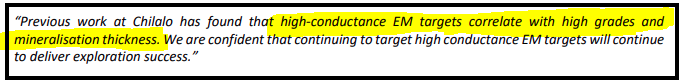

The conductivity is important because the higher the conductivity the thicker and higher grade we can expect the graphite to be.

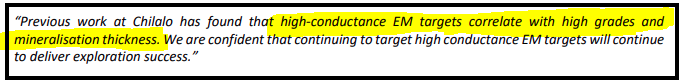

EV1’s managing director Phil Hoskin’s comments from today’s announcement summarise this perfectly.

Specifically – 8km of very high conductance (stronger than where the current JORC sits), 25km of high conductance and 22km of low conductance.

The significance of all of this is that the current JORC resource of 20mt @ 9.9% TGC sits on an EM conductor of only ~2km.

Effectively EV1 has managed to throw up exploration targets with higher conductivity than its current JORC resource over an area 4x the size of the area where the current JORC sits.

The image below really puts this into perspective:

Again comparing all of this to the current JORC resource sitting on 2km of EM targets, the airborne surveys have identified a total of ~64km in EM targets in the project area (almost 32x the size of the current JORC).

33km of that was followed up with ground based EM surveys and has put together three primary target areas as follows:

- 8km of very high conductance (stronger than where the current JORC sits)- 4x the size of the current JORC resource.

- 25km of high conductance – over 12x the size of the current JORC resource.

- and 22km of low conductance – over 10x the size of the current JORC resource.

These highly conductive EM targets can mean several different things, ranging from nickel-copper-cobalt-palladium mineralisation to non-economic sulphides; sometimes they also represent graphite.

Most investors are probably used to EM targets being generated when doing copper or nickel focussed exploration, generally, these explorers see graphite in their drill cores and see it as a sign of failure.

In the case of EV1, when the drilling starts in May that’s all we will be looking out for – more and more graphite.

Why do we care about the exploration program?

One of the primary reasons we made EV1 our “2021 Pick of the Year” was due to its project being well advanced with a DFS already completed on it in January 2020.

The DFS showed that with a low CAPEX requirement of US$87M, EV1’s project could deliver an NPV of US$323M, based on an 18-year mine life.

So we think the numbers already stack up well for EV1.

Exploration is almost always used to prove up a project and get the resource to a stage where a company can complete a DFS – which EV1 already has.

The natural question to ask then would be “why do we care about the exploration program?”.

We think this comes down to two key points, optionality and project economics.

First is the fact that exploration gives EV1 optionality.

The current project mine life detailed in the DFS is ~18 years, this on its own is a healthy amount of time EV1’s project can produce graphite for but it can act as a sort of cap on the duration of a potential supply contract.

If we play out the hypothetical scenario where a large European automaker approaches EV1 and asks to negotiate an offtake agreement, that same large automaker may be less interested when they realise the mine life is 18 years.

Large offtake partners will want at least some visibility as to production being able to continue out into the future.

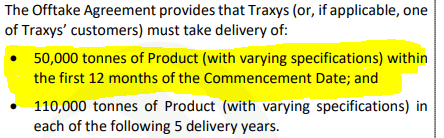

Let’s take the Magnis offtake agreement announced on the 20th of December last year, where the offtake agreement with European commodity trading firm Traxy’s was for 50,000tpa.

By getting this exploration work done and potentially increasing its resource size EV1 can show any of these interested parties that it is here to produce for well beyond that initial 18-year mine life.

The same goes for its production throughput, the current DFS has this at 50,000 tonnes per annum.

Be it as a result of geopolitical tensions escalating and shutting off alternate supply routes or the simple fact that the mining industry is not investing in new supply fast enough to keep up with demand.

If EV1 can expand its JORC resource through exploration, it can show to these buyers that without compromising its mine life it can increase throughputs and supply additional graphite based on offtake demand.

This would effectively give EV1 optionality to respond to the market and increase the amount of graphite it can produce.

The second is around project economics.

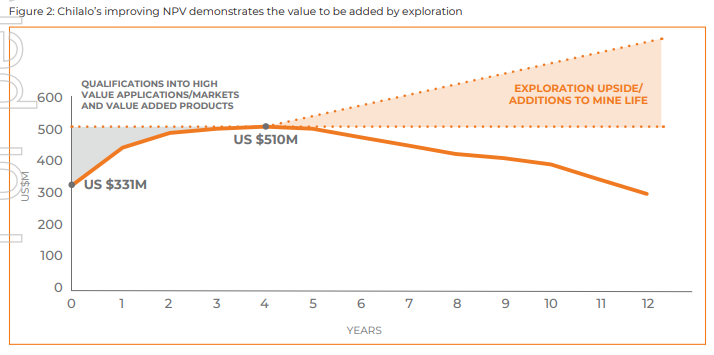

In the DFS published in September 2021, EV1 listed expiration upside as one of the major opportunities that could be used to improve the overall project economics of EV1’s graphite project.

Below is an image from the 2021 DFS showing how the exploration upside and additions to mine life could impact NPV.

The obvious benefit of this is that mining ore that is close to the surface is always cheaper, there are fewer non-mineralised rocks to mine through (This is what’s meant by “low strip ratio”) and effectively means there is less time and money spent to get to the graphite.

Whats next for the exploration program and what do we want to see the company achieve in 2022:

Trenching program 🔄

In today’s announcement EV1 confirmed that trenching was already underway across priority areas where the company thinks there is graphite from surface.

This is unlikely to be done over a large area but the results (Thickness and grades) should determine whether or not EV1 should be drilled down at depth into those areas.

EV1 expects to announce the results from this in Q2 2022.

Drilling to commence in May 🔄

EV1 also confirmed that the drilling program would commence in May of this year.

We think that the drilling program will come after some of the initial results from the trenching program, should the results show shallow high grade resources in particular parts of the project, we expect EV1 to target these structures first.

Final Investment Decision 🔄

Although being unrelated to its exploration program, EV1 also confirmed today that it was targeting a final investment decision in the second half of 2022.

The FID will be based on the 2021 DFS that was completed and is unlikely to include the results of all the exploration works.

This brings us to our 2022 Investment Memo and what we wanted to see EV1 achieve in 2022.

Today’s announcement shows us that EV1 is taking action across both objective 1 and objective 2 of our memo.

Our 2022 EV1 Investment Memo:

Below is our 2022 investment memo for EV1 where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the memo is to record our current thinking as a benchmark to assess the company’s performance against our expectations 12 months from now.

In our EV1 Investment Memo you’ll find:

- Key objectives for EV1 in 2022 (shown above)

- Why we invested in EV1

- What the key risks to our investment thesis are

- Our investment plan

To access the EV1 Investment Memo simply click on the button below: