Introducing our Pick of the Year

It’s been a while since we announced a new investment for the Wise-owl portfolio.

After months of following this project, it has just listed on the ASX today.

Long time readers will know our biggest investment wins have come from investing in sustainable, ESG focused battery metals and green energy stocks:

- VUL is currently up 5,190% (battery metal – lithium)

- EMN is currently up 800% (battery metal – manganese)

- PRL is currently up 1,167% (clean energy – green hydrogen).

While past performance is not an indicator of future success, today’s new portfolio addition is a later stage project, in the sustainable, ESG battery materials space.

The greening of the global economy as an investment theme continues to be strong and we expect this will continue for the next decade.

We have spent over 6 months running our due diligence process and getting an understanding of the potential of this company, we participated in the IPO and today we add this company to our portfolio:

Introducing our first ever Wise-Owl “Pick of the Year” and twelfth addition to the Wise-Owl portfolio:

Evolution Minerals (ASX:EV1)

EV1 is a sustainable, ESG friendly, advanced stage graphite project in Tanzania.

Graphite is a key component in lithium ion batteries, and up until now we did not have any exposure to its growing demand. Graphite has many other applications beyond electric vehicles too.

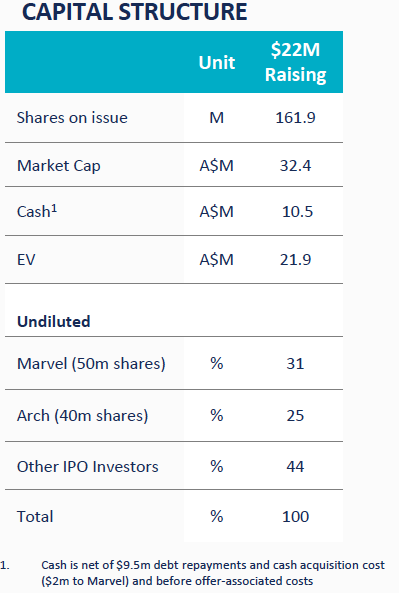

EV1 just listed on the ASX today after raising $22M in an oversubscribed IPO.

The IPO was cornerstonesd by an ESG fund (they own 25% of EV1), and the company will be one of the most ESG integrated mining projects on the ASX.

We have been so impressed with this company that we decided to make this stock our Pick of the Year.

Yes – we have a large position in this company – and what you are about to read should be considered conflicted and biased. Remember to seek professional advice before investing, especially in speculative early stage mining stocks like this one. Please also make sure to read the full disclaimer at the end of this email.

The majority of our EV1 shares are escrowed for the next two years. We aim to hold a position for the long term.

At Wise-Owl we invest in carefully selected companies and hold a position long term (4 to 7 years), we share our commentary on how each of our investments executes its plan.

Below is our current investment thesis covering the 10 reasons we invested in EV1.

We will periodically revisit the 10 reasons we invested and share our commentary on how the story plays out over time. You can subscribe to Wise-Owl to get these updates.

Our investment thesis: Here are the 10 reasons we invested in EV1

Here’s the quick summary of the ten key reasons why we invested in EV1, and we’ll provide a deep dive into each reason later in the article.

- Graphite: Right sector, right time – Our best performing investments to date have been sustainable, ESG credentialed battery metals stocks. Graphite is the primary ingredient for just about every electric vehicle (EV) battery, and demand is projected to outstrip supply for the better part of the next decade.

- Aiming to be best in class ESG – Green energy and battery materials buyers are demanding sustainability in their supply chains. EV1 has committed to becoming best in class sustainable, ESG focused graphite producer, which will allow them to attract funding from large pools of ESG capital to build their project.

- Future funding: Major IPO investor is a prominent ESG fund – Cornerstone investor ARCH Sustainable Resource Fund holds 25% of EV1. ARCH has appointed a board member and mandated that EV1 create a top class ESG graphite operation, which should allow EV1 to unlock access to development funding from vast pools of ESG capital. ARCH has already committed to investing a further US$25m in EV1 (subject to conditions being met) and has a network of ESG investors to tap for the rest. ARCH has 20 million 25¢ options which if converted could bring in $5M more in funding.

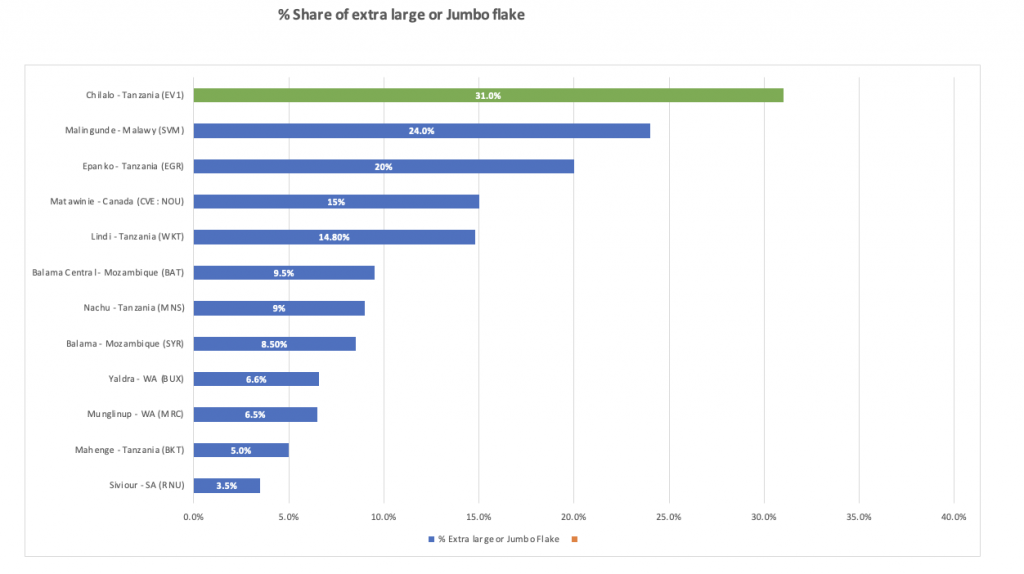

- EV1 is sitting on premium graphite – All graphite is NOT created equal – Graphite “flake size” is what differentiates mines that are economic and those that are not. 31% of EV1’s defined graphite resource is made up of extra-large or jumbo flake sizes. This gives EV1 optionality in selling it directly at high-margins or using it internally for downstream opportunities. Jumbo flake sizes can sell as high as US$3,000/t whereas smaller mesh sizes fetch prices of US$700/t.

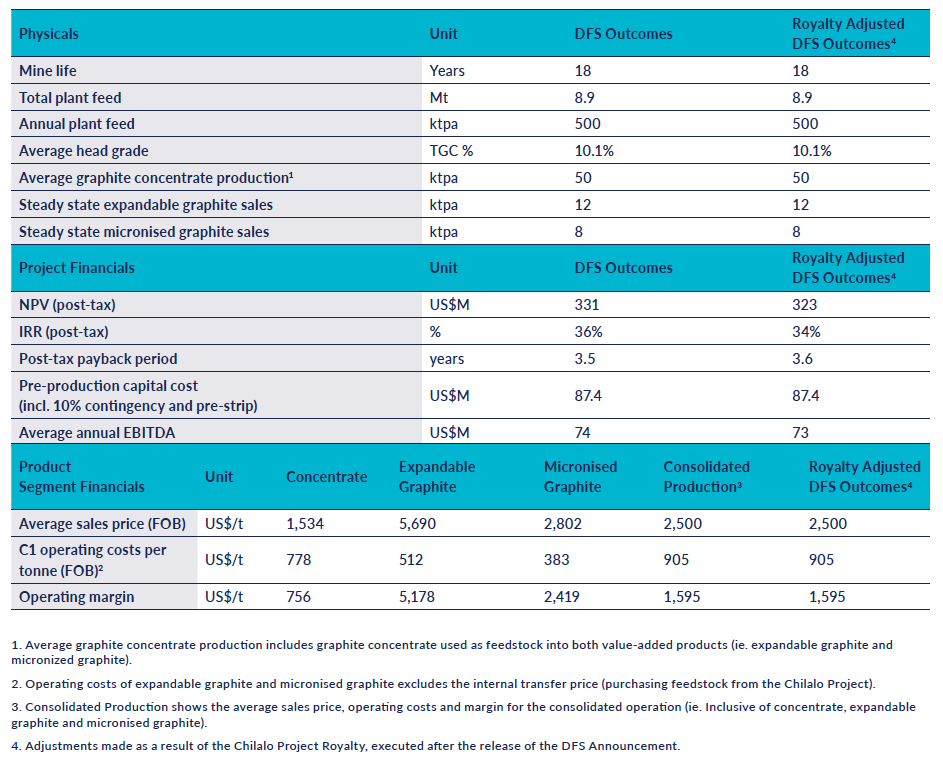

- Project is development ready, low capex, quick to production – We like that EV1 is an advanced stage project, with low capex that can be in production relatively quickly. EV1 has a large graphite resource with upgrade potential, its DFS was completed (in Jan 2020) and a low capex requirement of USD $87M for a NPV of USD $323M with a plan to be in production by 2023, with an 18 year mine life based on reserves only.

- Exploration program to increase resource size – Beyond the existing defined resource, we like that EV1 is investing in a near term exploration program to extend the resource AND try to find more near surface graphite that could bring down the cost to extract and optimise the current DFS.

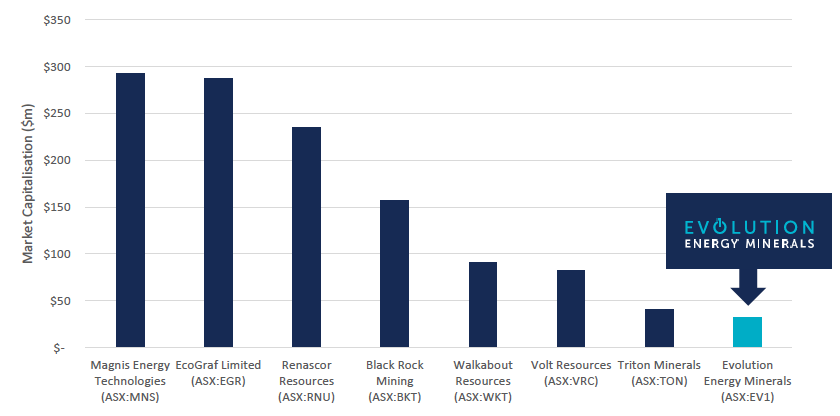

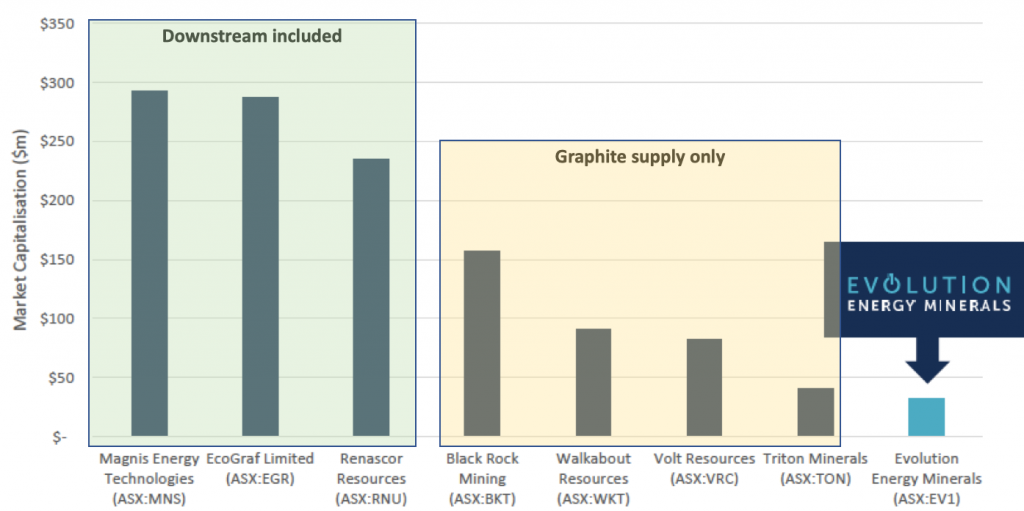

- Low market cap compared to peers – EV1 is listed at a market cap of $32M with $10.5M in the bank, a very low enterprise value relative to its peers. EV1’s resource-to-market cap ratio is among the lowest of ASX peers in the graphite space. The highest market cap peers refine and process their graphite as a “value- add” to the end product. We think EV1 share price will re-rate IF they can deliver capability around “value adding” to their raw graphite.

- Exploring downstream “value add” to graphite products – Digging a material out of the ground and selling it “raw” is the traditional route that most resource companies take. Adding value to the product downstream by refining and processing BEFORE selling it can be highly profitable and is viewed favourably by the market, especially in the graphite space, as we have seen with EV1 peers EcoGraf Limited ($306M capped) and Magnis Energy Technologies ($636M capped). $32M capped EV1 already has DFS-level downstream strategies for expandable and micronised graphite, but we believe the company can re-rate if they introduce downstream battery anode capability as they flagged in the IPO prospectus. In the prospectus $2.5M has been allocated to pursue/study downstream capabilities.

- Best team in the graphite industry – When we invest, backing the best management teams is everything. In our view EV1 has the most experienced management team we have seen on the ASX to bring an advanced stage graphite project to production – we will cover what each key person brings to the table and their experience later in this article, including executive director Michael Bourguignon who was responsible for managing the construction of Syrah Resources’ Balama graphite project in Mozambique.

- Tight capital structure, leveraged for share price growth – The share table and cap structure is one of the most important things we look at prior to investing. EV1 will have ~162M shares on issue when it lists, ~42M options, 25% owned by ARCH and with the Top 20 holding 75% of the shares on issue. The top 2 shareholders own 56% With Marvel Gold escrowed for 2-Years & ARCH for 1-Year, so there is not much free float.

Here is what we want to see next from our investment in EV1

According to the prospectus, EV1’s plan for the money it has raised in the IPO is to:

“Increase the current 18 year mine life of the Chilalo Project through a targeted drilling program on the deposits located within the Chilalo Project and an assessment of further opportunities to enhance the outcomes of the DFS whilst pursuing the project finance necessary for development with a view to ultimately become a vertically integrated manufacturer of sustainably produced, high-value graphite products.”

That’s a very long sentence with a lot of detail – so well done if you got all the way through it.

In order for us to track EV1’s progress over time, we have broken down EV1’s above strategy into the below key objectives and sub-milestones.

This will help us to clearly identify how each announcement EV1 makes contributes to its overall strategy (we will share our commentary and opinions as the EV1 story progresses).

Key Objective 1: Final Construction Decision & progress towards Project Funding

The main name of the game for EV1 is to reach a final construction decision and secure the ~US$87M required in capital costs to bring the project into production. DFS upgrades and optimisations will form a part of this process, but more importantly, EV1 needs to deliver all of the ESG requirements set out by ARCH (the cornerstone ESG shareholder), so that ARCH can help EV1 secure funding from other ESG funds in its network that only invest in top class, proven ESG opportunities.

🔲 DFS Optimisation

🔲 Front end engineering design (FEED) – Appointment of Engineer

🔲 Front end engineering design (FEED) – Progress update

🔲 Front end engineering design (FEED) – Final report

🔲 ESG – Initial assessment or report

🔲 ESG – Sustainability report

🔲 ESG – Quarterly progress reporting

🔲 ESG – Life cycle assessment report

🔲 ESG – Progress towards zero carbon operation

🔲 ESG – ESG investment readiness announced

🔲 ESG – Independently assessed ESG score

🔲 ARCH Provides further project funding

🔲 ARCH introduces other ESG funds

🔲 Strategic Board appointment

Key Objective 2: Assess Downstream “Value Add” Opportunities

Assessing further downstream “value add” opportunities and the prospect of commercialisation is important for EV1’s success. Given that each graphite project’s mineralisation has a “unique signature”, it will be important for EV1 to work with potential offtake partners to ensure compatibility with existing technologies as well as the development of new technologies with EV1’s graphite.

🔲 Market update on downstream value add studies

🔲 Market update on downstream value add partnerships

🔲 Market update battery specific value add (studies or partnerships)

🔲 MoU signed with downstream partner 1

🔲 MoU signed with downstream partner 2

🔲 Offtake agreement 1

🔲 Offtake agreement 2

Key Objective 3: Increase Resource Size and find more shallow resource

Whilst an increase in the resource size is not necessary for making a final investment decision, the greatest opportunity to improve project economics identified in the DFS was adding more near-surface graphite deposits to substantially reduce mining costs.

We expect EV1 to undertake an expansionary drill program mid-way through next year, with a geophysics program to identify drill targets to commence imminently. We also want exploration to optimise the economics of the DFS by finding more resource at a shallow depth (cheaper to extract).

🔲 Announce Exploration Program

🔲 Drill Targets Identified/Refined

🔲 Drill Program commenced

🔲 Drill results announced

🔲 Resource Update

What are the key risks?

All mining projects have risks. Here is a short summary of the specific risks we see in an investment in EV1. We will go into them in more detail later in the article.

- Sovereign risk – Tanzania is not Australia. Investing in Africa always poses sovereign risk. While the early signs with regards to the current government’s stance towards mining are in our view encouraging, the situation may change. Economic and social instability are factors we considered before investing in EV1, and indeed in all companies trying to bring a project into production in Africa.

- Market risk – Graphite prices are subject to fluctuations. If the graphite market moves into oversupply territory, this could negatively impact EV1’s DFS and ability to access capital.

- Funding Risk – EV1’s current DFS requires US$87M to develop the project – EV1 may not be able to secure this funding for a variety of reasons that are difficult to predict.

- Construction Risk – Building a mine comes with a set of variables that need to be considered. This includes adverse weather events, safety incidents, environmental factors and stakeholder engagement.

Our EV1 Investment Plan

At Wise-owl, our general strategy is to invest with a view to maintain a position over 4 to 7 years.

Over time we expect this investment to de-risk as the company (hopefully) delivers key milestones and a share price re-rate – at this point we look to free carry and take some profit while retaining the majority of the position.

We generally try to wait 12 months to unlock the capital gains tax discount before selling any part of the position, or at least 5 material company announcements are delivered.

This plan works for us and our circumstances, but this is not personal investment advice.

✅ Initial Investment: @ 20c

🔲 Price increases 250% from initial entry

🔲 Price increases 500% from initial entry

🔲 Price increase 1,000% from initial entry

🔲 12 Month Capital Gain Discount

🔲 Free Carry

🔲 Take Profit

🔲 Hold remaining Position for next 2+ years

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities (including staff), own 3,125,000 EV1 shares.

1,875,000 of these shares are escrowed for 24 months.

All S3 Consortium Pty Ltd directors and staff are restricted from selling any of their personal holdings in EV1 for 3 months after the announcement of EV1 to our portfolio.

S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our investment in EV1 over time. Please read full disclaimers and disclosures at the end of this communication.

Deep Dive: Further details on the 10 reasons why we invested in EV1

1. Graphite: Right sector, right time

Our best performing investments have been in battery metals – consider VUL (up over 3,000% from Wise-Owl initiation) EMN (up over 700% from Wise-Owl initiation).

While past performance is not an indicator of future success, the common thread among those investments is that the associated commodity is used within lithium-ion batteries.

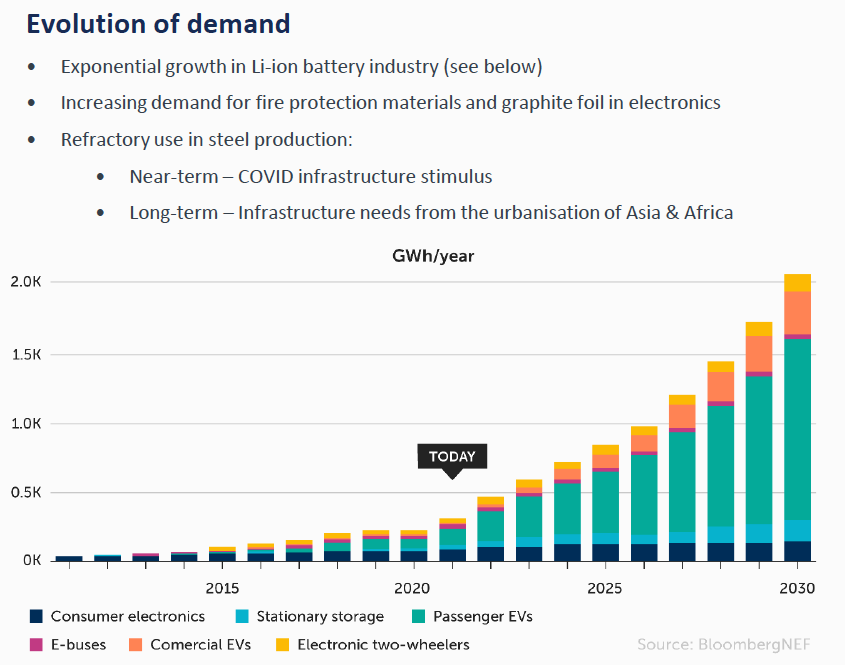

With more and more customers choosing electric vehicles (EVs) to replace their petrol-guzzling predecessors, and this trend gathering momentum in an increasingly climate-concerned world, demand for battery materials is expected to grow strongly over the next 10-20 years.

Some governments are now mandating the phasing out of petrol fuelled vehicles, whilst the EU, China and the USA have placed tougher emission standards for new vehicles.

Following the recent COP26 summit, six major car makers including General Motors, Ford and Volvo, alongside several nations and cities, signed the Glasgow Declaration on Zero Emission Cars and Vans, aiming to phase out fossil-fuel vehicles by 2040.

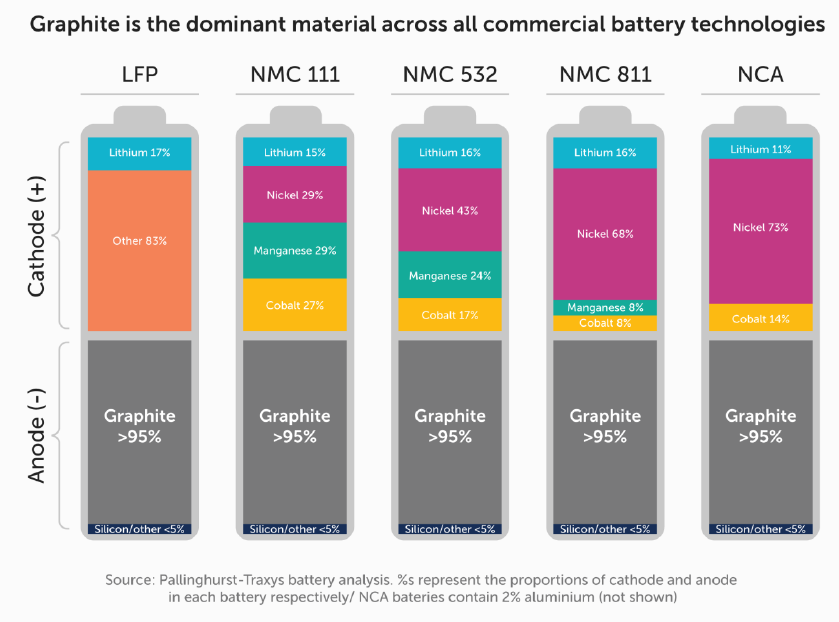

Graphite is the dominant material across all lithium-ion batteries – comprising over 50% of every lithium-ion battery (and over 95% of every battery anode).

However it does not garner the same market attention as lithium, cobalt, nickel and rare earths, which is surprising.

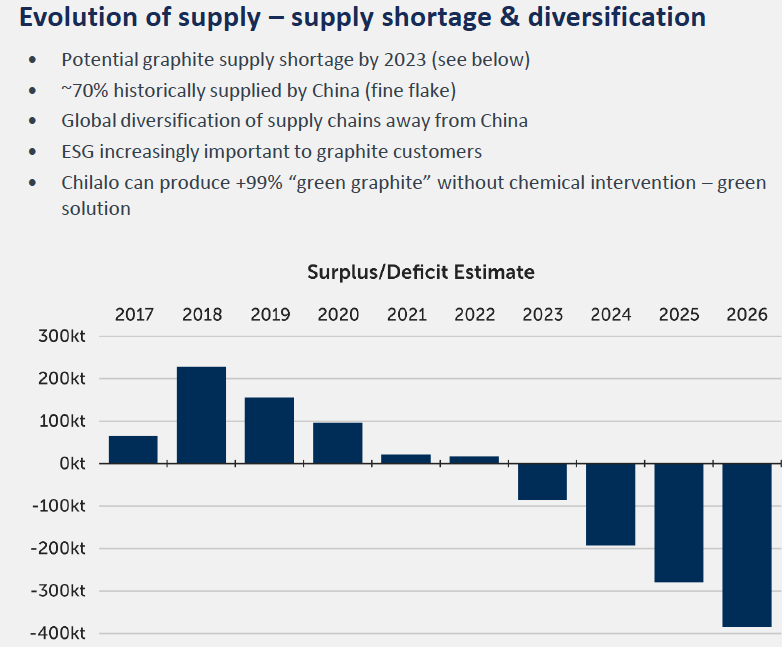

Whilst China dominates the graphite market today, delivering over 60% of supply, we believe many customers, especially in Europe and North America, will prefer to source this input elsewhere, due to strategic factors and supply chain concerns.

A simple rule in Economics is that when demand is greater than supply, prices go up.

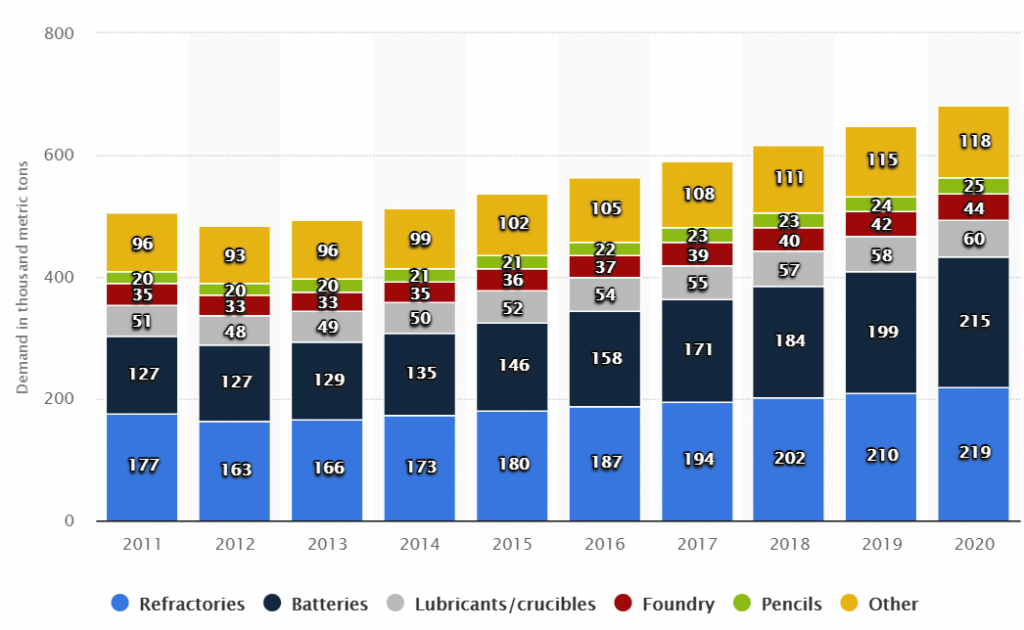

We are confident that graphite demand will remain strong and grow over the coming decade – consider the growth forecast in the chart below, which also incorporates non-vehicle sources of graphite demand:  With demand predicted to surge up exponentially, it is worth considering the supply side dynamics relevant to EV1.

With demand predicted to surge up exponentially, it is worth considering the supply side dynamics relevant to EV1.

You can see from the chart below that the market is only slightly in surplus now, and should remain so next year.

However, the supply deficit could hit as early as 2023, and worsen as the decade progresses with new demand far outstripping production.

As you can see there was an oversupply of graphite in 2018 which hurt prices and thus the bottom lines of companies mining graphite: That oversupply notably hurt large graphite miner Syrah Resources whose share price slid down the charts rapidly between 2018 and 2020.

That oversupply notably hurt large graphite miner Syrah Resources whose share price slid down the charts rapidly between 2018 and 2020.

This time we think things could be different as the deficit in supply is projected to occur just as EV1 plans to ramp up production.

We think EV1 is perfectly primed to capture an emerging graphite price renaissance.

So to sum up, EV1 is in the right commodity, and if they can execute their plans, would be supplying at the right time just as markets tip into deficit in 2023.

Advanced stage projects with a DFS and good market conditions such as this are relatively rare – a major part of the EV1’s appeal to us.

2. Aiming to be best in class ESG

You’ve probably heard of environmental, social and governance (ESG) now.

The world has collectively decided it wants to “go green” and also usher in a new version of capitalism that takes into account not only shareholder profit, but environmental, social and governance (ESG) considerations too.

EV1 is mandated to deliver a sustainable, top class ESG graphite project, and has funding set aside in its IPO to do so – we believe this will help EV1 secure ESG funds to develop their project.

True ESG investments that have ESG baked in at their core are hard to come by, and there are now trillions of dollars in ESG funds around the world looking to be deployed into a limited number of top class ESG investment opportunities.

Companies with true ESG at their core are able to:

- Access ESG funds – There is currently more ESG money than there are ESG investment ready opportunities.

- Secure top tier customers – Top companies are conscious of ESG in their supply chain – think Tesla, Apple, Governments etc.

- Attract the most talented teams – Smart people do not want to work for non-ESG companies.

- Positive community perception – Doing business at all levels is just easier when the community wants you to exist.

- Shareholder returns with positive impact – Be proud they are creating a positive change in the world while providing outsized returns to shareholders.

For EV1, ESG is NOT a mere ‘window-shop front’ idea, but is core to its business. ESG investment fund ARCH would not be involved if it wasn’t.

Moreso, the performance rights and bonuses of the key directors and management is tied in with ESG outcomes which if not met, means essentially they don’t get paid.

That is motivation, commitment and alignment to genuine ESG in a nutshell, and will be critical to securing capital from ESG funds in the future.

EV1 intends to be the go-to ESG-focussed premium graphite company in the world within the next few years… and this is not marketing to them.

EV1 is seeking to be the most sustainable/green/ESG friendly graphite play on the planet.

But why does this matter?

Investors care – from global funds through to your mom and dad retail crowd – are increasingly seeking investments that help make the world a better place, and as a by-product, helps us feel better about those investments. The belief is that companies with strong ESG credentials are less risky or prone to questionable practices, more transparent, and better positioned for the long term.

The best ESG investments are now considered “bragging rights” amongst the ultra wealthy.

The appeal to ESG-centric companies is picking up steam across the globe. Research from Gartner last year indicated that “85% of investors considered ESG factors in their investments”.

Another case in point, in Europe a critical mass of pension funds and insurers now award new business exclusively to asset managers with ESG capabilities. Which brings us to the next point.

Financiers care – just note how many financial institutions will no longer fund coal projects and other unsavoury business practices. Large funds (think superannuation, sovereign funds, endowments) are driving the movement towards ESG investments.

When the big money demands it, everyone moves towards it.

Customers care – Of note, the EU has in place regulations ensuring battery manufacturers promote sustainability, including:

- Responsible, sustainable and ethical sourcing of raw inputs (including graphite),

- Declaration of carbon footprint,

- Traceability of raw materials,

- Recycling and establishing a circular economy.

Governments care – from federal through to the provincial offices – life as a company is just easier if you are top class ESG.

EV1 is positioning itself as the go-to ESG-centric graphite supplier in the world.

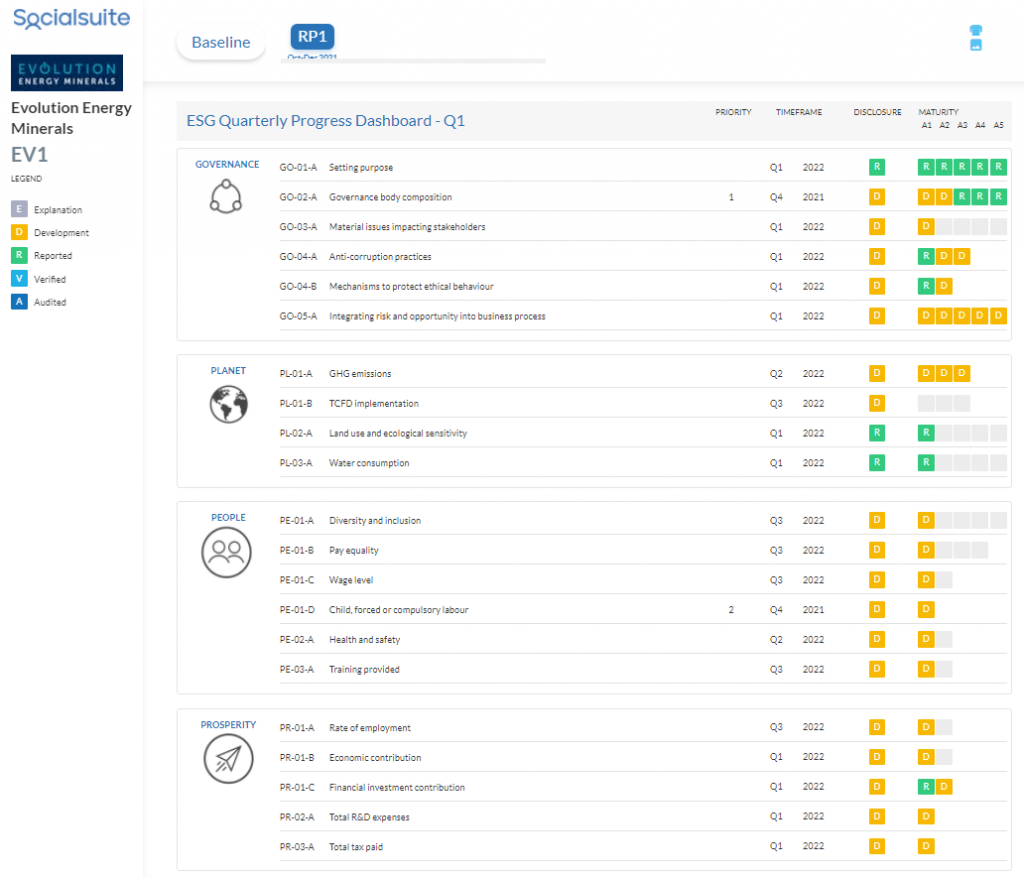

EV1 has committed to quarterly disclosures of its ESG progress as it develops over time – click the image to see EV1’s quarterly ESG disclosure progress:

3. Future funding: Major IPO investor ARCH is a prominent ESG fund

Understanding the importance of ESG to helping secure future capital (and the other benefits), EV1 has secured investment from ESG fund ARCH, who owns 25% of EV1 after investing $8M in the IPO.

London-based ARCH Emerging Markets Partners runs several investment funds, with EV1 set to be the inaugural investment within its ARCH Sustainable Resources Fund.

ARCH brings several key elements to the EV1 story, primarily:

- An initial cornerstone investment of $8M,

- ESG expertise through consulting and board member Amanda van Dyke (more on this later),

- A hands on approach to helping EV1 be top class in ESG, and;

- Future funding opportunities via US$25M set aside for follow-on investment (there are some conditions on this), co-investment from some of its investors (described below) as well as introductions to project financiers.

Project financing is going to be a huge hurdle for many budding graphite companies, but we believe EV1’s relationship with ARCH combined with their commitment to ESG means they already have one foot over that hurdle.

As part of the investment deed with EV1, ARCH secured co-investment rights in EV1 for existing investors in its own fund.

This is important as we expect those investors to primarily be ESG and Green Funds that absolutely trust in ARCH’s due diligence. As a result, when the time comes to seek project financing, we believe EV1 will have greater access to capital from a host of ARCH’s investors seeking more exposure to what could be considered the most sustainable, green and ESG friendly graphite play in existence.

EV1 represents the ARCH’s first investment in its Sustainable Resources Fund. As the inaugural investment in the fund, ARCH will be highly motivated for a successful outcome.

Outside of the Resources Fund, ARCH also has an African Renewable Power Fund and a Cold Chain Solutions Fund that were established over the last few years.

Melanie Mann is the Head of ESG at ARCH with over 18 years expert ESG experience. She has been involved in setting up EV1’s ESG Program and is currently on site in Tanzania alongside ARCH SRF Managing Director and EV1 non-executive director, Amanda van Dyke.

Key advisors to ARCH’s sustainable resources strategy include:

- Cynthia Carroll, the former CEO of mining major, Anglo American, and;

- Patrice Motsepe, noted South African mining billionaire, founder and Executive Chairman of African Rainbow Minerals, and obviously well connected with African project financiers.

4. EV1 is sitting in premium graphite

Not all graphite is the same – there are different use-cases for different types of graphite.

In today’s market, flake graphite is one of most desireable types of graphite, largely due to its applications in the auto industry.

The majority of EV1’s graphite is large flake graphite, making it more attractive to end users.

Flake graphite is generally used for anodes of the lithium-Ion batteries used in electric cars and with the large OEM manufacturers committing to an electrification of their product lines.

Flake graphite comes in several different sizes: jumbo, large, medium and fine.

This is important to understand because the price a miner can receive and the use-case for its product can vary massively depending on the flake-size within the resource.

The purity of the graphite product is everything for an end-user – the less contaminants, the more valuable the product.

Flake size is generally an indication of the purity of the graphite resource – the general rule of thumb is that the larger the flake size, the purer the resource.

When graphite is processed in a plant to increase its purity, smaller flake sizes are generally less efficient and can reduce the margin on the end-product.

The key thing we look for in a graphite investment is for the resource to naturally have a large portion of it in the jumbo and extra-large categories.

EV1 ticks the boxes for us with respect to this. Here is a comparison of EV1’s % of extra large or jumbo flake size compared to its peers:

31% of EV1’s resources are made up of extra-large or jumbo flake sizes and up to 61% of the resource is either +80 mesh or higher, which gives the company optionality when it comes to selling the product.

Because of the nature of the resource, EV1 can either sell the graphite directly to consumers or value-add the product for a larger margin using downstream processing – something we explore later.

We believe one scenario that EV1 may look to explore is to sell the product directly in order to fund future processing and resource expansion while also entering a range of partnership opportunities with end users.

Also, since EV1 has different graphite for different uses EV1 is able to pivot depending on what the demands of the graphite market are.

You can see the demands from various uses such as lubricants and refractories (heat-resistant ceramics) below: Demand from these sources is, in our eyes, unlikely to go away. Meanwhile in the coming years battery demand ramps up exponentially.

Demand from these sources is, in our eyes, unlikely to go away. Meanwhile in the coming years battery demand ramps up exponentially.

Ultimately, EV1 is a battery materials story due to the composition of its resources.

That resonated with us and was a major contributing factor in our EV1 investment.

5. Project is development ready, low capex, quick to production

Located in south-eastern Tanzania, EV1’s flagship Chilalo Project is an advanced, development-ready project that we think can become a premier source of world-class coarse flake graphite products.

Chilalo is fully permitted, and EV1 holds 100% ownership. It is also 180km west of the coastal port city of Mtwara and 400km south of Tanzania’s largest city, Dar es Salaam.

To date, over $21M has been spent progressing Chilalo to the point that it is construction ready.

Importantly, a definitive feasibility study (DFS) has been completed in January 2020, demonstrating the economic viability of the project.

The key takeaways from the DFS:

- US $323 NPV (post tax)

- Capital Cost (CAPEX): US $87M

- 18 Year Mine Life

- 34% IRR (post tax)

- US$73M average annual EBITDA

- 50k tonnes of Graphite produced per year

- US$1,595/t operating margin

- Payback Period: 3.6 Years

We like that EV1 is an advanced stage project, with low capex that can be in production by 2023.

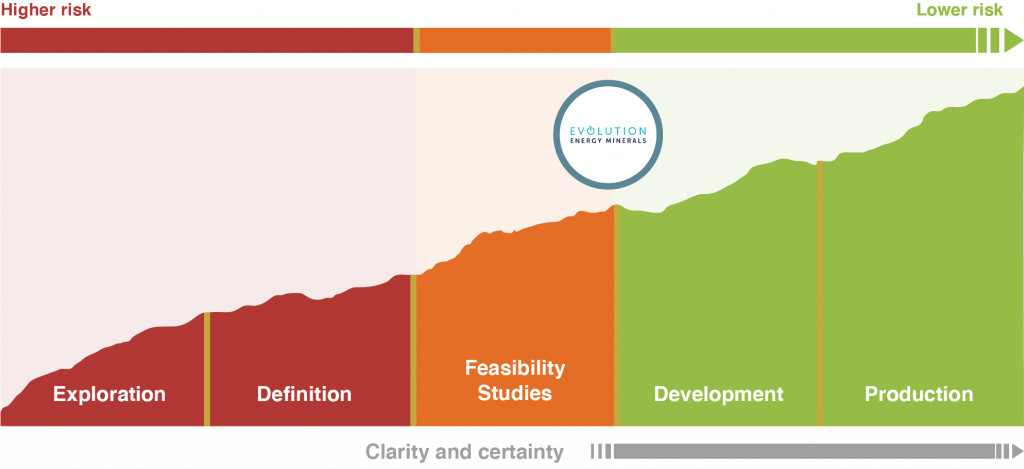

EV1 sits on the border between feasibility studies and development, with ‘funding’ being the next major hurdle to progress EV1 through to the development stage. EV1 has a large graphite resource with upgrade potential – any further exploration that results in more graphite discoveries will improve the project economics (a bit more on this later).

EV1 has a large graphite resource with upgrade potential – any further exploration that results in more graphite discoveries will improve the project economics (a bit more on this later).

The DFS does not take into account downstream opportunities, which we believe will be substantial in increasing the operating margin of the project, as well as any increase in graphite price, which we think will grow over the next 10-20 years.

6. Exploration program to increase resource size

EV1 plans to conduct another drilling program to expand the size of its resource, looking for high-grade graphite at surface. If further graphite can be discovered, then we think it will improve the project economics, by both increasing the mine life (as there is more graphite to mine), or reducing the capital cost through near-surface discovery (it’s cheaper to mine shallow deposits).

Whilst an increase in the resource size is not necessary for making a final investment decision, the greatest opportunity to improve project economics identified in the DFS is to add more near-surface graphite deposits to substantially reduce mining costs.

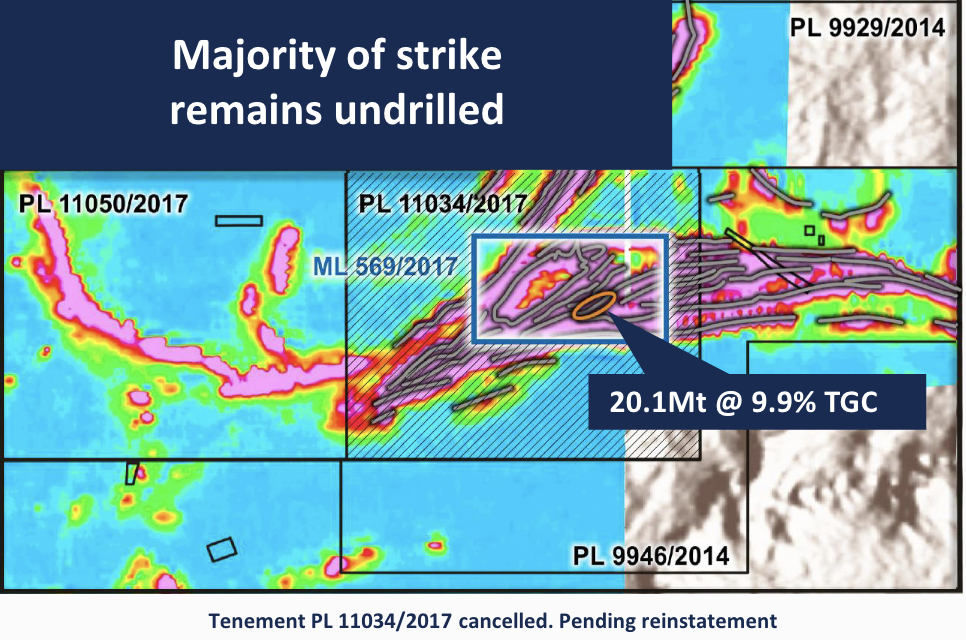

Chilao has a high-grade Mineral Resource estimate of 20.1Mt of 9.9% total graphitic carbon (TGC) for 1,991 Kt of contained graphite, and an Ore Reserve of 9.2Mt of 9.9% TGC for 878Kt of contained graphite.

These numbers represent the estimated amount of graphite at Chilao so far, and form a baseline for the DFS’s economic projections. Any upgrades to this resource estimate will likely enhance the project economics and provide an even more attractive investment opportunity to fund (remember, EV1 still needs to raise ~$87M to fund the project).

Looking through an opportunistic lens, the small orange circle (in the image below) represents EV1’s current Resource estimate, and the big square surrounding it represents the area that EV1 can drill. All of the ‘pink stuff’ is potential mineralisation that has been identified by a historical EM Survey.

As you can see the majority of the strike remains undrilled, providing EV1 with a strong opportunity to potentially increase its Resource estimate. The grand plan for EV1 is to become a vertically integrated manufacturer of sustainably produced, high-value graphite products within 2-3 years – however it will need to secure the funding to get the project up and running first.

The grand plan for EV1 is to become a vertically integrated manufacturer of sustainably produced, high-value graphite products within 2-3 years – however it will need to secure the funding to get the project up and running first.

Any drilling that improves the resource or reduces the capital cost of the project, will make it a more attractive investment for institutional investors and financiers looking to fund the project.

7. Low market cap compared to peers

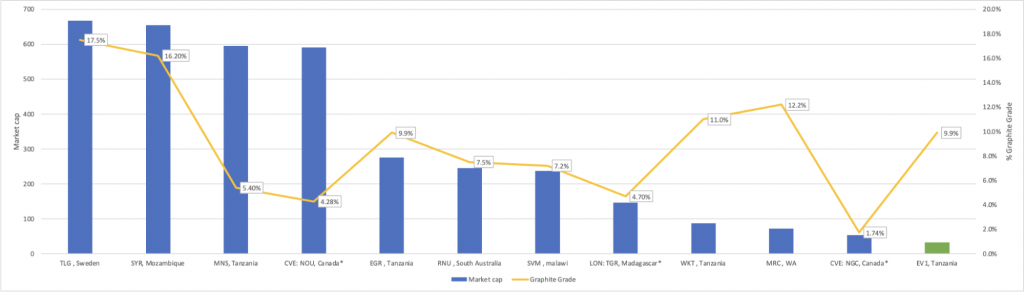

When compared to other Tanzania graphite companies that are currently ASX listed, EV1 provides strong value in ‘resource-to-capitalisation’.

EV1’s Market cap is the lowest of all of the other Tanzanian ASX listed graphite exposures with a market cap of ~$32m on listing vs Magnis Energy & EcoGraf which have market caps of $636M and $306M respectively.

The nearest peer to EV1 is Volt Resources, which has a market cap of $69M and Mozambique based explorer Triton Minerals with a market cap of $48M.

We also put some context behind the market cap and compared EV1 with the Tanzania based graphite exposures calculating the ‘Enterprise Value per Tonne’ (EV/T) of contained graphite resources.

This is one way of valuing a graphite company – think of it as a sort of ‘pound for pound’ assessment.

EV1’s EV/T of graphite is $6/t compared to $65/t of graphite for Magnis Energy and $61/t of Graphite for Ecograf.

What explains this is the fact that both Magnis & Ecograf are further along with their downstream value-add offerings, but as EV1 progresses with its own downstream opportunities, we think it will be able to narrow the gap.

It’s also worth noting that the only other listed company with a lower EV/T of graphite metric was Volt Resources who have a lower grade resource and are not as far advanced with its project (yet to have a DFS completed).

EV1 has the lowest market cap and the lowest EV/T of contained graphite metric of any Tanzanian graphite explorer that has an asset at the DFS stage. Therefore, we think it is currently undervalued in comparison to its peers.

Since EV1 published its prospectus, Magnis has re-rated to a $636M market cap which is almost 20x the market cap of EV1.

This demonstrates the upside potential of a successful graphite project.

We think that the graphite market is just starting to fire up and that our EV1 investment will eventually be re-rated to levels in-line with its peers.

When we compared EV1 to its international peers there was again a big difference in the market cap despite EV1 having a relatively large Resource grade.

This gap between EV1 and both its ASX and global peers was too large for us to ignore and drove a large part of our investment decision.

We expect this gap to become smaller over time after the IPO is completed and the Chilalo project moves towards production.

While the predictions for the graphite market are looking very good, remember that anything can happen globally, make sure to read the graphite market risks in the risks section below.

8. Exploring “value add” to graphite product

Rather than be just a pure mining play, EV1’s strategy is to tap into the high-margin, downstream markets through processing of its own graphite. Think of EV1 as a manufacturer in addition to being a miner.

These value-added products would include micronised graphite and expandable graphite for sales to international markets.

Micronised graphite can be used in batteries while expandable graphite has industrial applications ranging from flame retardants and metallurgy.

In the prospectus EV1 has indicated that it is in advanced discussions with certain technology partners to fast-track entry into such markets, either by way of collaboration, joint ventures or acquisitions.

On this front, in July 2021, EV1 signed a non-binding memorandum of understanding (MOU) with Perth-based International Graphite Ltd. International Graphite has downstream graphite processing operations in Collie, Western Australia.

Pursuant to the MOU, the parties have agreed to cooperate with each other in relation to:

- the sale of Chilalo’s products and other graphite products (including micronized graphite, expandable graphite, graphite foils and other graphite-based products);

- downstream studies on the production of graphite products; and

- the sharing of knowledge on the graphite market and graphite industry.

The key themes for downstream businesses are to reduce their CO2 supply chain footprint and secure key materials outside of China, and with the listing under their belt, we expect there to be news and updates on feasibility studies, testwork and partnerships with external third parties.

Going back to the peer comparison chart we looked at earlier, you can see that the companies with downstream capabilities are rated significantly higher in the market than those that are primarily commodity suppliers. EV1 plans on playing in the space of the downstream operators too.

9. Best team in the graphite industry

The EV1 board and management team has extensive experience in the mining and resources sectors, including Tanzania and graphite, capital markets and the graphite industry. Importantly, they have strong relationships with key stakeholders, including major players in the graphite market, end users, local communities and government.

What sets this team apart from its peers is that no other graphite company has anyone that has successfully managed to bring a non-Chinese graphite operation on stream…

… apart from EV1.

Add to this two other key directors with over 6 years experience with graphite (several peers don’t have any directors with that experience) AND a well regarded ESG expert with strong links to capital markets, and you can see why we are fans of the team EV1 has assembled.

Executive Chairman Trevor Benson

Trevor was the Executive Chairman and CEO for Walkabout Resources, a Tanzanian graphite company and has 6 years’ graphite market experience.

We like that Trevor has extensive in-country experience, working with graphite on a similar project and think that he will be able to leverage his networks gained from his time at Walkabout Resources to advance EV1’s commercial aspirations.

Executive Director Michael Bourguignon

Amongst a number of other successfully delivered projects, Michael was responsible for managing the construction of Syrah Resources’ Balama graphite project in Mozambique.

Older investors may remember Syrah Resources from 2016, when its share price hit an all time high of $5.75, from ~10c 2011. Syrah was the company that put Tolga Kumova on the map, and Michael was a key part of the project’s development.

Having someone of Michael’s quality and experience supporting the board bodes very well for EV1, indeed Michael is the only person to have built a graphite project outside of China in the last ten years.

Non-executive Director Phil Hoskins

Phil has been responsible for the development of the Chilalo graphite project since 2014. Phil is currently the managing director of Marvel Gold, the company from which EV1 is spinning out.

We like companies where a board member has been involved for a significant amount of time, and Phil certainly ticks that box.

Phil also has extensive finance and commercial experience from exploration through to operations, in Africa and Australia.

Non-executive Amanda van Dyke

Amanda has over 20 years’ experience in commodity markets, having previously managed an UCITS Gold and Precious Metals Fund at South River Asset Management, as well as multi asset and fixed income funds.

During her career, she has raised over US$500M in debt and equity finance for mining companies.

Amanda is currently the MD of the ARCH Sustainable Resources Fund, and we think a critical piece for EV1’s ESG aspirations and ultimate project funding.

Her presence on the board signifies ARCH’s investment in the EV1 project and commitment to ESG.

10. Tight capital structure, leveraged for share price growth

One of the most important things when we make a new investment is to analyse the company’s capital structure.

A lot of our due diligence is based around determining the people backing a particular company as we believe this is an essential ingredient for a company’s success.

We especially liked how much of EV1 is being held by long-term investors who, like us, will back the company all the way through to bringing the Chilalo project into production. The top two shareholders Marvel Gold, who are spinning out the asset, and the cornerstone investor ARCH, combined hold 56% of the shares outstanding.

The top two shareholders Marvel Gold, who are spinning out the asset, and the cornerstone investor ARCH, combined hold 56% of the shares outstanding.

Importantly ARCH have put a voluntary 12-month escrow on their entire 40 million shares + 20 million options shareholding and Marvel Gold has a 24-month escrow on their entire 50 million shareholding.

This essentially means that out of the total ~161 million shares on issue, 90 million won’t be traded for at least 12-24 months. We expect ARCH and Marvel Gold to continue holding all the way through to a final investment decision beyond both escrow periods.

With the free-float being so low at only ~44% of the total shares on issue and the top-20 which is made up mostly of fund-managers holding ~75% of the company’s register, in our view EV1 has an excellent capital structure.

EV1 has also managed to get investments from other European funds like DELPHI, Deutsche Balaton & BPM Capital. Seeing other domestic fund-managers like the Nero Resource fund, Precision Opportunities Fund and Ashanti Investments on the register is a massive positive for us.

This level of institutional backing at the IPO to us reiterates the quality of EV1’s assets and team.

With the top-20 shareholders holding ~75% of the shares outstanding, and most of the top-20 made up of institutional investors who will be long-term holders of the company, we expect shares to be really hard to come by after the listing is completed.  With all of our investments we are always looking for long-term holders who are aligned with our goals of backing a company through to execution of its business plan.

With all of our investments we are always looking for long-term holders who are aligned with our goals of backing a company through to execution of its business plan.

Pairing all of this with an EV of only $21.9M for a project so advanced, we expect EV1 to re-rate significantly as it gets closer to putting the Chilalo project into production.

What are the Risks?

Investing in Africa always brings social and political risk, and Tanzania is no different.

However it is our view that, relative to some of its peers on the continent, Tanzania is a safer jurisdiction for mining operations.

We believe a balanced view of risk related to EV1’s operations must take into account two features of the Tanzanian political environment.

On the one hand, there were the much publicised 2017 Tanzanian mining reforms which sapped the flow of investment to mining in the country for a period.

Subsequently however, and prior to his death, former President John Magufuli reaffirmed the country’s commitment to boosting mining’s contribution to GDP to 10% by 2025.

As of early 2020, the country had already reached this goal as mining accounted for some 15.3% of Tanzania’s GDP.

You can see data from Tanzania’s National Bureau of Statistics on the growth in the contribution of mining to GDP below:

Research commissioned by another graphite and battery materials company EcoGraf, states the following.

‘Given issues with the Mining Law and ex-President Magufuli over the past few years, being located in Tanzania may be seen as a weakness by some. However, on the other hand these now have been largely sorted out, with finalisation of the new laws, the Minerals Commission being formed and MLs being granted. Also, due to the recent passing of President Magufuli, Tanzania has seen the elevation of ex-Vice President Hassan to President, with her actions to date indicating that she wishes to lead a more investor-friendly Government.’

The political situation in Tanzania is subject to change, and this may affect our investment in EV1.

As a counterweight to that, it is also worth noting that EV1 is part of a growing host of well-backed ASX-listed graphite companies in the country.

In February 2021, Black Rock announced it has a deal with POSCO of Korea to help develop the Mahenge graphite mine in the country.

Also in February 2021, EcoGraf completed a $55M placement to help develop the Epanko graphite mine in conjunction with KfW a German development bank.

And as of April 2021, Walkabout Resources announced that it has a US$20M debt facility through the Tanzanian government for the Lindi graphite mine.

So while we are conscious of Tanzania’s recent history with regards to mining, the political and economic momentum behind graphite in Tanzania appears to be building.

There are four key risks we will be tracking in our coverage of EV1:

- Sovereign risk – Tanzania is not Australia. The jurisdiction’s approach to mining may change and while the early signs with regards to the country’s stance towards mining are in our view encouraging, the situation may change. Economic and social instability are factors we considered before investing in EV1.

- Market risk – graphite prices are subject to change, and this could either positively or negatively impact EV1’s ability to access capital.

- Access to funding – EV1’s current DFS requires $US 83M to develop the project – EV1 may not be able to secure this funding.

- Construction Risk – building a mine comes with a set of variables that need to be considered. This includes adverse weather events, safety incidents, environmental factors and stakeholder engagement.

On construction risk – the prospectus notes that community/stakeholder engagement will be important to secure the necessary support for the project.

Announcements that signal outcomes with regards to this may move the share price as Chilalo progresses towards production.

Additionally, prior to our investment in EV1 we explored how the 2017 Tanzanian mining reforms fit within the overall project and the 2020 DFS. Management underlined that as the DFS was completed subsequent to the 2017 reforms, that figures regarding royalty treatments and the prospect of the Tanzania government taking an equity stake were accounted for in the DFS.

To conclude, EV1’s commitment to ESG, ARCH’s backing and a financial environment conducive to graphite mining investments in the country are factors that we believe de-risk our investment in EV1.

For a full list of the risks involved in this investment, check out the IPO prospectus here.

If you want to follow the EV1 story and our investment journey or any other investment in our portfolio, subscribe to Wise Owl for updates.

Disclosure: The authors of this article and owners of Wise-Owl, S3 Consortium Pty Ltd, and associated entities (including staff), own 3,125,000 EV1 shares.

1,875,000 of these shares are escrowed for 24 months.

All S3 Consortium Pty Ltd directors and staff are restricted from selling any of their personal holdings in EV1 for 3 months after the announcement of EV1 to our portfolio.

S3 Consortium Pty Ltd has been engaged by EV1 to share our commentary and opinion on the progress of our investment in EV1 over time. Please read full disclaimers and disclosures at the end of this communication.